Everyone Knows, You Never Go Full Bull . . . in the Oil Market

August 19, 2023

As we wind down the summer days, I’ve been taking stock. Contemplating some things in the oil market and trying to figure out where we stand. Pulling threads I call it. Everything seems to be in play, higher inflation, deflation, global slowdown, a soft landing, no recession, China growth via stimulus, and/or a China implosion.

Yeah it’s all there. Everything’s possible, but everything has a probability. Some more likely than others, and some less. Just take oil for instance. Assuming there’s no credit event, or a severe crash, we think supplies will continue to tighten as demand stays robust, but the likelihood of hitting triple digits in 2023? That may actually decline. How does that make any sense? Why not when inventories are declining?

All fair questions. The best answer we can give?

Because.

Because things just seem to happen in the oil space. Despite inventories drawing and supply cuts, stuff happens. 2018 should be a great year for energy, Trump quid pro quo with the Saudis stuffed US inventories. 2019 should be it . . . US China trade war. 2020’s gonna be great . . . then the VID happens.

Always something.

That’s certainly not thoughtful analysis, but it is our reality as energy investors. As bullish as we are, we do think 2023 may have a ceiling. Even as inventories decline, there are countervailing factors that could limit the upside.

Here’s an example.

Contemplate Saudi’s additional 1M bpd cut extending to September.

Then look at this image posted by HFI Research . . . yeah they’re slamming supplies down.

Then ponder this tongue and cheek response posted by @WTIBull (where he inverts the original graph to make a counterpoint).

To be fair, both are probably good comments, though the first is more of a reaction, and the latter an interpretation. The implication being that the more supplies the Saudis withhold from the market, the more supplies they can release later. In turn, pundits will argue that the tightening we’re seeing in the energy space is an artificially induced one, given the Saudi’s desire for higher oil prices (sorry, their desire to “manage” inventory levels), and that once the barrels flow again, inventories will rise and prices will fall.

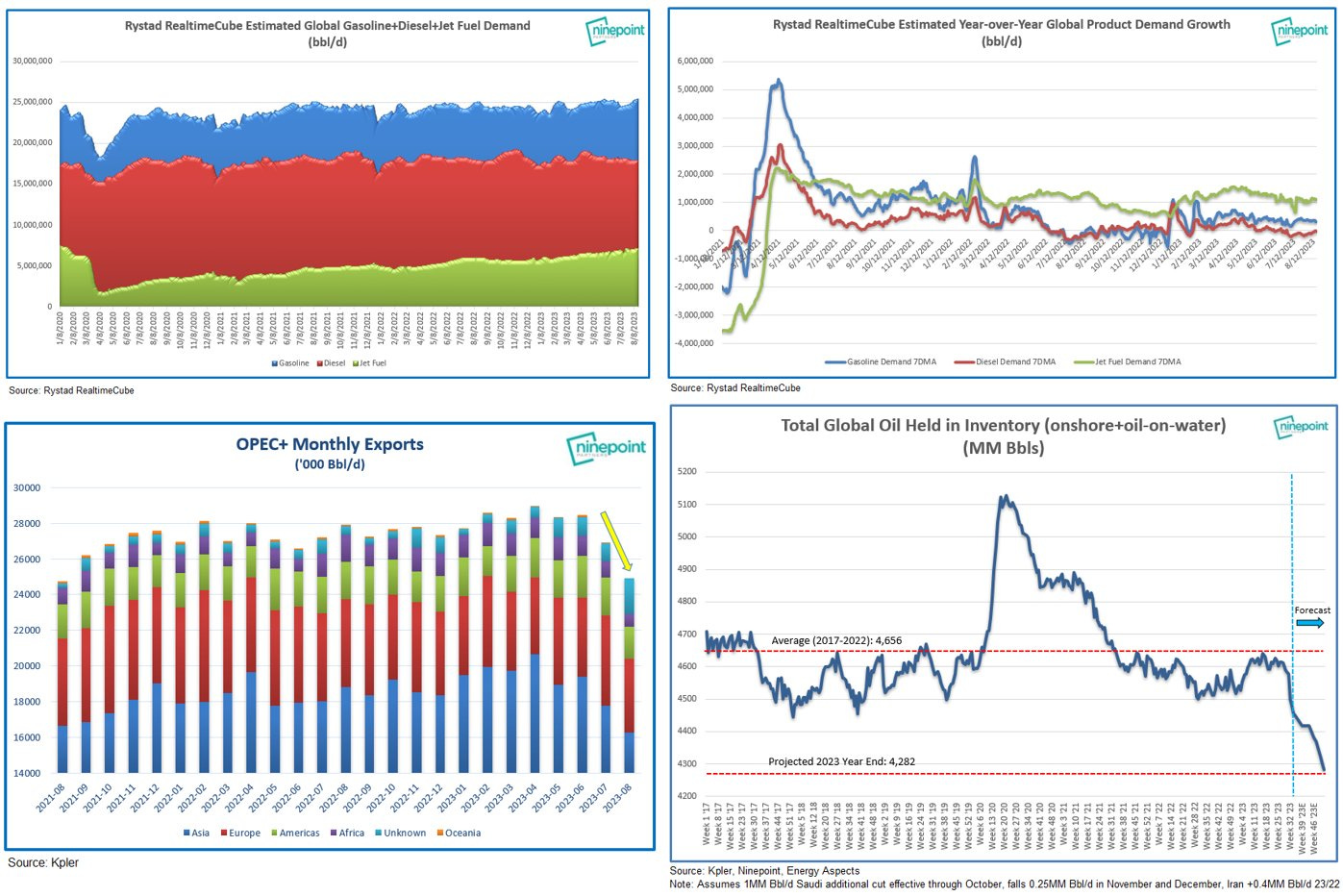

Yet, I’m forced to also contemplate this tweet by Eric Nuttall at Ninepoint, which includes this chart pack.

Just look at the bottom right chart. Global inventories. They are falling, and projected to fall even further as we head into Q4. While most believe that demand falls off after the summer season, the reality is, not so much. In fact, if you eyeball IEA’s data, the change from Q3 to Q4 in 2017, 2018, 2019 was +300K bpd, -500K bpd and +200K bpd, respectively. Hardly a post-summer lull.

So as the Saudis cut into September, barrels which “never” arrive in October and mid-November, the reality is . . . this is just beginning. Meaning this tightening will continue as demand stays seasonally high, and supplies low.

Beyond the $90s though? That’s where we think “stuff” starts to happen. Especially as we approach an election year. First, the perception that OPEC+ still has spare capacity will prevent investors from going full “bull” on this rally. Second, politicians get squirrelly as prices approach triple digits, so the inducements get a bit more attractive. If Western leaders, particularly in the US, begin to worry about higher energy prices rolling into 2024, expect some rapprochement with Iran, and maybe even expect the Saudis to trade their spare capacity for political gains. That Biden fist bump may just turn into a handshake.

Surprising? It shouldn’t be. The Saudis want back on the world stage. They want foreign investments, and they want the normalization of relations post-Kashoggi to attract those investors. Specifically, they want Neom to succeed and the leverage to make it happen.

“M” is for MbS . . . *sigh*.

So at least for 2023, we don’t anticipate oil to climb beyond $90/barrel. The Saudis will likely trickle supplies into the market as prices climb, trading higher prices for price stability and political favor. They’ll likely play nice, knowing that runaway prices defeats their ability to garner investments for NEOM as a severe macro-recession would depress the appetites of global investors. Doing so further pushes back the timelines for a sorely needed project that diversifies the Saudi economy. It’s about jobs, as jobs brings political stability for the royal family.

Still, don’t discount the drawing inventories. That’s real. The physical does discipline the financial, and the tightness will raise the floor for prices, solidifying $80/$90 barrel as the new floor. With US production beginning to tip over though, which floor we get out on is increasingly being controlled by the Saudis. Eight floor? Ninth floor?

Ding. Anyone?

Since they’re the ones pushing button these days, they may actually get what they want, higher oil prices, political leverage, and foreign investments.

So appreciate oil’s recovery, but be realistic about where prices can reach this year. We don’t need runaway oil prices this year for our companies to do well, and we likely won’t get them. 2024? That’s a different story, but for now, calm yourself and think rationally/probabilistically .

Everyone knows you never go full “bull.”

Why? Because.

Please hit the “like” button above if you enjoyed reading the article, thank you.

It feels as though oil is starting to take on characteristics of gold, good long term fundamentals, but always for next year

Great analysis. Thank you.