A Jobs Report That Allows You to Ease Into Yours

January 5, 2024

Happy New Year Dear Readers!

Back to work already eh?

Well you probably are if you’ve decided to take a gander at this article. We hope your holidays went well though and that Santa, Amazon, or whoever brings you your presents, brought all that you desired. We hope your hearts, bellies, and storage units, are now filled to the brim as we begin another year in investing.

We don’t typically make any resolutions for the new year, except the general “just get better” one. Investing is a continuous process of learning, so we try to keep it simple and just pick and choose things that seem interesting to us. Then we poke and prod them, in the hopes of finding something worthwhile to invest in. For 2024, we’re hoping to write a few more articles about specific companies that interest us, but those tend to take a bit more time to pull together, and we do have a day job . . . actually running a fund. Still that’s our goal, and with a bit of luck and commitment, we’ll be able to provide that to our readers.

So back to work, or at least work-lite for this week. So let’s break you in shall we?

Jobs.

Sure lot’s of them.

Job openings data came out earlier this week and for November, there was a slight deterioration, but because unemployment also fell in November, the delta between job openings and the number of unemployed still hovered around 2.5M.

Although on the right hand chart you can see that unemployment tightness is easing, we can also see that there’s just more “jobs” that need to be filled than prior to the pandemic. If 1.2M more jobs than unemployed doesn’t seem like much to you, well take a look again, it’s nearly double. There’s work to be had, part time or full time, and not enough people (or we should say qualified people) to fill them.

A few days after the November job openings report came out, the unemployment report was then released for December. The unemployment rate came in unchanged at 3.7% with 6.3M people unemployed. Not much of a change there from the prior few months.

Average hourly wages ticked up slightly, and notched around a 4.1% YOY gain. We believe that rate should stay firmly positive as the CPI (inflation) report should also come in mild in the coming weeks.

So again, wages are keeping up with inflation, and in fact slightly ahead of inflation. If we pair the jobs opening report with the Atlanta Wage Tracker, it gives you a bit more insight as to what’s happening with wages. While the tightness in the labor market has eased the requirement for employers to “pay up” for workers, it’s still well above average. Wage growth should start to slide lower here in the coming months, but it will likely notch well above the 2% annual growth many have experienced in the last decade. Continuing labor tightness will almost assure that.

What about leading indicators like unemployment claims? Initial claims have ticked up lately, and continued unemployment claims have stayed elevated.

Frankly though, those charts are noisy. Average out say the initial claims over 4 weeks and you can see the trend is different. In fact, average it out and then zoom out, the picture looks mild.

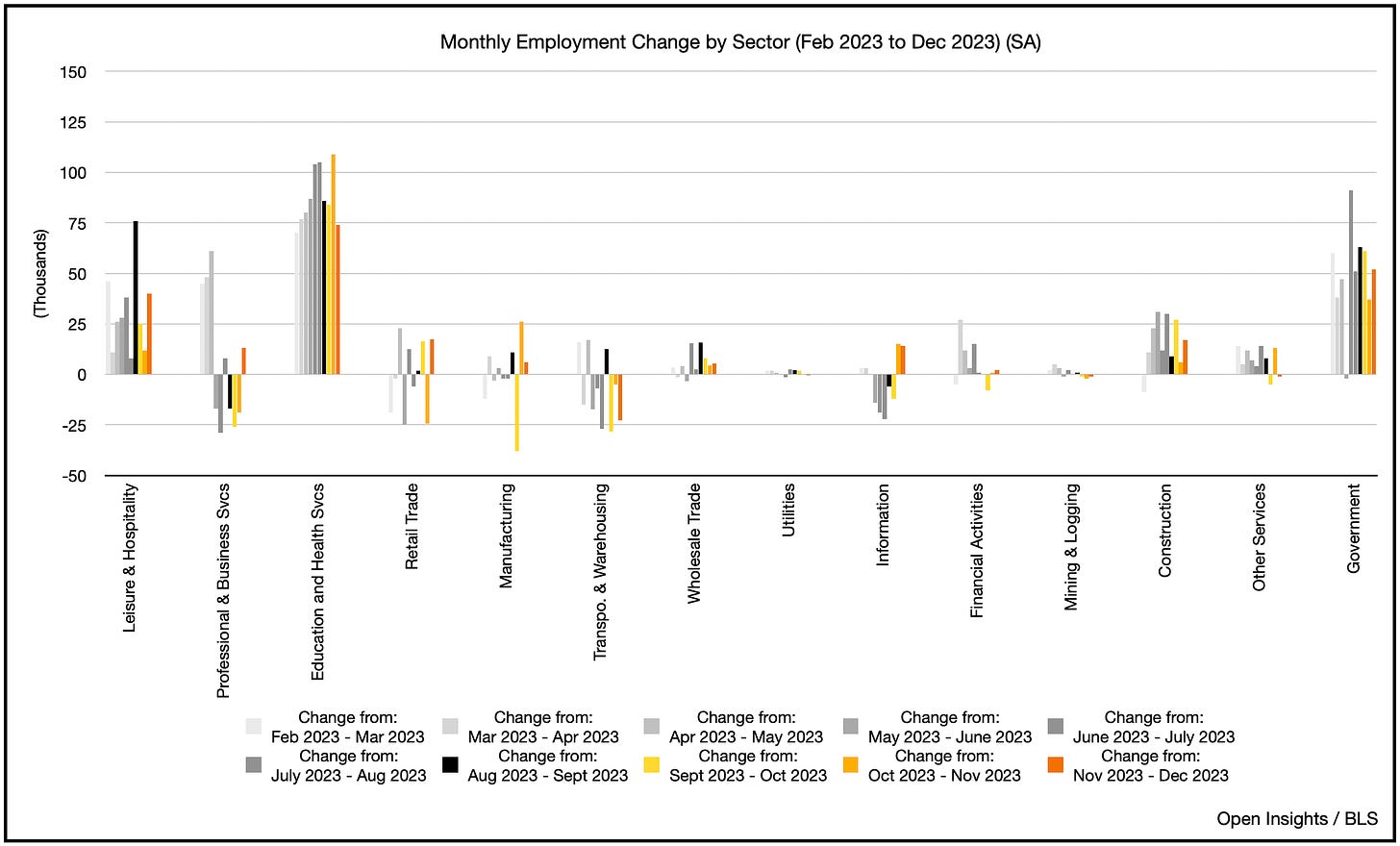

So where’s the recent hiring from? Well surprisingly from a few places.

It’s not just retail and leisure/hospitality, but professional and business services. Instead of shedding jobs, professional and business services and IT actually added. Construction similarly stayed robust into year-end.

Who’s getting hired? African Americans and those with high school diplomas. As you can imagine, those with college degrees and higher haven’t dipped in the slightest.

So why does this all matter?

Hot jobs market = higher wages, higher wages = higher inflation, higher inflation = higher interest rates, higher interest rates = tight economy and lower asset prices.

Overall this was a fairly benign labor report, and doesn’t spell trouble for the Fed’s decision to begin reducing nominal interest rates in 2024. Since that pivot was announced in December, the market’s already front-run that expectation (and in fact anticipates a 1.5% cut vs. the 0.75% the Fed’s indicated). For now, it’s obvious that the Fed wants to get the nominal rate down so the real rate is not longer so restrictive. What prevents all of that is if inflation rears its head again and the Fed is forced to pivot and increase rates. This would whiplash the market (read: selloff) and severely damage the Fed’s credibility. The benign labor report hints at an economic slowdown, but a gradually softening one. It’s the perfect gift for the Fed as we come out of the holiday season, and should give them some wiggle room to consider the timing/velocity of rate cuts.

2024 is an election year, and everyone is rightly playing for their jobs. Let’s hope they keep it, but then again, there’s plenty of them out there. Time to go get one.

Don’t work too hard now, enjoy the next few days because it all starts “for real” next week.

Again Happy New Year.

Please hit the “like” button above if you enjoyed reading the article, thank you.