A Penny for Two Thoughts, the Market & Middle East

October 20, 2023

As we finished up our quarterly letter last week, which you can find here . . .

we turned our thoughts to two things this week.

First, it’s this tweet by Liz Ann Sanders at Charles Schwab.

So that’s an interesting tidbit. Not surprising since rates have been continued to climb, but corporate earnings? Not so much. We’re in the midst of corporate earnings season, and so far it’s okay, but for the full year, people are fairly cautious, so it’s unlikely corporate chieftains will aggressively raise guidance going into year-end (let alone 2024). All of this translates into the spread between the market’s earnings yield vs. 10 year Treasury bonds compressing.

Well if Treasury bonds are “risk free” then arguably, a riskier asset class such as the stock market should yield (i.e., provide investors with) a higher return. We are, after all, talking about compensating investors for risk. It’s risk vs. reward, and the greater the risk (stocks vs. bonds), the greater the rewards should be (earnings yield vs. bond yield). So if you’re seeing parity here, either bonds are mispriced, and yields should be lower, or stocks are.

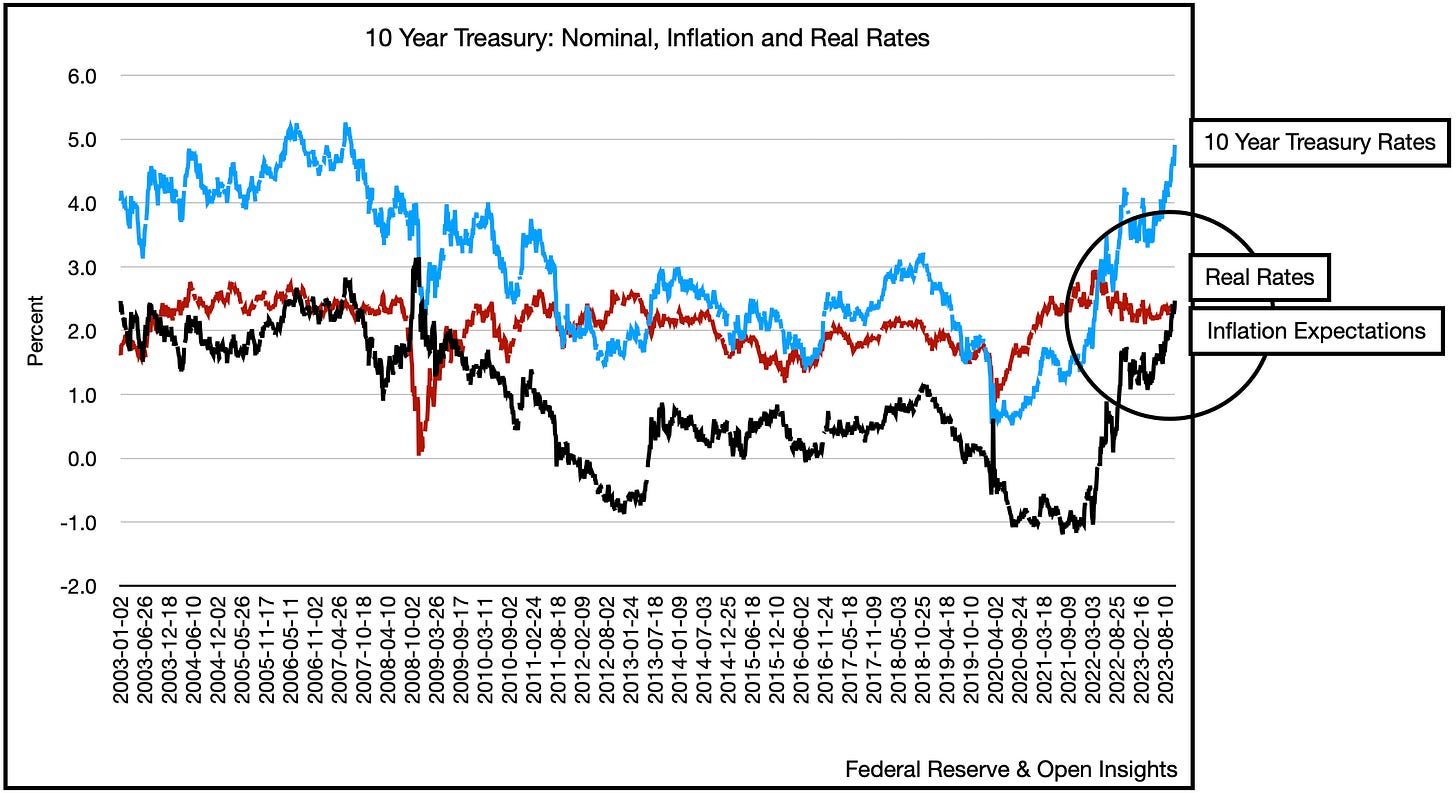

Especially since bonds are rising not because of inflation expectations, but because investors want a higher return given the massive indebtedness and increased borrowing (i.e., risk).

So unfortunately, between the push and pull of stocks vs. bonds, and which asset class is right . . . we kind of agree with Paul Tudor Jones that it’s stocks that are the problem.

PTJ?! Patoo-ey you say.

Well what about that other Paul?

Maybe he’s got a different take . . .

Guess not.

If you’re going to take more risks and own stocks in this uncertain environment, you’ll almost certainly want a higher rate of return than “risk-free” bonds. Absent higher corporate earnings, you’re left with a cheaper price. So will stocks fall if bonds continue to climb or even stay at these levels as the geopolitical uncertainty increases? Yeah, we think so. 10% lower? 15%? It’s all plausible, and frankly wouldn’t be unreasonable.

So position carefully.

The second thing we thought about this week is . . . what happens this weekend? When does Israel enter the Gaza strip and begin their land campaign against Hamas? About the only thing going up lately is oil prices, and nothing will impact oil prices more than what’s about to happen in the Middle East. Here’s something tweeted by OSINTdefender that we thought contextualizes what’s to occur:

Given cloud cover and iffy weather throughout this week, NY Times had reported that the Israel Defense Force (“IDF”) had delayed their ground offensive. We’ve got clear skies over the next week, so this weekend? One would think this begins soon, otherwise the window will start to rapidly close as the humanitarian conditions in the region deteriorate and public opinion on the matter turn from shock/outrage to compassion for the suffering (worldwide not Israel). The Overton window will truly become over the further this drags on.

On the flip side, that ground campaign into Gaza may trigger additional Hezbollah attacks from the West Bank and Southern Lebanon. The conflagration will likely spread. How much though is the question. We doubt an open direct conflict is in the cards right now given the US and Israel forces arrayed around the region, but things will blow-up as indirect attacks increase in frequency. The odds of Iran tying to tie the US and Israel hands here by complicating their lives?

Extraordinarily high.

Brent prices end the week about $1.50/barrel higher, and it’s climbed steadily as shorts exited and the geopolitical premium rose.

So we’re all waiting with bated breath, and will keep doing so over the weekend. Once the campaign begins, then we’ll start to see the rippled consequences. The US is keen to avoid spreading this conflict, but it’s in Iran and Russia’s keen interest to entangle us further into this tar baby of a situation . . . and then throw a match.

After all . . .

Please hit the “like” button above if you enjoyed reading the article, thank you.