Back on the Peloton

August 18, 2024

We got on, then got off. No not because we had some brilliant insight. We sold our position for a tiny gain because we rotated into something else. It happens when you're a portfolio manager. R&D positions are often bought then sold quickly because something more interesting (or likely an R&D idea) came along.

Well not our bike, mind you, but the stock.

Now we’re just staring at it. A lonely unridden bike, sitting in the middle of the room. Sadly depreciating, day by day, month-by-month.

Like some members’ bikes, it’s become a clothes hanger for the market. Languishing below $3/share for awhile, abandoned and unloved. Below that magical $5/share threshold that preclude some mutual fund managers from considering. It can’t seem to get out of the dog house, and out of its way. Since our write-up a few things have happened.

Three in particular.

A Changing of the Guard

Karen Boone and Chris Bruzzo, both formerly board members at Peloton, were announced on May 2 to be the new Co-CEOs of the company. Barry McCarthy, the former CEO, was fired after two years at the helm. Ms. Boone was most recently the President and CFO/CAO of Restoration Hardware, and Mr. Bruzzo was an EVP and Chief Experience Officer at Electronic Arts.

Making Hard Choices

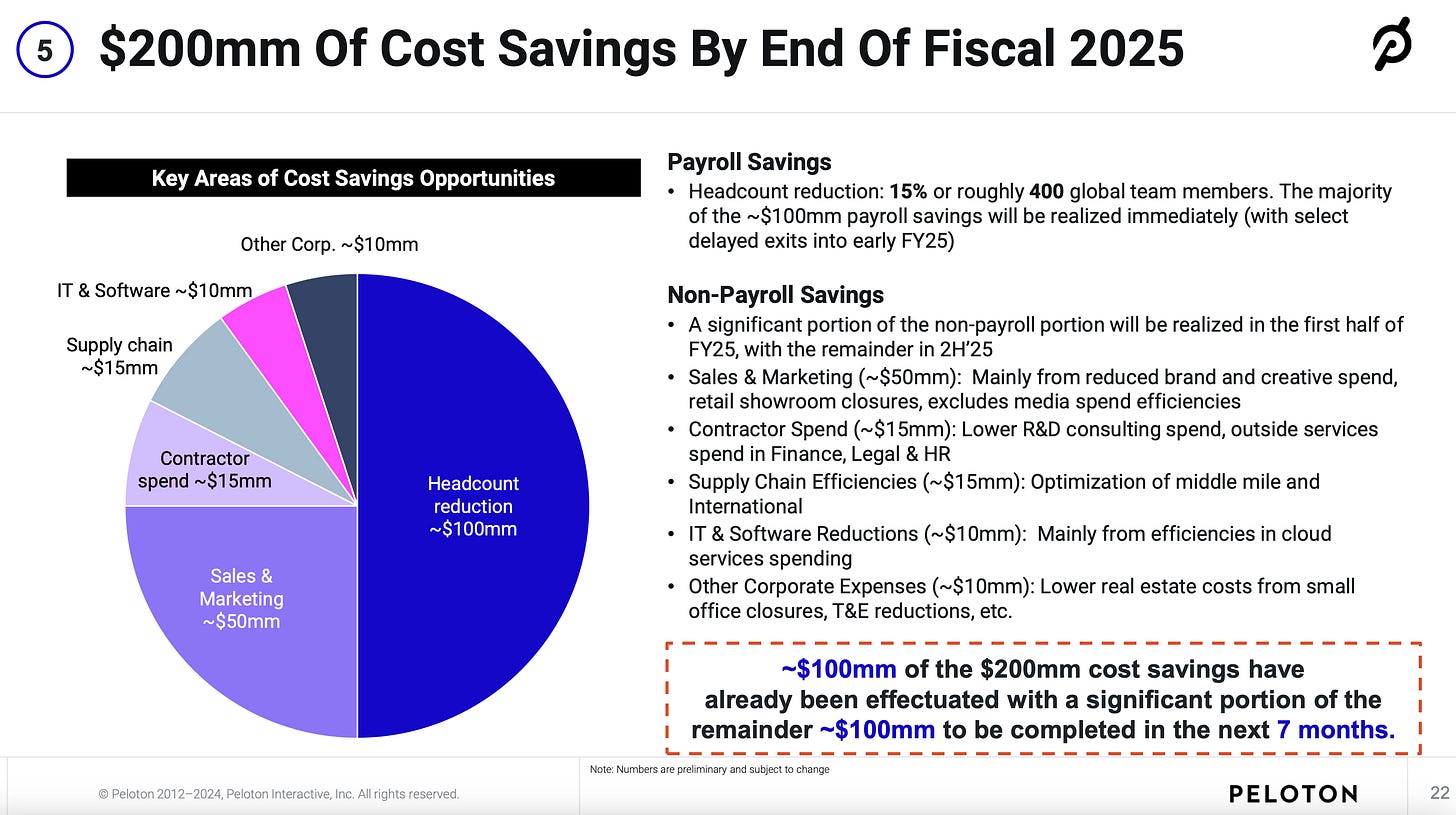

The company also announced a new “2024 Restructuring,” one designed to cut 15% of the company’s workforce (i.e., 400 employees). The company will take a cash hit of $90M to sever employees, but the overall plan to slash operating expenses is projected to save $200M/year in run rate. Half of the savings are related to the layoffs, and should be realized by the end of the year. The remaining $100M will sprinkled through IT, marketing expenses, outside consulting fees, etc. and will be realized over 2025.

Reinforcing the Foundation . . . at a Cost

Third, a refinancing of its balance sheet. Sadly, gone are most of the $1B of 0% 2026 Convertible Notes with convertibles at a $239/share strike price (“2026 Convertible Note”). This gaudy “loan” (really a call option for lenders to buy in disguise) had already been heavily discounted given the rise in interest rates and precipitous decline of Peloton’s stock. Peloton repurchased $800M of the 2026 Convertible Note with cash raised from a new $350M 5.5% 2029 Convertible Note (the convertibles have a strike price of ~$4.58/share, and could increase share count by ~76.5M shares out of 352M (currently outstanding)) (“2029 Convertible Note”).

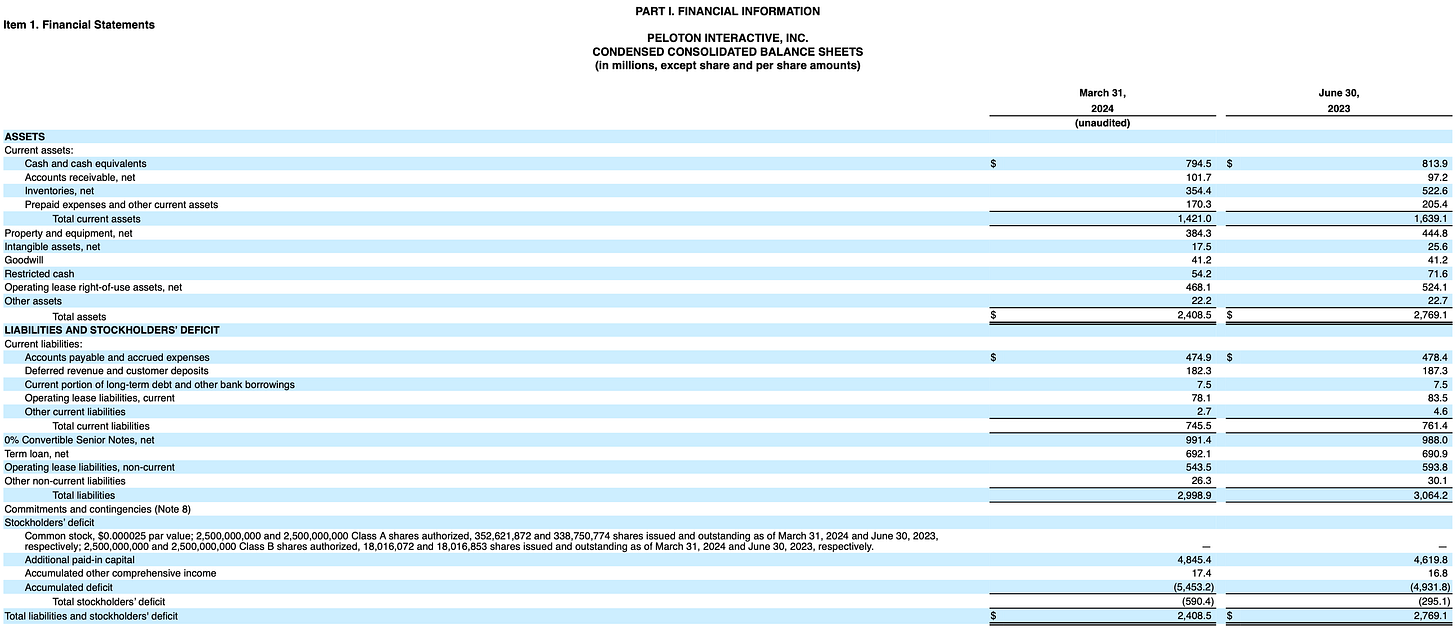

In addition, the Company priced and allocated a new $1B 5-year term loan facility (“New $1B Term Loan”), and $100M 5-year revolving credit facility. These new credit facilities replace the Company’s existing $750M term loan facility (~$740M outstanding as of 3/31/2024) (“Old Term Loan”) and $500M revolving credit facility (untapped).

We surmise that the “extra” $250M Peloton received under the New $1B Term Loan was combined with the $350M under the 2029 Convertible Note to pay-down the 2026 Convertible Note to ~$200M. The Old Term Loan carried a 14.5% interest rate, and we assume that the New $1B Term Loan also carries the same rate. Consequently, when combined with the 5.5% yield of the 2029 Convertible Note at 5.5%, Peloton will likely pay a blended rate of 9.3%, raising the company’s interest expense by $55M. (Note reducing the revolving credit facility from $500M to $100M should correspondingly save ~$1M in commitment fees, but we’ve left that aside for materiality). Nonetheless, all of this allows the company to extend its debt maturities by ~5 years (though in reality ~4 years as companies don’t wait to the last minute before refinancing).

Live to play another day.

Should we though?

Should we also play with Peloton another day?

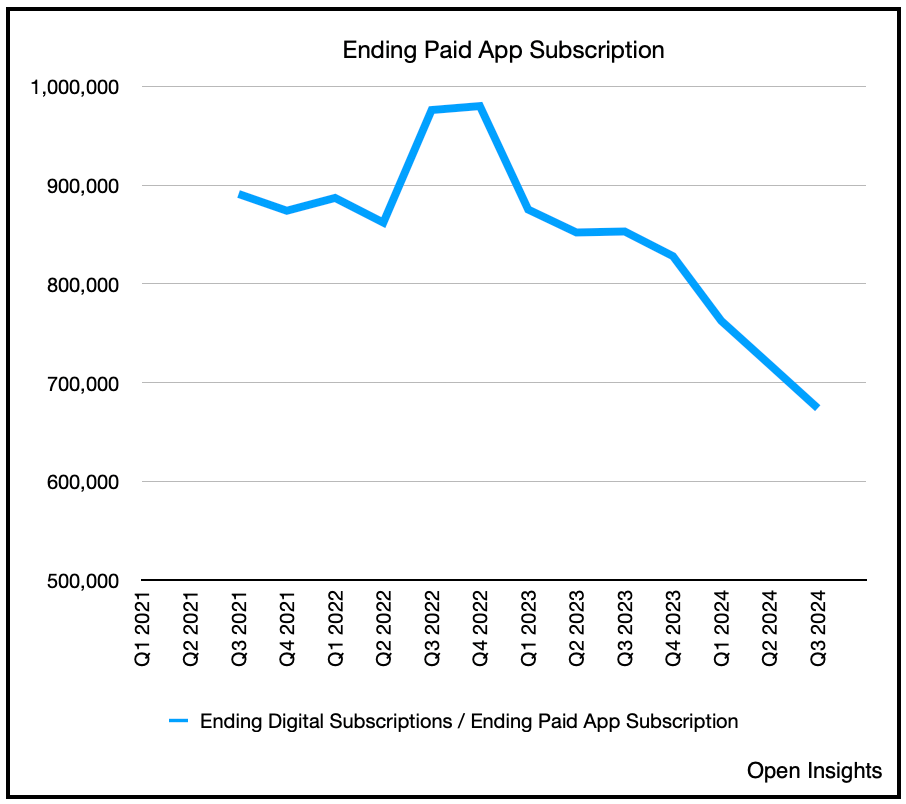

Since we last left this company, Barry McCarthy’s grand plans for growth never fully materialized. Despite hyping the Peloton One App, it hasn’t been able to gain much traction. Converting free subscribers to paying ones has proven difficult, and for those who did pay, cancellations accelerated. After an initial boost following its relaunch, the app has continuously bled paying subscribers.

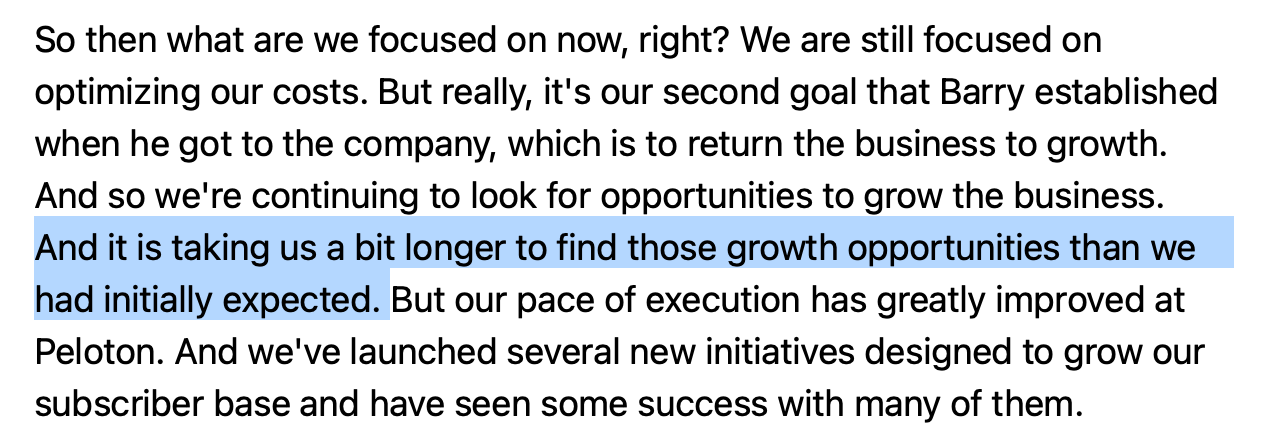

This, coupled with low lower Bike sales in the critical holiday seasonal period likely led to the ouster of Barry McCarthy as CEO. Here’s Liz Coddington’s comment at a Morgan Stanley Tech conference back in March, two months before McCarthy’s firing.

This is really the key issue. Two years with McCarthy at the helm and the company’s failed to grow. No wonder the Board got antsy.

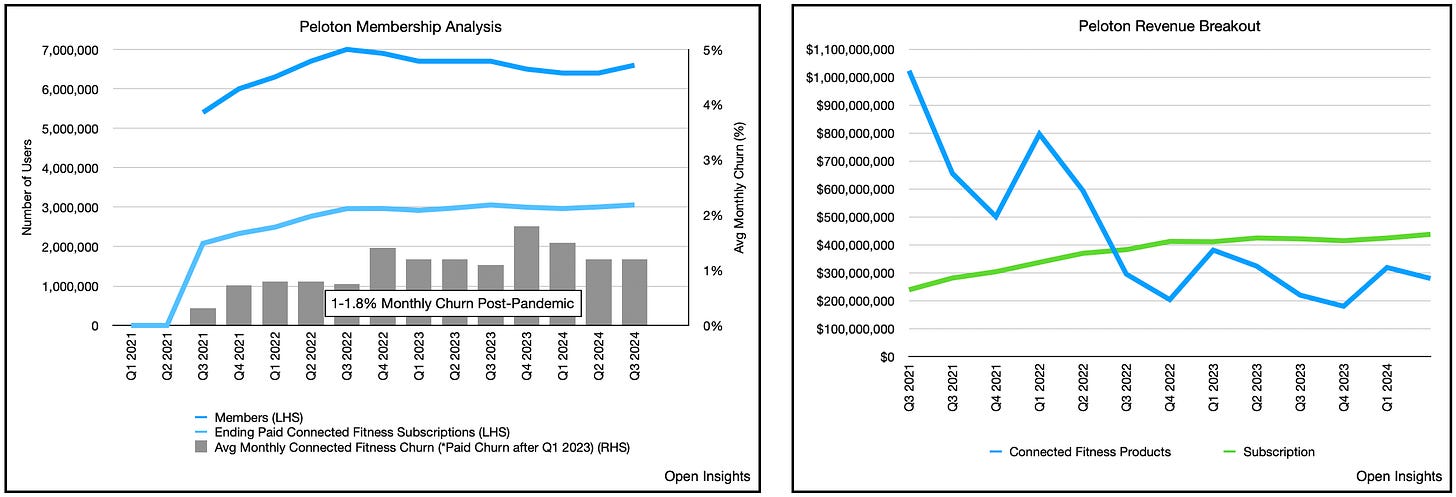

At this stage, Peloton’s overall business has stabilized. Despite declining app subscribers, overall membership statistics have stabilized and the monthly churn rate has been consistent for years at ~1.2%.

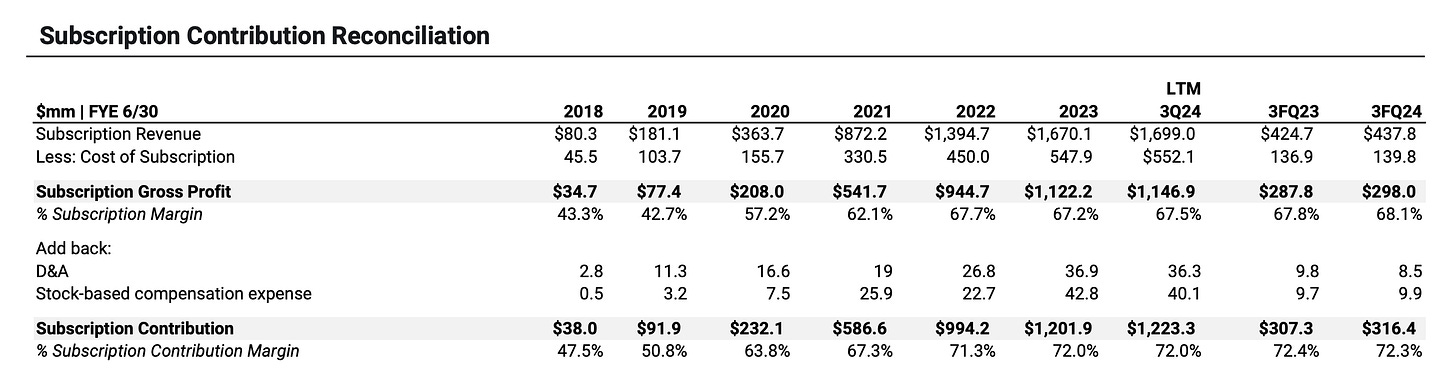

From a top-line revenue standpoint, Connected Fitness Subscribers (i.e., subscribers connected with an acquired Bike/Bike+, Treadmill/Treadmill+, and Row have all held steady, whereas Subscription revenue (with gross margins of ~68%) have actually increased.

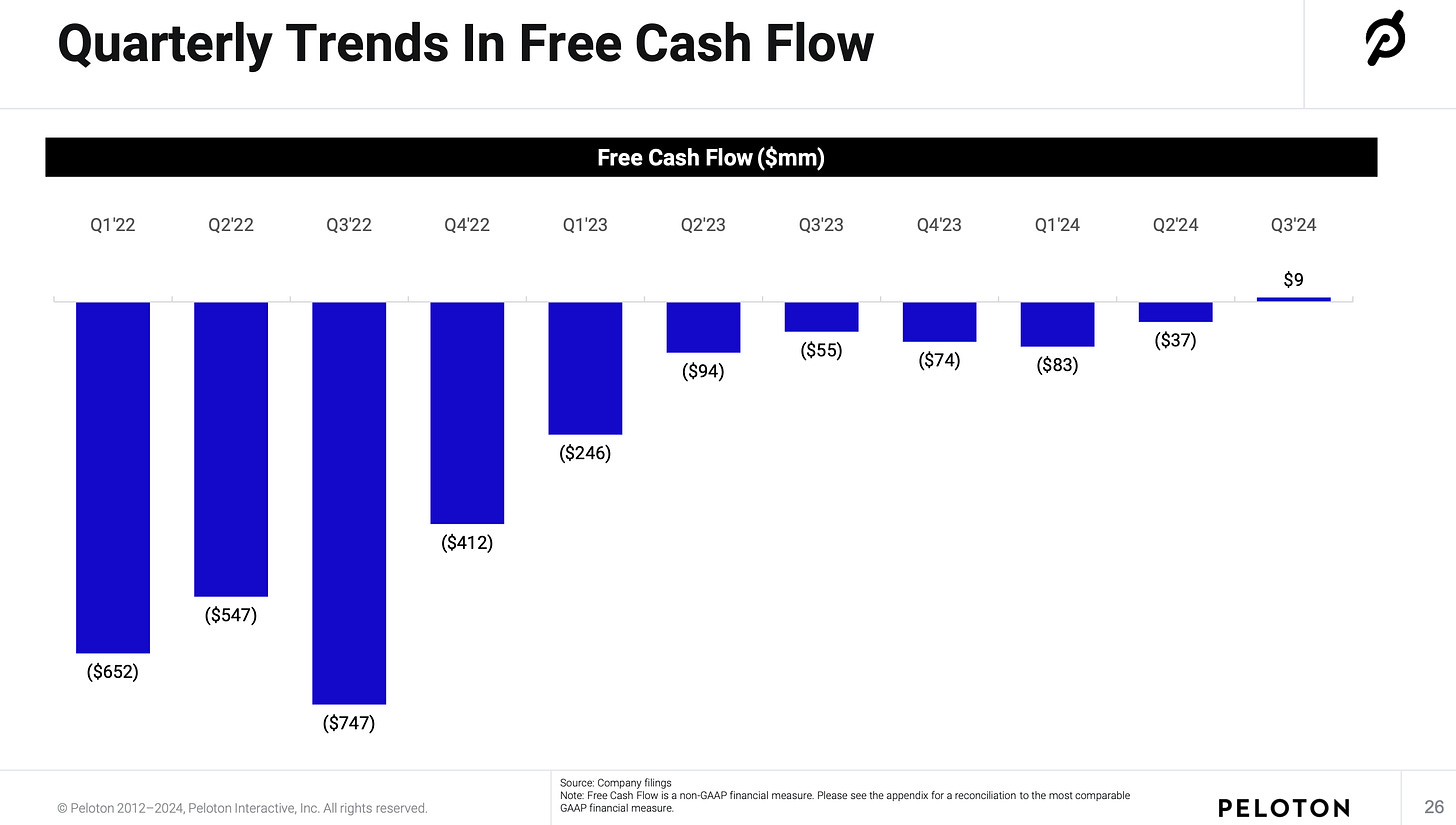

So stable revenue, meet declining operating expenses (see 2024 Restructuring above). As Peloton cuts, some of the Subscription/Connected Fitness revenue may decline (i.e., if you decrease promotion, marketing and selling expenses, you may actually “sell less” . . . imagine that). Still, this company is near cash flow breakeven today, and with the 2024 Restructuring will almost certainly be cash flow positive in 2025.

Hold things steady state (i.e., assume revenue stays flat), but cut operating expenses by $200M? This thing may just generate $100M-$150M in free cash flow (net the higher interest expense) for a $1B market cap company.

If that happens, then what? Well then the $794.5M of cash and cash equivalents, or a portion of it, sitting on the company’s balance sheet can actually be redeployed to pay down the nearly 14.5% of New $1B Term Loan debt. What’re we talking about? Well this . . .

That first line on the balance sheet? You read that right. $794.5M in cash and cash equivalents sitting in an account earning 2-3% interest rate.

Now we get why they’ve retained so much cash on hand. Two years ago there were real systemic risks for this company coming out of COVID, and a turnaround required significant capital to pay severance costs, exit agreements, rebrand, relaunch, and rethink/right-size the business model. Moreover, what if they needed cash to invest in certain activities to grow? Better to have some readily available resources than tap the skeptical deb market.

Immediately post-COVID though, Peloton was bloated, and had an unrealistically high cost structure completely unfit for a post-pandemic world. Today? Well after 2 years of high intensity workouts, it’s getting closer to its idea weight. You can see the progress. The health and stability of the business is apparent, and after shedding much of the excess weight, it could be ready to get shredded.

Of course even if the company’s cash flow positive, management won’t bleed cash reserves to zero, but they certainly won’t need $794.5M in cash lying around while borrowing $1B at 14.5% interest rate. It’s prohibitively expensive from a cost of capital standpoint, and a ridiculous way to fund the business. Use $500M to repay some Term Loan debt, and you’ll save $72.5M in annual interest expense. Again for a $1B market cap company. Tack $72.5M to the $100M-150M of free cash flow, we’re now looking at $175M to $225M of free cash flow . . . again for a $1B company.

The next major step, however, is the Board’s ability to recruit a growth-minded CEO, which is very different from a turnaround artist, and it looks like that’s what they’re focused on . . .

If the Board is successful in recruiting someone who can innovate and grow, this could set the table for an interesting position. Subscriber rates simply need to tread water here, and the reduction in operating costs will drive the company towards material free cash flow in 2025 and beyond.

Beyond that? Peloton will need a new CEO who can reinvigorate growth, but Peloton’s shares are low enough where shareholders may get paid either way. Given how the market’s abandoned the company at this stage, in some sense, it’s a free optionality on growth. At worst, tread water and see FCF improve organically, and at best take a ride with a new enthusiastic/incentivized CEO to lead the next iteration of Peloton’s involvement.

At $3/share? We’ll reengage.

Time to ride.

Always love your ideas. I followed you in with 6000 shares Monday. Thank You!

Great read, great call