Don't Look Back . . . It's a Shortage . . . Just Run

January 13, 2022

Get to the roof. Get to the chopper. It’s the most cliche of all movie tropes. The safety offered by the helicopter. They couldn’t have invented a better machine for a plot device if they conjured it up in Hollywood. A twirly bird that descends quickly and then lifts you vertically into the air, into safety. A mechanical guardian angel if there ever was one.

Whatever you’re being chased by, be it zombies, wild animals, assassins, aliens, or predators, it’s all the same. Get to the chopper and you’ll get saved. Until then, run. Run. Always run. Always yell into the radio, in between breathless gulps of air . . . you’ll be there right? Say you’ll be there . . . please?

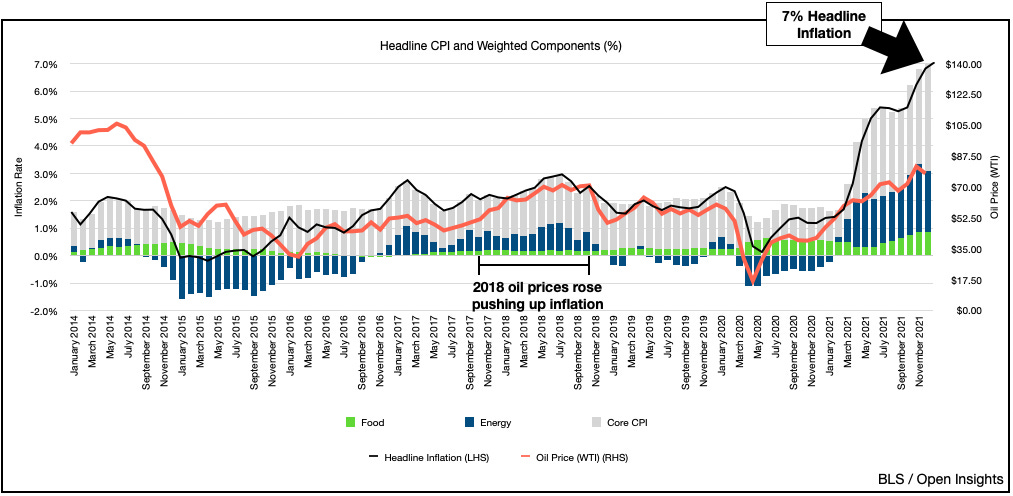

That’s what we’re asking now, but we’re getting static. We’re seeing inflation leap in everything. Okay not everything, but certainly the things that matter. The big 3, energy, labor and shelter. If it matters, then it’s going up.

It’s all going up because as we’ve discussed, shortages abound, and it’s in the stuff we want. It’s in the stuff that goes into the stuff we want. There are structural imbalances in almost every commodity we track, which is why we’re seeing prices vault higher. It’s leaping barriers to get at us, and we’re running desperately. Trying to get to safety, hoping something or someone will save us from what’s seemingly a shortage.

Structural Shortages are Boss-Level Monsters

Let’s talk energy for a second because have you really played 2022 out? Like really played it out? Let’s set the scene. Our world, the protagonist in our film, was just staggered by COVID. Monsters abound trying to catch us. We were just bowled over by Omicron, we’re dazed, but now regaining our senses and with one overriding thought. Get up and keep moving. Get to safety, put some distance between us, 2020/2021 and those monsters.

We’re not totally defenseless, since we’re all boosted by boosters. Still no time to ponder life. Just keep moving. Get to that chopper. Everything will work itself out if we can get some distance. Supply chains, global economy, these high prices, they’ll all calm down and recover to norm in time. It will all work out . . . somehow. Someone will produce more, prices are going up so everyone will produce more right? If not, disruptive innovation will save us. If not, the government can save us. If not, something surely will. Just get to safety, because the chopper is coming.

What if . . . what if there is no chopper? What if we’re being chased by structural shortages that demand feeding and are bearing down on us? What if the people we’re banking on to bring us to safety haven’t even taken off yet to reach us?

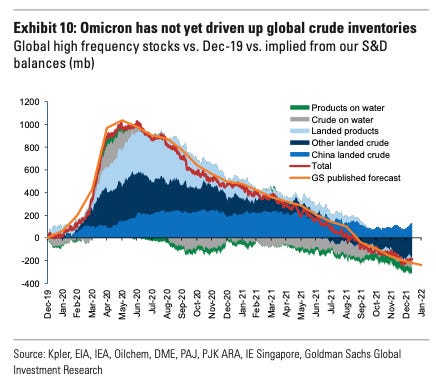

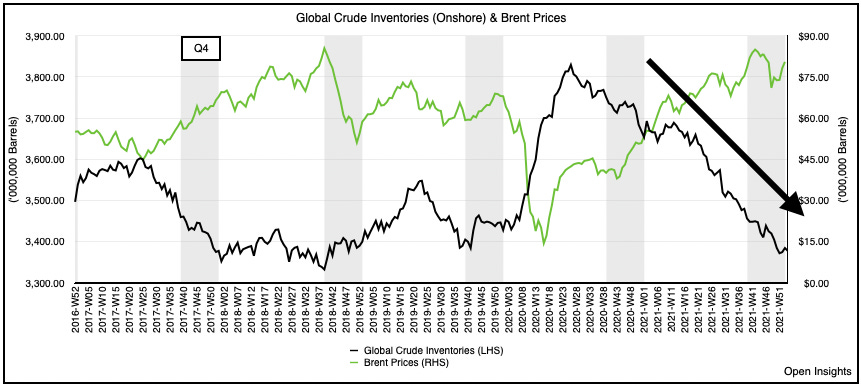

We’ve been draining 1.9M bpd in 2021. We turned the calendar to 2022 and guess what? We’re still draining 1.9M bpd. Ask Morgan Stanley.

Ask Goldman Sachs.

Heck ask us.

Sure seasonality-wise we’ll build a bit in Q1 because demand typically falls by 1.5M bpd on average. OPEC+ will also continue to push 400K bpd into the market (we have them down for 300K bpd overall), and US production should increase slightly each month. Add it all up and we expect a flat January, minor builds in February and March, and slight draws in April. Then we get to May, and May is when the monsters really pick up our scent and resume the chase.

Get to safety. Get to the chopper.

Because as we’re running, we’re going to find ourselves low on energy. As we deplete our inventories, increasing oil prices will feel like mud on our global economy. If it increases high enough, the weight will feel like cement. Still, just keep heading towards safety. They’ll be there. Who? The marginal producer. The only machine with pilots crazy enough to quickly swoop in, ramp production, and save us. As we get bogged down in the sludge, as we weaken from the deleterious effects of higher energy prices, many in our group will hold out hope that the marginal producer can save us. They did so before, in the early 2010s. They’ve shown us before that they can ramp materially, and drop an anvil on the finely balanced scales of supply and demand.

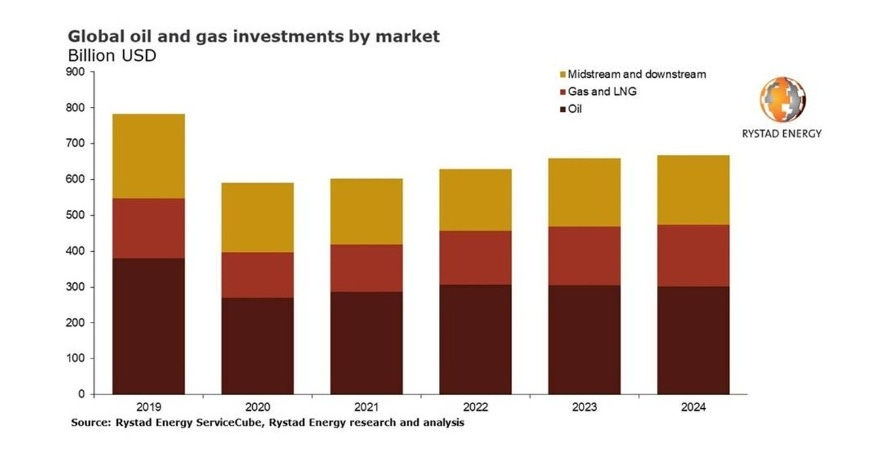

Yet will they? Because they currently don’t plan to despite $70/barrel oil prices (on the curve). After Q4 prices that averaged $77 WTI/$80 Brent, the below O&G budgets (Rystad) don’t seem overly aggressive.

Furthermore, even the effects of the increasing budgets above will be muted. Nominally they look higher, but there’s inflation (i.e., service costs, labor costs, raw materials, etc.), and it’ll ripple through to productivity. As we’ve written . . .

“Now shareholder crushed, capex choked, and ESG smoked E&Ps will struggle to add production, especially in an economy with 10M job openings and 7M unemployed people.”

Today, update those figures to 11M and 6M, respectively.

E&P capex budgets are pretty much set. Sure they haven’t been announced to the Street yet, but they’re likely already management approved and soon to be board approved. Many management teams continue to take a cautious approach, while cooing the same shareholder soothing words that emphasize “shareholder returns” vs. growing production. After 6 years of painful oil prices and 2 near bankruptcies, most E&Ps simply don’t have the desire to increase production materially, especially into a world that is supposedly near “peak demand,” and one increasingly controlled/regulated under ESG mandates.

There’s also a healthy skepticism that oil prices can remain at these levels. Sure many in the industry “see” an oil crisis brewing, but as all E&P stakeholders know, it can quickly vanish, and prices can plummet again. All of this effectively means that the marginal producer is closed for business, if not entirely, at least materially.

Yes, yes. We know they will add, just not much, and definitely not enough. What’s more certain is the opposite. As we sit here above $80/barrel at spot, many producers are generating eye watering free cash flows. Since losses are weighted twice as strongly as the prospect of gains, human nature will compel management teams to begin hedging their production. They’ll attempt to lock in windfall profits as they presell the upside via selling calls, buying collars, etc.

They’ll hedge, plain and simple, while paying down debt as the cash rolls in. Conservatism will rule the day. If you think we were skeptical at $70, we’ll be even more so at $80, $90, and $100. We’ll keep doubting the prices, thinking another shoe’s ready to fall (e.g., White House intervention, SPR, Iran or Venezuela coming back, or the OPEC+ coalition failing). They’ll think that the only permanent thing is impermanence, and maybe deleveraging. Instead of saying “maximize production, maximize growth,” they’ll say “we continue to execute on our announced capital budget plans.” So those budgets? Yeah they’re pretty much set.

Sure maybe in 2023, we’ll see some additions, but again immaterial. Immaterial to the 1.9M bpd that will reemerge in H2. If not 1.9M bpd exactly, it’ll be something. We think it’ll be larger. A recovering global economy with increases in international mobility means demand inevitably rises. The structural shortage being masked by seasonal weakness will again reveal itself and then it’ll restart the chase.

So we’ll run to the chopper. We’ll run towards it thinking it’ll be there as we surpass $80, $90, $100. In shale we trust as we run, that is until we realize . . . it’s not there. It was never going to be. The minute we do is when we realize . . . we’re not going vertical, but oil prices are.

End scene

Please hit the “like” button below if you enjoyed reading the article, thank you.

Send the chopper

Fantastic