Frogs in a Pot: Why the Fed Can Turn Down the Temperature

March 18, 2023

“What do you think?”

“I don’t know . . . ”

“No, but serious, what do you think about the macro?”

“This is hard.”

“Yeah.”

That above . . . that’s how my conversations start these days. Actually that’s exactly the conversation I had today with another investor. For the past 5 days it’s been that. Like Groundhogs Day, we repeat the same conversation. At this stage, it’s like what Buffett so eloquently says in his Berkshire annual meetings sometimes . . . “I have nothing to add.”

Isn’t this your job though? Your J-O-B? Surely as a fund manager, you have some thoughts. No clue at all? Really?

Fine.

Fine, let’s start articulating something. A vague outline. Let’s throw it against the wall and see if the string diagram sticks. Since I’m simple, let’s break it down Denzel style. Like his character in the movie Philadelphia, where he plays a lawyer and tells Tom Hanks’ character . . . “explain this to me like I’m a 2 year old.”

We’ll work big to small.

Here’s the big.

Maybe . . . maybe the market is right, and maybe, maybe the Fed has an out.

I think they do. The market certainly thinks it does as the recent systemic risks vaporizes the notion that the Fed can keep tightening and raising rates without any consequences. In fact, the bond markets are now pricing in the potential for the Fed to cut after the spate of recent bank failures. Here’s a chart from Bloomberg (as posted by ZeroHedge) as the turmoil spread in the recent days.

As of Thursday, the market is implying that not only will the Fed raise only a tiny bit more going forward, it will soon be cutting the fed funds rate to sub-4% by year end.

Contrast that with this.

That is inflation (CPI). 6% headline, year-over-year . . . . it’s soooooo bad. Ouchie hot, but it is coming down. Nonetheless, interest is supposed to cover you for 2 things, risk of loss and inflation, and a 4.5% fed funds rate (and the implications of that on a rate curve) may not be enough in a 6% inflationary world.

Or maybe it will?

Because this is the CPI overlayed with some real-time indicators to see what the “trajectory” will be like in the coming months.

See the direction? 4 large pieces fit together to spit out the CPI. Energy, housing, food, and services (wages). In real-time, the data for every piece of the puzzle is falling. Translation? The CPI number will be heading south . . . shortly.

Specifically though, take a look at energy. Nearly a 30% weighting in CPI these days. That’s bigly, and if that falls . . . CPI falls harder, and faster because like the chart above shows (top left corner), it’s nearly real-time (i.e., energy prices you see on your screen almost immediately impact CPI).

Oil prices this week? Womp. ~$77 to $67/barrel.

If oil falls and stays down at these levels, the energy component of CPI will surely fall even more. Reducing CPI (and headline inflation) by ~1%. 1%!

Thusly, inflation falls from 6% to 5%, but wait there’s more.

Look at the housing piece (top right corner). That’s about to get as the kids say “rekt.” The housing calculation in CPI uses lagging data (a rolling average), and eventually, the real world/real-time data will ripple through to the Fed’s data. It’s just a matter of time before the CPI reflects it. 6 months from now? Possibly down another 1%.

Inflation falls from 5% to 4%, but wait there’s more, more.

Throw in a tiny bit of food and services deflation, inflation is poised to fall to 3.5-4.5%, likely somewhere in the lower range. In say 6 months.

So if inflation is 3.5-4.5%, and the Fed is raising rates to be more hawkish to combat inflation in the coming days, won’t the 4.75% fed funds rate be a bit too high? Doesn’t it give the Fed some room to cut? Especially if inflation falls below 4%?

The market thinks so, and so the entire curve began stepping down.

We get it though. We can see the logic. The Fed has an escape hatch from its current intractable problem. Raise rates to tame inflation, but risk systemic failures as the higher rates crash asset prices.

The Fed has an out because if we can see that the data in real-time is turning, surely so can they when they plug the numbers into their models. So after the Fed announces the next 25 bps raise in interest rates next week (0.25%) (i.e., a 75% probability), the key question becomes, how do they message the next few months? How hawkish do they want to be to tame inflation? Especially when they just declared a systemic event in the case of SVB’s failure, and stepped-in to protect all depositors, and not just those insured up to $250,000 per account?

Although financial stability isn’t one of their two mandates (price stability and full employment), it almost certainly leaps to the forefront when it threatens.

So they have an out. Lowering rates will actually improve the balance sheets for some of these banks (and other shadow industry participants) as the “mark-to-market” impacts ease. It would also help sentiment as we turn the temperature down for all the frogs in the boiling pot. Undoubtedly, the water is still hot, but it’s all relative.

Just the hint of lower rates have already lifted animal spirits. Even as the market worried about the hidden dangers lurking everywhere, speculative euphoria began to rise. Look at what the best performer this week was . . .

Good for them. They have an out to say “we’ll raise, and then we’ll see.” We’ll see . . . how this plays out for inflation . . . knowing (as we do) that it’s going to fall, fall soon, and fall materially.

Then what?

Energy . . .

Well . . . if we’re right about energy, that fall may just reverse because guess where oil prices and that -1% on inflation is headed if it reverses?

Higher.

Shelter . . .

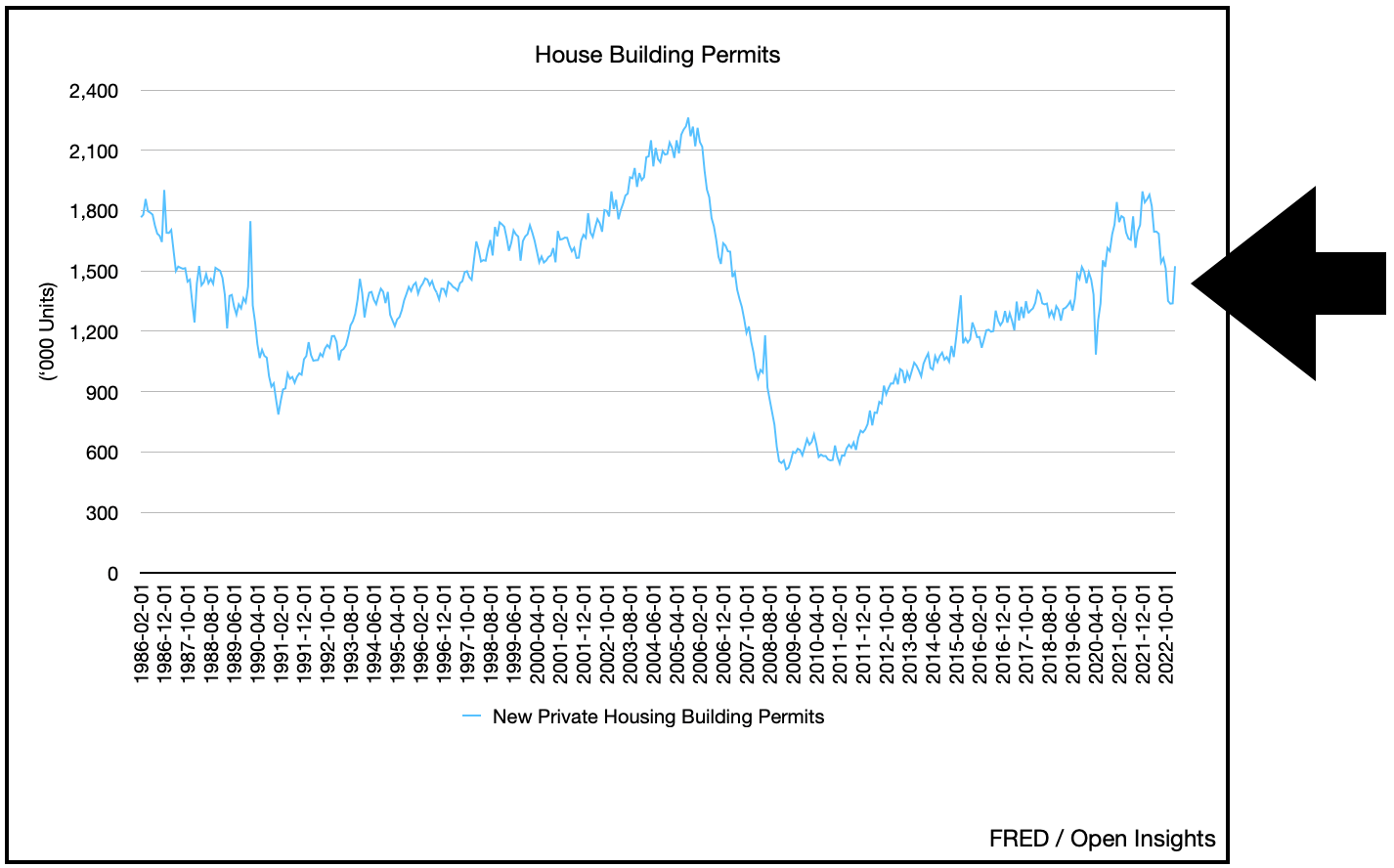

Guess where housing is headed if housing permits/starts are any indication and mortgage rates come down a bit as those rates fall?

Services (Wages) . . .

Guess where services are headed as 4% per year raises getting handed out (or proposed) kick-in in a tight job market because older people have simply retired.

(Note: the Caterpillar pact above is a 6 year deal that includes a 27% raise and a $6,000 one-time bonus, and it’s not an outlier these days.)

Yeah all of those potential factors could push CPI higher later this year. It’ll take some time for the impact of lower rates, a slight easing of financial conditions (from the relentless tightening) to trickle through to the economy and real-time data, but they will eventually.

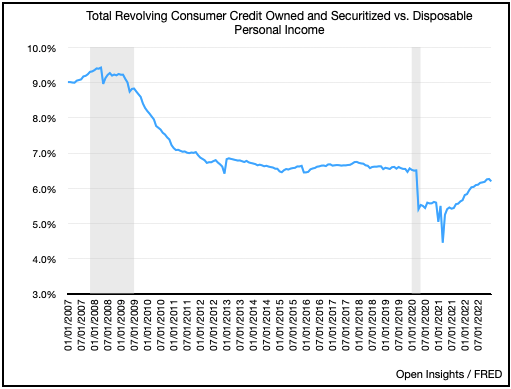

Lastly, we believe that the economy, absent a systemic failure, will still be robust this year. Despite the volatility in the markets, consumers (again 70% of the US economy) have not only high savings (i.e., an excess of $1T in savings), but also debt service ratios that are within range.

So that’s where my thoughts are.

I don’t know.

Maybe we just see things a little differently.

Maybe I’m just dreaming, which is why my kid’s keep pinching me.

Maybe it’s St. Patrick’s Day.

We all could use a bit of luck as we sit in the warm waters.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Informative. Hope he's right!