COVID's Impacts Are Just Beginning

March 2, 2021

We saw two figures this week and it reminded us of a song by that full time teen idol from yesteryear and part time central banker. Disney’s Lizzie Mcguire . . . or in real life, Hillary Duff. Not that we would listen to such bubble gum pop, but if did, we’d surmise that the lyrics to her best selling sing “Come Clean would read something like this . . .

“Let the rain fall down and wake my dreams, let it wash away my sanity.”

Again, pure conjecture. What’s not a pure guess, however, is this . . . $166B . . . $422B

That’s the amount of direct stimulus payments provided by the US government in December ($600/person), and the pending one in March ($1,400/person). The total amount of the bills $900B and $1.9T were certainly much larger, but for now we’ll limit ourselves to the direct Economic Impact Payments (“EIP”). That’s the deluge, or it should feel like one since the enormity of it is hard to grasp. The Bureau of Economic Analysis (“BEA”) though is here to help as they’ve just published their January Person Income report. Now the BEA annualizes their figures, but what it says is telling, and matches the other indicators we’re seeing.

Overall, Person Income has increased by 10% in January, but much of it is because of government transfer payments (i.e., unemployment benefits and EIP.

If we exclude such transfer payment we can see the month-over-month growth to have flatlined.

Some would look at the figures and claim that wait, Personal Income levels are about the same as they were last year before COVID hit. Why do we need all of these stimulus/support payments. Well truth be told some of this “employment” is being supported by government subsidies, PPIs and the like, and if the programs fade before the private sector and state/local governments can recover, we’d snowball down the economic hill. This isn’t entirely surprising because if we think about what’s happened in the past 3 months, increasing cases of COVID, heightened economic restrictions, and a turbulent political transition, economic recovery has stalled. In turn, unemployment levels have failed to decline materially, and overall registers around 6.3%.

If we dive deeper into that 6.3% figure, we can see that in the last three months, more people have left the workforce than have been hired, which means that even the slightly downward trajectory in unemployment rates could be a byproduct of people exiting rather than entering the workforce.

So a real recovery means we need to add jobs . . . we have to add jobs. Fortunately, we see glimmers of hope for a jobs recovery in the services industry (i.e., hotel, entertainment, restaurants, etc.), and then in the industrial sector second, as the next federal stimulus package comes out. You didn’t forget about that one did you? The other $2T infrastructure bill? One that will repair and replace our dilapidated transportation infrastructure, roads, water infrastructure, energy grid, etc. If commodity prices are already leaping, we hesitate to think what the next round of stimulus will do for steel, aluminum, copper, and oil demand. Now the cadence of spend (i.e., spigot) will be slower for that package (as it’s indirect and will be awarded via grants, contracts, credits), so unlike the $1.9T stimulus working its way through Congress, a smaller portion of the $2T would land immediately (e.g., estimates place 2022 spend at $100B, a small 0.5% bump to 2022 GDP). Nonetheless, it depends on how much pork is stuffed into this empenada because if Democrats manage to infuse it with funding for ancillary items such as child care, health care, education, etc., that portion of the spend could occur sooner. Time will tell as we complete this round of stimulus, and think about the next.

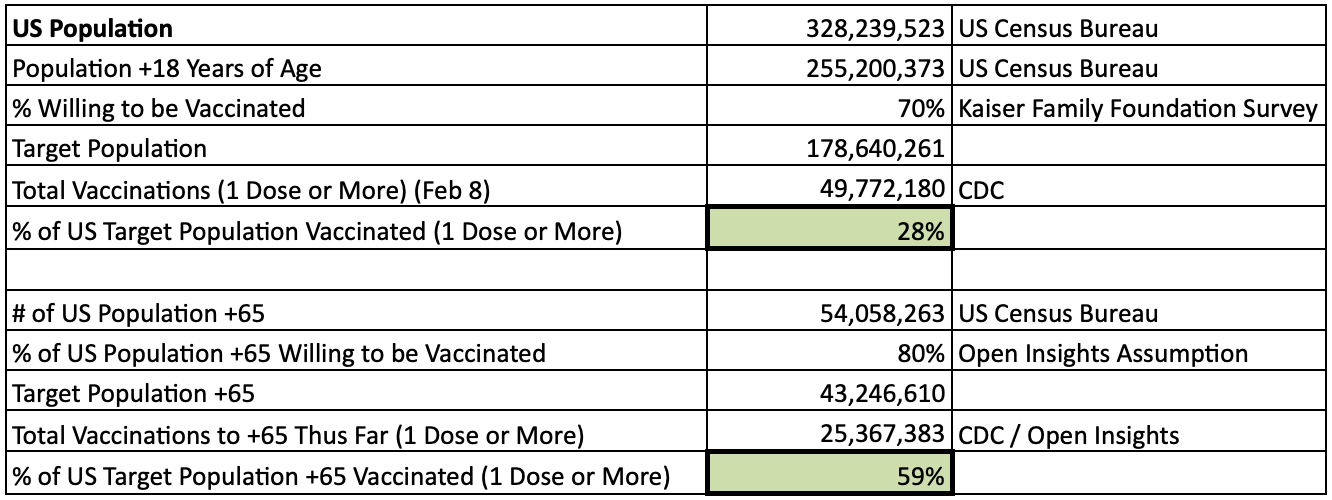

Nonetheless, for the services industry, they should begin to hire once health restrictions around the country begin to lift. Undoubtedly our vaccination efforts are progressing faster than many anticipated, and could even be characterized as robust. We calculate that >25% of the US adult population willing to get a vaccine (assuming a 70% “willing” rate) has already begun their vaccination treatment (+1 dose). For the group that really matters (i.e., +65 years old), almost 60% of that group has started treatment (assuming an 80% “willing” rate).

Increased availability to vaccines, better planning, faster manufacturing have all played a role thus far, and Johnson and Johnson’s vaccine approval this weekend will only bolster the numbers. Moreover, that shot requires only one injection, easing logistics. Novavax’s vaccine should be the next up for approval, and hopefully the UK data (showing 89% efficacy in preventing COVID) bears out in the US trials. The Novavax vaccine requires two shots like Pfizer and Moderna’s vaccine.

Pent-up Demand

As we turn the page to March, we’re eagerly anticipating what the recovery will look like. For those of us tracking the oil markets we can see mobility already beginning to increase. Below is a YOY chart of implied petroleum product demand.

The blue bars represent everything (e.g., gasoline, diesel, jet fuel, NGLs, propane, etc.). Now demand for everything (i.e., every fuel that we use to make things, heat things, and move things) continues to steadily improve. If we just focus on the fuel that moves things (i.e., gas, jet, and diesel), which we’ve overlaid as a black line, we can see a similar upward trajectory. February has seen an on-trend recovery just as vaccinations really started gathering momentum. Thus, we believe March figures will be higher. Note that the latest blip downward was because of the Texas polar freeze, which should fade quickly as additional weeks pass.

So from a mobility indicator, we are starting to venture out. We can also see it in the TSA airline passenger data. Undoubtedly the airline industry has experienced the greatest impact, but sure enough, week-over-week, we’re seeing a recovery, and in the last few weeks, we’re averaging passenger traffic that exceeds what we saw during the holiday period in late-2020.

This isn’t just confined to the US. The desire to move and the plan to move are creeping up. For instance, the UK announced today that it plans to lift COVID restrictions fully by June 12 if all goes well. Immediately thereafter, EasyJet announced that bookings for vacations vaulted by 630% and flight reservations by 337% from the prior week. This is just a hint of things to come as the pent-up demand asserts itself.

The Stimulusssss

So all of this brings us back to our two figures, $166B and $422B. Thus far, some of the $166B stimulus has been spent on goods, the purchase of which increased by 5.8% month-over-month per the BEA. The BEA figure tracks closely with retail sales, which reported a +5.3% rise in January. In contrast, spending on services increased by only 0.7%. As we’re still staying home, we used the morsel of a $600 stimulus check to simply buy more stuff. If, however, we pass the third stimulus bill in March and those checks land in late March/April just as vaccinations ramp and COVID recedes, expect consumers to redirect their $422B and historically high savings to services, which should impart shockwaves on that sector from Easter through the summer.

We’re already beginning to move, and the extra shot of economic caffeine should jolt us further in recovery, but on the services side of the ledger.

Inflation in the Punch Bowl

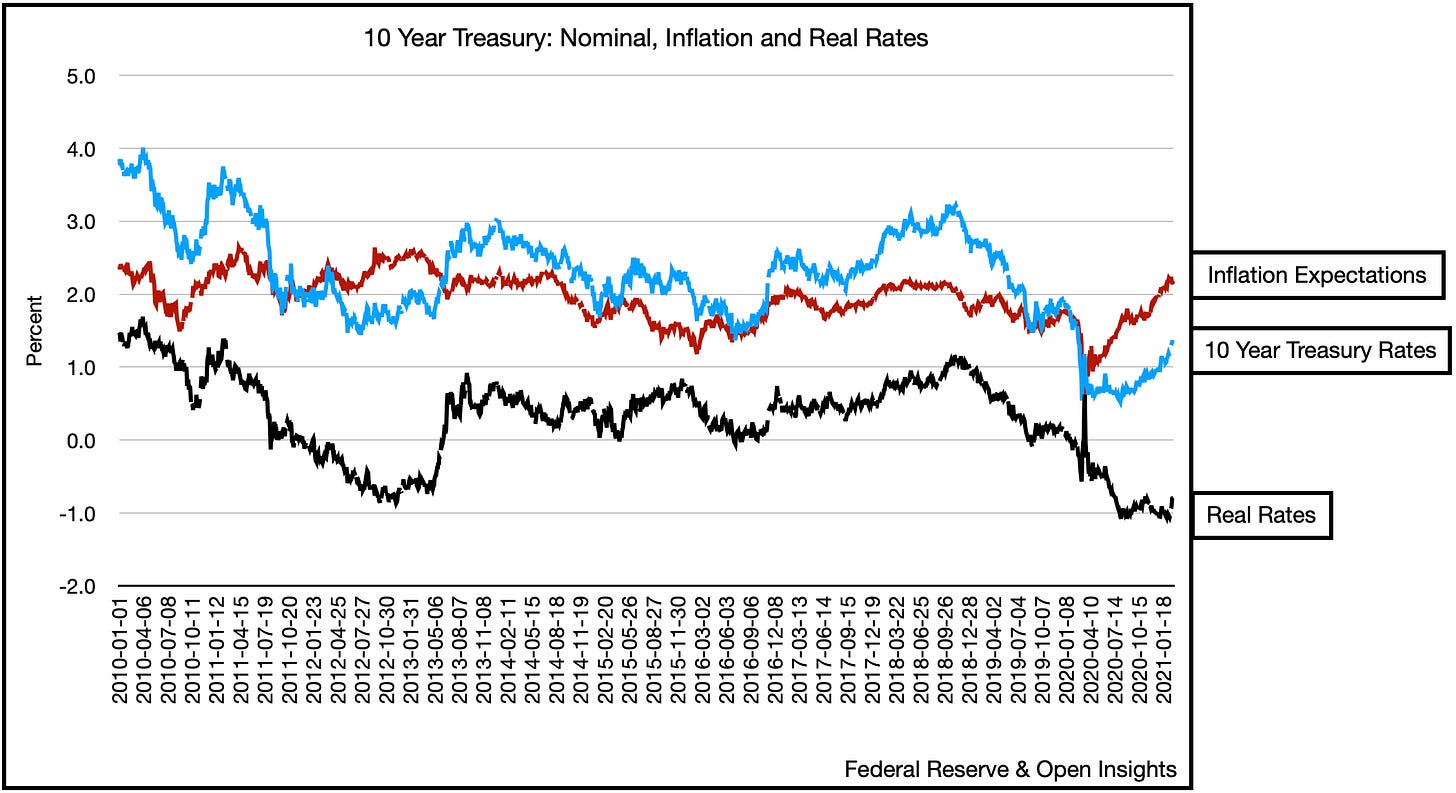

Now we know, inflation expectations, and in turn, interest rates have been driving higher the past few weeks.

We’ve written about commodity prices and the prospects for higher inflation before and continue to believe that’s the path forward. To us, rising commodity prices are less about demand vaulting higher, but more about chronic underinvestment in production leading to dwindling supplies.

Easy money after the Great Financial Crisis led commodity producers to overproduce. For a miner or driller, if you can’t control prices, you can at least control volumes, and increasing volumes meant increasing revenues if prices held firm. Nope, because the law of supply/demand always reasserts itself, and overproduction inevitably led to falling prices in 2014/2015, negative cash flows, and damaged balance sheets.

The past few years have been a slog as commodity producers, whether in metals or energy, have spent the time “rightsizing” their industry. Just as we were on the cusp of doing so, a US/China trade war again muted overall demand in 2019. We then said, 2020 should be better right? We can finally recover right? How about a spoonful . . . wait, no . . . a ladle’s worth . . . of COVID. The “right size” became even smaller. 2020 was about survival, and for those who could, they emerged only to see a devastated commodity landscape. So now as we recover, the years of underinvestment stemming from the hangover experienced after the post-GFC years of cheap money, followed by a global pandemic that exacerbated the situation, means production and supplies will stay depressed for awhile. Ironically, prices must now overshoot before volumes will again, or to paraphrase John Hess, a “V” shaped demand recovery is now being followed by the shallowest of “U” shaped supply recovery.

So will inflation rise? We certainly think so. If energy prices stay at today’s $60/bbl level, just the YOY increase (from last year’s ~$30/bbl) means that the consumer price index should see a 2-handle. We saw the same thing happen in 2018 when energy prices climbed from the high-$40s to the low $70s.

If so, the Fed has already said that they’ll shrug-it-off, letting inflation creep above 2% so the economy can run hot. In turn, this will bolster nominal GDP, which makes our Debt to GDP ratio more presentable, but if inflation runs hot wouldn’t interest rates rise to meet it? Logically, interest rates cover an investor for two things, inflation and risk of loss. While the US government has almost no solvency risk (it could always print more money), inflation can still erode your invested principal. For now, it appears investors are willing to tolerate a negative real return, but will it tolerate an even higher one?

Maybe not, and if not, then rates must rise, particularly on the longer-end of the curve. Note that we’re not concerned with last weeks blip upwards, whereby rates “vaulted” to 1.5% on the 10 year Treasury. Some of that is really related to a growing economy. We’d expect rates to rise further as the economy gains steam. We’re wondering what happens after it climbs past 2%, or if inflation forces the market’s hand in demanding a real return.

This leaves us thinking that the Fed’s next step must be some type of Yield Curve Control (“YCC”). Well really a more forceful one than the “YCC-lite” it currently practices (because remember the Fed is already doing QE to the tune of $120B a month). Under YCC, the Fed essentially pins long-term interest rate at some % and vows to buy as much bonds as necessary to do so. Effectively, employing this idea . . .

Buying all the things also means printing all the moneys, and a vicious loop of further devaluation, and in turn inflation, we create. Even if the Fed succeeds in pinning interest rates to a targeted floor, real world inflation would still chug along. So the pressure must go somewhere.

This then leads us to another logical thought. If “YCC-heavy” will be in effect, wouldn’t the US dollar weaken as we effectively leave the digital printer on? As a country that imports most of its goods, wouldn’t this further reinforce inflation because the things we buy are suddenly more expensive? Interestingly, a weaker dollar would support our exports, making US goods/services cheaper around the world (again helping our GDP), but certainly China, Europe and Japan would frown upon that as their export economies would be less competitive. Still, devalue and inflate could be the superhero team we need to get us out of this mess.

In the end, the scenarios pondered above may handicap the stock market. Companies could have difficulty passing along the rising costs, which would impact margins. Furthermore, a slightly higher interest rate would impact valuations, especially those of high-flier tech stocks whose future earnings are being discounted using historically low rates today to justify their valuations. So if the stock market weakens materially, would the Fed, already supporting the bond market, jump in and purchase equities? We believe so as 2020 greatly expanded the Fed’s toolkit for what it’s willing to purchase and prop-up (see junk debt buying).

Devaluation and inflation will have massive implications on our global trading partners as well. Will a devalued US dollar force other countries to devalue as well and/or strengthen the US dollar? Perhaps even in a coordinated manner à la an ‘87 Louvre Accord 2.0? Perhaps this is a G-7, or heck a G-20 effort if it happens, because the aftershocks of a global pandemic means it’s all hands on deck.

There are no clear answers at this stage. As Paul Singer recently said . . . “it’s all path dependent.” We’re creating string diagrams on the wall here, drawing decision trees that look downright at home in a swamp, but if we step-back a bit, one thing is clear. We can engage in QE, pass stimulus/recovery packages, ease monetarily and support fiscally, but regardless of the nomenclature, we are printing money and doling it out into the world. Eventually the debt must be refinanced, extended, and dealt with (forget about repaying). Given the unprecedented amounts, we believe the only option going forward really is to devalue the dollar and embrace inflation, but the implications for doing so won’t be pretty. A sobering reality will follow the current jubilee we feel, and the implications will have wide ranging impacts economically, socially, and politically. The real impacts of COVID have only just begun.

In the meantime, here’s $166B . . . $422B . . . because as Hillary Duff also sang “Why Not.” . . . or so we’ve heard.