A Snapshot of the Oil Market

September 26, 2025

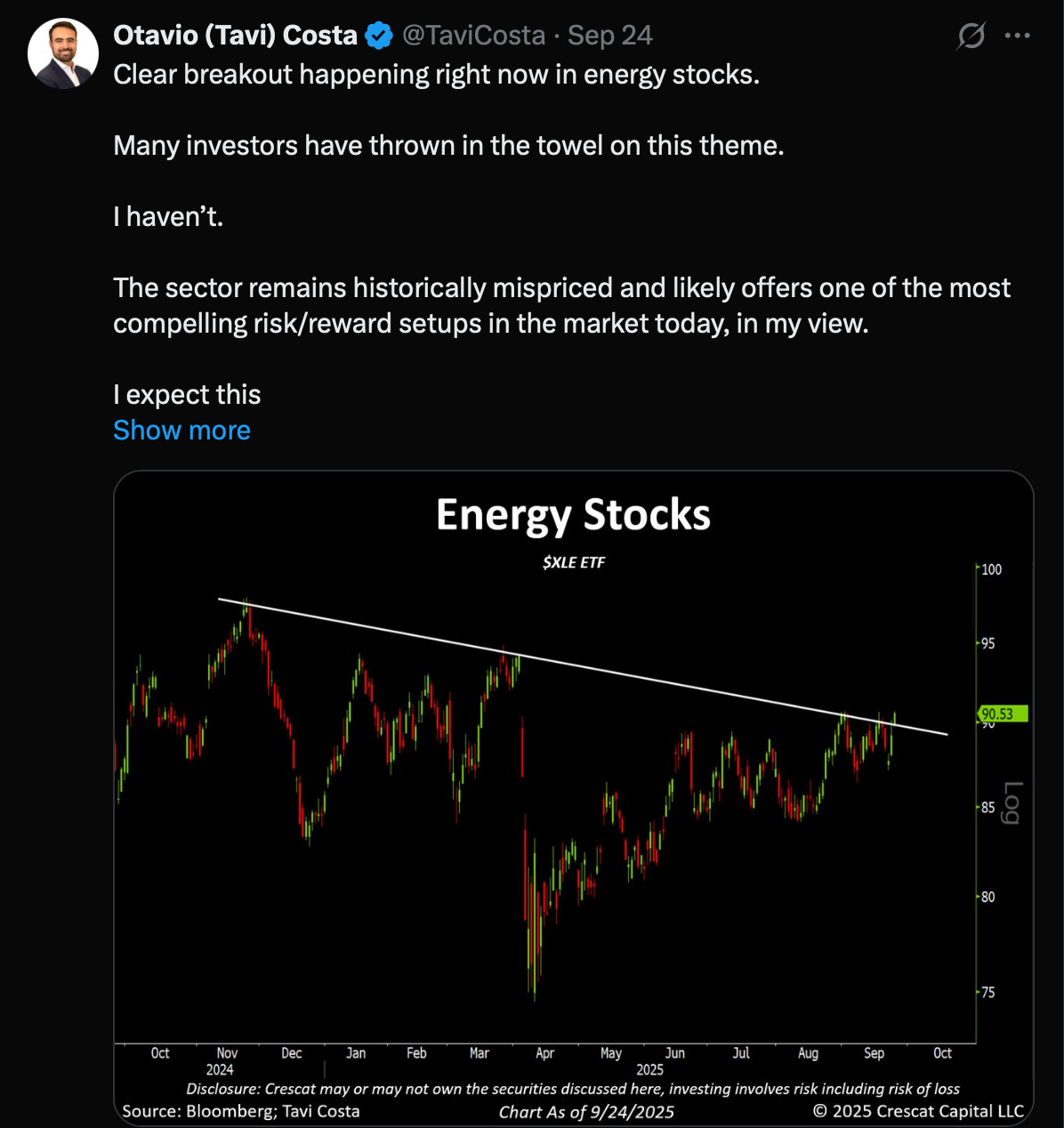

So we’re traipsing through Twitter the other day, and a posting came about energy stocks. Here’s Tavi’s post:

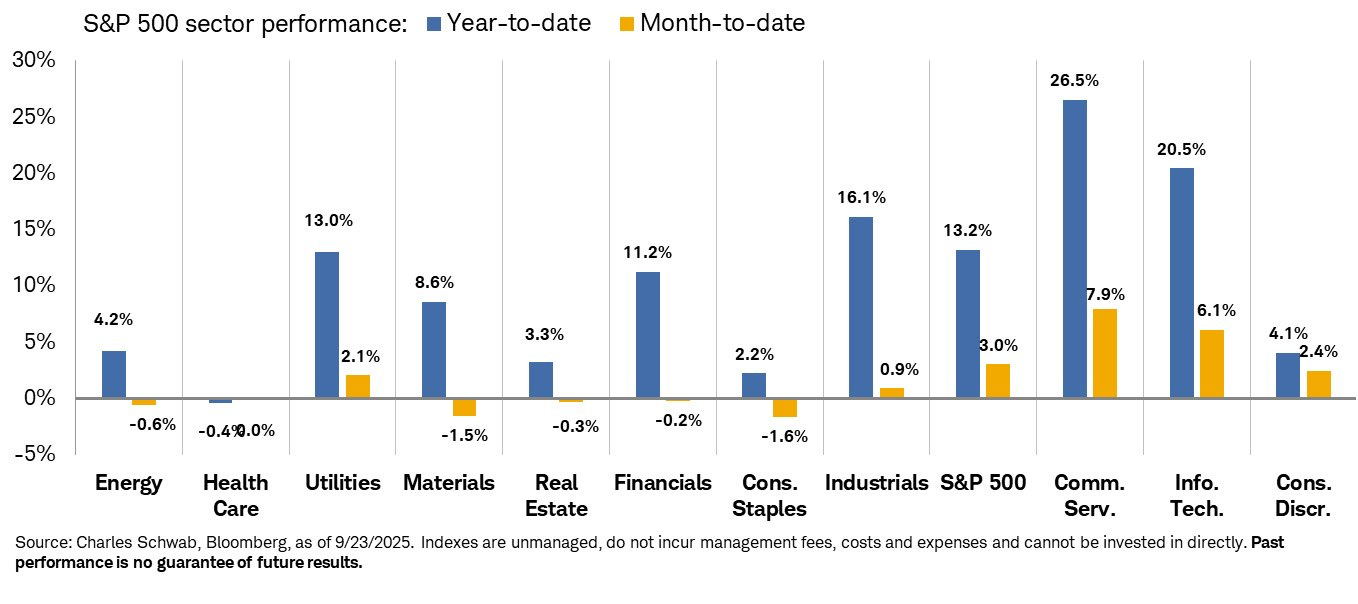

As the AI everything bubble sucks out all the oxygen in the room, it’s easy to forget some of the things that really makes the world move. You’d never know, but as of 9/23 (per Charles Schwab), energy as a sector has actually been positive for the year.

Sure, 4.2% is trailing the broader S&P 500 by many-of-percentage points, but it’s not negative, and for most energy investors, you’ve come to expect that in recent years. Let’s just walk-through what we’re seeing this year.

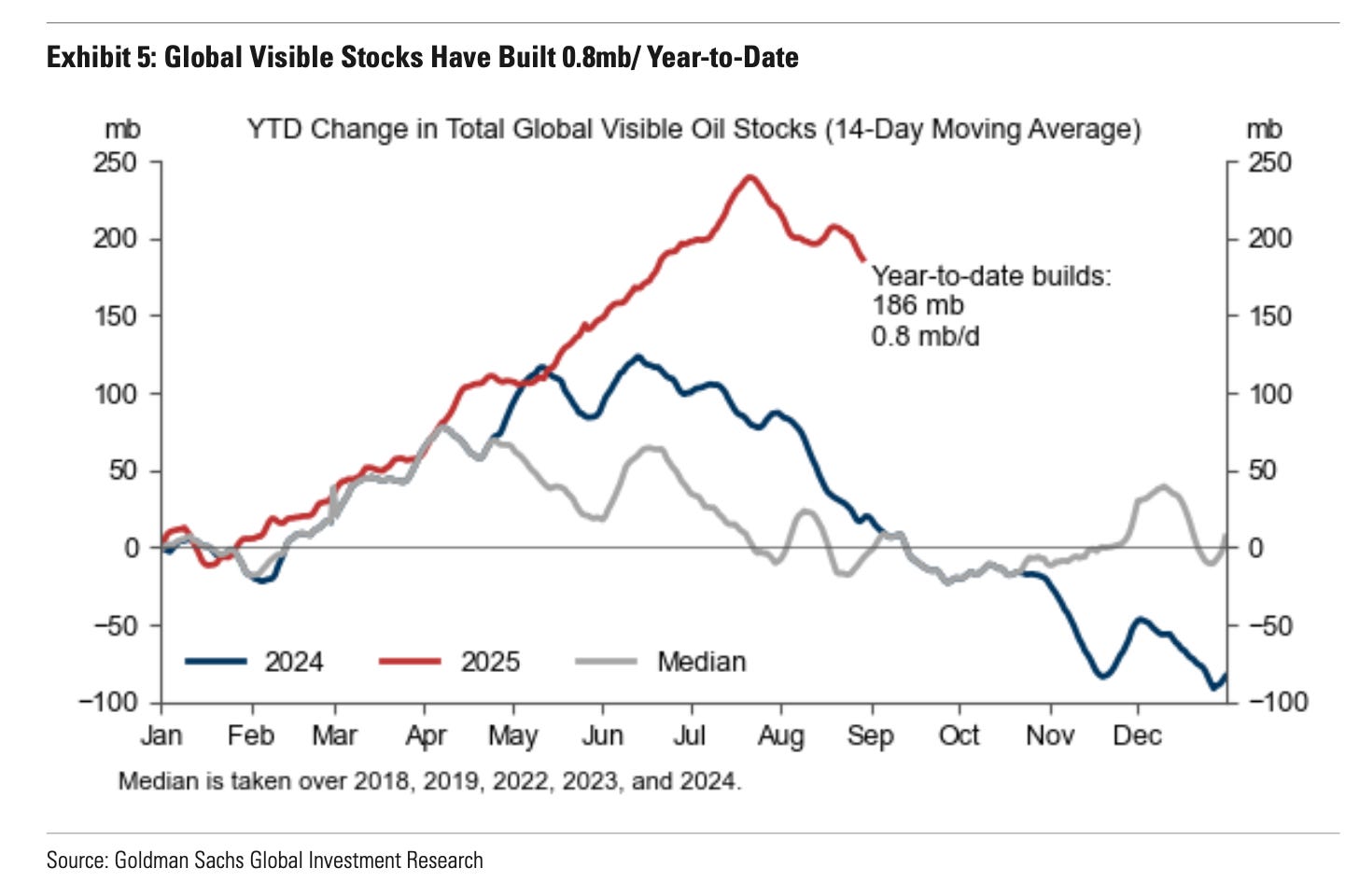

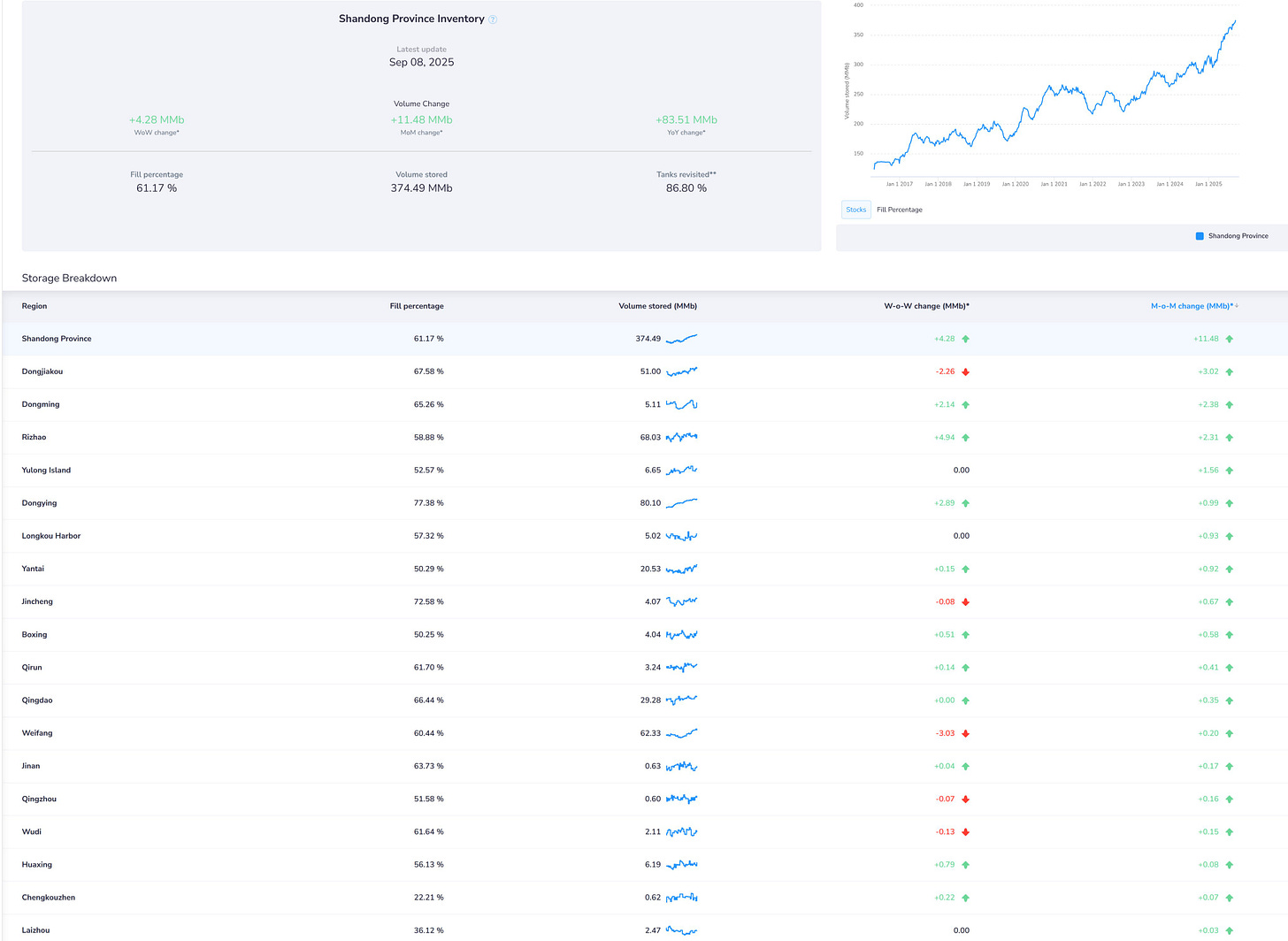

First off, inventories. Globally, they-are-a-building. Increasing Iranian storage coupled with ballooning Chinese inventories. Overall, oil inventories have built around ~200M barrels year-to-date. Okay, ~186M barrels to be more accurate.

Most of this (i.e., nearly half) have landed in China as newly expanded storage facilities are being filled for strategic and commercial reason.

It’s hard to pass up a bargain, and besides, filling storage facilities insulates China from geopolitical volatility/risk.

Interestingly, almost all of the builds happened since April. A reverberation from Liberation Day (i.e., US imposition of tariffs)? Yes, in part as that hampered demand, but also because producers worldwide have yet to fully throttle back despite oil’s 10% decline since the beginning of the year, and OPEC+’s unwinding of voluntary cuts. Thus far OPEC+ has unwound about 2.5M bpd of cuts, and they’re likely to unwind the remaining 1.3M bpd of cuts in the coming months. We had anticipated that they wouldn’t, or couldn’t, put the total amount of oil on the market, and that’s proven true. Exports though have gone up ~0.9M bpd so far, so OPEC+ is grabbing at market share. So as summer domestic demand tapers off and OPEC+ rolls-back some more voluntary production cuts, we’re likely to see some more supply increases hitting the market.

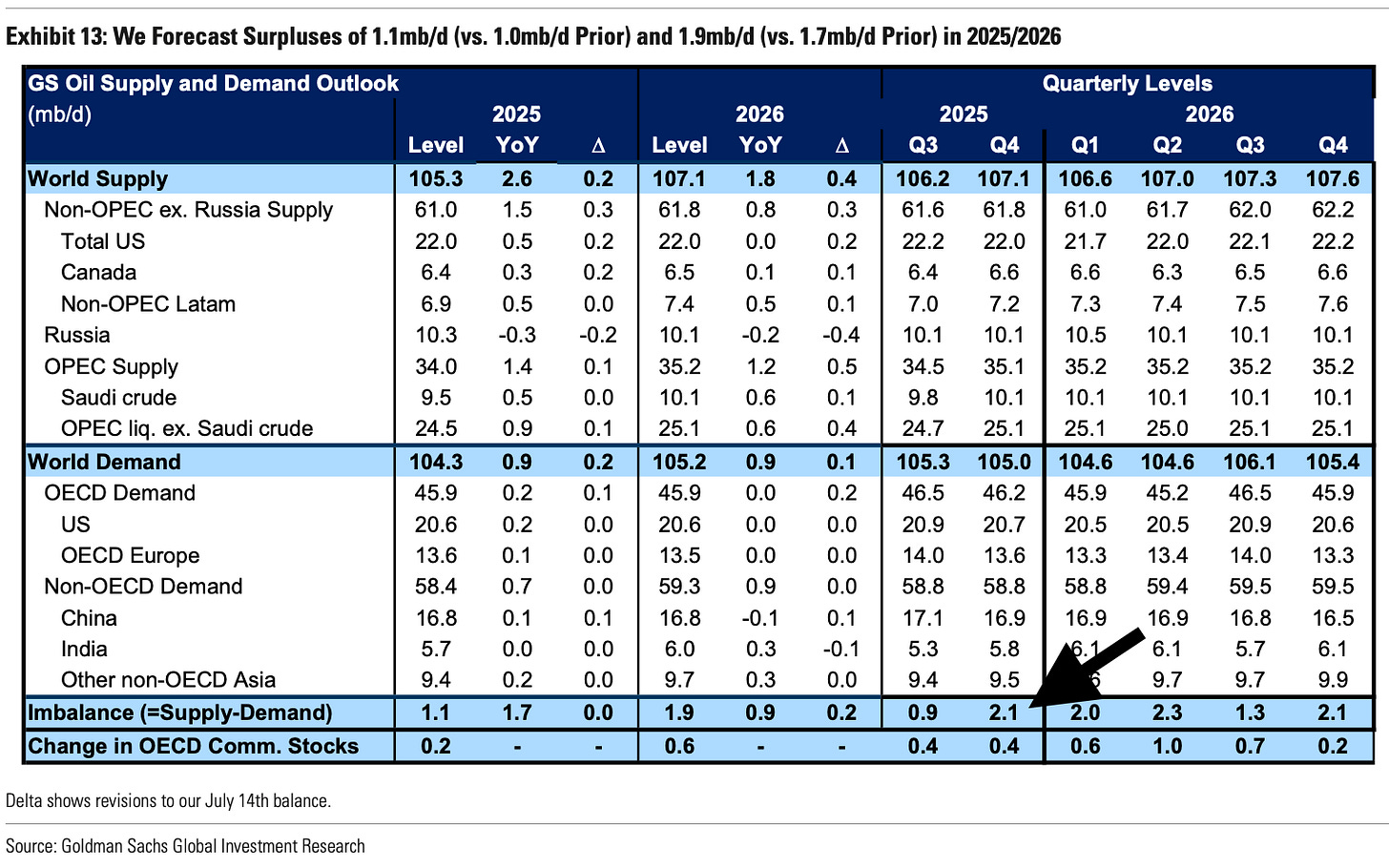

As we near Q4, analysts are forecasting a grip of inventory builds to come as long-term projects in Brazil and Guyana come online. Goldman Sachs is forecasting a 2.1M bpd build for the quarter, which would nearly double the current inventory builds we’ve seen YTD. Such a waterfall will almost surely crater oil prices.

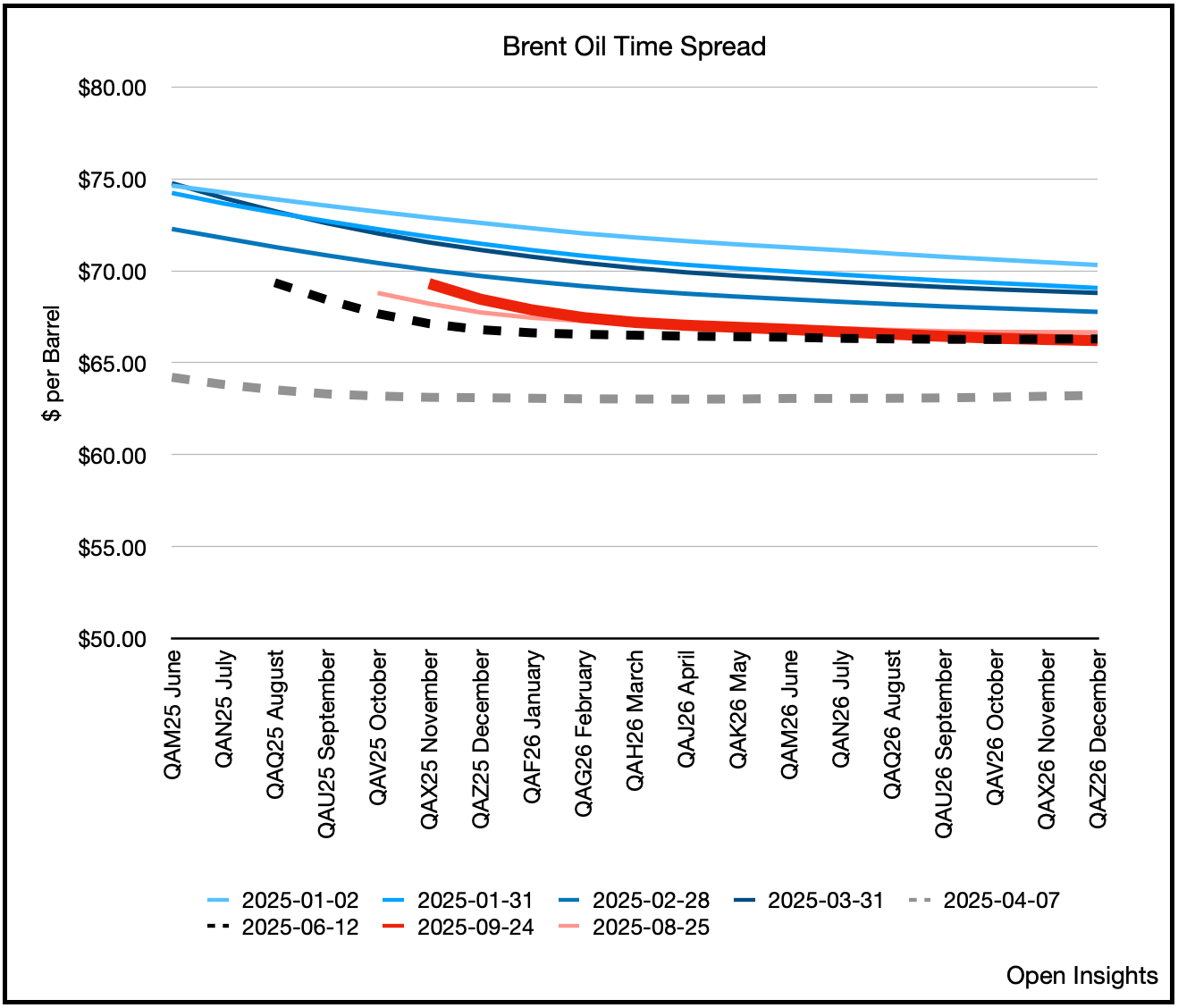

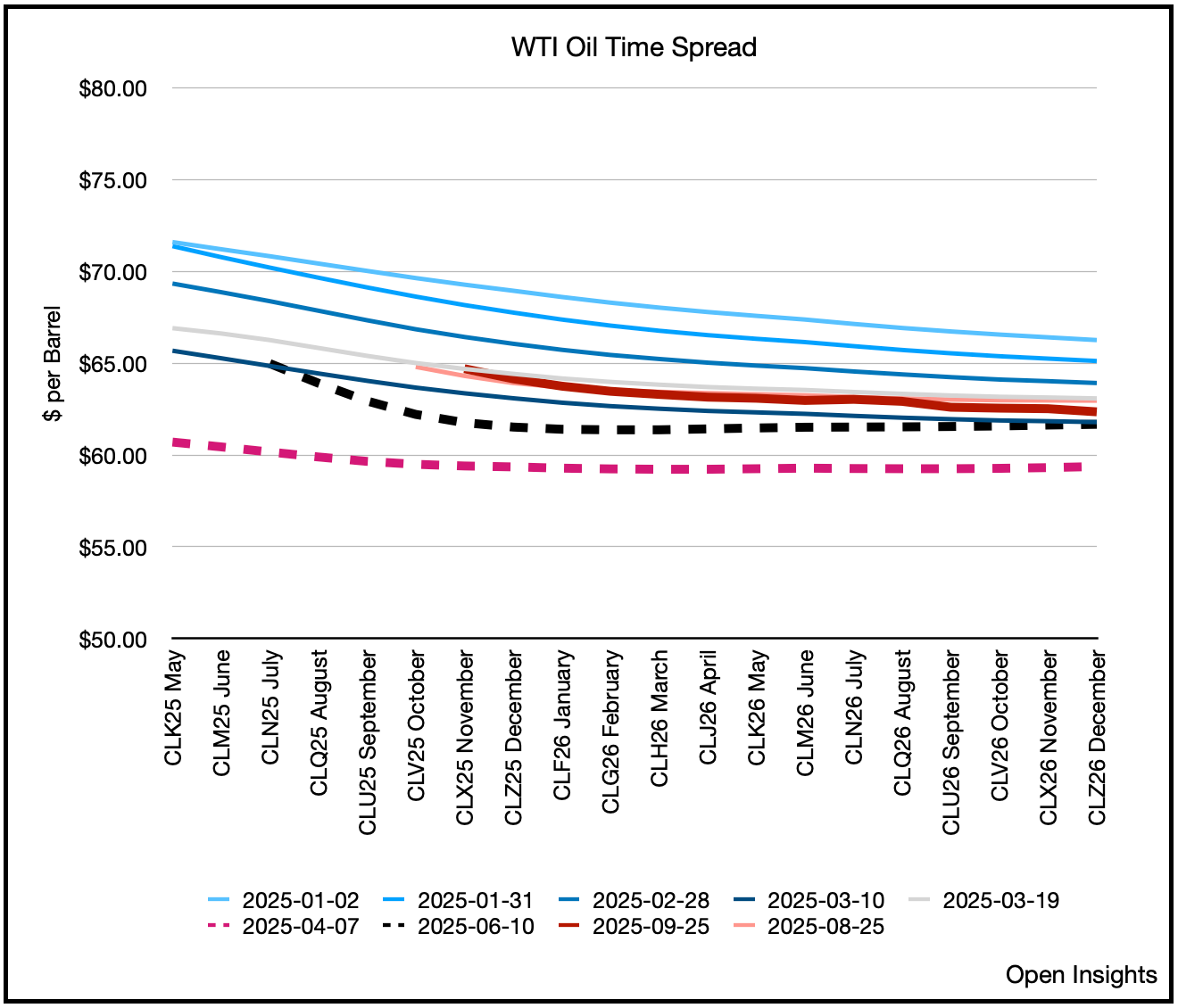

Sadly, they aren’t even the most aggressive as the IEA has penciled in higher builds. What’s odd though is that you’d think with these forecasts, prices would’ve reacted negatively already, but crude time spreads aren’t showing that calamitous fall (red line).

In fact, they’re smack in the middle of this year’s trading range, and recently the curve’s moved higher. Dare we say the market’s actually “sanguine?”

Prices are hovering in between where we started at the beginning of the year, and the trough period immediately after Liberation Day. They’ve clung stubbornly in the $60s, despite the depressed sentiment and rising inventories. There’s a few reasons for that though.

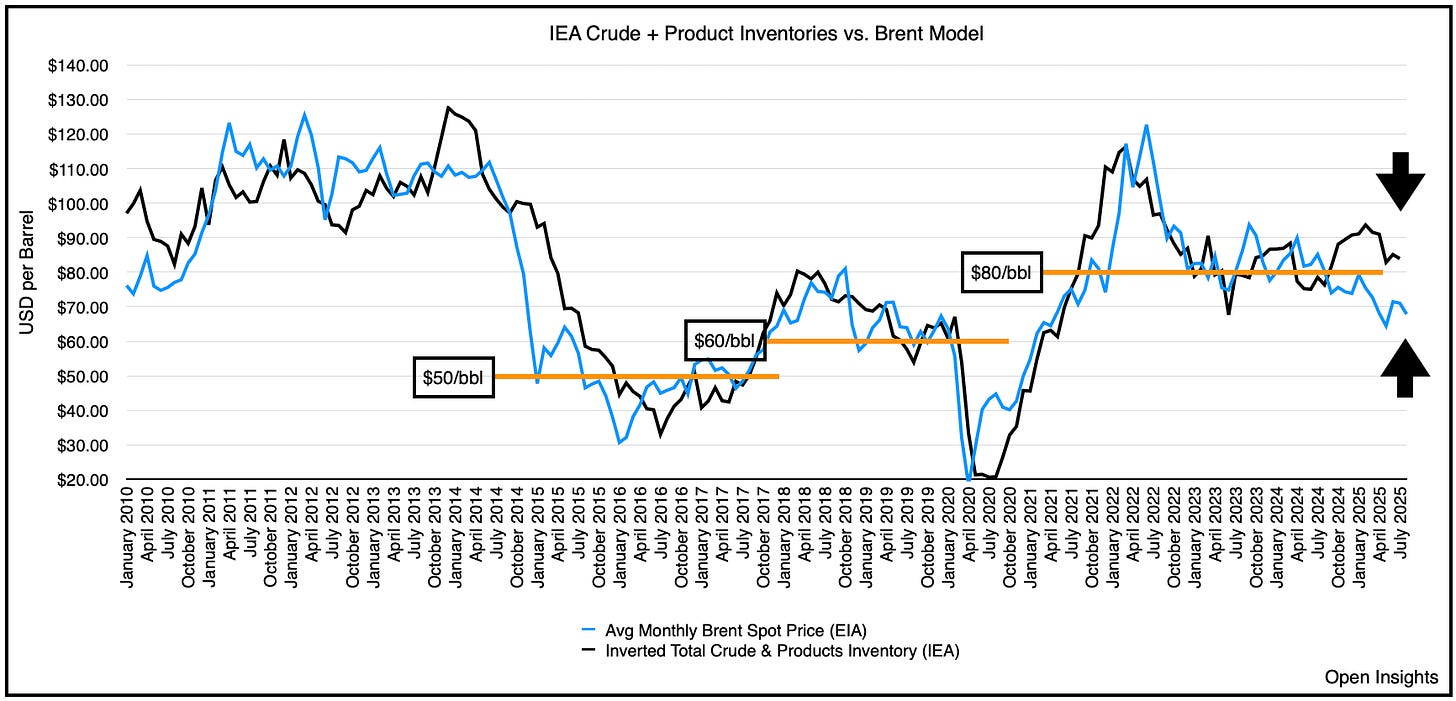

First, much of the inventory builds have occurred in non-OECD countries (i.e., basically China), and as such haven’t hammered the areas where they’re more visible and priced in.

Typically, oil follows inventories, but the disconnect’s been wider of late. If inventories fell to where the price indicates, we should already have 100M more barrels in OECD countries. Said another way, 100M of the 186M barrels of oil built this year are being priced in.

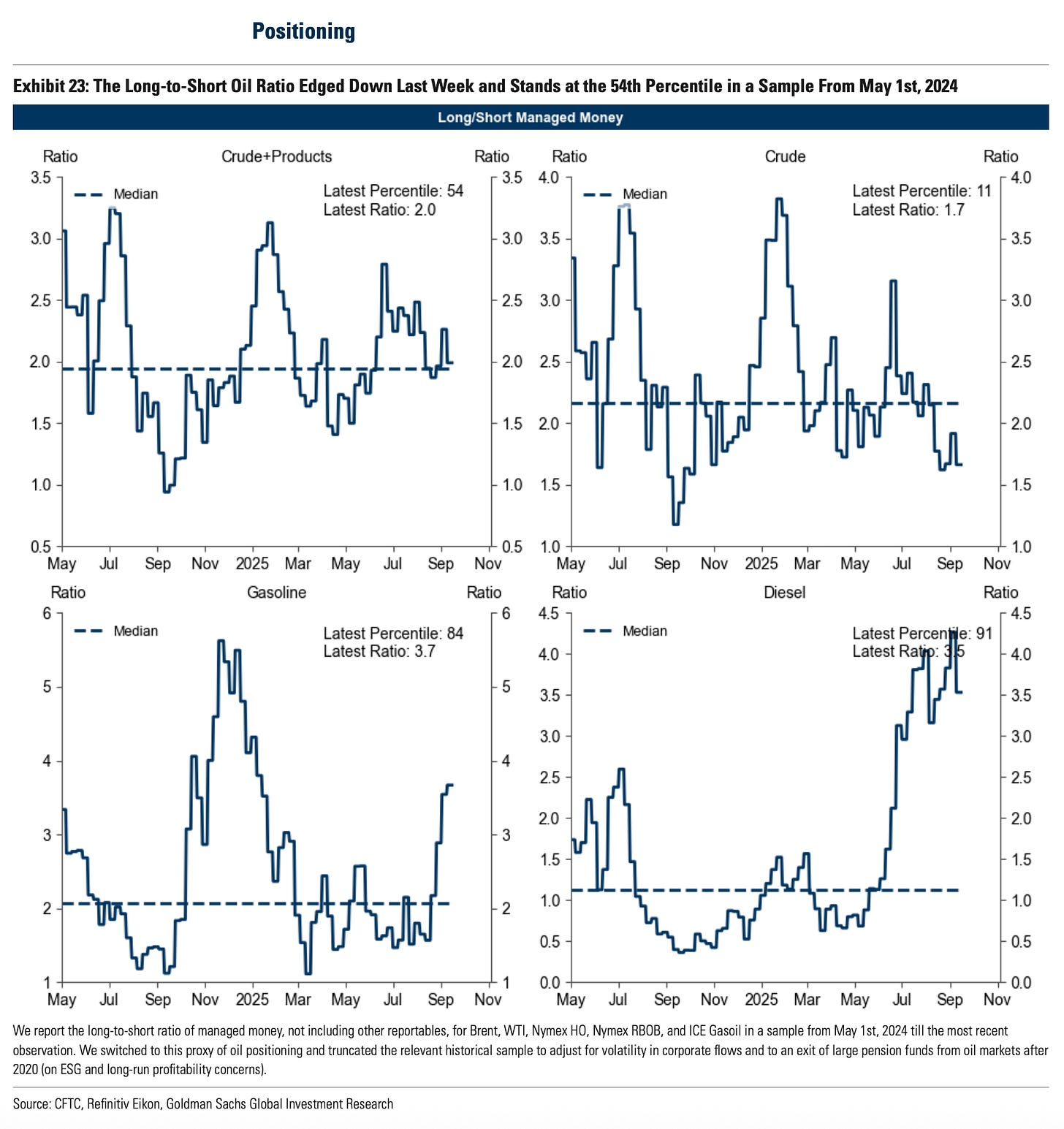

Second, positioning. The market was already pretty bearish energy post-Liberation Day, and it’s only increased since. So the higher inventories coupled with expectations of further builds means positioning is likely bearish and bombed out today. Let’s check . . .

Yes, indeed. For only crude though. For products? Not so much. This likely has to do with robust GDP, refinery shut-downs, and Ukraine’s systematic dismantling of Russia’s refinery complex (Kpler’s graphic).

Reducing Russia’s output of products not only increases domestic pressures (i.e., long lines at gas stations and population discontent), but could force crude shut-in at the field production level. So far, we’re seeing increased crude exports as Russia is likely diverting its crude.

So we’re really seeing some dueling banjos here. In the short run (say a quarter or two out), we’re looking at more builds, more OPEC+ unwinding of production cuts, and more supply additions (i.e., Brazil/Guyana). Past that though, we’re in a world where demand will be higher, US production plateauing, and OPEC+ spare capacity reduced by 80-90%, from an “on paper” 5-6M bpd to a likely ~1M bpd (~1%). Higher demand coupled with less supply and a lower buffer typically induces higher prices. It’s why we’ve held firm, well that and one of our positions is in the midst of an M&A transaction.

The fact that analysts have gotten so bearish for Q4, and forecasted builds larger than during COVID when the world shut-down, made us question the probability of that happening. Will inventories build? Yes. Not only because of the sheer volume of supplies OPEC+ is nudging back onto the market, but refineries are in turnaround season for maintenance. So we expect product inventories to fall in the coming months. Refinery maintenance and refinery attacks may exacerbate low product inventories, which means refineries may come back to face high margins and run flat out, bolstering crude demand.

There’s plenty of crude to sop up, but come next year? Likely not, as the world grapples with lower product AND crude stocks. That’s the idea anyways. For the time being we’re price constrained. The dueling narratives means it’s a toss-up with many uncertainties, but veterans of the oil market know that things never quite happen the way everyone expects them to, and for now, nearly everyone expects a deluge of supplies and ballooning builds in the coming quarter . . . we doubt it.

In fact, we’ve bet against it.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

interestingly, I continue to read that we are at or near peak oil demand, something I find very difficult to believe. but it would undermine prices if that were the case