A Red Bull in the China Shop

May 20, 2022

In the past few weeks we’ve written about some pretty scary stuff. The market’s decline . . .

The terrible macroeconomic environment for risk assets (according to Paul Tudor Jones) . . .

and a developing food crisis.

We we’re just about to update our thoughts on the global food shortage, one that’s quickly and sadly coming true, but we’ll put a pin on that for this week. The topic is important and we’ll address it, as well as provide some thoughts on the market implications, but for the time being let’s switch back to energy for a few moments, and update ourselves on the thesis before we tumble further into the volatile markets/headwinds we see ahead.

For oil, the shortage continues. Not a shortage you can readily see from the data, but one that you can see if you look beyond. Historically, the second quarter is the slow season. Crude inventories, having built during April begin to slide as refineries come back from maintenance season. In contrast, products begin to increase as refineries fire back up and churn out gasoline, diesel, jet fuel, etc. by processing the crude. It’s all a bit regular, and the two ebb and flow.

You can see it more clearly in this chart, which are the inventory balances we track for about half of OECD.

The thing to also notice about this chart is that as we extend further past-COVID 2020, notice the “builds” have turned into draws? So even though still repeating the “ebb/flow” of crude/products, when netted, total liquids are firmly in the negative. It’s the reason why global inventories continue to decline.

Wait though, that’s half of OECD, which we’re using as a proxy for the totality of OECD, what’s happening in China, who’s not part of that chart?

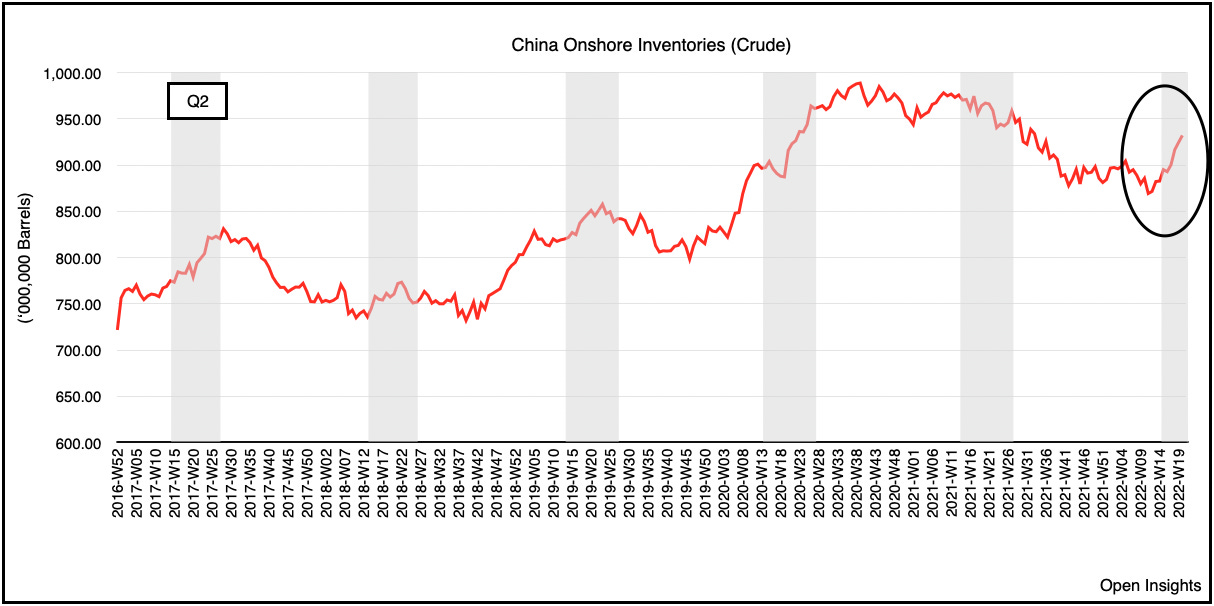

Good question. This . . . on the crude side.

Oh. +50M barrels since the start of April.

It’s not entirely unusual that China builds in Q2, as the prior years illustrate, but the size of the build this quarter-to-date is definitely noteworthy. Yet, perhaps the ~1M bpd of build isn’t that bad considering they locked down 40% of China (Gavekal) because of COVID. Now the fun starts. As China reopens and demand reengages, the government is handing out cans of Red Bull, and saying, go forth and prosper.

The calculation above is based on a mix of monetary and fiscal measures, and it will almost certainly climb higher as China emerges from its COVID shelter.

"The mainstay of policy this year is fiscal spending and government investment, while the central bank is only playing a supportive role so far," said Mr David Qu, China economist at Bloomberg Economics. "There is still a lot of space for a stronger fiscal policy, which is more effective in supporting growth now."

Yeah no doubt, because 2.0% GDP growth in Q1 (if it’s really that), isn’t going to cut it when your goal is 5.5% for the year, and the US just nudged you out with 2.8% for Q1. ‘Merica!

Any idea what Q2 through Q4 will have to be to get to their targeted average of 5.5%? Yeah . . . MOAR. So stimulus . . . here it comes . . . to salvage what’s left of a year, a year that was supposed to include a communist victory lap.

Strict lockdowns, a busted economy, faltering stock market, falling real estate market, and widespread discontent are beginning to crack the veneer of an all powerful central party leadership. Universal lockdowns wasn’t what people had in mind when Xi Jinping touted common prosperity; apparently he meant in your house.

So perhaps he’s loosening up. Falling COVID cases will allow him to. Make no mistake though, the zero tolerance policy will continue. What about the hard crackdowns on internet firms, property developers, and the economy in general as they pivot their goals to “common prosperity”?

Well okay, maybe we’ll let that slide a bit because the tricky thing about our slogan? You can’t spell prosperity without property, and you can’t have it if you aren’t actually prosperous.

Therefore, although we saw an upturn of inventories in China, which flatlined our global crude inventories by bringing draws to a halt, the true truth, if there ever was one, is that the slide was only halted by restricting nearly half of China.

Again locking down just Shanghai is the equivalent of locking down the State of Texas (similar population size). Our COVID restrictions pale in comparison to the sheer scale of their undertaking. Halting such a supertanker took immense effort, and so too will restarting it. Hence they need a jolt, and hence they’re delivering it. A Red Bull powered one, delivered in the form of tax cuts, fiscal and monetary policy stimulus, regulatory reforms, and a deep desire to get back on track.

Interestingly, as China stocks were building, we were actually drawing everywhere else, ever so slightly offsetting/eroding their builds.

As the global economy muddles along and we begin the busy summer season, we’re fairly certain (as much as we can be in this volatile space) that China’s economic recoupling means they’ll join us in our thirst for more energy. It’s only a matter of time, and that time is upon us.

So get your Red Bulls ready China . . . and come to the Dark Side of inventory draws.

We have cookies.

Oh wait . . . they’re already here.

Awkward . . .

Please hit the “like” button below if you enjoyed reading the article, thank you.

"You can’t spell prosperity without property, and you can’t have it if you aren’t actually prosperous. " very qoutable