Global Debt & the Pandemic

August 17, 2020

$142 Trillion, that’s global GDP in 2019 in international dollars (you know, that hypothetical currency with a comparable purchasing power parity to the USD), when all was well, or at least better. For 2020, the IMF forecasts that global GDP will fall by 4.9%. That magnitude of decline is close to $7 Trillion of lost GDP, or basically the equivalent of closing Germany and France for the year (or for us US-centric folks shutting down California, Texas, New York and Florida). Lost productivity, lost services, lost jobs, those are all big holes to fill.

If you don’t think that’s big enough, then tack on multiples more because it’s not just the $7T lost, but it also puts at risk the debt that the $7T supports. So a liquidity event can spiral into a solvency event, and losing tens of millions of jobs can quickly push us over the edge into a depression. These numbers aren’t just a rounding error, they’re a chasm. So what are governments to do? Fill that hole! With money and promises. Massive, massive amounts of fresh digitally created currency and guarantees/pledges that would make lenders and angry wives forgive any transgression.

How much? As of June, IMF calculates it’s about ~$11T. Now that ~$11T is set to grow because the COVID pandemic continues to rage. Half of that ($5.4T) are loans, equity injections, guarantees via state banks, etc., and the other half ($5.4T) are additional spend and foregone revenues. Most of the loans will be repaid/refinanced at some point and the guarantees will fall away as the economy recovers, but the other half? The $5.4T? Well that’s spent, that’s money rained down into our pockets to get us to the other side of the chasm.

Expect more rain because COVID’s impact continues. Since June, the EU passed a €750B economic stimulus plan and if Congress can finally agree to a follow-on CARES Act package, the US may add an additional $1.5-2T (our forecast). So voila . . . a $7.8-8.3T (and growing) bridge to cross a $7T hole. What becomes of this debt? Once shoveled into the earth, it can never be removed.

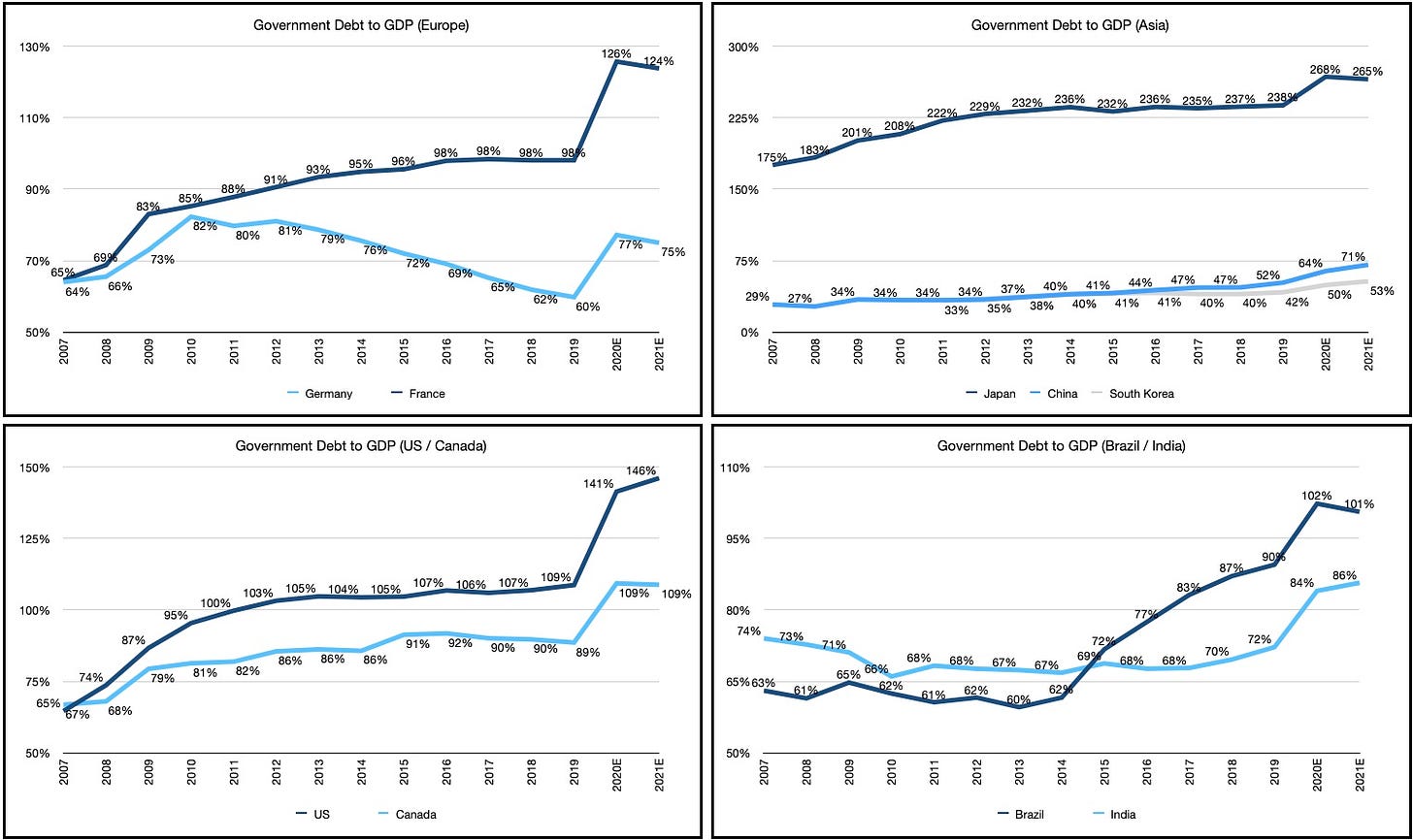

These amounts don’t really stimulate GDP, they merely bridge it. So while our debts continue to climb, GDP does not (assuming it recovers). In developed countries, debt to GDP ratios have increased by almost 20-30% in the past year, and will remain elevated going forward. The rescue payments, guarantees, low interest rates, etc. allow individuals and corporations to survive for now and service debt while waiting for a vaccine, but once we exit our suspended animation, the debt will remain, but our GDP will continue to stay weak.

We also think our collective debt binge is only just beginning, particularly in the US. As the economy recovers, the Federal Reserve has already indicated that monetary policy will stay accommodative (i.e., keep interest rates low, engage in QE, and relax reserve requirements). On the fiscal front the next Congressional package will bridge us past the election, but what happens thereafter? We expect a large stimulus package regardless of who wins the White House.

A stimulus package is easier to sell from a debt standpoint because the inputs change. If budget analysts like the CBO project that the increased spending will lead to higher GDP and a larger tax base, the net effect could be positive. Whereas the COVID rescue packages helped defend an economic floor, a stimulus package could raise the roof. Both President Trump and Biden have separately proposed large infrastructure plans, and from Biden’s perspective an infrastructure bill in the vein of a Green New Deal would help fulfill multiple economic and environmental campaign promises.

The size and difficulty of passing such a bill will largely depend on how the Senate races conclude. While many are fixated on the presidential election, we think the key races to watch are on the Senate side. Democrats are expected to maintain control of the House, so whether they’ll have 2 years of free rein, or face an obstinate Republican roadblock depends largely on whether the Senate flips. Republicans currently hold a 53-47 seat advantage in the Senate, so Democrats will need to flip at least 4 seats (as one of the Senate seats in Alabama will likely flip Republican). The outcome of the Senate races will also factor into the likelihood of passing Biden’s proposal to raise individual and corporate taxes, with the latter certainly impacting corporate earnings going forward.

Nonetheless, for now, if Congress agrees on a package in short-order, we’ll have fiscal dollars trickle into the economy just as COVID cases recede in the US. On that front, hospitalizations and positive cases continue to track positively and are on the downslope. Net hospitalizations (i.e., the number of patients hospitalized) are falling by about 700 patients a day (“per day” numbers are 7 day moving averages), and with 44K patients hospitalized, we’re on trend to fall to May levels (when the economy began reopening) in 3-4 weeks. Death rates have also plateaued and are slightly below our forecasted peak of 1,100-1,300 per day rate (currently hovering ~1,050 per day).

While flare-ups in Europe (France, Spain, Germany) and Asia (Japan) are leading to tighter restrictions at certain venues (e.g., clubs/discos), the case volumes and hospitalization rates are multiples lower than what we saw in March/April, so we don’t anticipate a retreat to full lock-downs as before.

Per Goldman Sachs, there are currently 167 vaccines in various stages of testing and 8 vaccines in Phase 3 trials. We’re fairly confident one of the 8 will be approved by year-end, and then it’s off to the races in terms of manufacturing and distribution. Mind you these are only the vaccines, and on the therapeutic side, additional testing continues there as well.

Lastly, the past week saw a rotation from growth to value as indicated by the Russell 2000 value index gaining 1.8% vs. the growth index declining 0.4%. Energy producers and service providers led the sector gains as did industrials. Are investors beginning to pre-position for a world with higher inflation? We suspect so as even Warren Buffett (or his co-investment managers Ted/Todd) have recently acquired a toe-hold in gold. One week does not a market make, but it could be a start.

As for perspective, we wanted to level-set our readers on the scale of global debt, GDP and the multitude of COVID aid packages that have already been passed in this latest issue of our newsletter. As some of you may have noticed we addressed COVID in our first issue, the coming US stimulus package in our second, and oil in our third, and now it’s global GDP and debt. These aren’t disparate issues, they’re drivers/repercussions coming from the pandemic, so should be viewed collectively and in their entirety. What’s occurred in 2020 is truly unprecedented, and the repercussions will be far ranging. While inflators/deflators/stagnators contend that one or the other will occur, it’s critical each investor makes their own judgment about the possibility of these scenarios. In the coming weeks we’ll attempt to summarize the various arguments and present our own. Who should you believe? We’ll let you decide, but at least after reading, we’ll all be able to articulate some of the reasons why.

Join the Distribution List

So that concludes this letter. We’ll endeavor to send these out weekly, so if you would like to be added to our distribution list click on the subscribe button above. This is our start and it’s our invitation to you to join us and share your thoughts. Welcome to Open Insights and let the conversation begin.