Fear Has Clearly Arrived

September 24, 2022

This isn’t fundamental.

There’s nothing fundamental here.

This is market psychology, it’s human nature. You can dress it up with technical chart patterns and blame algos, CTA, the Fed, or market conditions, but eventually all of it distills down to human behavior as markets sell off and fear creeps in.

We didn’t need a headline to announce the arrival of fear, but if you did . . . here you go (from Bloomberg). . .

Thanks Alon, fear has CLEARLY arrived. It’s scary. We know. We figured this was coming. We wrote about it last week.

Though it’s not surprising, it doesn’t come any easier when you’re holding positions. So we understand. So what caused this 10-car pile-up in our markets? Well what most people “say” was how aggressively the Fed is hiking rates.

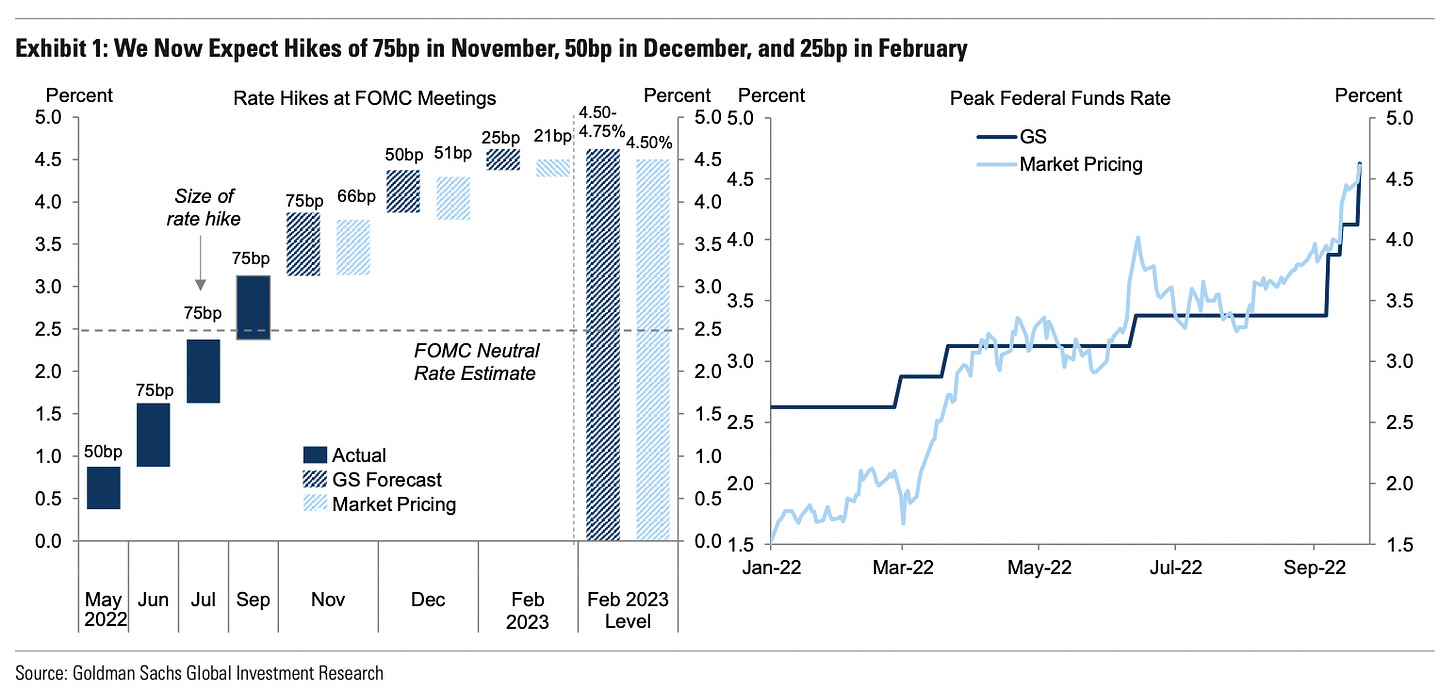

The FOMC meeting this week was an eye opener for many as the Fed continued with its hawkish stance. If anything, they raised the bar for rate hikes for 2023 via their internal “dot plot,” which is their survey of where each Fed member thinks rates should be. Unfortunately for the “MOAR GROWTH” crowd, any hopes for easing interest rates were dashed, as the Fed swatted away the silly notion.

Instead, the bar is getting raised as Fed governors signaled raising the Fed funds rate to 4.5 - 4.75% by next year.

Remember, the Fed fund rates are the overnight lending rate, so it doesn’t get any shorter-term than that, and at around 3% today, 4.5 - 4.75% sure seems much further away.

Before, market participants had anticipated 4.5%, which is to say, is the new higher range really that materially different? No, not really, which is why this is less about fundamental repricing, but more about expectations and psychology. What surprised the market was the Fed’s tenor. The declaration of an all out war to tackle inflation even as coincident and leading economic indicators are already pointing to a slowdown that’s scaring the market. Whereas before the market gave the Fed the benefit of the doubt earlier (i.e., perhaps they will get this under control), today the narrative’s shifted. It’s now, holy #@&^$@123!!!!!! they’z gonna break things.

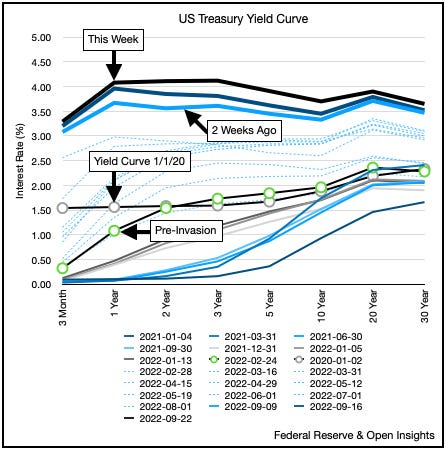

The shock and awe is working though as the Treasury markets reacted, and rates leapt higher.

So everyone?

Duck.

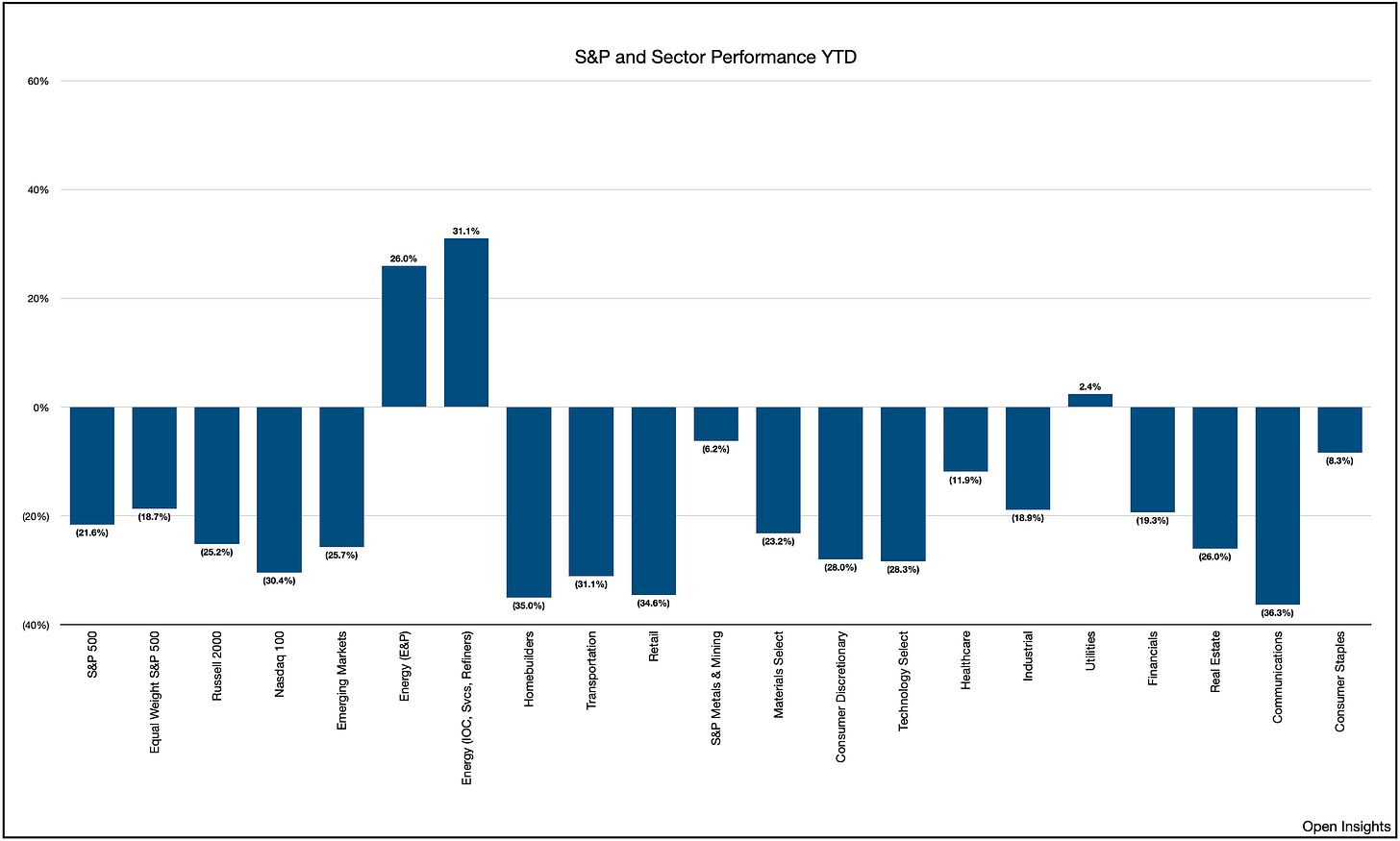

It was a bloody mess for the week, with no place to hide. Year-to-date figures are similarly a wasteland, with nary an oasis.

Will we see a bounce? Yes.

Is this over? No.

Not yet. Not yet because we have to break things now because the economic/fiscal policies are muddled at best and disastrous at worst. They have to because we have competing priorities, but no real plan to thread our way out of it.

It’s politicians vs. central bankers. One side’s pressing the accelerator; while the other’s slamming the brakes. You can’t have two authority figures running separate playbooks. If you need a case study, look just across the pond at our UK brethren.

The British finance minister Kwasi Kwarteng unveiled a broad set of fiscal stimulus measures, which cuts taxes and subsidizes soaring energy costs. A flagging economy coupled with profligate spending means all of this money comes from borrowing (i.e., central bank money printing). The market promptly reacted, unwilling to fund such deficits at current rates, and the UK 10-year yield went ballistic.

In addition, the British pound collapsed.

Incredible, because I’m old enough to remember when the British pound was 2 to 1.

What times we live in.

Still this is all entirely predictable right? Well yes, because it’s human nature. We’ve written about this before.

For politicians there’s only one solve for inflation and that’s to print more money.

In contrast, central bankers, unable to control supply, can only tame demand. Yet, how do you do that for staple goods (e.g., food and energy)? Starving and shivering aren’t viable options. Still, you raise interest rates to bolster your currency (knowing you’re imposing greater financial hardships on your citizenry and lowering asset prices), you maintain high reserves, and you project confidence. All the while the politicians craft stimulus plans to ease the burden, tunneling right under the very foundation you’re trying to set. What choice do you have though? Inflation must be tamed. So pick your poison.

What ends up breaking isn’t just the financial markets and the strength of the currency your country brings to the table, but eventually the population’s patience. First the market loses faith in your country’s credibility, and then it dials-back the investments and dials-up the funding costs. Inflation gets worst as affordability plummets. Inevitably, the populace loses faith in its current slate of leaders as the weak currency and moribund economy foments discontent. What’s dangerous about this toxic mix of bad choices is that it ushers into power authoritarian governments that pretend to have the answer.

For us, this isn’t just about the financial markets. Yes, that’s important as we manage our positions carefully here, and maintain a conservative stance (i.e., not rushing to buy dips and similarly not rushing to sell during drawdowns). We think an 18x “recession impacted” S&P 500 earnings of $200 (down from $234) means S&P 500 at 3,600 levels isn’t unreasonable right now. So we will likely decline more. The caveat on that, however, is that those few sentences are about fundamentals. It’s not fear, and fear is decidedly something different. Fear can lead to capitulation, and capitulation leads to despair, so the market can go “no-bid” here if it gets twitchy. We don’t think that’s in the cards though because we’re not (at least in the US) experiencing a credit crisis, and “tough talk” from the Fed can be dialed back a bit. Other countries, however, are the main concern as their weak currencies coupled with the strength of the US dollar really hamper their ability to repay US dollar denominated debt. The US dollar wrecking back is in full swing here, so be wary. For readers located outside the US, you simply need to look at your US dollar exchange rates and you know exactly what we’re talking about. There are a few “outs” though. One of the main ones is China. You simply can’t have a global economy with China locked down. It’s Japan and South Korea’s largest export customer, the EU’s 3rd and the UK’s 7th. If China sorts itself out, that will help the global economy and financial markets greatly.

Still, we have one eye in the present and one eye on broader trends. What’s important to note is that as financial markets dislocate, as each country comes to grip with its own fiscal/monetary issues, we believe the world will become increasingly fractured as countries turn inward to “get theirs” and “protect theirs.” Financial instability leads to political instability, and political instability leads to people reaching for things that aren’t there.

“People want leadership, Mr. President, and in the absence of genuine leadership, they'll listen to anyone who steps up to the microphone. They want leadership. They're so thirsty for it they'll crawl through the desert toward a mirage, and when they discover there's no water, they'll drink the sand.” - Michael J. Fox’s character in American President

Then again, maybe authoritarian government’s aren’t all that bad . . . at least some are amusing.

You'll be back, soon, you'll see

You'll remember you belong to me

You'll be back, time will tell

You'll remember that I served you well

Oceans rise, empires fall

We have seen each other through it all

And when push comes to shove

I will send a fully armed battalion to remind you of my love!

Da-da-da, dat-da, dat, da-da-da, da-ya-da

Stay rational and conservative out there. Good luck.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Nice work!