339K Jobs . . . Dude That's A LOT of Jobs

June 4, 2023

Whoa that’s A LOT of jobs dude.

339K jobs created.

That was my first thought waking up this morning. I kid you not. I’m terrible at waking up. The first thing I do is reach for my phone and scan the latest headlines, and the first thought this morning . . . duuuude. Jobs.

Consumer consumption is 2/3rds of this economy, and if jobs are healthy, consumption continues. “But jobs is a lagging indicator they say . . . .” Um okay, but 339K jobs created when the “expectation” was 190K? Yeah that’s a lot.

It’s a lot when labor participation rates are already decently high.

What it means is that the tight labor market is staying tight. Tight in the sense that there are 4.4M more jobs available than people unemployed, and it’s not easing as much as the economists would like.

Tight in the sense that despite the unemployment rate inching up to 3.7% from 3.4% . . . we’re still a hair’s breadth from the low unemployment rates pre-COVID.

That’s tight.

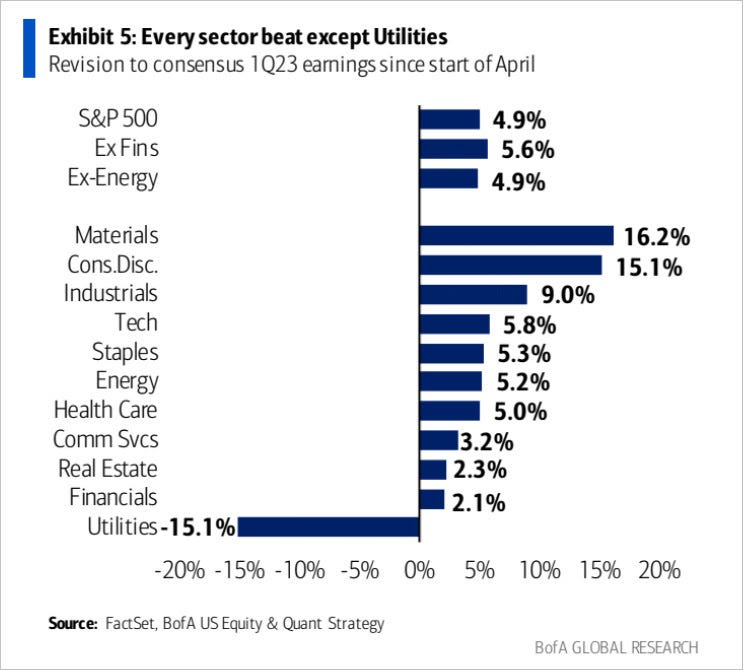

It means the economy can stay more robust than people think, well at least those on Wall Street. Despite tightening financial conditions and a manufacturing malaise, the economy is chugging along. Probably explains why corporate earnings in Q1 actually came out fairly decently and above consensus in EVERY SECTOR . . . except utes. Bad utes.

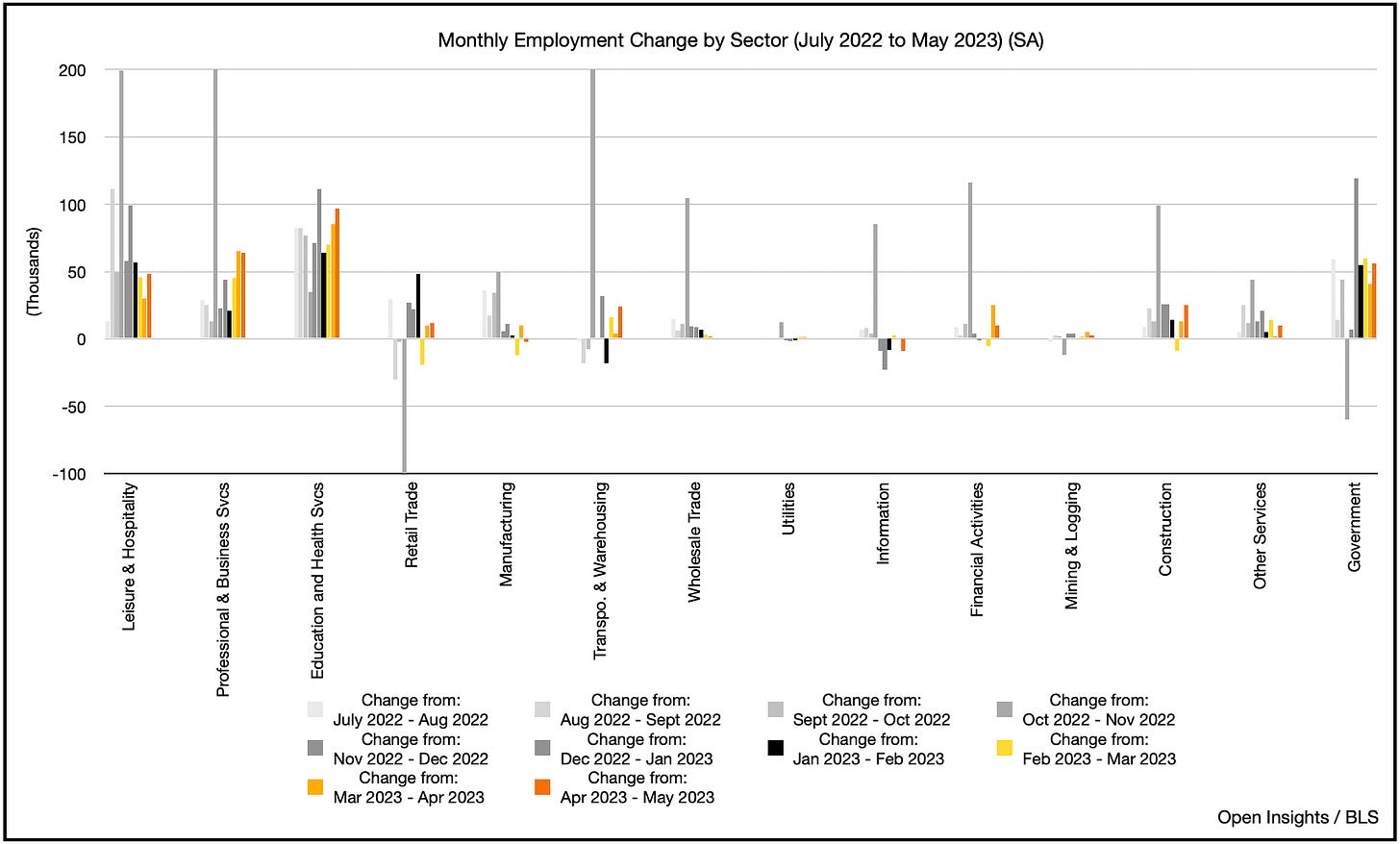

339K though. What’s even more fascinating is that it was broad based. Almost every sector added jobs. The housing sector will weaken . . . added jobs. Retail and lodging will start falling off . . . added jobs.

The only weakness? Manufacturing, and you’d have to squint to see it.

Average hourly wages also kept climbing, 4.2% year-over-year. Couple that data with inflation, “real” average hourly wages are increasingly becoming flat. What happens when wages become positive relative to inflation. Crazy thought, but maybe millennials will be able to tell their grandkids that “in my day” we had inflation, but rising wages actually kept pace . . . so consumption stayed high. Yeah crazy thought.

It’s early morning though, so that’s a lot to digest. After the obligatory “duuuuude” my next thought was . . . that’s gonna hurt a bit because remember, a strong labor market equates to strong wages, and wages drives consumption. In turn, consumption drives . . . dun dun duuuun . . . inflation.

Eyes now turn to the Fed.

Will they or won’t they pause. Certainly the market is still wistfully thinking that they will. Nonetheless the possibility of a raise in rates for the June 14th meeting increased to 38% on Friday. Take a deep breath though because invert that and it’s really a 62% chance they’ll pause. What’s the forecast for the rest of the year? Here’s Charlie’s graph . . .

For the June meeting, we’ll take those odds because we think the Fed doesn’t want to raise rates anymore than it has to. Sure employment is robust, and inflation is still high, but arguably a 5% fed funds rates is much closer to neutral when inflation is running at 5% and projected to come down further. Pausing means allowing more data to roll in. Headline/core CPI and PCE still need to cooperate, but a brief respite would allow the Fed to let already tightening financial conditions play out.

So tighten it, but don’t crash it. The dirty little secret to all of this is that this country needs inflation to run high. Living our best lives these past few years means we’ve really let ourselves go. We ate at home, ventured out little, and gorged on debt at the government level.

So as debt flew . . . so did our debt to GDP ratio.

That’s recently leveled off though, and no doubt in part to GDP climbing higher as inflation plays its roll. So while we’re still growing the numerator, the denominator is at least keeping pace. Doing so, inflating GDP, only really works if inflation is kept higher than the Fed’s “preferred” 2% target. That target, however, is a mirage. It’s an arbitrary one plucked from thin air, and realistically it could be 3 or 4% if the Fed chooses. Changing the target, however, means bonds (i.e., interest rates) will need to be repriced, and if you reset gravity higher than 2% (i.e., 4%), well then, asset prices will need to adjust. What was a 6% rate of return on a rental property sure doesn’t look as appealing in a long-term 4% risk-free interest rate world.

There’s a chance though. It’s a tiny one, but if the Fed hits the vault just right, it could stick the landing. Robust employment, wage inflation, milder inflation, and a decent if not gangbusters economy could allow the Fed to ease off on rates, or at least hold off a bit. It would also allow the Fed to strengthen the US balance sheet by inflating that GDP figure a bit, easing the debt tension. Lower inflation would also allow it to eventually lower rates in the coming months, enough to help the economy, mitigate the banking risks, and help support risk asset prices. A tight labor market would also ease the public and political pressure on the Fed, giving workers a real wage bump, something that they haven’t experienced for years. Sure it’s somewhat illusory with the rise of inflation, but for those with fixed debts, rising incomes would be a slight boon.

Do we think all of the above is possible?

Maybe. Potentially. Okay unlikely.

It’s a tight window of opportunity, and when has everything ever worked out exceedingly well for the Fed? Still, we think they’ll take the path of least resistance and pause for now despite the glowing employment report. Remember, the Fed Chair and the governors are people. They care about their legacies, reputation, and credibility. Over-tighten and crashing the economy brings a hot of problems, under-tighten and you become Arthur Burns, considered by historians to be the worst Fed Chair every. The aggressive stance in the past year has allowed the Fed to take a more cautious approach, and they’ll likely do that.

We’re increasingly of the belief that inflation will need to (and will) run structurally higher than the 2% we’ve historically experienced. Onshoring, commodity constraints, labor/wage inflation because of demographic shifts, and a need to “right size” our US balance sheet are all important factors. If the early 2000s was the decade of appreciating capital assets (i.e., as gravity/rates fell to zero, risk assets imaginary and real vaulted to the sky), the next few years could be the time of labor. Penciling in a 3-4% inflation rate isn’t too tough to imagine, especially when we keep seeing headlines like this (note the raise is over 3 years).

So time to wake up . . . it’s time to get to work, and with 339K jobs added. Dude . . . that’s A LOT of work to be done.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.