GDP? We May Just Owe You an Apology

July 26, 2024

There’s this quote I think about sometimes. It pops into my head once in awhile when I’m skeptical about something, but the end result surprises me. It’s this quote by Shaq. You know.

Shaquille O’Neill.

The Big Diesel if you will.

He said it once tongue-in-cheek on a TNT NBA broadcast when some unsuspecting player (Christian Wood then on the Houston Rockets) dropped 27 point in a game . . . when he averages about 14.

Quickly, this gem of a quote gets memed and now exists as a useful tool when things “surprise to the upside” or “outperforms our expectations.”

I thought of this the other day when I saw this.

GDP Now.

Growing at a blistering hot pace . . . 2.8%. ECON-OH-MY . . . In case you didn’t know, 2.8% is solid growth. It’s no joke. If you’ve any doubt that the current real-time GDP is that high, just look at Q2. Q2 GDP figures also just notched 2.8%, that’s real GDP, accounting for inflation.

As the Bureau of Economic Analysis says. “[t]he increase in real GDP primarily reflected increases in consumer spending, private inventory investment, and nonresidential fixed investments.”

Uh yeah.

Despite our thinking that this business environment will weaken as labor/employment dips, so far it’s not only been resilient, but STRONG. Yes, yes, our latest quarterly letter discussed the factors we’re concerned with . . .

. . . ones that we surmise will eventually slow the economy down, but against the force of GDP right now?

It may take a bit longer.

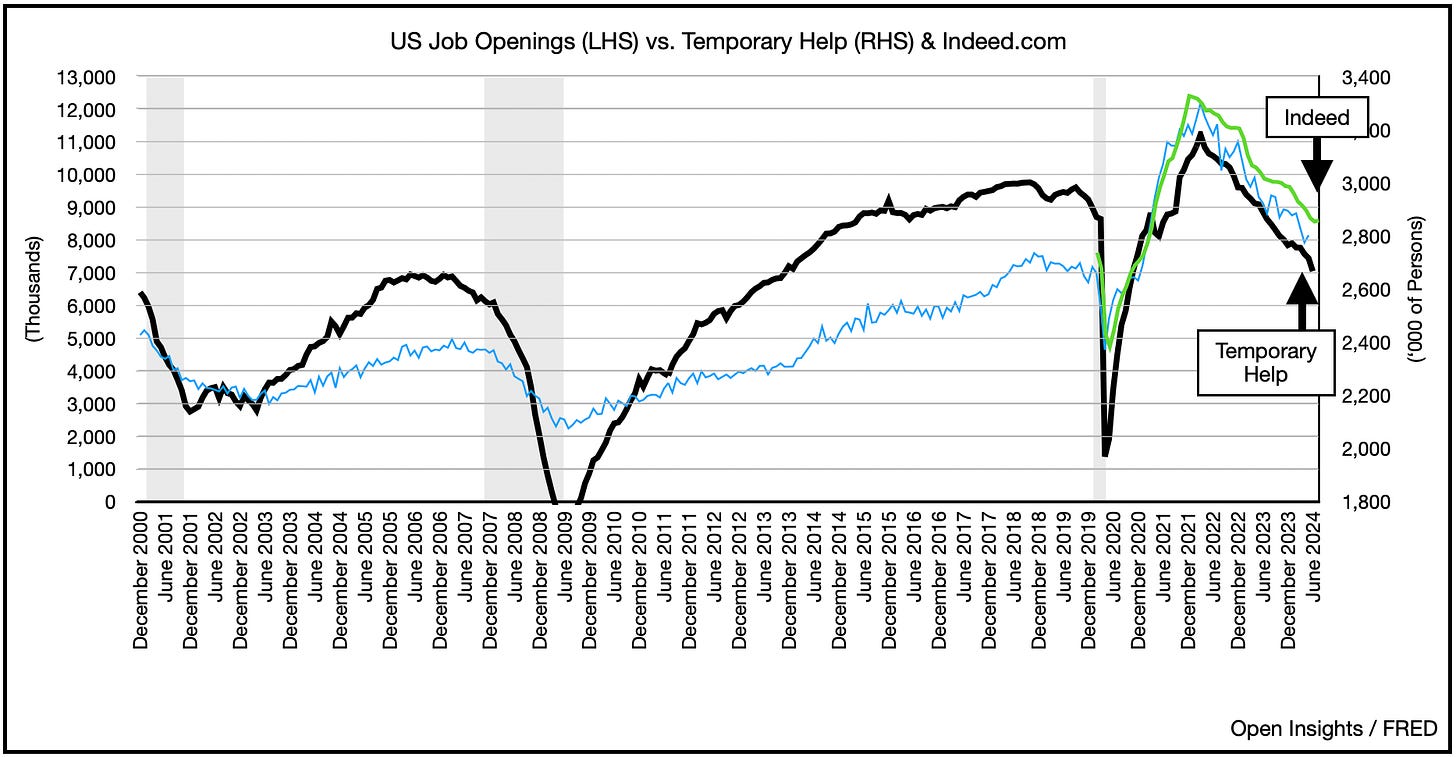

Even more so if this chart hooks-up. For readers of the quarterly letter, remember we posted this chart about temporary workers and job listings on Indeed.com. It was to illustrate that some of these things appear to be leading indicators of where the job market was heading.

Well guess what, the latest reading on Indeed? . . .

Bloop. Hmm . . . might that be a blip-up? Interesting . . . Indeed.

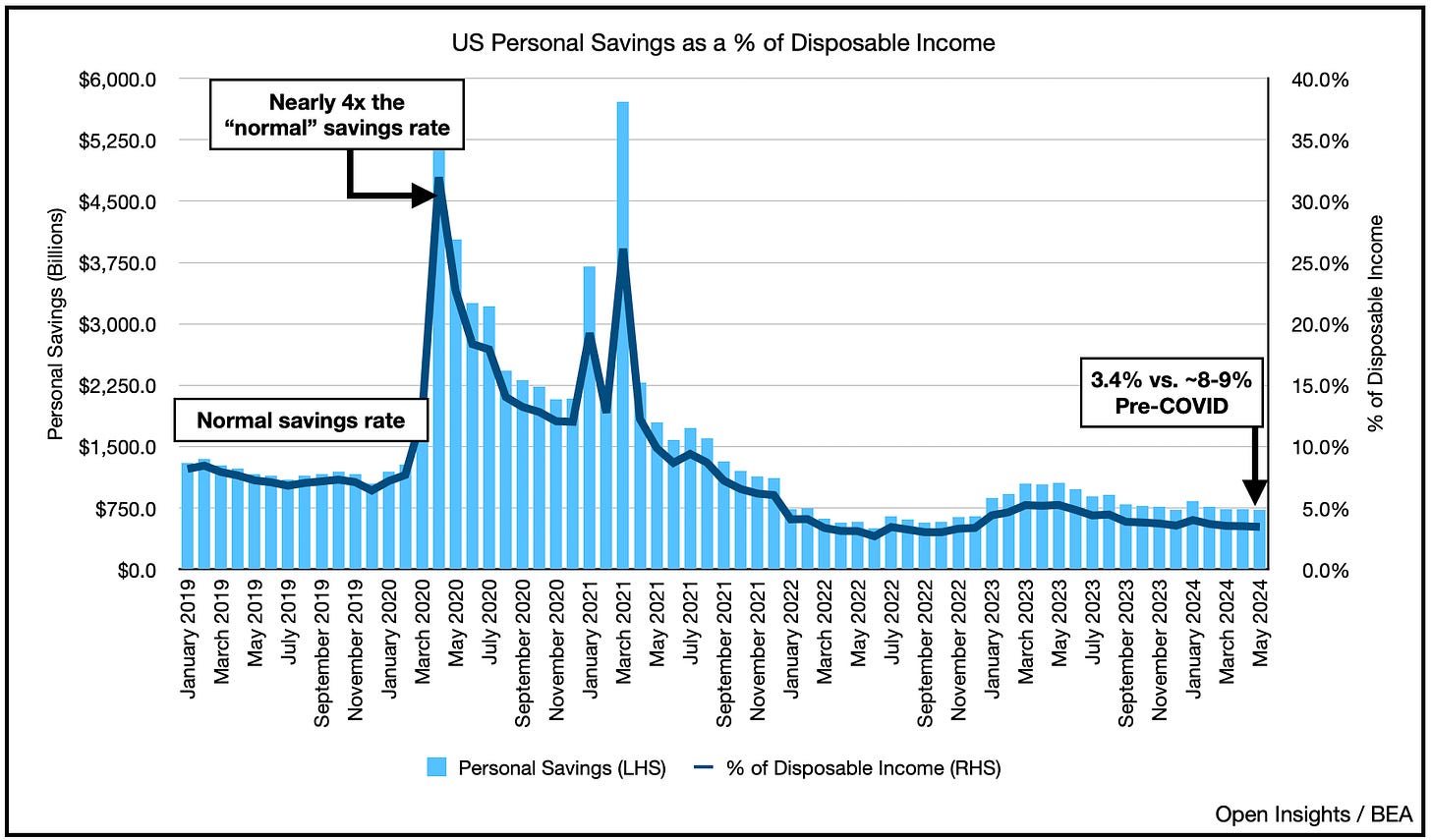

Okay in fairness to us, this is still early days. Despite the robust economy, we’re actually still saving even less, which means we’re burning everything we’re earning.

A low savings rate just dipped even lower, and came in at 3.4% yesterday. Can this persist? Maybe, but we doubt it. Something has to give, you can’t “not save” forever, and think that’ll work out well.

What’s happening in the real economy though, coupled with a financial rotation, has been reverberating through the stock market. As inflation falls while the economy stays strong, the bulls are coming out to play and stampeding towards economically/rate sensitive small cap stocks. Hence they’re getting quite the bid, while the dominant FAANMG stocks (i.e, Big Tech) have sold off (this week).

The Russell 2000 is getting a bid, and even the equal-weighted S&P 500 is now seeing better days vs. the Big Tech dominated market-cap weighted S&P 500.

Overall the real economy is scorching lately, as is the Russell 2000. Month-to-date (July) it’s trounced the S&P 500 (9.2% to 3.6%), but don’t look now, MAG 7 still notched +6.1% despite the sell-off this week.

If the economy does achieve a soft-landing as the Fed brings inflation and interest rates down, we’ll be pleasantly surprised. Given our energy holdings, trust us, we’ll be right there cheering if this plays out.

Again, it’s early days though. As we noted before in our letter, we are at a tipping point. Whether we dip though still needs to be determined. So far? The economy is lighting up the scoreboard, and we may just need to issue a half-hearted apology . . . and get familiar with GDP’s game.

Please hit the “like” button below if you enjoyed reading the article, thank you.

We seem to be in a situation where the survey data continues to paint a negative picture (did you see the regional Fed surveys in mfg?) but the hard data won't roll over. is it the fiscal spending that is keeping things ticking over? is it that Fed policy has never actually been tight in a real sense? These are the things that remain so difficult to determine and I suspect it will be quite a while before there is real clarity.