As Israel's Offensive Begins, It's Time to Diagram Oil's Upside

October 27, 2023

Will they?

Won’t they?

Unsurprisingly, they did.

The ground offensive begins as Israel attacks Gaza. Call it a massive raid (perhaps initially), but what it is tanks and armored vehicles moving in mass.

https://twitter.com/sentdefender/status/1718058177265115585

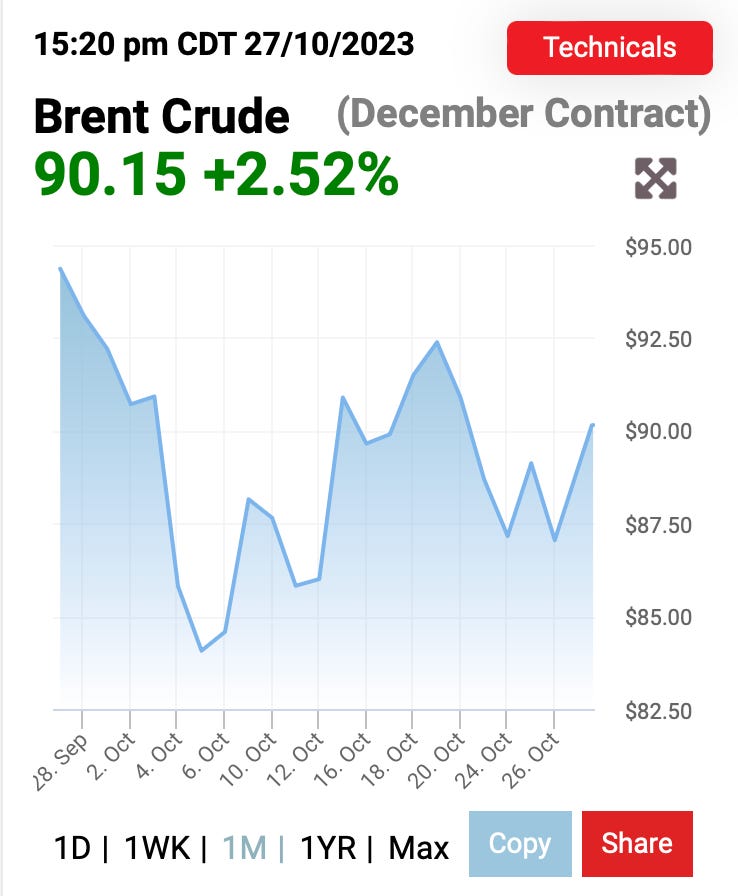

Oil prices climbed as the Friday trading day ended, and after a tumultuous week where the market expressed skepticism that Israel would actually attack as hostage negotiations continued (and potential “cease fires” would be agreed to), once the troops and tracks started moving, prices climbed.

What’s unknown, however, is what comes next. We can draw string diagrams on the wall all day long, but what will affect the oil market is if the conflagration spreads. Does Israel (or the US) attack Iran because the Iranian proxies (i.e., Houthis, Hezbollah, etc.) inflict enough damage on the US to drag them into the campaign? If we were Iran, that might just be the play as a retaliation by the US would further enmesh the Western world into the Middle East conflict. Moreover, it’s another way to redirect the enmity against a greater foe.

Anger the perfect foil.

Uncertain though, which is why the market isn’t pricing it in. Bets on significantly higher oil prices are being made, but the spot price is range bound because the possibility/probability of a supply disruption remains low. Uncertain at best, unlikely at worst. So why go long indeed.

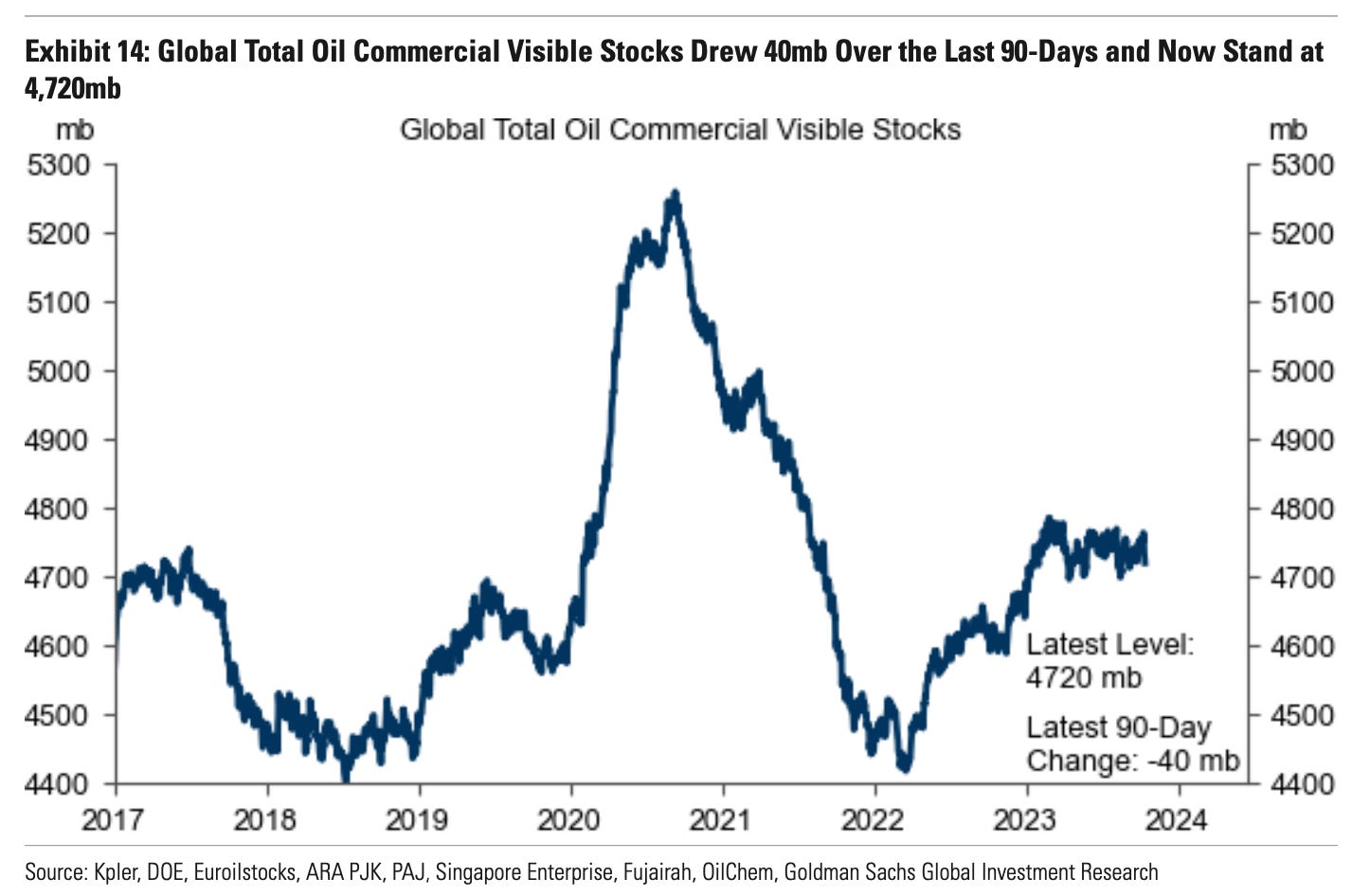

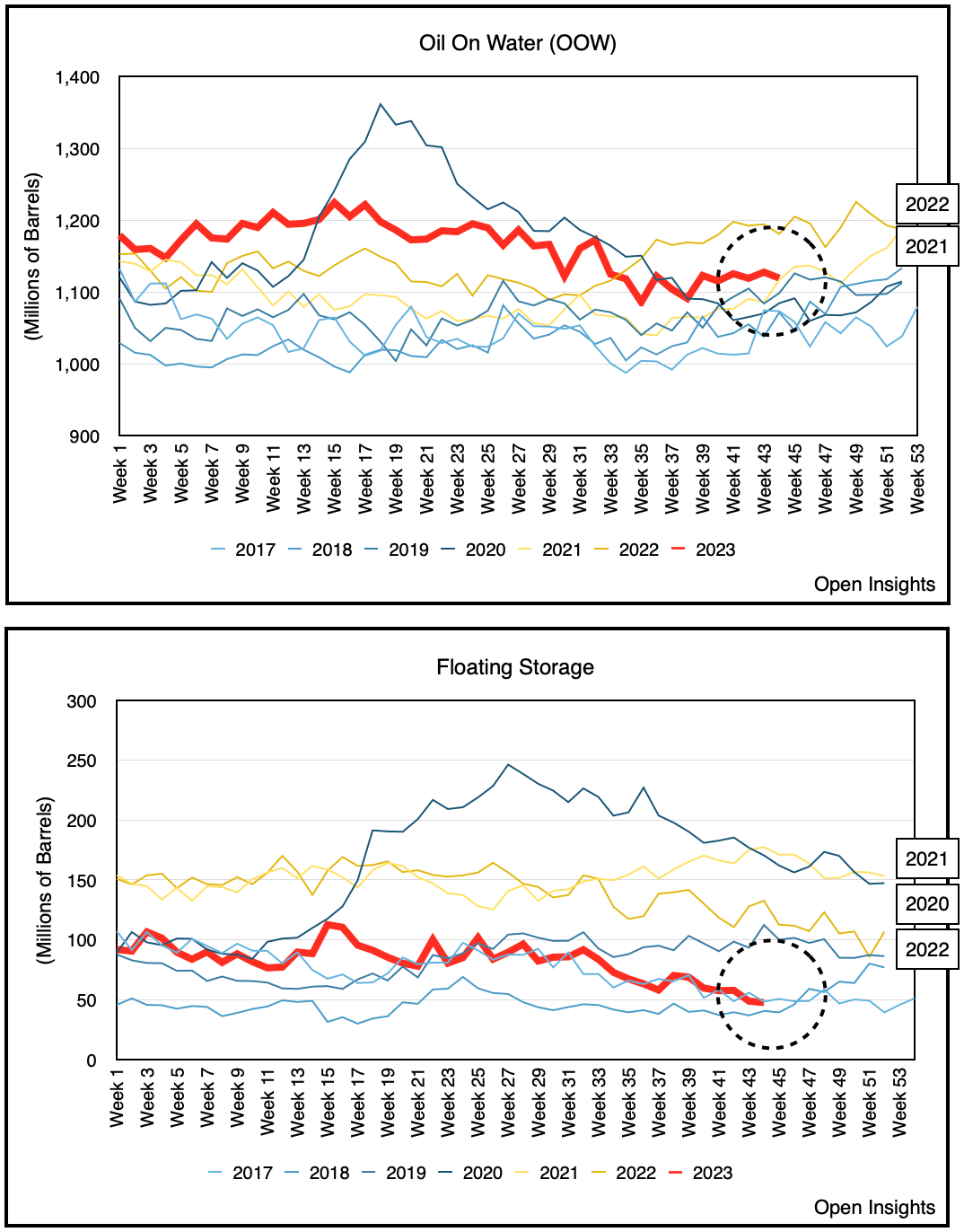

There’s also no fundamentally compelling reason to right now. Oil inventories are hanging in there. Low, but not too low. Oil on water combined with onshore storage has been fairly flat, while refinery maintenance season continues.

Break it out separately and while oil-on-water has increased, floating storage has been drained. Net/net, the stuff on water (i.e., those moving and those stationary)? Flat as well.

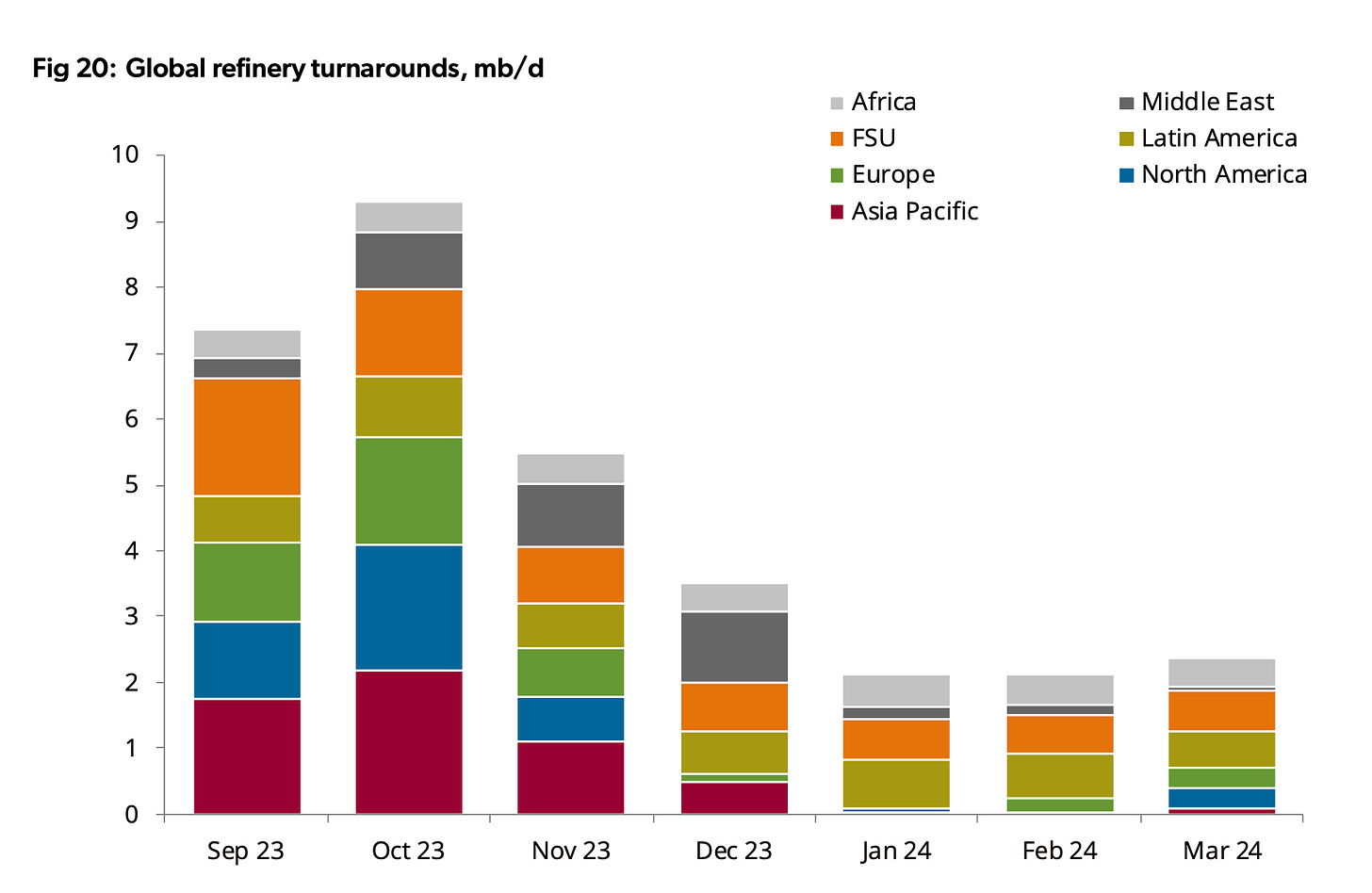

Refinery maintenance season, mind you, is a time when crude draws are supposed to be lower as refiners take a seasonal break to conduct repairs/upgrades. Globally, we’re at the peak of refinery maintenance now, and we should be coming off the lows in the coming weeks. Here’s a chart from Energy Aspect that shows you just how much is offline.

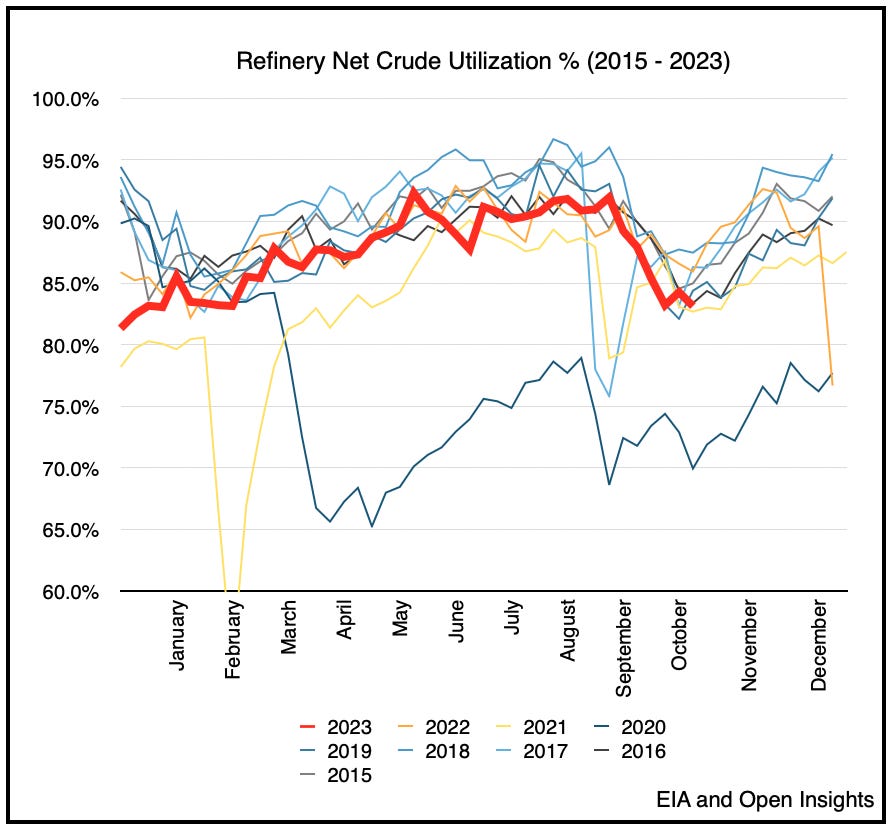

Zoom into the US and you can see, late-October is about the peak of the fall-off, and we should be climbing soon.

So everything’s flat, and that’s fine. Saudi Arabia and OPEC+ continue to manage the market, and given the Middle East uncertainty, it’s likely they’ll extend the “already extended” production cuts from the year-end to 2024. Most likely past the next refinery maintenance season in April 2024 (why, after all, let inventories seasonally build in early 2024 after working so hard to drain inventories in 2023). Our best guess is they’ll also do so until oil prices reach $110/barrel, since they know full well that once they let off the brakes, the prices will coast lower to nearer $100. Beyond that the instability in the Middle East and the ripple effects on the global economy warrant caution. So they’ll play it close to the vest in the coming months, and prevent the market from getting too squirrely.

Overall, demand should remain stable in the coming months as well. The consumer remains healthy in the US as income increases are keeping pace with the rise of credit card balances. Look no further than all the wage increases being handed out. UPS workers with 5 year, 55% wage increases, UAW’s 5 year, 25% wage increase, and airline pilots with 4 year 40% wage increase. Seeing those contracts, do you really think inflation will subside to 2% per year for the foreseeable future? hmmm . . . .

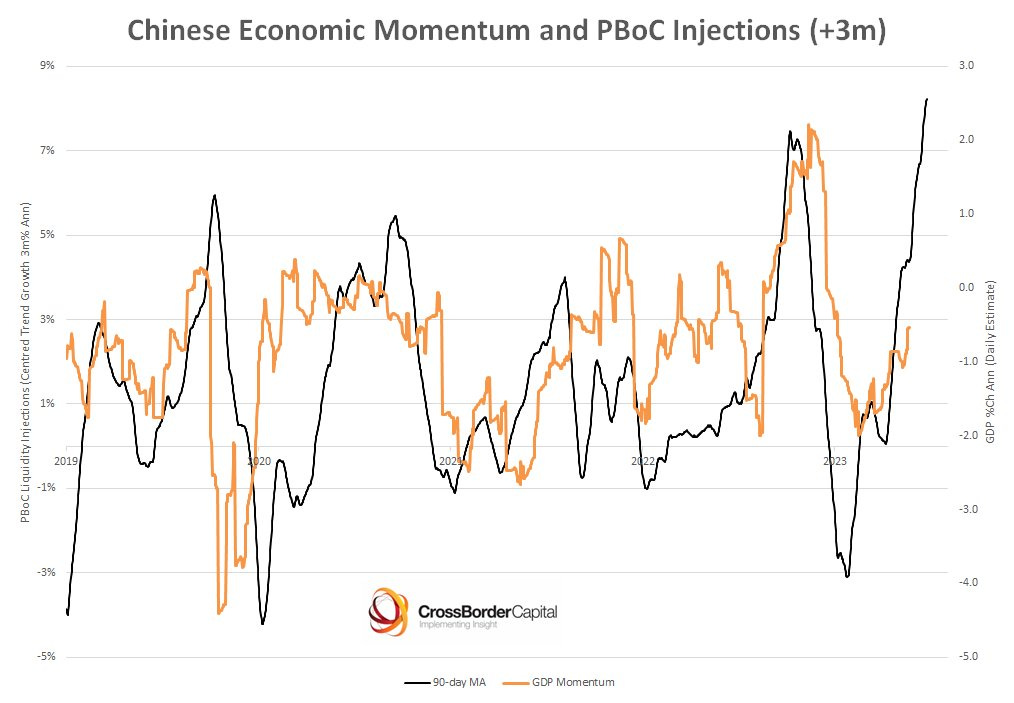

On the other side of the world, China? Yeah they’re bringing the monetary juice.

Growth is slow, and the property market is still hurting, but bring that much firepower to the economic landscape, and it’s sure to motivate the capitalists in that country. China will rise again.

So overall, crude inventories are low, and they should begin to trend lower in the coming months. The consumer remains healthy in the US, and China has begun to stimulate aggressively, and overall, demand “should” be okay. Geopolitical and macroeconomic uncertainty means we won’t have more clarity until we see who attacks whom in the coming days. We can’t create string diagrams in a vacuum, and even if we can, they’d be meaningless as the pins will surely shift quickly in the coming weeks. For now hunker down on energy.

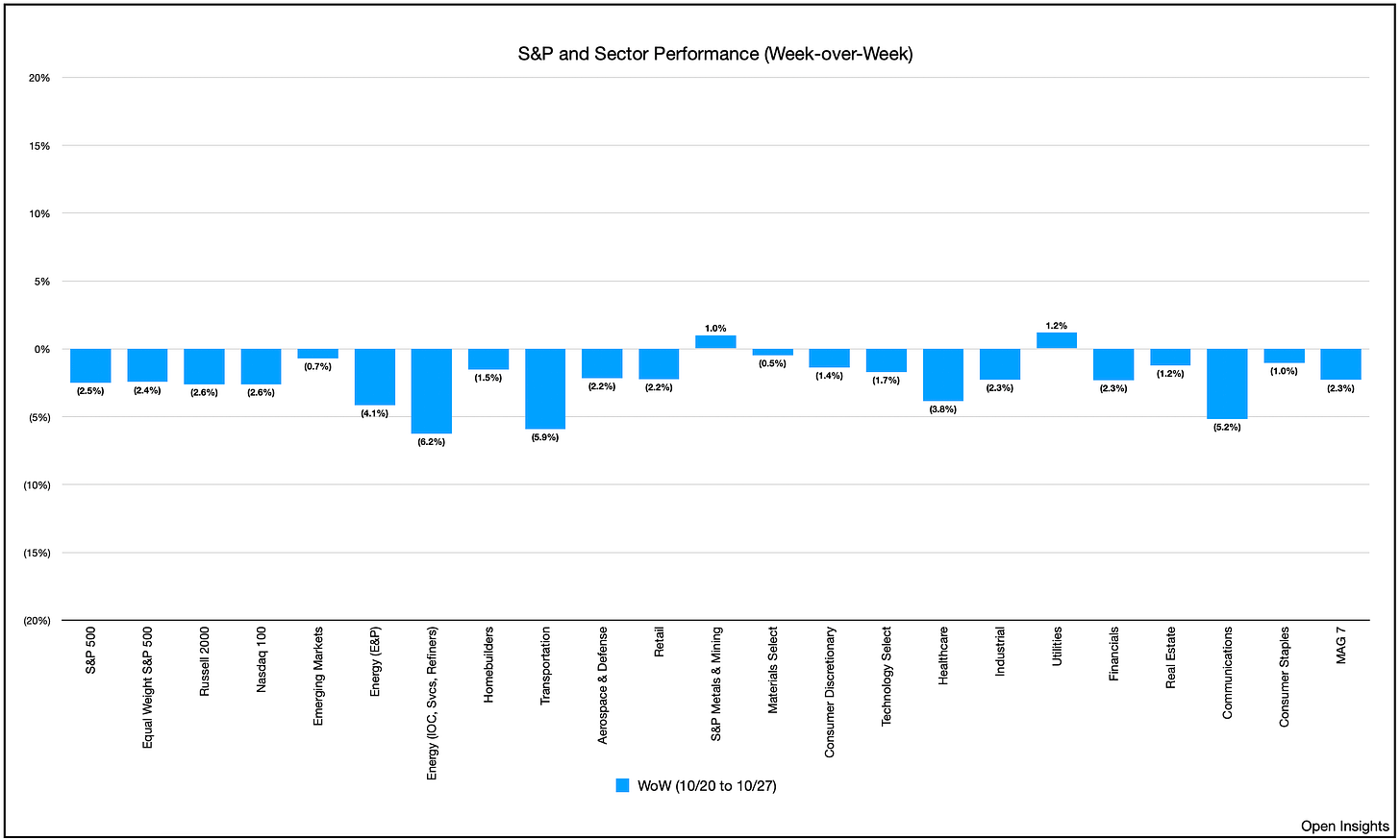

As for our broader market concerns we aired last week?

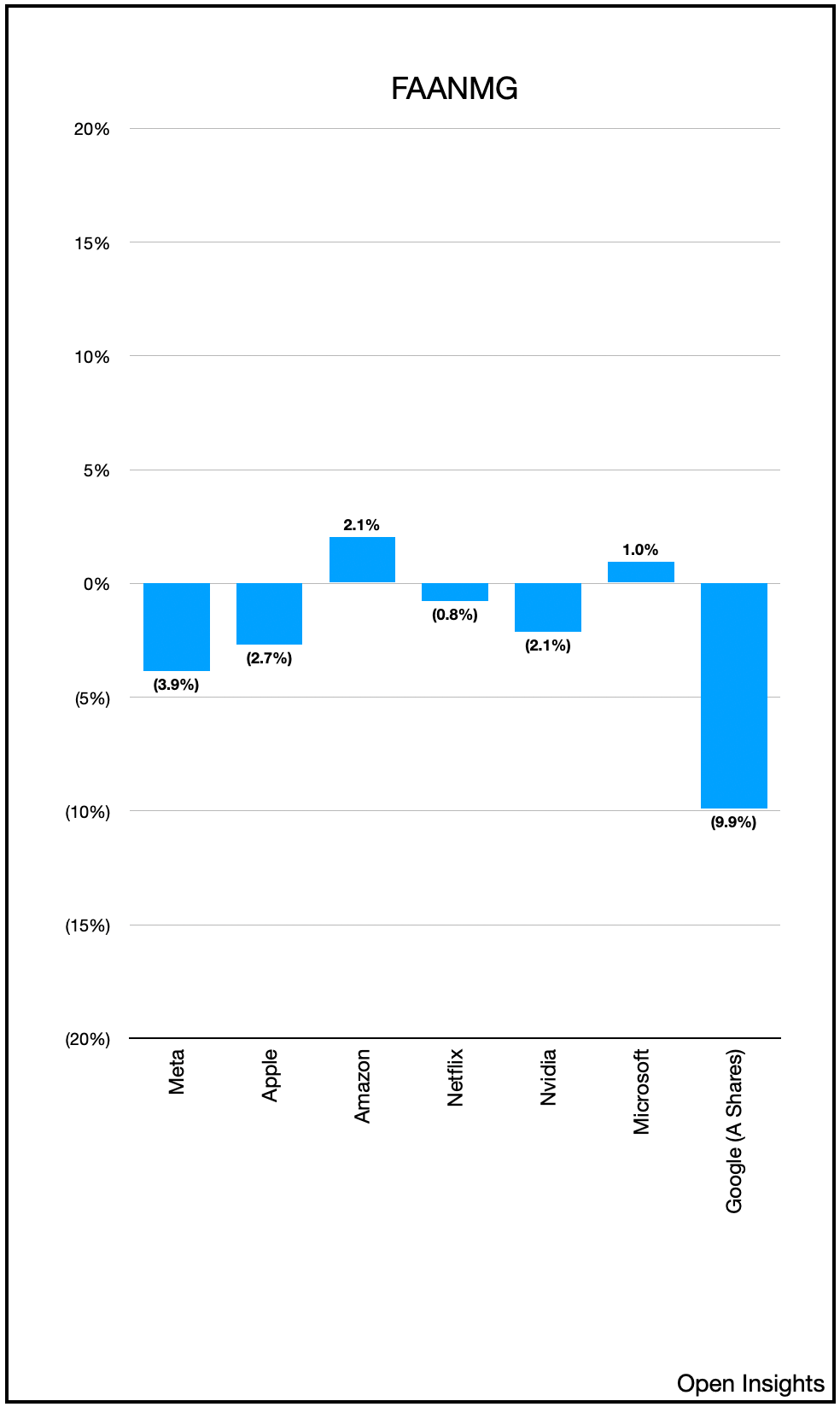

Yes, that still applies, as MAG 7 starts to look weak, and if not for Amazon’s outperformance, it was a decidedly dicey week.

Up next is Apple’s earnings on 11/2, and should that prove out to be tepid, we could be in for some downside here.

As for energy . . . some more waiting. Another week to see how the pins move and for the lines to form. Get the strings ready.

It’s diagram time.

Please hit the “like” button above if you enjoyed reading the article, thank you.