Heading Back to School, Inflation & Our Intern

August 14, 2022

Summer’s coming to an end now as my kids are headed back to school and vacations wind down. The incessant chattering and clattering around my house dims, and quiet solitude returns. It’s been a summer filled with chickens, orcs, internships, cleaning, commodity volatility, Buffett/OXY drama, and yes, even outperformance thank heavens. The last, was like Botox for our ever-wrinkled brows, and we forced ourselves to relax, at least for a bit.

Truthfully, we were never far from “the grind,” but the sunny days outside do lend to a calmer mind. Even if we weren’t in the pool at least knowing that our kids were brought a sense of fun and relaxation.

So here’s to tangential experiences. Here’s to summer osmosis.

All good things come to an end though, and new adventures await. A new school year begins. Crack open the textbooks now and those new Trapper Keepers, it’s time to go back to school.

Dueling Markets

Here’s a question for you to warm up those addled minds. What’s 3x larger than the stock market? If you answered the bond market, ding, you get a star. While equity investors think the world revolves around them, many don’t know that the bond market is much greater in size (~$120T vs. $45T), so it’s often a better gauge as to how investors “feel” about the economy. It’s particularly useful after important economic news comes out, like the Bureau of Labor Statistics’ 8.5% CPI print for July.

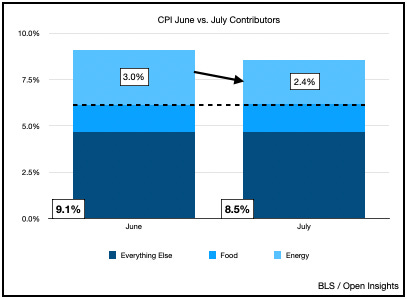

For clarity, this is 8.5% YOY inflation, down from the 9.1% printed in July. Some commentators (and the Biden Administration) proclaimed triumph over inflation as the month-over-month change was zero. We’re not entirely certain that’s the best way to read it (e.g., just because the camp fire isn’t burning as hot anymore doesn’t mean our marshmallows aren’t still melting), but that’s political theater for you. To be fair, even we were off by a bit for the month. While we had inflation falling, we certainly didn’t have it falling to 8.5%.

No, that precipitous fall was largely thanks to energy prices falling off. Energy contributed 2.4% to the total 8.5% of YOY inflation, down from 3% last month.

This 0.6% reduction was by far the single largest contributor to inflation deflating, and you can largely see it at the gas pump. Nationally, gasoline prices retreated from $5.032 to $4.668/gallon, a near 10% fall. Food prices continued to increase, as did shelter, whereas services and durable goods stayed flat, so on balance, energy costs accounted for almost all of the decline. Said another way, it’s apparent energy has becomes the key category. We’ll keep plugging away at our model to refine our forecasts. We’ve got it down directionally, but we need to nail it more precisely before turning it loose. What’s obvious, however, is going forward, if we figure out energy, we’ll figure out CPI.

Bonnie Raitt or Bonds Rerate?

For the stock market at least, it’s grabbed the reins of the new narrative and taken off (i.e., the Fed has this thing under control and a soft-landing is possible), leaving many investors in the dust this week.

Q3 performance quarter-to-date has also been eye watering.

As I type those sentences, Spotify suddenly decides to play an acoustic version of Bonnie Raitt’s hit song

“I can’t make you love me . . . if you don’t.”

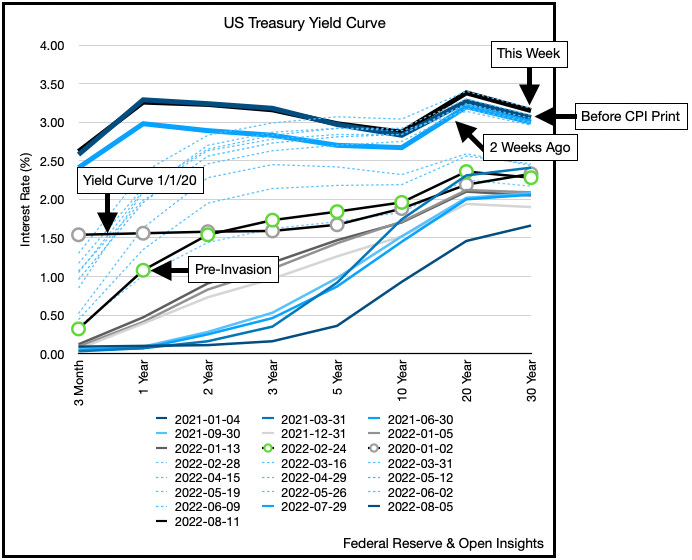

It’s fitting because as I take a look at the bond market immediately after the 8.5% CPI dropped and spurred a ferocious rally in the stock market, that’s what I’m seeing. Indifference. If the stock market is filled with rapturous love, the bond market is filled with a whole lotta meh.

If inflation is truly being tamed, shouldn’t interest rates fall and bond prices rally? The narrative shifted a month ago dude, where have you been? Given we’re in an August Fed “summer lull” (i.e., a month without any Fed meetings), a better than expected inflation print ties really well with what the Fed last wrote in our yearbook before we went on summer break, “we’re at neutral” and they’re “data dependent.” So KIT baby, TTYL.

So out came 8.5%, strolling to the last summer party like a big dawg with a pair of sunglasses and a fog machine. Mash that like button because deflationary data just made an entrance. Frankly, as long as it wasn’t more than last month’s 9.1%, then it’s an improvement. Rate of change fellas, soft landing here we come. Couple with low investor exposure and high short interest, the stock market rally ignited. Love me, pick me, choose me, equity investors shouted . . . but sadly, bond investors haven’t responded.

Spurned, scorned . . . and now forlorn . . .

I will lay down my heart and I’ll feel the power

But you won’t, no you won’t

I can’t make you love me . . . if you don’t.

Nope . . . not at all, as bond investors have shrugged it all off. Remember, bond prices are inverse to interest rates. Bond prices fall = interest rates increasing, which is we’re also seeing. Flat on the front and higher on the tail (i.e., 10 year, 20 year, 30 year).

As my son would say . . . that’s cold bro. Stone cold in fact because it’s steepening, meaning the longer dated maturities are rising faster. If equity markets are pricing in less inflation and an eventual Fed “pivot” towards easing interest rates because inflation is subsiding, why are rates not showing it? Remember, besides providing a modicum of returns, interest rates cover investors for two things, higher inflation and risk of loss. These are government treasuries so the risk of loss is close to nil. Inflation on the other hand . . . .

Could it be the bond market is saying inflation is stickier? Certainly seems like it.

So go back to our narrative (not the market’s). Our view is that we are in a structural deficit for commodities and energy in particular. The recent rise in refinery margins spiked gasoline prices to the equivalent of $180/barrel oil, but crude oil itself never surpassed $120/barrel. Although prices increased, they didn’t stay there long enough to spur any new production, which means we’ve yet to resolve our structural deficit.

We’ll need years of high prices and not just weeks, which simply means our energy crisis will continue. It will continue in waves as inventories run short, prices increase, and demand destruction ensues. Prices will then tumble as demand recedes, but lower prices again spur higher consumption, so up and down we go again. Meanwhile the financial markets will experience the same bouts of volatility. If energy price swings are so material to the calculation of the CPI, guess what happens when energy prices spike and CPI comes in “hot?” The stock market will be caught long as the Fed is forced to stay more aggressive in its tightening and for longer than expected.

It’s something Goldman Sachs recently noted as well:

“In our view, macro markets are pricing an unsustainable contradiction – it is difficult to square a softening FCI, a more accommodative Fed pivot, falling inflation expectations and drawing commodity inventories . . . .

In a similar vein, any further decline in commodity prices suppresses demand destruction and disincentivizes additional supply, the opposite of the rational reaction to tightening fundamentals. As a result, we see growing tail risks to commodity prices inherent in the scenario of sustained growth, low unemployment and stabilised household purchasing power . . . .

[I]n the physical world markets cannot stay irrational longer than the consumer has physical inventory, which is nearing critical levels across all markets.”

Today, equities are rallying despite the bond market’s indifference and our knowledge of how short the commodity markets are. Many of these cross-currents simply aren’t compatible and eventually they’ll need to resolve themselves. We think the physical market will eventually tighten again as we head into year-end, driving prices higher and making inflation much more persistent than the market anticipates. Ultimately, the Fed will need to continue tightening despite the stock market’s sunnier outlook.

In the interim though, the Fed is still on vacation for another month, so until we all really need to go back to school, we think the market will YOLO the party to the end. We’re hearing last calls though, so try not to go to class hungover.

Parting Thoughts From Our Intern

Speaking of going back to school, it’s also time to say goodbye to our summer intern, Ramya Sridhar, who you’ll remember as the one who penned one of our previous articles on inflation. We thought we’d end this note with a little Q&A we did with her before her time with us ended.

Hi Ramya,

Welcome back to Open Insights. Summer’s almost over now and you’re getting ready to go back to school so we wanted to give you a chance to share what you’ve learned with the readers.

You’ve had quite the tour through finance and markets in the past few months, eh? So what do you think?

When I started this internship, I knew very little about the world of Finance and Economics. And at this point, about two months in, there’s still so much to learn! But, I’ve managed to codify some of the foundational frameworks I learned/gained this summer.

Can you unbox that? What are some of the things that sticks out for you?

A number of things! Let's start with the fundamentals:

Warren Buffet advocates that investors should “[b]e fearful when others are greedy, and be greedy when others are fearful.”

The ideas seem simple enough. The more risk you take in the market, the greater the reward, but it’s so difficult to execute. What’s interesting is the psychological aspects of the market, and how critical it is to control your emotions. Your worst fears and personality flaws will reflect on your performance in the market. An anxious person will see little above-average return because they’re not willing to risk much. A reckless person may see volatile results because their risk-to-reward ratio is disproportionately high.

Per Howard Marks, the trick is finding a reasonable midpoint where the risk is worth the reward. From what I can tell, this point is not easy to find when all the competing narratives are swirling around.

Howard Marks likened the market to a popularity contest: ”. . . the most dangerous thing is to buy something at the peak of its popularity. At that point, all favorable facts and opinions are already factored into its price, and no new buyers are left to emerge.”

Therefore, it’s important to stay away from rather confining labels like ‘bear’ and ‘bull’--it’s much more important to strike a balance between the desire for gain and the fear of loss, without automatically defaulting between greed and fear.

What else?

Nothing in the market lasts forever. There are pendulums, whether in psychology, credit, or economic cycles. One pendulum can swing between greed and fear, or euphoria and capitulation, and the other between the peaks and troughs of the debt cycles.

Ah debt cycles, I see you’re referring to Ray Dalio’s ideas about How the Economic Machine Works.

Yes, debt basically allows people to pull forward consumption. By borrowing to fund a purchase, you become indebted to someone else—a person, an entity, or a bank—who will carry that debt. My liability (my debt) becomes their asset, an asset upon which they can lever for their own debt. My debt, as an asset, can create a webbing ripple, upon which other debts and assets are built. If I’m unable to pay may debt (i.e., someone elses asset), that asset becomes impaired, leading to a potential cascade of further defaults as the entire web becomes undone. Therefore, accelerating consumption comes with its fair share of risk.

Which is why interest rates are so important.

Because low rates (coupled with profligate fiscal and monetary spending) fuel even more consumption. It’s like giving everyone a ladder to climb Maslow’s pyramid, until everyone’s near the top. That weight, that demand destabilizes everything. Demand outraces supplies and inflation explodes.

Interest rates then have to rise, right?

Exactly, because interest rates exist to compensate for inflation and risk of loss. As inflation moves higher, interest rates have to move higher to reduce demand.

Making money more expensive would seem to make climbing up Maslow’s pyramid more difficult, steeper?

Yes, it reduces demand as things get more expensive. Previously I mentioned the debt cycle. Well, the amount I can borrow to accelerate more demand is reduced because interest rates are higher now. Moreover, the amount I have already borrowed, and must be repaid, must also be repaid at higher rates if I hadn’t fixed the rate previously.

So consumption slows.

Which is what the Fed is trying to do by raising rates.

Yes.

Don’t forget the wealth effect.

Right. To quote Warren Buffett, “Interest rates are to asset prices what gravity is to the apple. When there are low-interest rates, there is a very low gravitational pull on asset prices.” So asset prices rise.

Yes, we sure get silly when money gets cheap. Bitcoin, Space XYZ, Meme stocks, SPY multiples, Nasdaq.

It turns though. The greater the interest rates, the lower the prices. This means that when we see price inflation, interest rates can help work to lower that inflation for everything (commodities, goods, services, etc. as consumption falls and assets (as asset prices fall and the wealth effect fades)). They work like gravity—the higher the rate, the lower the prices should fall. Increase gravity, and suddenly, it’s raining apples.

Speaking of apples . . . apparently, after losing a fortune in the stock market, Isaac Newton declared, “I can calculate the motions of the heavenly bodies, but not the madness of the people.” If only!

I’m going to guess many people are going to say that if some of these bubbles burst. So you think raising rates will help?

It’s complicated. Within the long-term debt cycle, we can see the greater, familiar themes of finance and economics that may seem more familiar to the average person’s eye.

Inflation, for one, is categorized as the scenario in which there is more demand than supply—for goods, services, currency, etc. This can be caused either by a demand issue--suddenly, edible arrangements become the new fad or something--or a supply issue--a new strain of flu wipes out half the country’s chickens, and now a bucket of KFC costs the same as a house in Texas.

Whether or not the inflation is caused by issues in demand (demand-pull) or issues in supply (cost-push) matters, because the action taken to address the issue differs between the two. For example, if the issue is one of demand, then that is something that the Fed can absolutely control. They have the ability to hike up interest rates, which will increase the cost of debt, and thereby slow consumption. Things look less appealing when they’re more expensive.

However, things get a bit more complicated when the issue lies in supply. When facing serious, structural shortages, there simply isn’t enough ‘stuff’ to satiate (typically inelastic) demand, and this causes inflation, and the Fed’s weapon of choice, interest rates, isn’t very competent against structural shortage issues.

The whole country seems to be holding its breath, waiting for when we tip over from ‘slowed growth’ into ‘economic contraction’.

And that’s just this country. The rest of the world has another problem to worry about. As the US raises interest rates to combat inflation, we’re creating knock-on effects globally.

The USD Wrecking Ball

Little history lesson: The dollar was declared the global reserve currency shortly before the end of WWII. It was a provision under the Bretton Woods system, in which the dollar was pegged to gold, and other currencies to the dollar. Though the US eventually delinked the dollar from gold in 1971, we subsequently agreed with OPEC member nations to price oil in US dollars, in exchange for US protection, and created the petrodollar. The prevalence of the US dollar outside the US turned it into the global reserve currency. Everyone uses the US dollar today because most commodities, such as oil, are transacted in dollars. In turn, foreign countries, holding US dollars also borrow in US dollars. There are more dollars outside the U.S. than inside, and therefore more dollar debt outside the U.S. than inside. To be specific, according to the Bank of International Settlement, there is around 12 trillion dollar-denominated credit outside the United States.

So as we tackle inflation, as the Fed quantitatively tightens its monetary policy faster than other countries worldwide, the US dollar is strengthening relative to all the other currencies in the world. Hypothetically, if a country with a lot of dollar-denominated debt faces an economic slowdown, and is unable to repay US dollar-denominated debt with their own devalued local currencies, it could find itself in default. Many have coined this the US Dollar Wrecking Ball.

Pretty grim, huh?

I feel like you’re a ray of sunshine. So what’s the solution?

The world is our oyster . . . . In other words, it really is what we make of it. It’s up to us to figure out what exactly our destination is, and then spend our time working towards that vision. Maybe the destination is a hard-landing with limited casualties, a soft-landing with a still-strong labor market, or a completely prevented recession with a slightly decelerated economy. Either way, it’s like you’re always telling me--find the goal, and then figure out how to get there.

So . . . that’s it? That easy?

Well, to be honest, probably not.

The world isn’t exactly that simple. You can’t just make a vision board and wish on a shooting star and suddenly, you’re living your best life. Even if you work really hard, there are always unforeseen circumstances and curveballs that life throws at you. At each curveball, often, you’re presented with a question, and a chance to make a decision--a decision that will either materially or minutely change your life. Eventually, those decisions compound to make what we call “life.” When we’re younger, the questions are easier. As we age, the choices get more complicated and nuanced.

Yeah . . . adulting kinda sucks.

But that’s the thing.

At the end of the day, adulting is just playing a game of decisions and repercussions. We make a decision, and we face its repercussions, and the consequential decisions we have to make as a result of the first decision’s repercussions. Therefore, for many, it tends to be filled with regret, about what could have been--the Road Less Traveled, by Robert Frost, “Two roads diverged in a yellow wood, And sorry I could not travel both.”

But this game is made easier by the realization that there are no great answers. There’s no cheat code, no combination that declares you the winner and empties all the world’s gold at your feet. There are no final, fortuitous answers, there are only decisions; decisions, and the branching possibilities that accompany each one.

I think the Fed and other central bankers would share in that sentiment, wouldn’t you agree?

There is no denying that with each decision comes some sacrifice, an opportunity cost for what could have been.

I’m realizing that now, more than ever, in college--every year that goes by in these four years, I’m going to experience the opportunity cost of unfollowed interests, untaken paths, and subjects that I found interesting, but never followed through with. But while it may be true that each decision narrows and shapes the range of possible outcomes, it is also true that each decision teaches you something. Your viewpoints broaden as you explore more. And the more you learn, the more you realize how little you truly know, and it’s easy to feel unmoored by that, but maybe that’s just a byproduct of growing as a thinker.

So it’s not that adulting sucks. It’s that the questions are getting more complicated. It’s that the decision-making process, as a result, is also getting more complicated. But there is beauty in complexity. The key to figuring out adulting is understanding that beauty, and even enjoying it.

Wow. So you got it all figured out then?

Not even close.

:/

But from what I can tell, the best things start with uncertainty. Innovation. Parenthood. Art. Uncertainty is often the precursor to greatness. So I’ll just make my own way and hopefully the fog lifts. I’m certainly ready for the venture!

See readers? Like the Fed, even our intern hasn’t quite figured it all out, but at least we’re all trying, and that’s the point to all of this. Best of luck in all you do Ramya, it was a pleasure having you for an intern.

For any of our readers who’d like to reach out to our wonderful (ex)intern for future opportunities, she can be reached at: ramya.sridhar01@gmail.com

Thank you all for being part of her education this summer.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Excellent reflections and a remarkable intern.

Ramya, best of luck

I hope you have learnt as much as I have over the last 2 months.