Energy? Meh.

January 20, 2022

“The opposite of love is not hate, it’s indifference.” - Elie Wiesel

It’s something I quoted the other day as I chatted with another investor on a call about oil. I was specifically referring to energy and the underinvestment in the space. Not just in capex, but the overall indifference to energy producers. How do we know there’s indifference in the energy landscape? This . . .

Energy companies are generating 5% of the profits in the S&P 500, but despite the recent gains, they represent only 3% of its market weight. Said another way, the stocks would need to double to be “fairly represented.”

That my friends is indifference. Of course there are various reasons given for the collective apathy. Energy companies are too highly indebted, too volatile, and too unpopular. We hear it all the time.

Oh but . . . even if the E&P companies repay debt, debt reduction doesn’t increase the value of the stock. Really? So when you pay down the mortgage on your house, your equity stake/value doesn’t go up? Yeah, no.

Oh but . . . oil prices at these levels won’t last. They’re going to crash because demand is going to dip and supplies are going to catch-up. Really? Transportation is the largest usage for oil, so until you hear supply chain snafus are fixed, inventory stocks have been replenished, auto manufacturing has recovered, workers are back in the office and international flights are taking off, then no, demand hasn’t fully recovered. As for supplies catching-up? Not if producers keep their capex budgets below 2019 levels.

Oh but . . . politicians, business leaders, academics will force ESG upon us and kill this industry. Really? You didn’t sense the temperature change? After haranguing and pummeling the energy sector for the past few years a subtle shift occurred in the past few days.

Evidenced in part by BlackRock’s 2022 Letter to its clients. We went from “Climate Risk is Investment Risk” in their 2020 Investment Letter . . .

to this in 2022 . . .

Wait. Hold up. Two years ago BlackRock was advocating that stakeholders of this precious blue marble we call Earth redirect their capital to choke off fossil fuel development and battle climate change. A reallocation that coincidentally BlackRock can help you with. Yet, two years later they backtrack and say . . . well hang on a bit, we didn’t say sell EVERYTHING.

Well again, let’s let BlackRock say it in their own words.

“And BlackRock does not pursue divestment from oil and gas companies as a policy.”

No certainly not. BlackRock simply helped you screen the candidates for divestment #amiright? Again their 2020 letter:

So why the subtle shift? Why did Larry Fink, CEO of BlackRock who pens these letters, belt out Shaggy’s “It Wasn’t Me” rap? Because like the artist said . . . “to be a true player you need to know how to play.”

. . . and BlackRock clearly does . . . as they said two years ago:

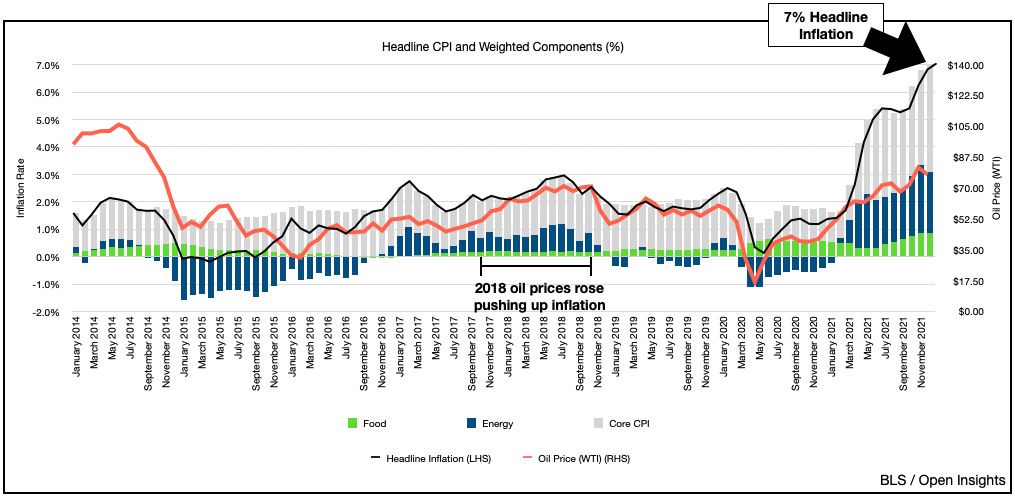

Oh we see. Mindful of economic realities like this?

Maybe. We know this is craaaazy, but just hear us out. Maybe an asset manager with $9.5 TRILLION, would be hard pressed to justify to the world what happens when runaway energy prices caused by a dearth of investments they helped catalyze . . .

lead us to a chasm filled with SCARCITY, MASSIVE INFLATION, SHORTAGES, HOARDING and VIOLENCE. Maybe the thought leaders with their well-intended, but misguided (and perhaps a bit self-serving?) musings have actually created a situation that will have real-world implications.

No certainly not. Though we write about BlackRock, they aren’t alone because even Ray Dalio, founder of Bridgewater, one of the world’s largest hedge funds said on Monday at a panel in the Abu Dhabi Sustainability Week summit:

“Thank God for the oil producers because they are providing reliable supply.”

As Bloomberg wrote:

Yeah because just 3 months ago (Sept 30, 2021) he instead felt differently:

Apparently what’s more uncool or nasty than harming the environment? Inflation.

Yet here we are, being uncool because coolness has given way to survival. Western and industrialized economies will now cede greater geopolitical and economic power to Middle Eastern countries and Russia as those producers increasingly gain influence as energy supplies tighten. Sure, their interests do not entirely line-up with ours, but who cares when you’re cold and can’t move.

As energy prices climb, politicians and the public at large will also undoubtedly look for scapegoats. First, they’ll blame E&P companies for generating “windfall profits” amidst a shortage, and once satiated with whatever remedy they deem appropriate, they could turn their attention to Wall Street at large. We can see it now. Protests against the wealthy and those money managers who led us down this completely unsustainable sustainable path. First the Great Financial Crisis and next the Great Energy Crisis.

So perhaps that’s what these new musings are for. Preemptively deflect the blame, or encourage more investments? Likely the former. Still, capital must flow back to the energy sector. It has to if we want to maintain any semblance of our modern society. At this stage we don’t need the market to love our companies, we simply need it to tolerate them and admit that our civilization still needs fossil fuels. Even mild tolerance will garner significant inflows. Either way, the indifference will end one way or the other.

Frankly, we believe we’re already in the early innings of an energy crisis. The time to start drilling was yesterday and having failed that, we’re simply counting the days before our depleting inventories force a repricing, and There. Will. Be. A. Repricing. Energy prices must rise because it’s saying . . .

There will also be a reckoning when fingers begin pointing, and politicians plus the public at large begin assigning blame. Money managers are simply ducking first. Like professional athletes, these are all business decisions. Tom Brady doesn’t get paid to tackle, Lebron James doesn’t get posterized, and money managers push products, but sure as heck sidestep the fallout. That’s called risk management baby. So don’t take it personally. It’s just business.

Besides . . . It Wasn’t Me.

Please hit the “like” button below if you enjoyed reading the article, thank you.