Fighting Bulls . . . Oil-ay!

June 9, 2023

We know.

Summer vacation is kicking off soon.

It’s already T+10 days post-Memorial Day and the beaches are calling.

In fact, we’re off to Hawaii soon, so expect some pictures of free-range chickens roaming around, caw-cawing advice at us about the oil markets like last summer.

The Selloff's for the Birds

I’m sitting next to a chicken. No this isn’t an allegory or metaphor . . . or is it? Still . . . I’m literally sitting next to a chicken. It’s like he owns the place. Here, next to my table, crowing at the top of his lungs. Technically I guess it is

As we start THIS summer though, things are decidedly different. Maybe even dicier as uncertainty abounds. Oil prices have declined since yesteryear when they exceeded $100/barrel. As producers destocked, a mild winter struck and Russian exports stuck on high, oil prices have decidedly weakened since those high times. False rumors yesterday of a US/Iranian detente over its nuclear program led to a quick 5% fall in prices. The rumor was later denied by the White House, and the oil market largely recovered. Still, jittery the market be.

It’s not like OPEC+’s extended cuts have helped. Saudi’s unilateral 1M bpd cut for next month was announced to much fanfare. Unfortunately, we all ended-up watching a de-facto Taylor Swift concert as it then shook-it-off and eventually sold-it-off. Like we’ve said all along, the market wants proof of inventory draws, and will afford energy investors little leeway. So until inventories fall . . . We are NEVER EVER EVER . . . getting back to higher.

So yeah, this tumultuous relationship (i.e., we have or don’t have enough, it all depends on your demand forecast), it’s the current state. Why invest in energy now? It’s fool’s gold. We have plenty of inventories, and looming clouds on the horizon. Everyone also knows that “the recession is coming.” So sell the bounces, and dip the rips.

What we’re watching is bull fighting, as the matador (i.e., the paper market) taunts the oil bulls.

Physical shortage?

Oil-ay!

Demand increasing?

Oil-ay!

Seasonality?

Oil-ay!

The bulls are tiring now. They’re clinging to the age old adage that “the physical disciplines the financial,” but each plunge in oil price is another stab of the banderilla. As the bull thesis weakens, as the collective breaths of the oil bull becomes raspy, chest heaving from the strain, we think . . . this could be the end. It may never come, and instead the death sword of a recession will.

H2 is nearly upon us, and if this thing doesn’t improve fast, we’re about to find out what happens to bulls after the fighting ends. We’ll be invited for dinner . . . but as the entree.

Yet.

Yet . . . that red cape suuuuure loooooks tempting. So to heck with it. CHARGE!

So as you head to your summer destinations, just spend a few moments with these two charts before the cattle call rings out for your flight. Take a gander with those big moo moo eyes at what’s in store.

We’ll call it 2 and 20. Fitting for money managers, but for the physical oil market, it’s 2 charts for the next 20 weeks (okay maybe 3, but we like the alliteration).

This is what should happen in the next 20 weeks.

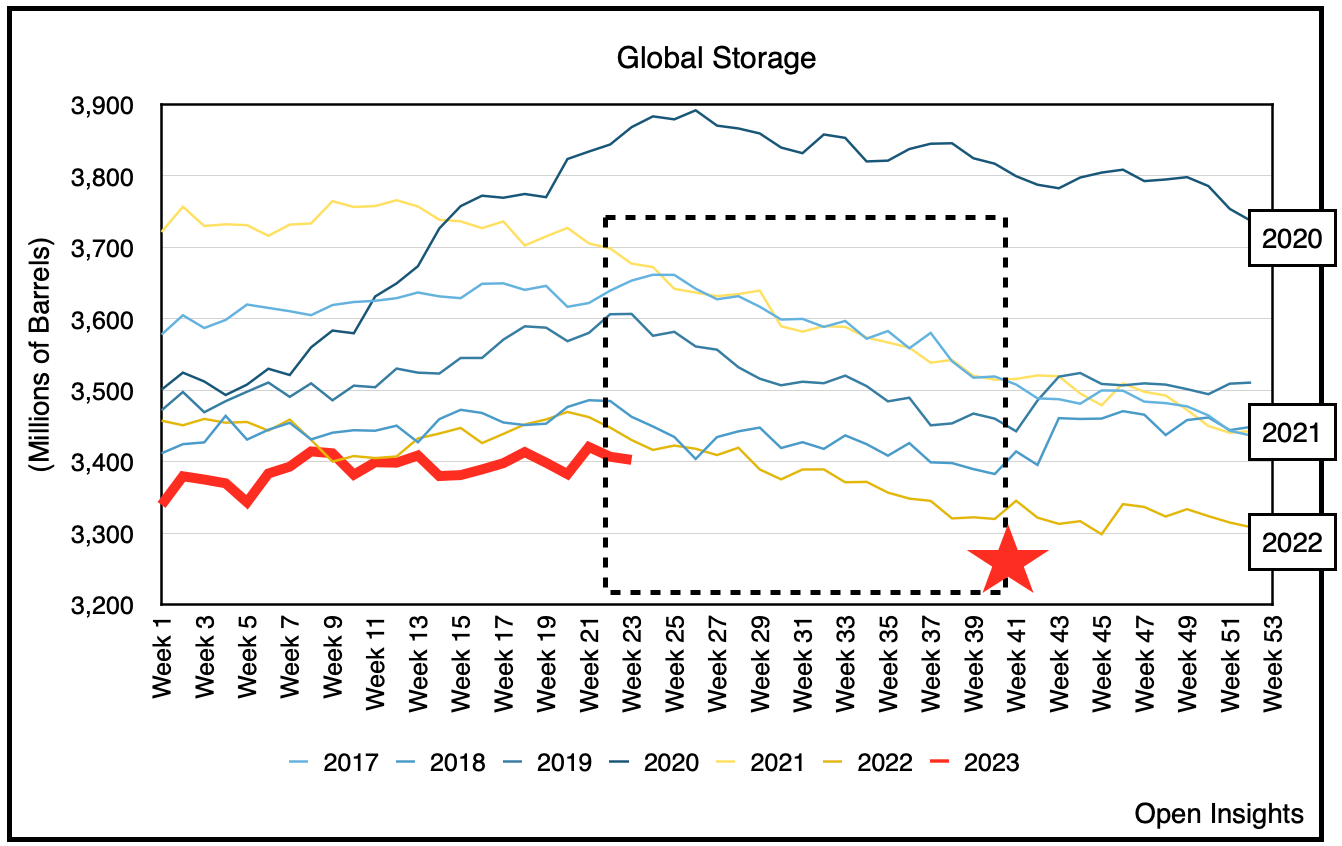

Isn’t the red so tempting? If we simply mirror what happens every year (except 2020), global crude inventories should draw in the next 20 weeks. As we noted in our last missive, if we draw about 1M bpd on average, oil prices should also hit $100/barrel by year end. At our seasonal drawdown rate, we anticipate global inventories should be at a decade low by mid-September.

What’s likely to happen though is that if commercial inventories plummet, the US and potentially OPEC+ would release additional inventories/spare capacity to retard the commensurate advance in price. Even so, the price levels for oil should firm as we go into June/July if we’re right. Said another way, the physical should discipline the financial.

The second chart just highlights another oft raised concern. If/when oil prices rise, pundits have argued that China will destock its strategic petroleum reserves to keep a lid on prices. Weeelll . . . the fact of the matter is that they almost always do during the summer. See?

So the pundits are correct, expect that China releases inventories again. The wrinkle, however, is that this year, we’ll likely have an offset that we normally don’t, a unilateral Saudi cut to production (which they define as production/exports) that will shave off nearly 30M barrels from the world (i.e., about what the Chinese tend to release). If HFI Research’s forecast is correct, we anticipate Saudi’s exports to fall dramatically (see below).

Still . . . go back to this first chart again. This is what matters and we need to see this begin shortly.

So we know you’re tired bulls. We know the year has been “choppy” to say the least, what were realistic and seemingly probable targets were simply the matador’s capote.

The paper market’s been calling bull on the physical one for most of 2022, and it’s been mostly right, but if you’re right, then seasonality’s about to give you a second wind.

If you’re right, the physical market’s about to gore . . . the financial one.

Now go board your plane.

Oil-ay!

A good read. Thanks for your thoughts.

Hopefully !