Dueling Narratives: the Economy vs. the Market

March 2, 2024

Hmmm . . .

2.1%

What’s that you ask?

GDP

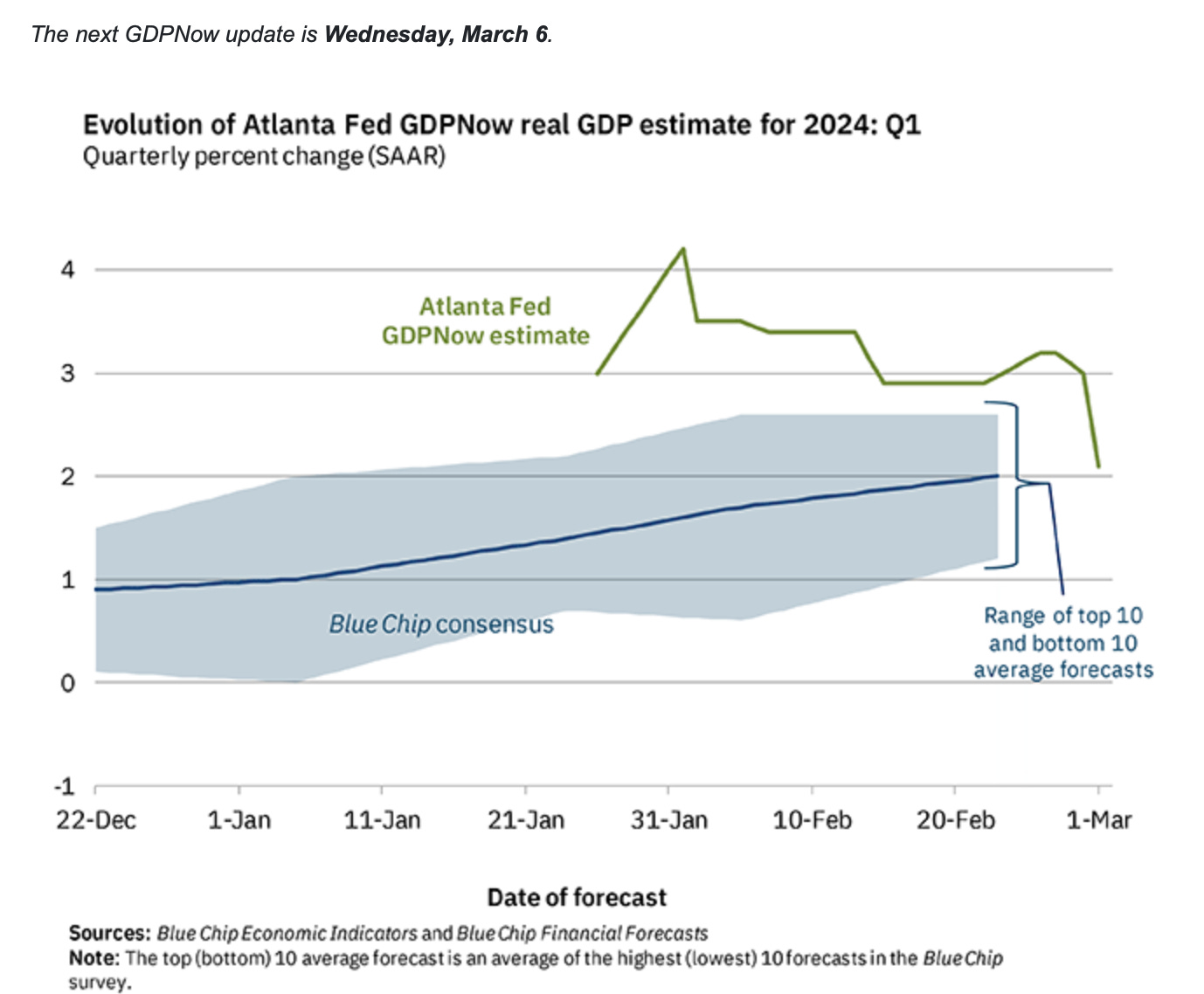

Well, not GDP, but GDPNow, that contemporaneous figure the Federal Reserve Bank of Atlanta prepares. Kind of a real-time distillation of economic data that tells you how things are going. A mercury thermometer if you will, maybe a turkey thermometer to tell you whether we’re over/undercooking the economy.

Lately? The air seems to be cooling.

Notice that dip? Down from a scorching 3%, after being impacted by manufacturing and consumer spending.

Manufacturing no good? Yeah still in the doldrums. A really positive print in February (49.1 vs. the 46-47-ish prints in the months before) suddenly made everyone excited for March. Alas, March came out and . . . wah wah trumbones played.

47.8

Wah wah indeed. We look at that, and think maybe all isn’t lost. After all its “seems to have bottomed.” We say that with all the humility we can muster, but doesn’t it appear as if manufacturing is trending at least in the right direction? We’ve not cracked 50, but maybe it’s just a matter of time?

Besides, what we’re really still spending money on is services as you can see.

Take a closer look though, after an admittedly egregious spike when we gorged on goods with our COVID stimulus checks, we withdrew and shifted to services, but it looks as if we may be shifting back. Services data though for ISM comes out the following week so we’ll get some additional read through on this. Those results could also nudge GDPNow in the coming week.

Still “bad news” (though frankly we don’t think it’s “bad”) is being interpreted as “good news,” meaning that the slower the economy, the more likely the Fed can cut interest rates. So whoopee goes the market/asset prices as gravity may soon get lighter, or have a reason to.

Back and forth we go.

What befuddles us about the entire economy though is really the data stemming from personal income. Every month, the Bureau of Economic Analysis comes out and publishes data about how much we make, how much we spend, and how much we save in the US. As someone who relishes data, it’s a smorgasbord of financial delight.

Kibble for financial kitties. Prrrr.

Normally, we take a look at the savings rate. What you make, less what you spend . . . what’s left (or isn’t) becomes personal savings. Personal savings has been falling, and since COVID, we haven’t been exactly fiscally conservative. Just take a look at our savings rate.

We’re saving at about half the rate we used to, which is amazing since we’re making so much more now. Maybe the % has fallen because the quantum of what we make has gone up? Perhaps, but really, $100 saved today isn’t the same $100 it was pre-COVID. Thanks inflation.

What’s clear though is that we’re certainly making more, and it’s not just because government payments have gone up (e.g., social security, etc.).

If you’re wondering why the economy keeps pumping higher, and despite the hand wringing and consternation, why things appear to be “fine,” you can find it in the data.

Before we get to savings, you have to have income, and what’s the data telling us? Simplistically to a cave-man? Income is good.

So good that as of January 2024, Wages and Salaries are increasing by 5.7% year-over-year (“YOY”).

5.7%!

Passive income is good. So good that as of January, personal interest and dividends increased by 5.6% YOY.

5.6%!!

Lastly, Government Social Benefits (government transfer payments like Social Security) is good. So good that old, disabled, and other peeps are getting 3.8% more YOY.

3.8%!!!

5.7%, 5.6%, 3.8% across these income categories.

Technically, that’s known as “a lot,” and it’s not a one month January outlier either. We can see below that the increases in personal income have been coming steadily, again no surprise when you see all the headlines about a tight labor market and higher wages (e.g., UPS drivers, etc.).

In turn, personal spending (i.e., Personal Consumption Expenditures) have also risen. Though it declined slightly in January, only growing 4.5%, it’s been 5.0%, 5.5% and 5.9% from October to December, it’s still a healthy bump YOY.

Again, spending is ~2/3rds of this economy, and if income and spending is up by nearly 5% for both, then that largely explains why GDP even after falling to “2.1%” is still strong.

I get it Open Insights, you’re saying we’re getting paid mucho dinero, but also spending mucho dinero, but isn’t this largely driven by inflation and it’s all illusory as we’re just running in place? That my friends is the worry. Yet, napkin math would tell you that 5% bumps in income trumps 2-3% inflation. We fully admit though that this treadmill is precarious as it runs at such high speeds. Good can sometimes be too good, and while we’re keeping pace, things get taken to an extreme. EVERYTHING is relative in the market, so going from 3% to 2.1% GDPNow isn’t considered “good” anymore, it’s relatively worse.

It’s the duality of sentiment we’re playing with here, or is it duel-ality? The market is euphoric right now, whereas the economy appears to be slowing as home sales come in weaker, auto loan availability shrinks, and personal savings dwindle. We still think the economy is in a fine condition, but our conservatism will tell you that the animal spirits haven’t matched, and despite certain segments of the market racing ahead, everyone else is still waiting.

If you pin us down and force us to opine, we think the market rally broadens out from here. We think the economy is strong enough to allow the euphoria to creep into other sectors, and there’s some room to catch-up. The S&P500 is up 8% YTD, but the equal weight S&P500 only 4%, which tells you just how strong MAG 7 (Facebook, Amazon, Nvidia, etc.) outperformance has been.

Does everyone else get to play, do other sectors get a turn at the piñata? Likely, because we sure like to juice things, and the economy’s strength may give us a decent enough excuse to do so. Having said that, things are relative, and a robust (albeit slowing economy) can start to release air from the bubbly sentiment.

After all this is hype, and this is how hype works. Narratives need to be reinforced so the next greater fool can be convinced to play. Just be cognizant of how quickly things can change, especially when a euphoric market is supported by a strong, but perhaps weakening economy. A bubble is sustained by the stories we tell each other, but if we keep hearing wah wah trombones in the background disrupting our growth narratives, our stories may begin to conflict. In the end, the duality of a softening economy with a euphoric market could morph into a duel-ality as everyone fights for the exits. So get your knives out early if we do head higher folks, we just might need to do some cutting.

Please hit the “like” button above if you enjoyed reading the article, thank you.