A Whole Generation of Investors Have Never Seen This

September 22, 2023

This is what it feels like.

This.

A 7% interest rate environment.

~7% or thereabouts. Sure the Fed funds rate is running around 5.33%, but the reality is different. Credit is beginning to feel more expensive because it is, and that’s about to create some ripples in the market.

For the past 20 years, we’ve lived in an investment climate where rates were headed pretty much in one general direction, but since COVID, inflation has forced them significantly higher. So for the past 20 years, those who’ve started managing money since 2000, have only known a world where gravity has been falling and asset prices rising.

All of these middle-aged Gen X or Y money managers now are wrestling with a very existential question. What if the world is different now?

Will inflation be higher and longer? Will fiscal profligacy continue unabated? Who’s available to absorb all the government paper? These question are being asked, but the answers are uncertain. Everyone’s got an opinion, but let’s take a look at rates to see what the market’s really thinking.

Let’s tackle that first question. Is the market expecting higher inflation for much longer?

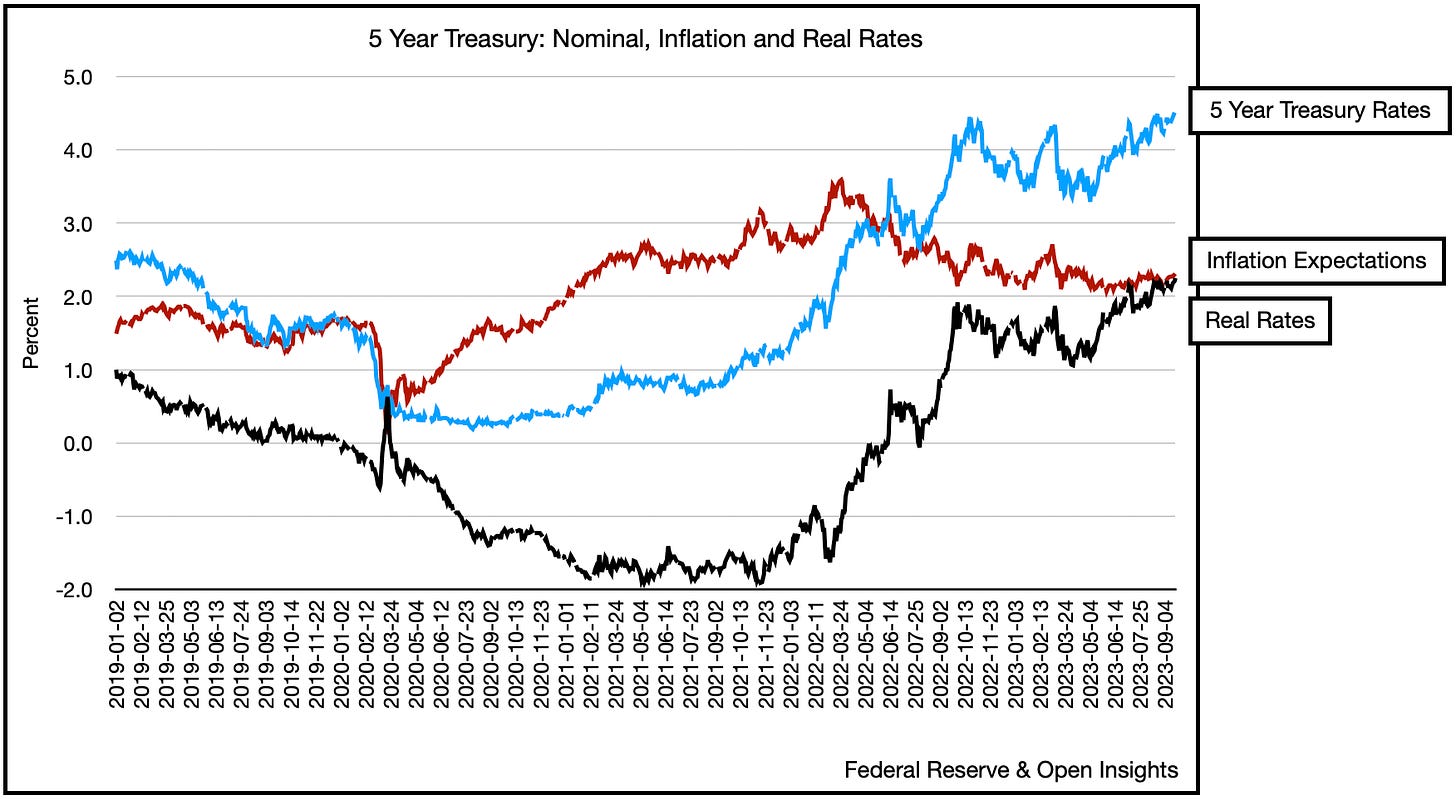

If we look at inflation expectations, they certainly don’t seem so.

The 5 year has flattened out (red line) lately.

The 10 year has flattened out (red line) lately.

The 30 year has flattened out (red line) lately.

What hasn’t though are the blue lines, the nominal rates. In turn, the real rates are also being dragged higher. This raises two questions. First, what if inflation expectations are actually wrong, and inflation doesn’t settle around the 2% area on a longer-term basis? Second, if it’s not inflation, what’s causing nominal rates to creep steadily higher?

Let’s tackle the first. Inflation, there’s just little evidence that inflation will trend back to a 2% level shortly.

To repeat, inflation is driven by four things, shelter, durable goods, non-durable goods, and service. Although the year-over-year growth in shelter prices is starting to fall and the cost of durable goods have bottomed, the latter two are beginning to creep higher.

Though inflation for shelter prices will temper core and headline CPI figures, shaving off 1% from them still leaves inflation rates well above 2%, and that’s assuming energy and commodity costs don’t push higher. A tall assumption as Saudi Arabia pursues its strategy of “managing the market” and constrain exports. In all likelihood, energy prices will climb higher in the coming months as inventories deplete further.

The current state also doesn’t include the wildcard of Russia, and what it plans to do as we head into the winter. As Louis-Vincent Gave at Gavelkal Research shared, there’s a not so insignificant chance that Putin will weaponize energy as the 2024 winter begins and we start the election season. What’s the likelihood Putin could further constrain the market to engineer a regime change in the US and UK? Higher than not, that’s for sure. Longer-term, outside of demand destruction, it’s going to be difficult to replenish those inventories. OPEC+ production is largely constrained (Saudi self-interest), and Western production by ESG/climate change initiatives and shareholder demands. So once tightened, low inventory levels will keep prices higher for much longer.

Again, that’s only energy, a non-durable good. Toss in all those raises/new contracts being agreed to with workers (e.g., pilot unions, UPS drivers, UAW (eventually), SAG/Writer’s Guild (eventually)), and we’re certainly in a “higher for longer” wage environment as workers gain the upper-hand in a still tight labor market. So services is likely to rise as well, and for years as the labor agreements are often 4 years long.

So overall, inflation? Yeah we doubt it’ll be 2% in the coming years as none of those factors have abated in the past few months. In fact, just the opposite. So go back to that chart, let’s look at the 5 year red line of inflation expectations. What happens if that red line starts pushing higher?

You can sure bet that the blue line (5 Year, 10 Year, 30 Year Treasury Rates) will also rise then. Heck it’s already rising even independent of inflation right now, which brings us to our second question. If inflation expectations are low, then why’re rates still creeping higher?

Remember, interest rates compensate you for 3 things, inflation, risk of loss, and a return, and if its’s not inflation, then perhaps it’s one of the other two. Well maybe it’s something I say to my kids sometimes . . . nothing is given, everything is earned. The federal government can’t technically default since it owns a US Dollar printing press, but with the rampant fiscal stimulus, government debt at $33T, debt to GDP at 120%, and massive issuances incoming, investors are increasingly being called on to absorb the deluge of government debt (i.e., someone has to buy our debt).

It’s a tough ask. Hence the asking price keeps rising, and as we can see, it’s increasingly not on the front end of the curve, but the back-end.

So yes, it’s not just that the Fed came out this week to intimate that they’ll keep rates higher for longer that’s prompting the reevaluation by debt investors. It’s something else. Investors are realizing that this isn’t quite the world we’ve been used to all along. Some things may have actually changed, so much debt has been issued that now needs to be refinanced, and so many things cost so much more. All of these things need to be priced in now.

It all starts with interest rates, and if rates are going higher and gravity is getting stronger. . . well asset prices may just need to come down to match.

Nothing is given and everything is earned . . . even for our government.

Please hit the “like” button above if you enjoyed reading the article, thank you.

higher for longer

I think you've underestimated the impact rising real yields have had - heck most of the recent rise in nominals and fall in inflation expectations has been due to the rise in reals.