Happy New Year You Two Silverbacks (US & China)

January 10, 2024

Happy New Year everyone.

Hope you all had a wonderful and safe holiday season.

So turning the page to 2025. With the inauguration less than 2 weeks away, markets are a bit choppy, but still up for the year . . . well for the first few days at least. It remains to be see what the coming weeks holds as the reality of Trump 2.0 takes hold and the policies he’s about to kick-off solidify.

We’re certainly looking at the Big 3. Fiscal, immigration, and tariffs.

Fiscal? Yeah extend those 2017 tax cuts, that’s an easy lift. Everyone likes tax cuts, and I mean EVERYONE. It’s bipartisan. Spending cuts? Not so much. Government spending cuts like the Department of Government Efficiency (“DOGE”)? Good luck there. It’ll be a drop in the bucket, and immaterial. Sure like other government efficiency initiatives, there’ll be much hoopla, but government workers are union workers, and it’ll be hard to remove many of them.

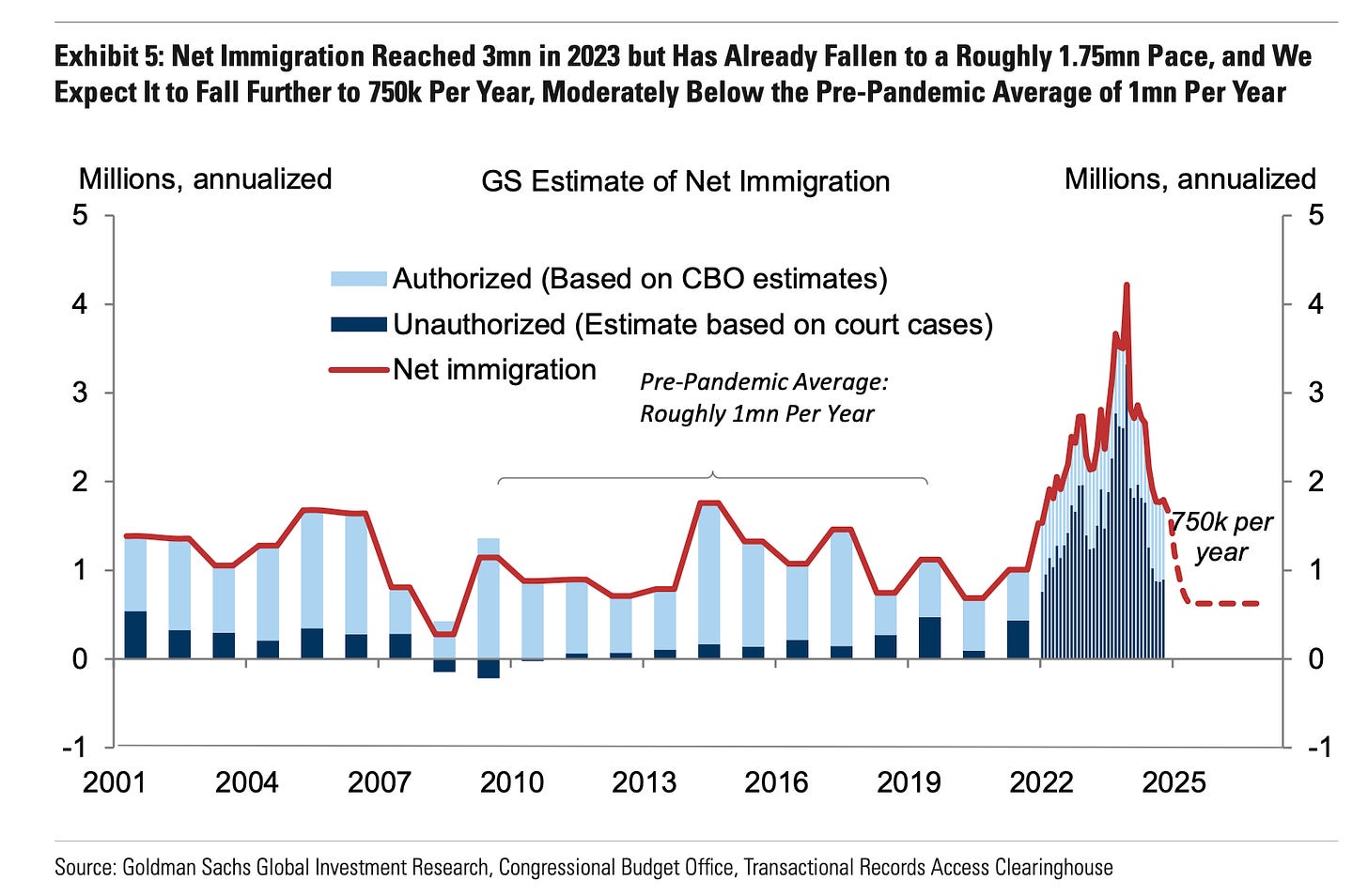

Immigration? It averages about 1.75M migrants a year these days. Pre-pandemic and during Trump 1.0, it averaged about 1M. So expect that to fall to the norm. Deportation for the criminals, but mass deportation? Unlikely given resource constraints (it’s costly and requires boots on the ground, which doesn’t square with the DOGE funding/government cuts being sought).

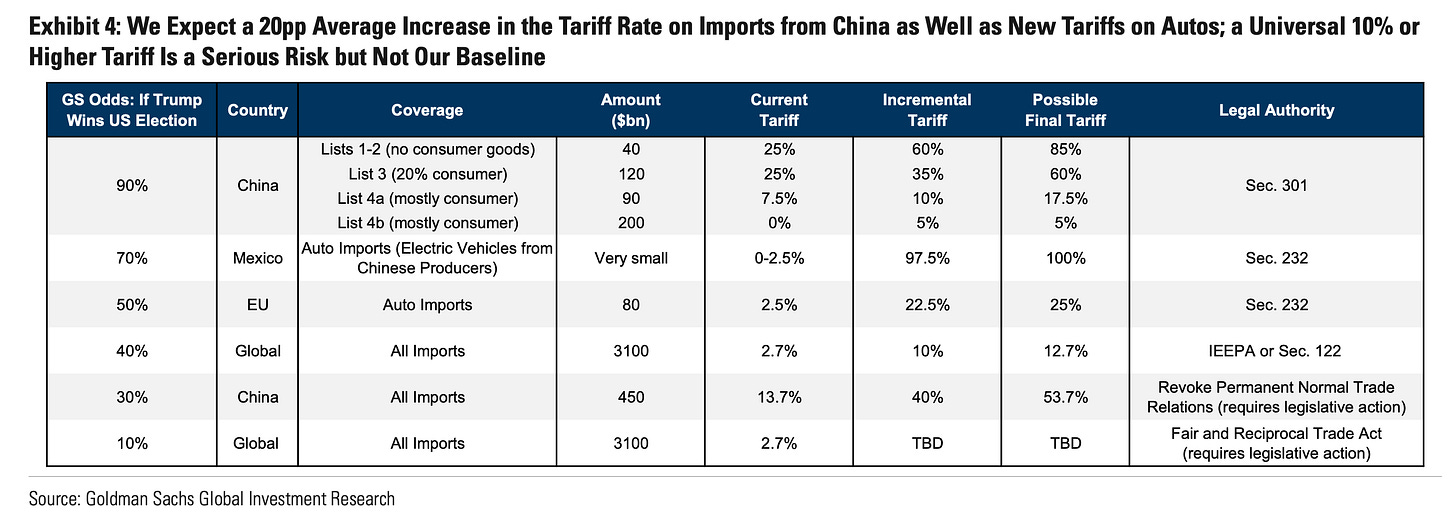

Tariffs? Universal? China? Will a 10-20% universal tariff apply? Doubtful. Washington Post reported on Monday that said his aides were exploring tariff plans that would cover only selected sectors that are critical to national or economic security. Quickly, Trump walked back the report in a posting on social media. We think advisors behind the scenes are attempting to nudge the President-elect in a different direction than the wholesale and indiscriminate tariff policy that may do more harm than good. We question whether the aides would’ve had freedom to explore the alternative policy without his Chief-of-Staff’s approval, and whether there’d be a leak about it unless they wanted it to be known that lower tariffs (or targeted tariffs) were an “option.” Remember, tariffs were floated as a negotiating tool, to “level the playing field,” by the Trump administration as a way to penalize and bring other countries into more US-favorable trade deals. What they’d want to avoid is to raise costs on US consumers, which would create unnecessary economic (read: political) backlash if prices and inflation were to spike. It’s interesting that the market rallied strongly on the initial WaPo reporting, then selling off on the Trump message, which indicates that the market is already pricing in the universal tariff. We surmise anything more watered down will provide a tailwind to the market. It’s also important to note that the tariffs we’re talking about are incremental. There already are certain tariffs in place, and Trump would be layering additional ones on.

Having said that, China is a different issue altogether. We do think tariffs there will increase considerably, some to ~20% and others to ~60-85% (though that list has no consumer goods). We think that’s one of the main reasons why China has held off on big fiscal stimulus. First, determine the implications of the tariff and then prepare the stimulus to offset.

Alternatively, can China weaken the RMB to offset tariffs? It could, but we don’t think so as it may exacerbate capital flight. It would also dent China’s efforts to have the RMB become further accepted as an international currency in the longer-term, which is why in the prior go-around, they’ve tried to maintain currency stability. What’s more likely though? Negotiate as the US and China did in Trump 1.0. That will take time, however, as it did then to sit together and save face. China today isn’t the China of 2019, and the weak economic backdrop in that country, as well as more experience in dealing with Trump, means there’s a path to mutual compromise, so we can all reach a “meh” outcome.

The counter to that? Chinese exports to the US are now 14% of exports vs. 18% back then, national security tensions are also much greater today as Xi bolsters China’s military presence in the Pacific, and many importers have already structured their business to mitigate the damage of tariffs (e.g., import from other countries or whole items subject to lower tariffs vs. components). On balance, we expect ASEAN countries to benefit. Just as Malaysia “doubled” its oil exports miraculously (i.e., read: Venezuelan and Iranian sanctioned oil), we’re about to flow consumer goods through other countries.

This reasoning leads us to our working assumption for 2025, and that is what’s perceived to be the key risks won’t turn out to be the risks, but things need to get more intense before it gets better. Meaning, the issues above, fiscal, immigration, tariffs, other policy pivots, won’t be the surprise that they were in Trump 1.0. Remember, Trump 1.0 was a game-changer. It reset the discourse and level of volatility in international economic and political relations. Who and what we tariffed, the leaders we realigned with, and the policies we adopted and abandoned. Heck, even after Biden took office, he kept all of Trump’s tariffs on China. More pointedly, he hiked them further in May 2024. So expect the “tough on China” playbook to continue and expect Chinese economic reprisals. While the shock value of what he says may decline, the tightening of the screws may not, and when screws tighten, things get more expensive. Adversaries and allies alike will deal with Trump from a position of strength (or at least try to), and running that playbook means squaring off like silverbacks before backing down. Can Trump’s Chief of Staff and aides rein him in more this time? We shall see.

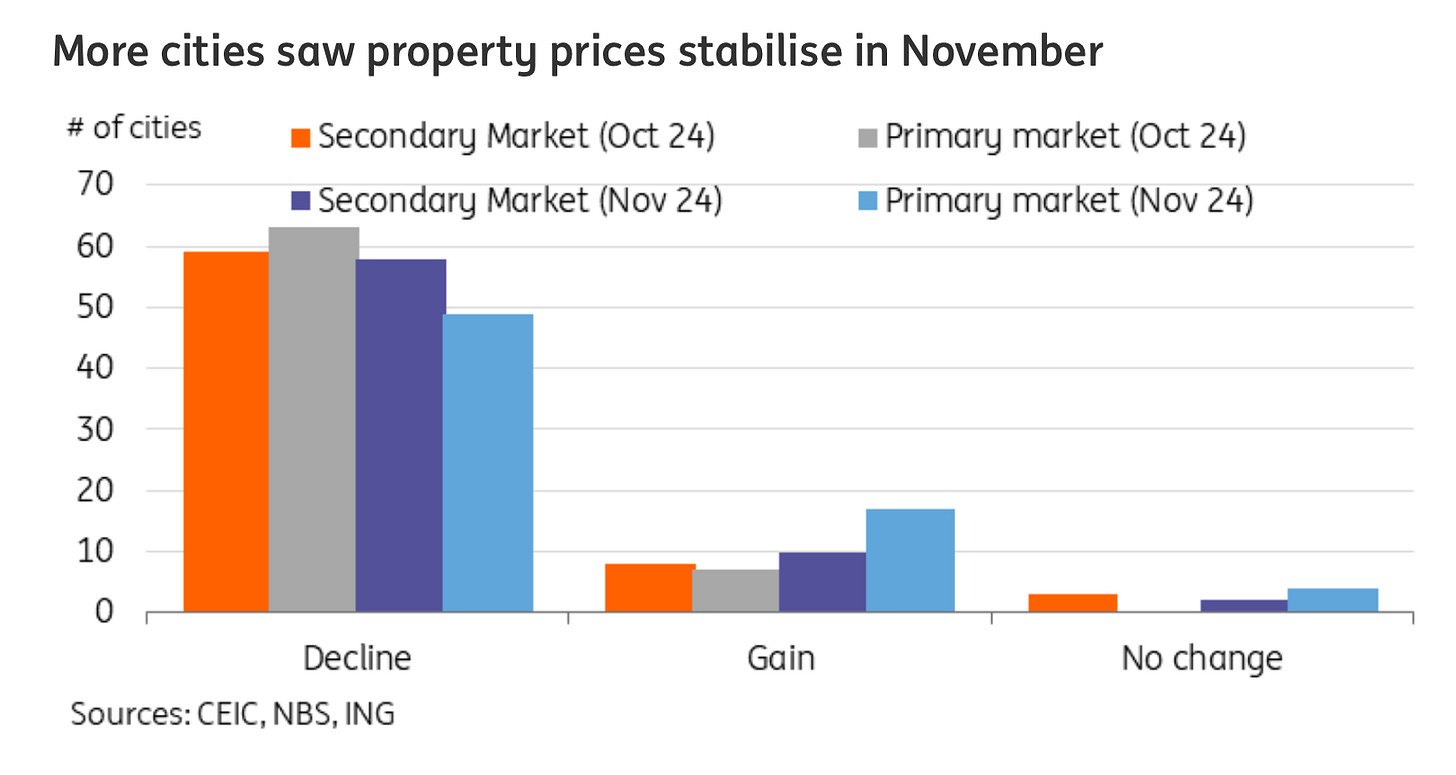

As for China? We were certainly wrong about its recovery in 2024, and with higher tariffs on the horizon it may pose another hit to their economy. Though in our opinion, trade doesn’t really die down, it gets rerouted. US consumers will still want what they want, so they’ll look for places to get it. Domestically in China though, the PBOC is prepared to act, and how they game out the stimulus could offset the headwinds if it spurs Chinese consumption. They will need to keep stimulating because consumer sentiment continues to be hampered by the falling property market.

Though prices do appear to be bottoming as recent support measures trickle through.

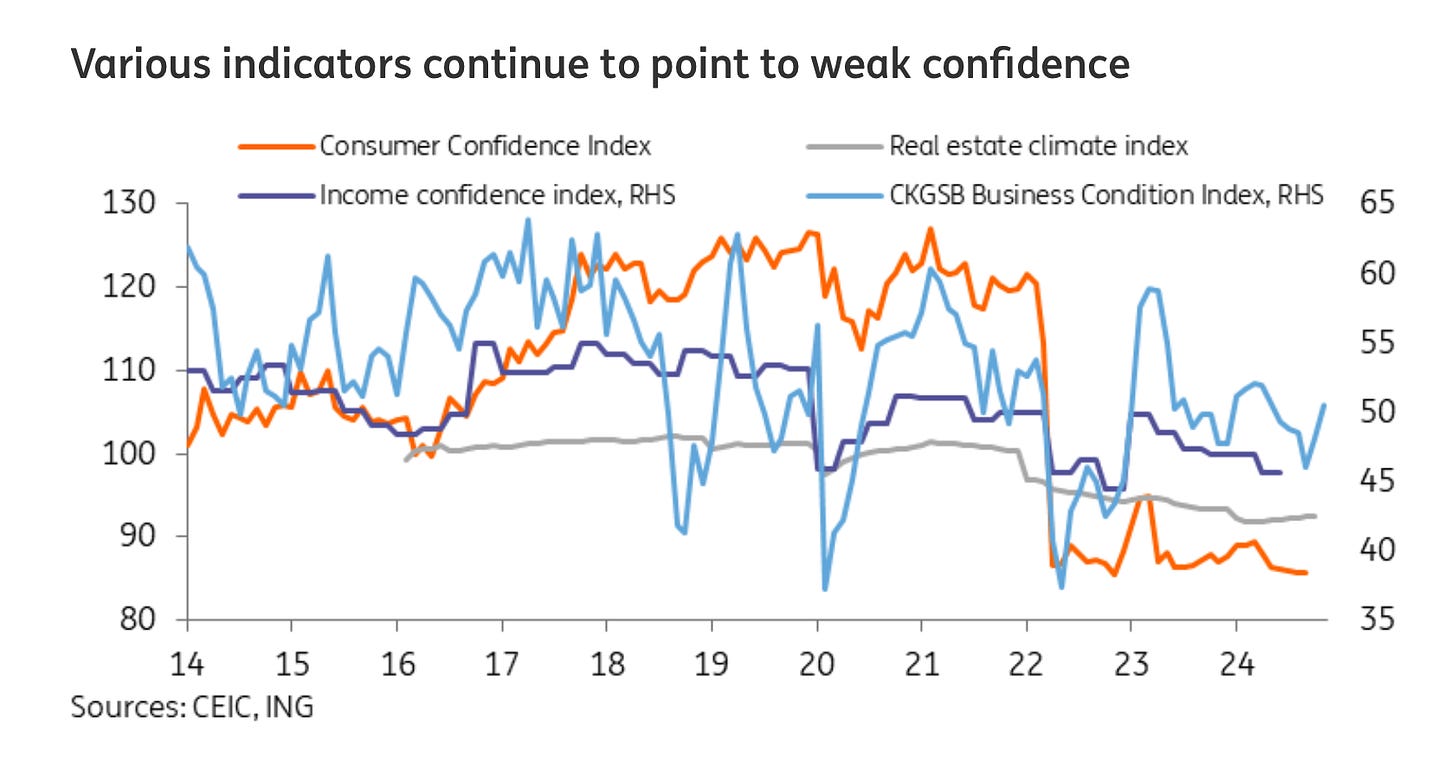

Still the consumer there will stay cautious until we know how the US’ shift in policies impact the economy there, and how the Chinese government will react.

About the best thing we can say is that consumer confidence is already near their lows, so it is possible that there could be some turnaround there. Again that will depend on how tariffs play out, but we reiterate, those are now expected, and supply lines are vastly different than they were before Trump 1.0 and COVID. For now, the soil is well watered as the PBoC have continuously eased rates on the monetary front, and as they stabilize the local governments, a consumer led rebound via fiscal policy would be the next step.

It’s confidence and demand that we need, and that will likely require the largesse of fiscal stimulus to fertilize domestic demand.

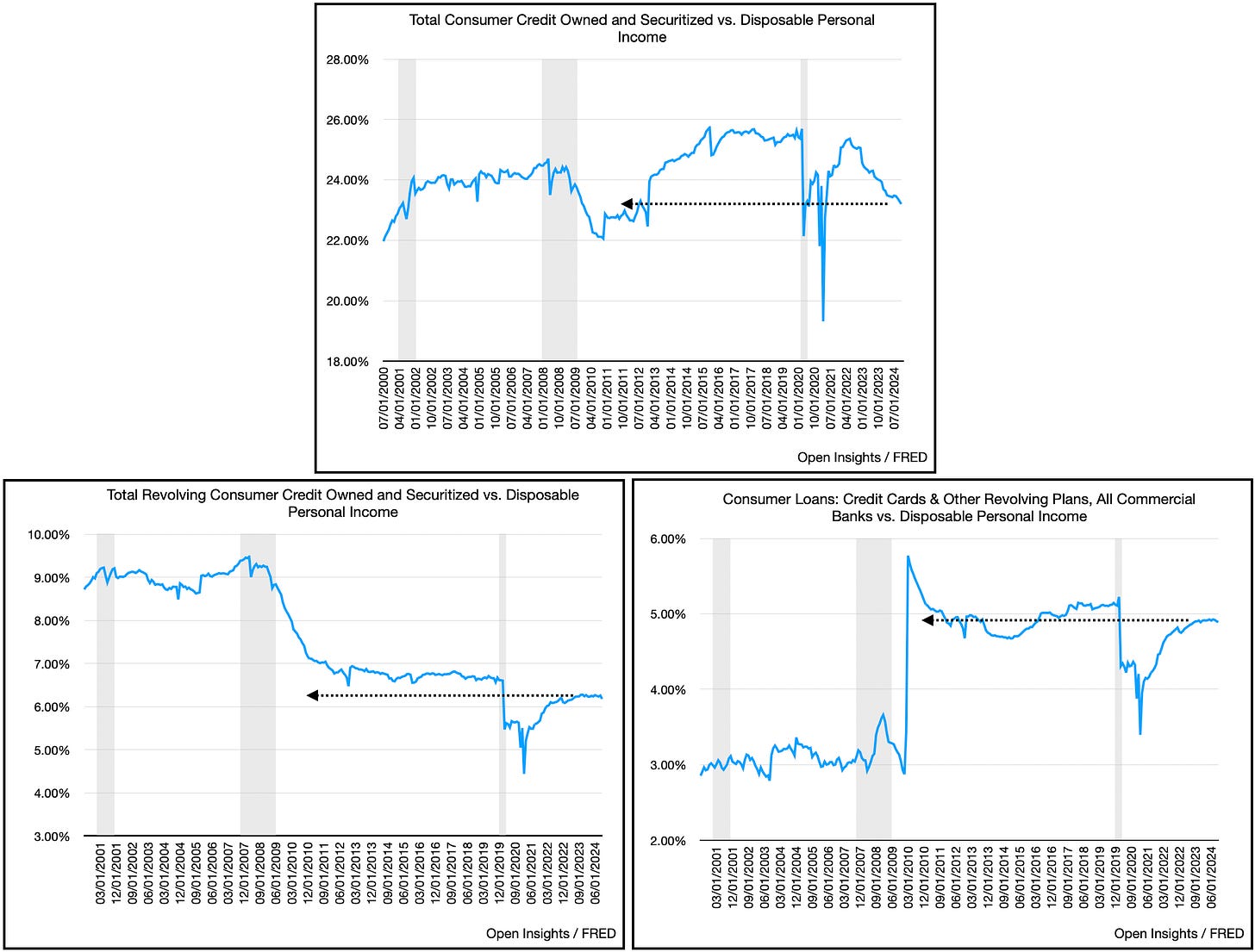

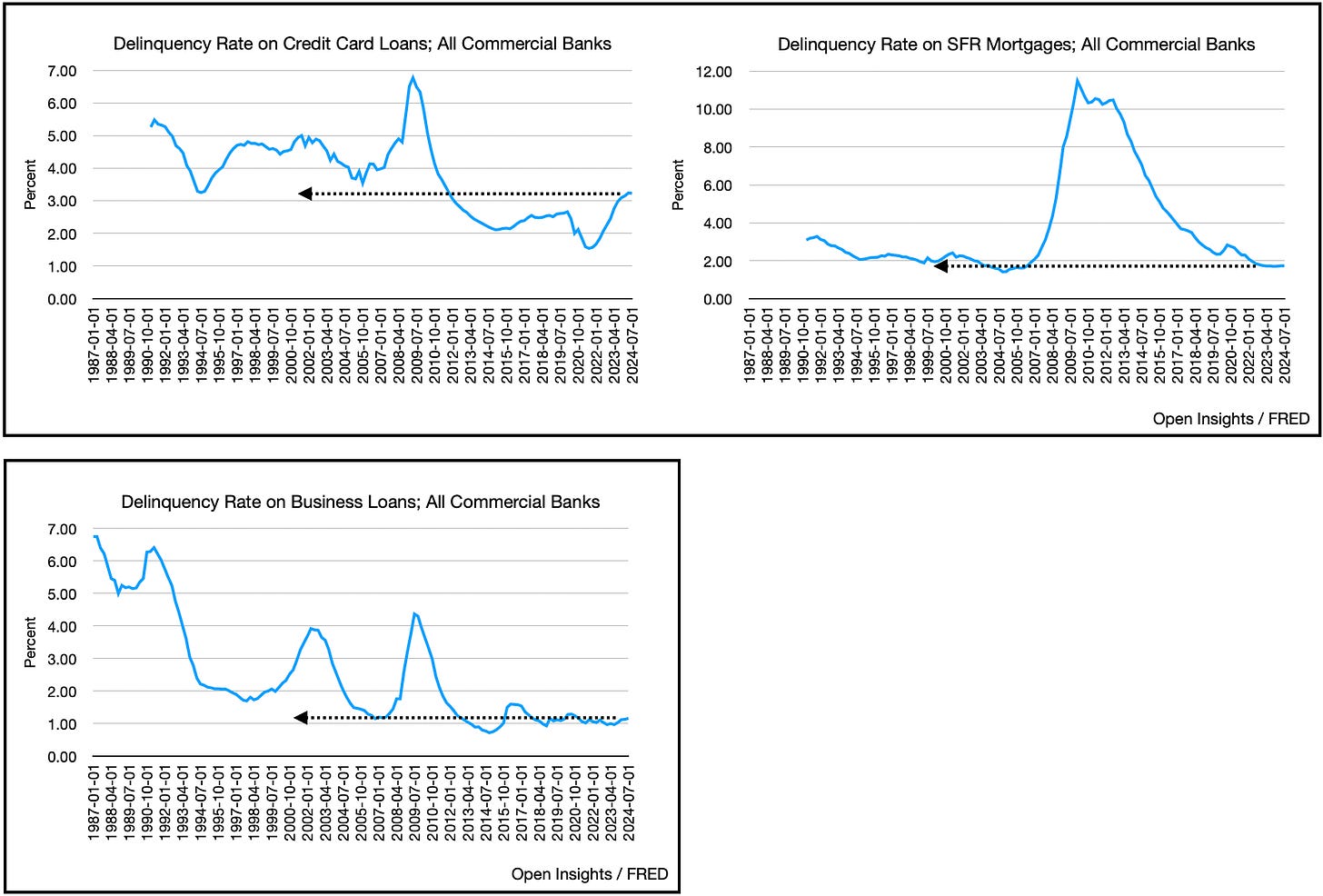

Lastly, on the US side of the equation, how’s that US consumer? Stunningly well. Just as we expected . . . everyone’s getting paid. If you get paid, all those debts you have start to really look much better.

Just look at that top chart, total consumer credit is actually dipping vs. disposable personal income. As you’d further suspect, default rates also look like they’re peaking for credit card loans.

Still not saving much though . . . but you never really have.

So as we ring in the new year, pay off those debts, and spend wisely. Consumers are in good standing, but as Trump 2.0 gets underway, so will Trump Trade War 2.0. Remember the last one took 2 years to simmer down, until COVID deprioritized everything. We think the US can withstand this go around, while the PBOC will rain money, but global trade will temporarily shake as the two largest economies and their silverbacks square off.

Both aren’t known for their subtlety.

Happy New Year.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Nice. Thanks a bunch for the update. Im VERY curious how if Trump / China will be repeat of late 2018. I remember that quite well,