BRICS Thrown At Our Glass House

August 26, 2023

Yeah that’s what we thought . . .

A few days ago, we posted this . . .

Positing that the US would do whatever it takes to rein in oil prices.

A week later, this happened . . .

and this . . .

It’s inevitable. It was inevitable because this must be reversed. This tightening engineered by the Saudis and Russians.

This thin red line that represents barrels on water that won’t be arriving at refineries . . . ever. You have to reverse it because that has a direct bearing on oil prices. Something you’re particularly attuned to as the election season starts-up. Energy prices, voters, and votes are tied at the hip, and at the very least it’s a major headwind.

If the above rears its ugly head and craters your economy, then it’s not just the center guy, but these other fellas that’ll be your new bosses again, and they sure don’t seem to be the “let bygones be bygones” type.

We jest though. Well as much as we can given the severity of what transpired, and what these people are accused of. What matters for investors though isn’t the morality of what’s at stake, but the outcomes of what may be. There are forces at play here that really really wants to take us down a few notches. No it’s not just the domestic factions that plan to undermine the country, but the external ones.

That Fab 5 called BRICS? (Brazil, Russia, India, China, and South Africa) just held their meeting and decided to extend invitations to Iran, Saudi Arabia, UAE, Egypt, Ethiopia, and Argentina to join the band.

US sanctions on Russia after its Ukraine invasion forced countries globally to reconsider the intelligence of perpetuating a US dollar dominant system, especially one that could quickly and effortlessly confiscate their assets via the US-backed SWIFT banking system. It was one thing to sanction North Korea, but big ‘ole Russia? Whoa now, maybe I’m not so secure.

The US dollar’s ubiquity is driven largely by oil as the black stuff is traded in US dollars (i.e., stemming from the petrodollar agreement whereby the US promised to protect the Saudis militarily, in exchange for their agreement to export oil using the US dollar).

If BRICS has their way, that won’t be the case in the future. The push towards de-dollarization has begun, and if BRICS can bring together some of the world’s largest consumers of oil (India and China) and producers (Brazil, Iran, Saudi Arabia, Russia and the UAE), a slow drift away from the world’s reliance on the US dollar could snowball. If not in totality, at least on the fringes.

So think about it, not only are some of the world’s largest producers tightening the oil market (Saudis and Russia), they’re also trying to weaken the dollar on a longer-term basis. A weaker dollar (i.e., because demand for the dollar falls if countries no longer need to trade with it) means as an importing nation, we can buy fewer things. Said another way “things will become more expensive” (think exchange rates). There’s a word for “things will become more expensive” . . . inflation.

The prices of everything goes up since we make little of anything we consume in the US. Moreover, our debts and interest rates rise as our creditors also expect more in return. On the flip-side, a weaker dollar helps emerging markets because they can pretty much buy more of everything (including oil), thereby boosting demand. It also strengthens the local currency because more people use it now to buy/sell oil, decreasing inflation. So for oil producers, it’s a win-win. Pivot away from a politically mercurial US, weaken the US economically, juice oil prices, and increase emerging market strength and demand in the long-run.

Overall? It’s a “good thing” for BRICS, but not a “good thing” for the US. It’s a longer-term threat though. Well, perhaps medium-term.

In the short-run, we’re flailing. There’s not much we can do in the short-run to prevent oil prices from increasing as we’ve largely drawn down our Strategic Petroleum Reserves last year. Hence the pendulum of power is swinging the way of the Saudis as their tightening increases their leverage.

All of the shenanigans by Russia and the Saudis? It sure seems like their plan is working.

The above is from Vortexa, a data analytics firm. Oil inventories are plunging, and we’re nearing a 4 week average of 5M bpd draws for August. That is simply unheard of. It’ll probably ease-up in the coming days as August is high demand season, but we’ve already anticipated a 1.5-2M bpd draw for Q3, and it would appear that that’s tracking.

Not surprising though since we don’t have a coherent energy policy. While we want more and cheaper energy, we’re simply not willing to drill for it in our backyard. Just look at what we announced this week as inventories fell . . .

We are, however, willing to reach out to Iran and Venezuela for what they have, although what they have is very little right now.

For Venezuela, analysts estimate that Venezuela could grow oil production by 200K bpd . . . by 2025. IEA already assumes Venezuela will grow by 100K bpd in 2024, so we’re looking at an extra 100K bpd! Again . . . vs. today’s 5M bpd draw.

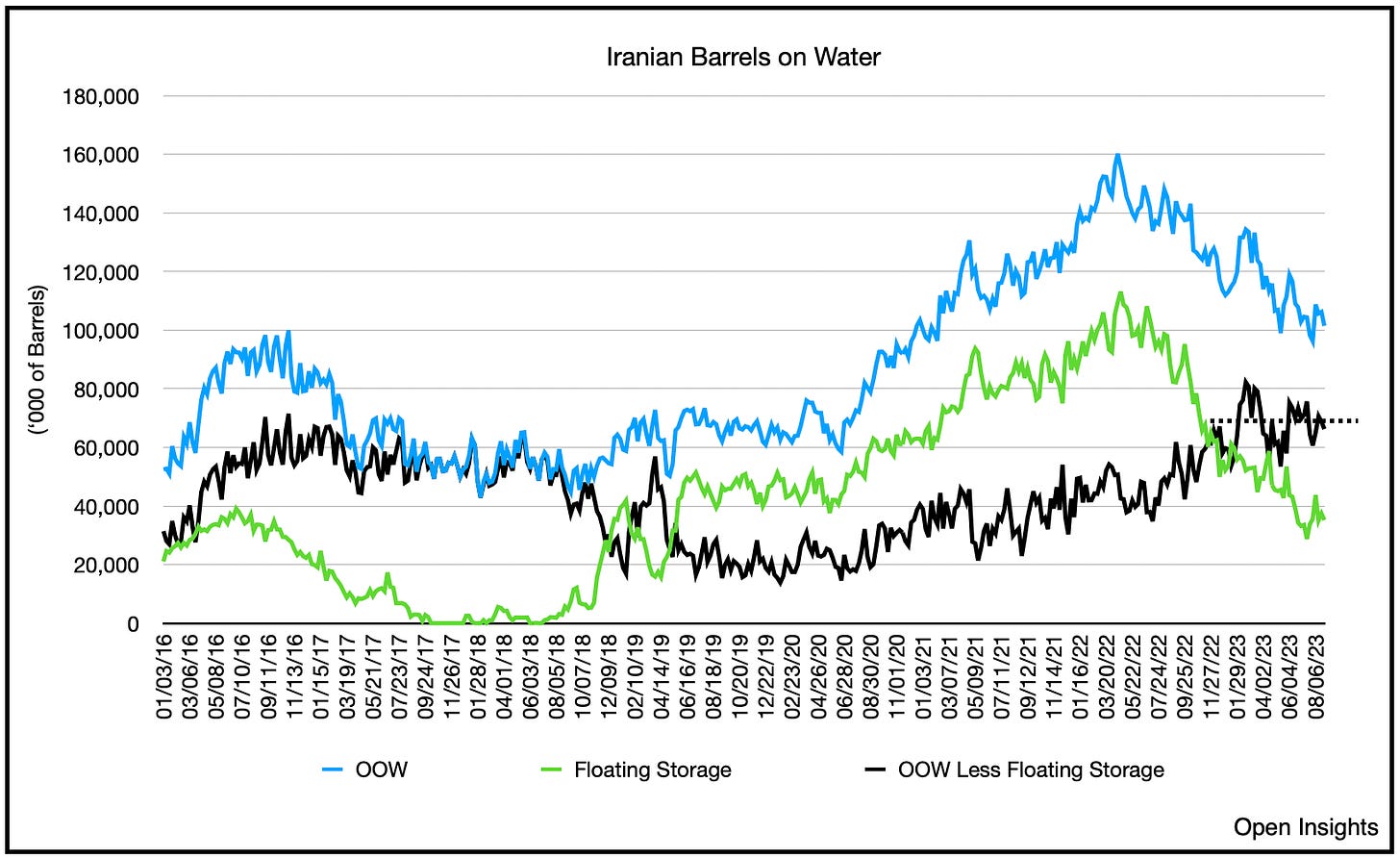

Then there’s Iran. Light-touch on sanctions. Will it bring increased production? Sure . . . but more importantly. That ship has sailed . . . literally. We can see they’ve already exported out most of what they’ve stored on water (green line).

As for increasing exports, it’s just not quite showing up (black line). The amount of oil on water from Iran has stagnated, which could mean production has to increase before more oil can be exported. In the end, that takes investments, and it takes time.

Time we may not have as oil inventories trend lower. What’s increasingly true as they do is this . . . we’ll increasingly get more desperate, and the deals we offer even more eye-opening. Regardless, give everyone a high-five for their efforts.

At this rate, they might not be around for much longer.

Please hit the “like” button above if you enjoyed reading the article, thank you.