A Quick Look at CVE as MEG's M&A Suitor

June 4, 2025

So we’ve been writing about SCR’s hostile takeover of MEG recently, and one of our readers responded with this:

That’s an imminently fair comment, so let’s just run through a high-level calculation to see how a purported “white knight” scenario could play out. Let’s assume Cenovus (“CVE”) takes a flyer and bids $28/share for MEG, give or take $3/share more than the current market price of $25/share, and $6.70/share more than the unaffected May 15 $21.30/share price (i.e., a 31.5% premium vs. SCR’s current offer of 9.3% premium).

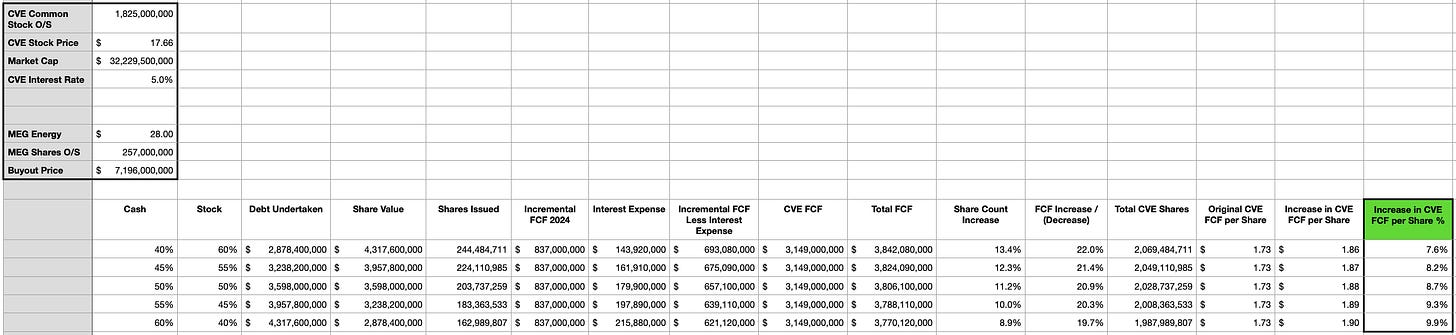

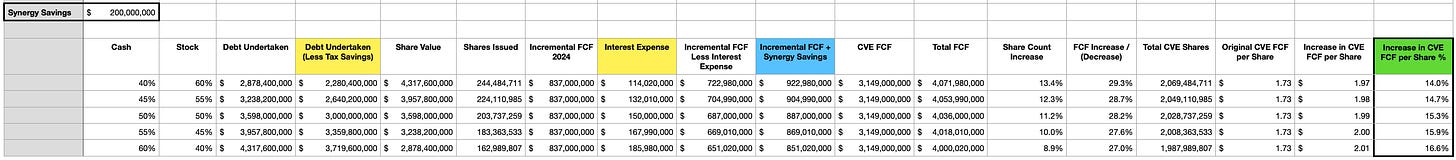

At $28/share, CVE “will” be paying ~$7.2B. Throw that price tag into a matrix of stock vs. cash . . . and let’s see if/how accretive the transaction would be to CVE.

Assuming a 60/40 cash to stock ratio for a $28/bid, we’re looking at a base case of about a 10% increase to CVE’s free cash flow (“FCF”) per share (using 2024 FCF figures).

Wait though that shouldn’t be it.

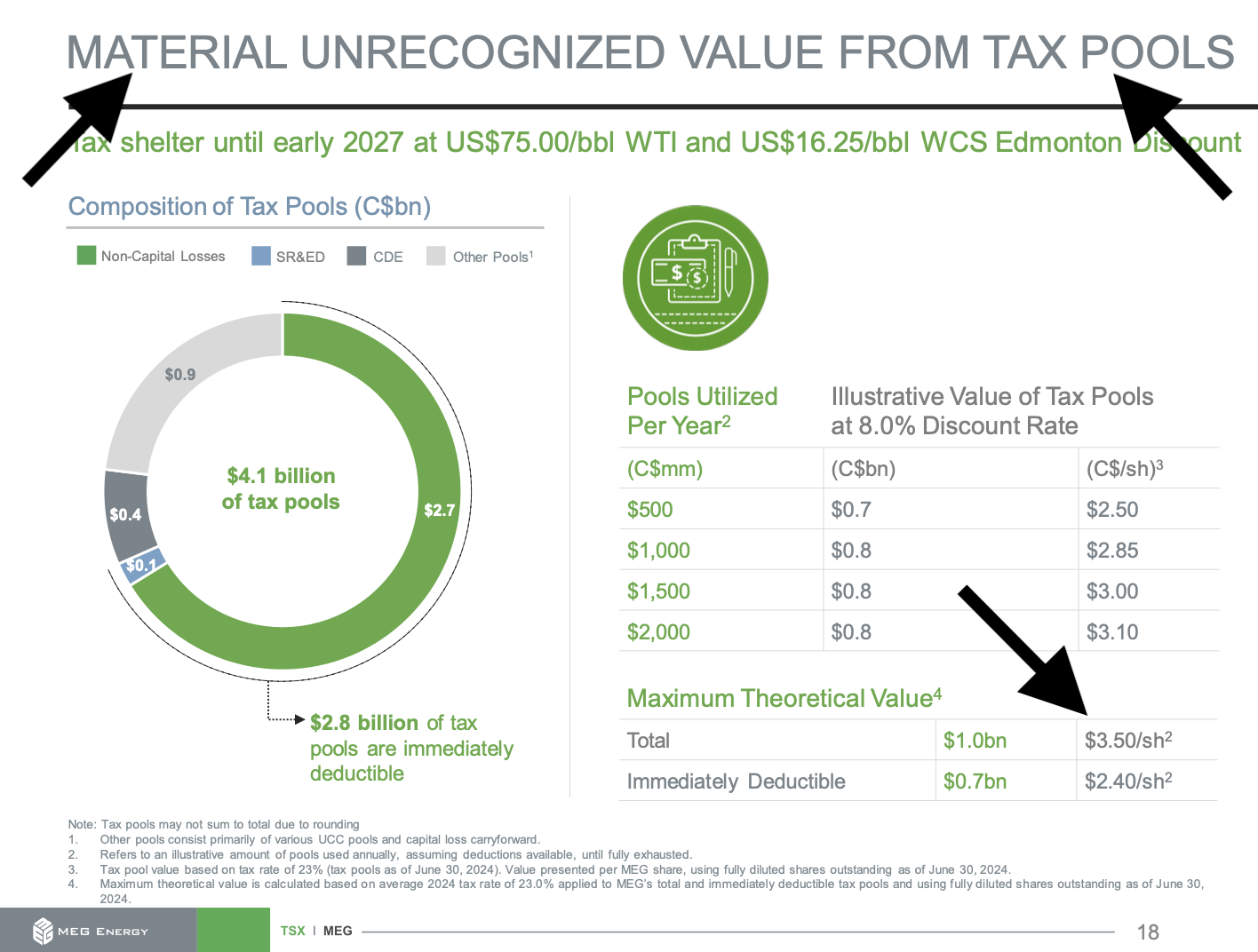

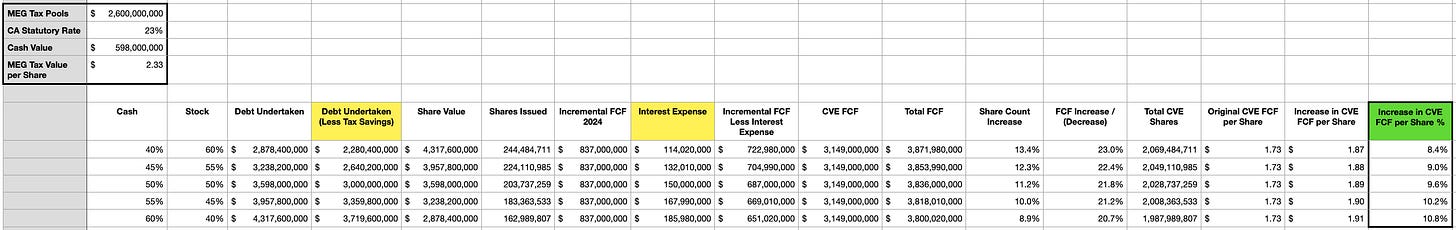

MEG has tax pools. Call it $2.6B post Q1 2025.

SCR has its own tax pools (net operating losses it’s currently deducting), so can’t really use MEG’s tax assets immediately. SCR would need to acquire another tax paying entity to monetize the assets and its own tax pools. In contrast, CVE can fully absorb them given that it’s already tax paying. Deduct just the $2.6B of “immediately deductible” tax pools at a 23% tax rate, and we’re looking at ~$600M of cash tax savings. Cash that it can use to fund part of the purchase price. In turn, having to borrow less translates to lower interest expense and higher free cash flow.

CVE’s FCF per share now increases by $30M (or essentially the interest expense savings of 5% on $600M of less debt).

Again, assuming a 60/40 cash to stock ratio for a $28/bid, we’re looking at a base case of about a 11% increase to CVE’s free cash flow (“FCF”) per share (using 2024 FCF figures).

Wait though, there’s more. What about synergy savings?

SCR estimates that they can find $175M of savings, $25M of which is interest rate savings because the combined entity can achieve an investment grade (“IG”) rating for its debt. Let’s strip that out as CVE already has an IG rating and pays an interest rate of ~4.5% (note we’re using 5% on new debt to be conservative). So $150M as our baseline. Since CVE operates in the Christina Lake, and adding MEG’s facilities would be close geographically, let’s assume synergy savings will be higher. We’ll throw-out $200M for conservatism, but think this could be too conservative.

What happens to cash flows in that scenario?

CVE’s FCF per share now increases again by the synergy. Once more, assuming a 60/40 cash to stock ratio for a $28/bid, we’re looking at a base case of about a 17% increase to CVE’s free cash flow (“FCF”) per share (using 2024 FCF figures).

So you can see, the combination of MEG with CVE would be highly accretive given it’s leveraging the cash portion of the bid. Using a 60/40 cash to stock ratio, you’re borrowing $4B to garner $850M of additional cash flows for an asset that has arguably a 50 year life.

The question on the flip side is if MEG shareholders would even accept this bid. Cash is cash, but if SCR were to match, whose stock (CVE or SCR) would MEG shareholders prefer?

Exit liquidity, future growth rates, diversification and execution/operational risks all come into play. CVE’s own management team has been inconsistent in their execution, and as of late pale in comparison to Suncor’s executive team (its nearest peer). In contrast, SCR’s team has long been viewed as superior capital allocators, if not exciting operators. Upon closing, SCR would operate oil sand projects in disparate areas, whereas CVE already operates in Christina Lake, mitigating the operational challenges. Net/net, would owning shares in SCR as the surviving entity allow greater upside overall? It’s not entirely clear-cut.

Nonetheless, as you can see above, there’s value to be had and dollars to be captured. If CVE can find any additional savings (in opex or capex), that’s accretive to the cash flows, so we’re certain they’ve been sharpening their pencils. On balance, we think it’s higher than even money that we’ll be seeing additional bids. Ultimately, it’s up to the shareholders which one succeeds, but it’ll be more lucrative when there’s more suitors.

Let’s hope it’s wearing gleaming armor.