A Few Thoughts Before Memorial Day

May 25, 2024

I’m building a house.

A dozen years after moving into my old place, I finally got around to it.

A patient wife who’s lived with half-patched walls along with two little ones running around a small space . . . after awhile, it was time.

Most things in life take time, and you can’t rush things, or I try not to. One year, nine months. That’s about the length of time it’ll take. Start-to-finish. Nine months for permits and a year for construction.

As the kids get older, hopefully they’ll enjoy/appreciate it. This time period is after all “transitory,” so might as well give them a good place to retreat as they grind away through school.

I’m thinking about all of this because as we’ve gone through the process, there’s been an extraordinary amount of things that we’ve learned. It’s not like we’re novices either, having owned multiple investment properties before and renovated rooms here and there. Still, on this scale? No, definitely not, so that’s probably different. Fortunately, our contractors been great, so the process has been smooth, but as great as they’ve been, at the end of the day . . . it’s all on you.

Ugly design? You.

Funky layout? You.

Why’d you put that there?

Yeah . . . you.

As I walk through the near completed house these days, I’m bemused because in many ways it’s much like running an investment fund. Two things have specifically stood out in my mind, the construction process and the tradesman. Let’s talk about the first.

The framers get all the glory because once you raze the lot, these guys start hammering out the rough outline of the house. That’s the sexy thesis, it’s the “oh there’s a supply demand shortage looming because of XYZ.” You think the thesis will hit fairly soon, but then the “real construction” begins, dragging out the process while taking you on twists and turns.

After that, you get rough plumbing and electrical. That’s the tedious work, the things you don’t see, the research and writing, the excel sheet modeling of companies that hopefully yield a ballast of stocks that can become core holdings that’ll be key drivers to your returns. Then drywall, tile/flooring, baseboards and paint. The decorative finishes, the things you see, the bling. Those are the outlier positions, the 10x’ers, the “too the moon” stocks. It’s probably when you hire interior decorators, you know those consultants/talking heads who tout this or that stock because it’s the latest fad, or momo that can give your room/portfolio that “pop.” As sexy as those picks can be though, you know what really matters, it’s the frame, the foundation, the inner piping, those are the things that make your house work . . . but we all love that bling.

Which is why so many people focus on the bling. Home improvement shows, CNBC, and Twitter are all about that bling. Buy this stock now for 3x, 4x, 10x returns, paint that interior wall black and hang a bleached animal skull for decoration . . . sure it makes for compelling television, but how does that work in everyday life when every room is over the top?

Remember the market’s a weighing machine and overtime, your decisions will be judged accordingly. Have a TV console pop-out from nowhere? Great, good luck maintaining it. Want softwoods nearer the beach? Get ready to have the painters on speed dial.

Fill your portfolio with 10x’ers? Stock up on antacids.

Everything has a price, whether in housing construction, or portfolio construction. Whether in actual monetary cost, or physical and emotional toll as volatility rampages through your house. I know, I know, I just don’t get it . . . by forsaking many of the bling, I’ll “have fun being poor.”

Maybe . . . or maybe not.

The other thought that’s crossed my mind lately is the human element. As I watch the various finish carpenters work, I can’t help but be impressed by their precision. Measuring 3x before making a cut and using custom guides to line up each pre-drilled hole before screwing the pieces in. It’s like us with our financial models, Excel monstrosities that are massaged and fine-tuned with such precision. DCF models that include so many variables that seem to matter, but only a few that truly do.

What’s unseen though, what’s unpredictable, is the human factor. Did the carpenter have a bad night, did he get enough sleep? Is he attentive? It’s only after observing them over these past few weeks that you realize . . . no these guys are consummate pros. Their consistency is what makes them great, and their ability to execute day-in and day-out is why they have work everyday. Their reputations precede them because they can visualize not only the end product, but also how to get there.

Yet that’s not in the “model.” The model can tell you what’s ostensibly cheap and what’s not, but it can’t tell you if that will persist. You don’t think that human factor matters in portfolio construction? Try making your way through a thesis with bad management teams. If stocks represent ownership of a company, and a company will succeed largely on management’s ability to convert assets to profit/cash flows, isn’t that something to focus on? We highlighted it last week, but it bears repeating . . . focus on what matters.

This is a qualitative and quantitative game we play. As I tell my interns, it’s narrative AND numbers. You have to get both right to get this right. It’s a lesson we’ll impart again as we just picked-up our intern for this summer.

So as we all get a small respite from the daily grind this Memorial Day, it’s important to remember that this game isn’t just a numbers one, but a people one. People, their skills, and their ability to bring value matter, and they matter tremendously. Life mirrors itself in many ways, and if you chosen the wrong contractor, tradesman, or management team to help you on your journey . . . you’re never going to make it. So choose wisely.

Where are We?

As for the numbers, let’s just step back a bit and see where we are. Before the break we’re looking at close to market highs. The S&P 500 index has notched a nearly 12% gain for the year with big tech obviously leading the way.

Growth stocks have surged ahead, and continues to lead since 2023. Not all of them though as the MAG 7 has seen Apple (-1%) and Tesla (-28%) drifting flat to down, respectively.

The S&P 500 currently sits at 5,304, and with an EPS estimate of ~$240/share (if we used Goldman’s estimate), we’re looking at a 22.1x PE ratio. 2025? $256/share, so a 20.7x PE ratio for NTM.

Is that expensive?

You tell me. It’s a 4.5% earnings yield while the 1 year Treasury provides a risk free 5.16%.

Yet maybe that interest rate is illusory because isn’t the Fed going to start lowering rates? Potentially, but under what circumstances? A calming of inflation, or economic recession? What happens if the economy hits an even worse scenario . . . stagflation? Under such a case, inflation rises as does unemployment.

Not many believe it’s pricey though, or that the economy will actually be that bad as everyone’s nearly aboard the soft-landing train right now.

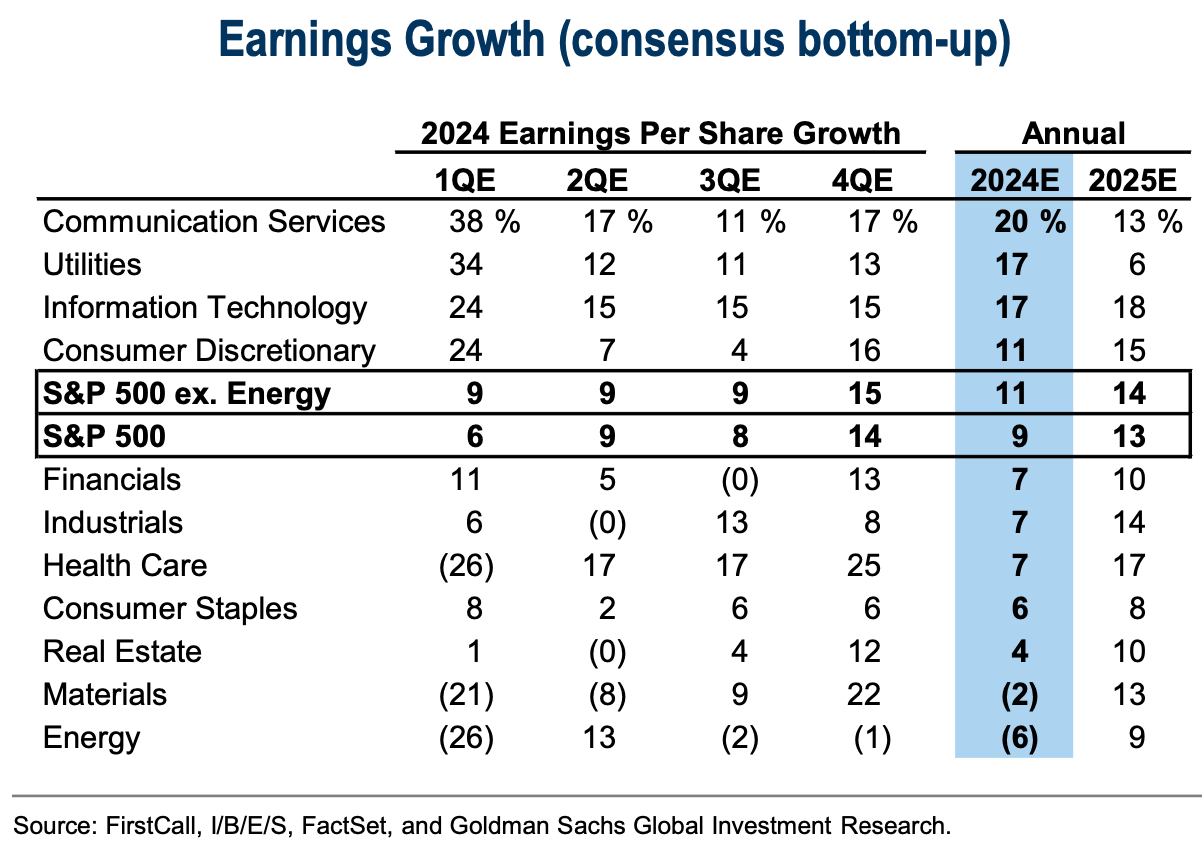

Still what continues to worry us is the outsized influence of Bit Tech. More pointedly, what if a slowdown begins to contract tech spending. Aren’t we concerned that that $240/share of 2024 S&P 500 earnings, or $256/share in 2025, will be jeopardized? What happens when Big Tech (Apple, Google, Amazon, Meta) pull back on capital expenditures and R&D if the economy softens? Just look at who’s doing the heavy lifting on earnings growth below (focus on the top of that chart).

It’s 9% earnings growth, but carried by Communication Services and IT at 20% and 17%, respectively. No wonder investors have forsaken pretty much everything except tech.

But relax though. These are all big questions that need big answers ONLY AFTER a long holiday weekend. Shouldn’t we at least try to enjoy the kick-off of summer before we tackle the volatility the elections, the economy, and the market will surely throw at us in the coming weeks?

We think so.

Quite frankly, most of you have already started cracking beers and relaxing . . .

Honestly, I don’t blame you. It’s time for a mini-break. So Happy Memorial Day to all, and for those who’ve served (including those families who support our troops), thank you for your service.

We’ll be back to swinging hammers in no time.

Please hit the “like” button above if you enjoyed reading the article, thank you.