Economic Confidence & Pixie Dust

September 10, 2021

We’re seeing a slowdown, but we’re seeing a slowdown that’s caused by the thing that itself is now slowing down, and that’s Delta. Let’s go through a few charts and we’ll explain. We’ll walk through US manufacturing, US consumers and the US labor market. As we’ve noted before, a picture is worth a thousand words, so here’s 15 thousand words to consider . . . .

US Manufacturing

ISM’s survey of manufacturing sentiment (i.e., purchasing and supply executives in over 400 industrial companies) continues to decline, albeit off of the highs seen in Q1. Likely a consequence of supply shortages (e.g., chips) and the Delta variant.

As people shift post-COVID spending from goods to services, that shift is lagging a bit as Delta impacts services greater (i.e., deterring consumers from traveling, etc.). The ISM Services Index showed this slowdown, appearing to have topped for now. Once Delta fades, however, we’d anticipate this to trend up again as we enter the holidays. Overall the downward direction could prove . . . transitory.

US Consumers

US consumer sentiment has also declined, as consumers were buffeted by Delta, higher inflation, slower wage growth, and smaller declines in unemployment. The response was also partly emotional. According to the University of Michigan, it likely reflects “the dashed hopes that the pandemic would soon end and lives could return to normal.” Invert that logic though, and we should see it recover once normalcy returns.

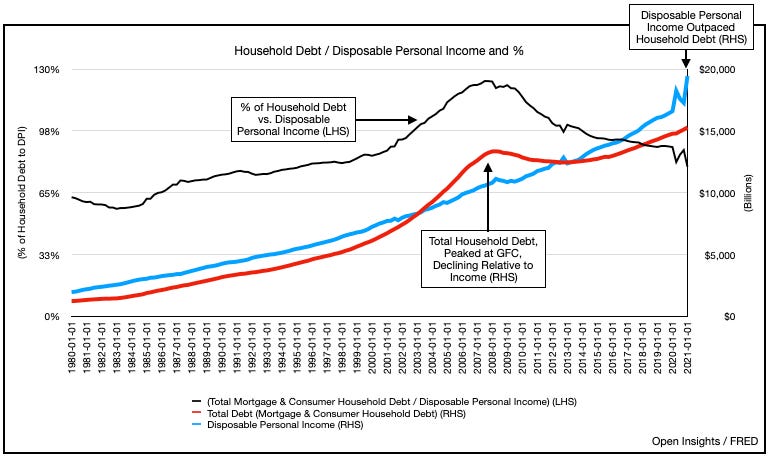

US consumers though have largely stayed financially healthy. With income growing month-over-month, it’s kept pace with debt.

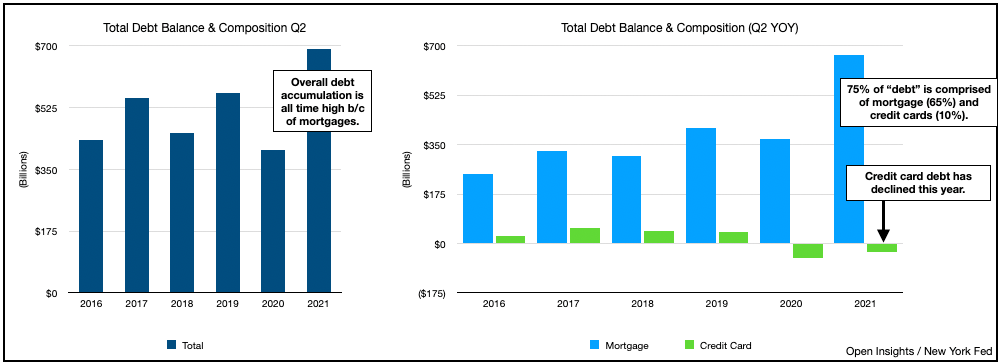

Consumer debt has also shifted. Although falling YOY last year, it’s now growing this year, but the greatest growth is in mortgages, a byproduct of rising housing prices. Short-term debt such as credit cards continues its decline.

In addition, savings continue to stay elevated, surprisingly bumping up slightly in July.

US Labor

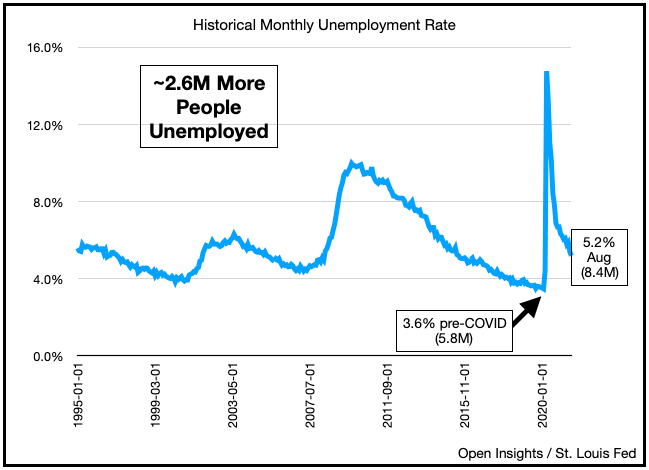

The US labor market is also recovering, which should help support the US consumer, whose spend supports 70% of our US economy. As of August there are 10.9M job openings, or 3.7M MOAR open positions than BEFORE the pandemic.

That’s 10.9M jobs, for 8.4M unemployed people (which itself is 2.6M more since COVID began). Stop and ponder this for a second . . . we’ve created more jobs than unemployed people since COVID began.

The demand isn’t just higher, but there’s a serious skills/labor mismatch in some sectors. So big incentives to job train, especially in education and healthcare.

Overall, that means wages are likely to fly higher. Couple that with rising inflation, loose monetary/fiscal policy, a government push to raise wages, income redistribution, and the real need to inflate our way out of our exceedingly high debt/GDP ratio, we anticipate wage growth will be above trend and continue to climb. This of course fuels further inflation, and our transitory inflation cycle may extend longer than most anticipate.

So what’s next? If US manufacturing and consumer sentiment are weak, are we in for a rough year-end? Is the economy heading for a further slowdown? Perhaps from our red hot restart, but in the coming months we’re starting to see Delta fade and employment climb as enhanced unemployment benefits have now expired. We’re about to see travel climb globally, and supply chains start to address the significant inventory shortages.

Fading Delta

It all starts with COVID fading, and for many countries, it already has. In fact, of the 15 largest countries by population, COVID cases in 13 are in decline. For giggles, we’ve even put in their oil consumption ranking (source: worldometer).

This isn’t your grandparents’ lockdown

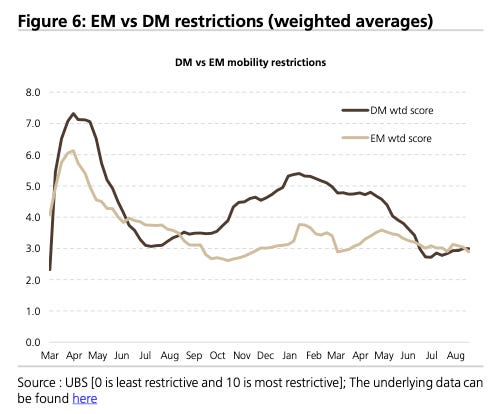

Despite the Delta variant sweeping the world, mobility/health restrictions in general have declined in developed (“DM”) and emerging markets (“EM”).

Mobility during the past few months have stayed largely flat despite higher COVID case counts and hospitalizations . . . everywhere.

This is to say that we were still “out and about,” but our economic sentiments were depressed as indicated by the consumer and ISM indices. Nonetheless, we’ve taken the Delta variant in stride. Those who were worried about Delta/COVID have largely been vaccinated, and those who were never worried about COVID to begin with, simply took their chances. As we noted earlier . . .

“Still, that shift in mentality (i.e., carpe diem) has allowed politicians to minimize healthcare restrictions and prioritize the economic wellbeing of society over individual health and our healthcare system.”

and here . . .

“The Overton Window (i.e., politically acceptable mainstream policies) has shifted. With widely available, efficacious and free COVID vaccines, the majority of the populace will begin to view COVID as a “voluntary disease” so unless new variants spike hospitalizations and deaths (they are currently not), then the world will begin to live with COVID, and focus on the nascent social and economic recovery.”

Sure, our consumer sentiment has fallen as evidenced by the prior charts, but for the most part, as cases climbed, we still moved and we were still allowed to move. Sentiment will swing the other way when Delta fades. Economic confidence will rise because as Delta lifts, the social, economic and psychological burden of the Delta variant will fade.

Nonetheless, our societal/global reaction to this third and more contagious wave is telling. Every country has begun to reassess its tolerance for restrictions, and are now siding with personal responsibility. This is how a pandemic fades to an endemic as vaccines become widely available and treatments improve. It becomes up to you (or your employer) how you’ll protect yourself.

Unless the pathology of the virus mutates into something far deadlier, our future reactions should mirror our current one, meaning, we’ll collectively shrug even harder. It’s the waning of the pandemic, and endemics, while still a concern for the medical community and from a healthcare perspective, don’t deserve the red banner scrolling across your monitors and splashed across media sites.

We believe the economy will reaccelerate again in short-order because the supply shortages are real, which means operationally our manufacturing bases and supply chains will need to run flat out into 2022 to replenish stocks. Economic growth is fueled by two things, liquidity and the pixie dust of confidence. We certainly have an ample amount of the former, we just need to Delta headwinds to fade so the latter isn’t blown away. We think the winds are shifting as the holidays approach, so stay confident.