How Hard's Our Economic Landing? Ask the Fed.

December 9, 2023

So let’s freestyle this article a bit today because our brains are trying to connect a few dots.

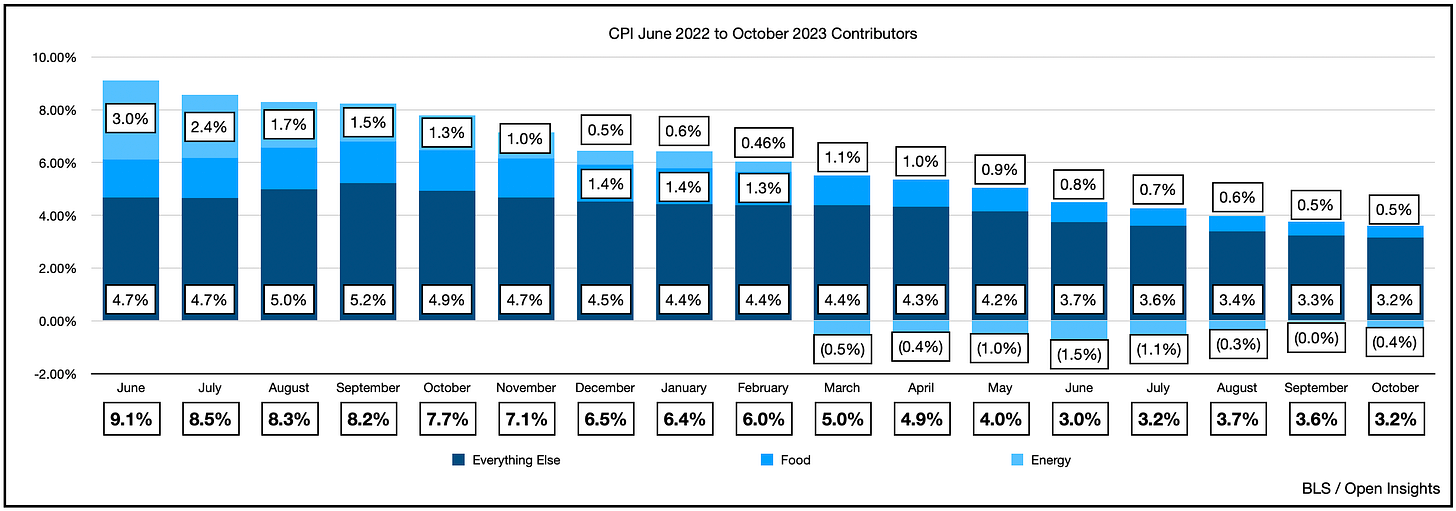

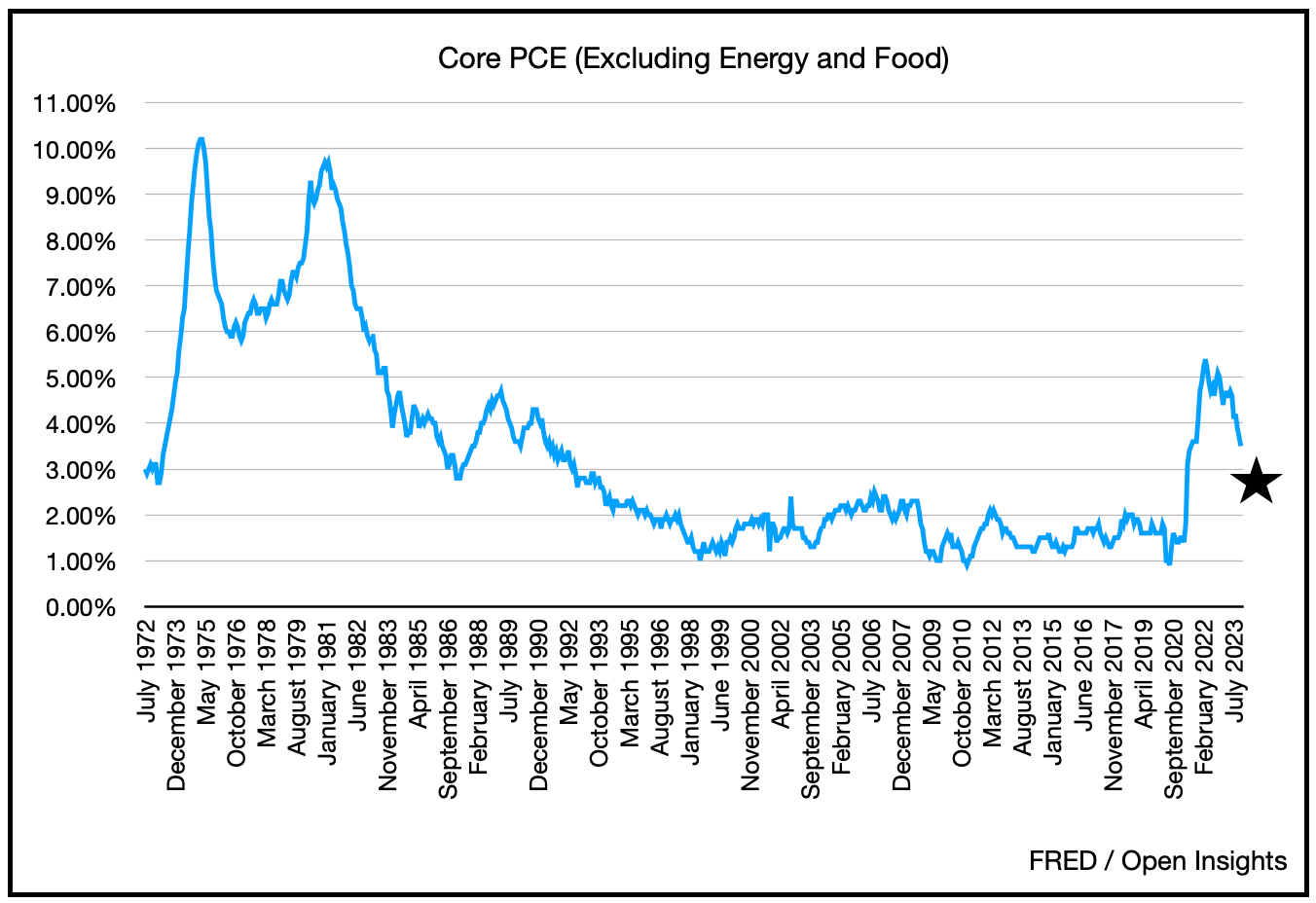

Inflation is falling, but hovering around 3-4%. It’s beginning to look like it’ll anchor near there, higher than the Fed’s 2% target. Here’s CPI . . .

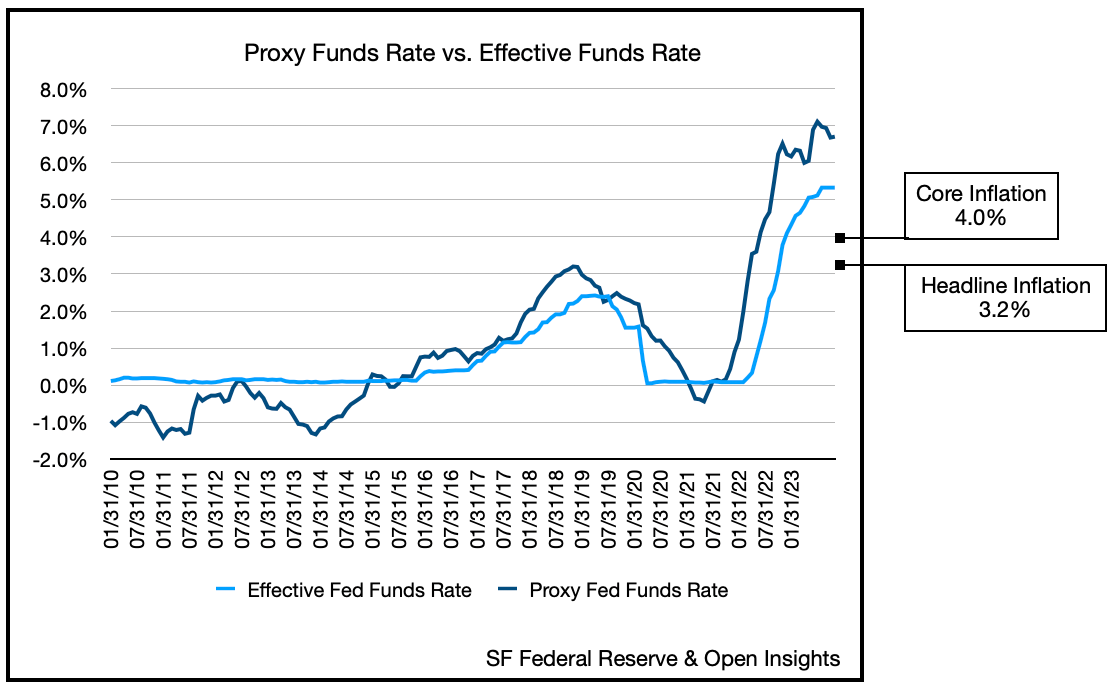

Overnight rates (i.e., the fed funds rate) though are running around 5.5%, but they “feel” much tighter at 6.7%.

This “real” cost of capital is severely restricting economic momentum, which is why the market anticipates the Fed will be able to cut rates in a few more meetings.

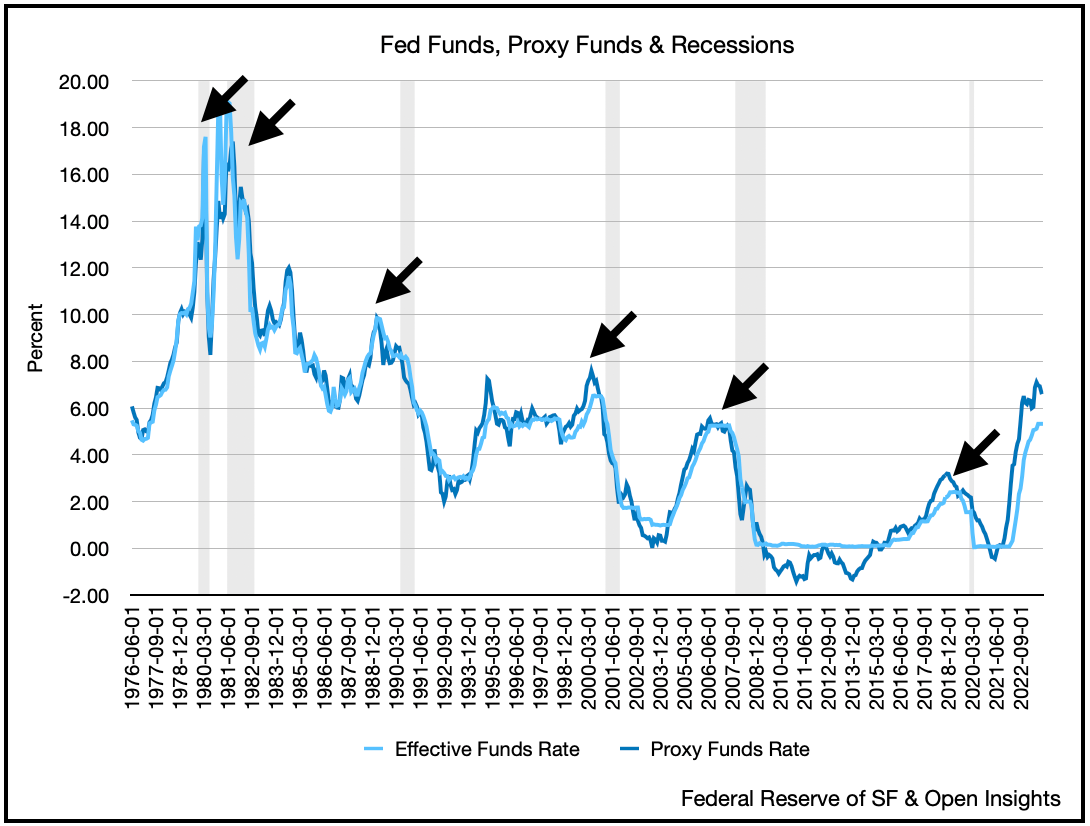

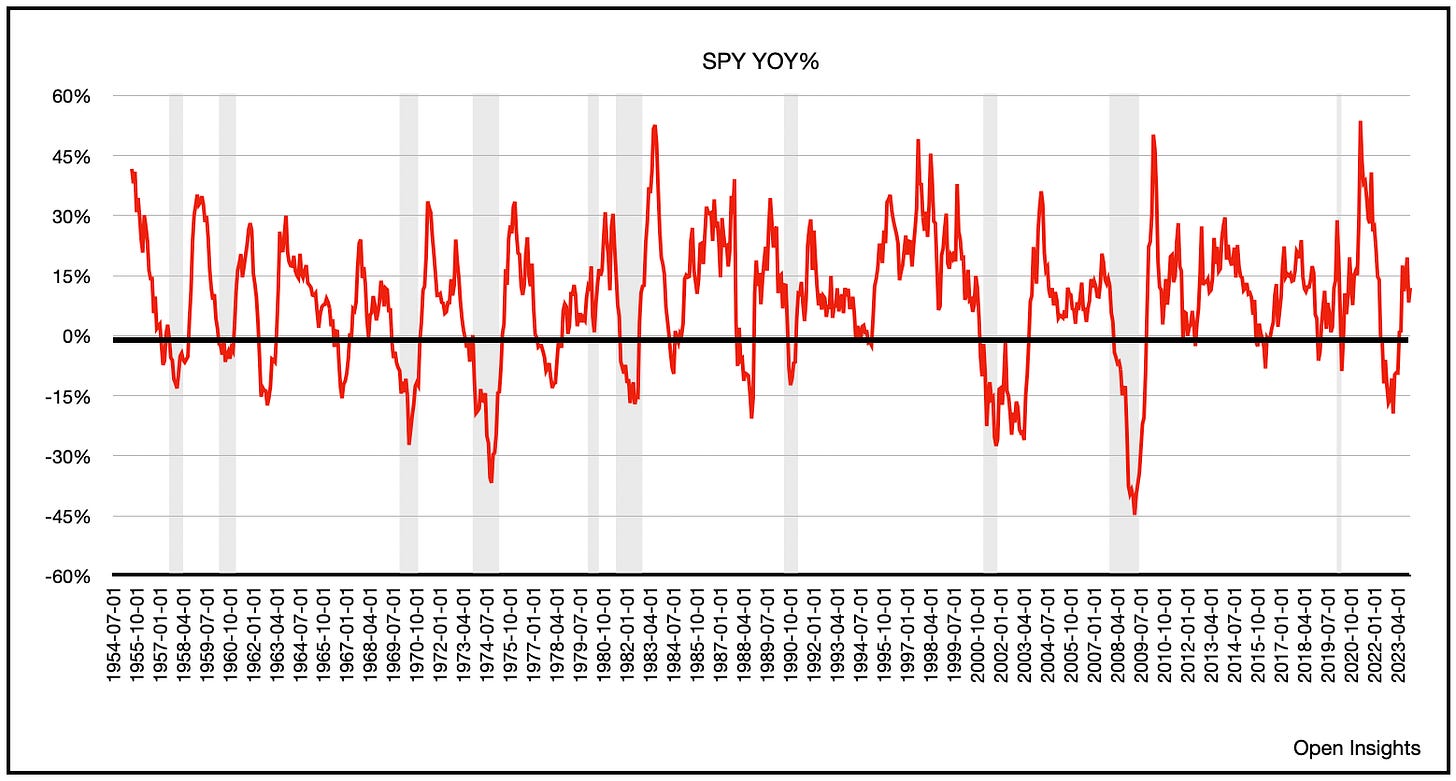

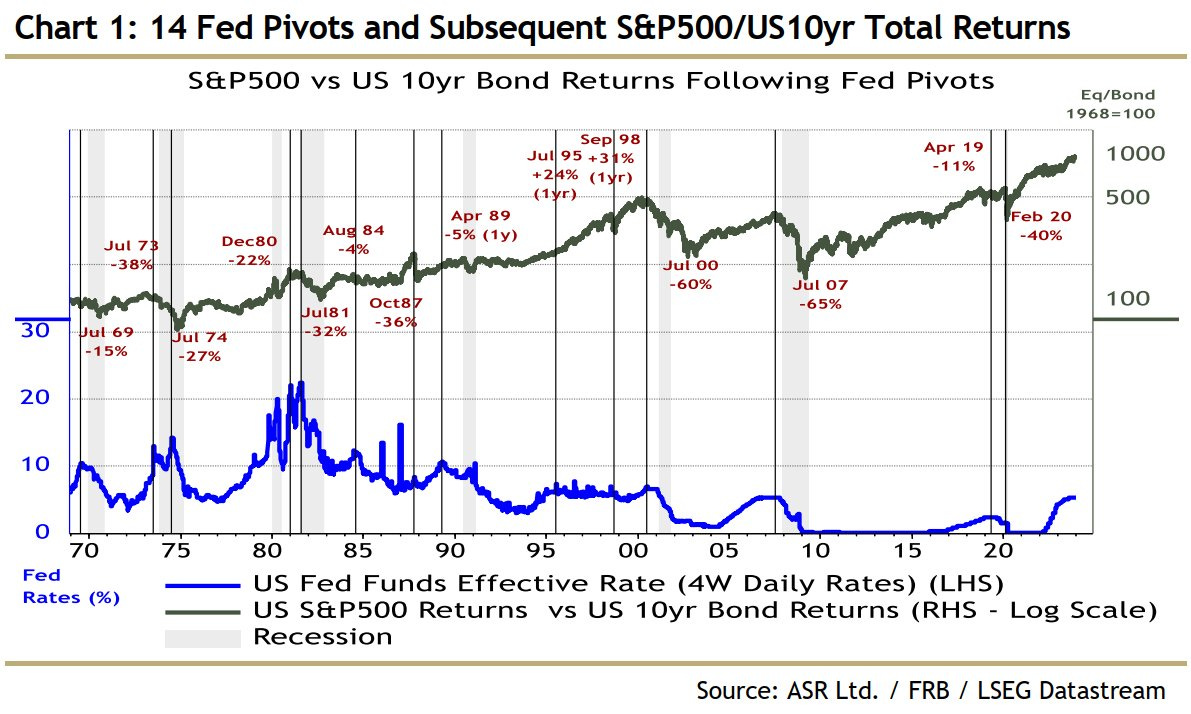

Historically though, when the Fed starts cutting rates, that’s when things start to really slow as recessions come to fruition. Dog wagging the tail, or tail wagging the dog doesn’t matter, what matters is that they are connected.

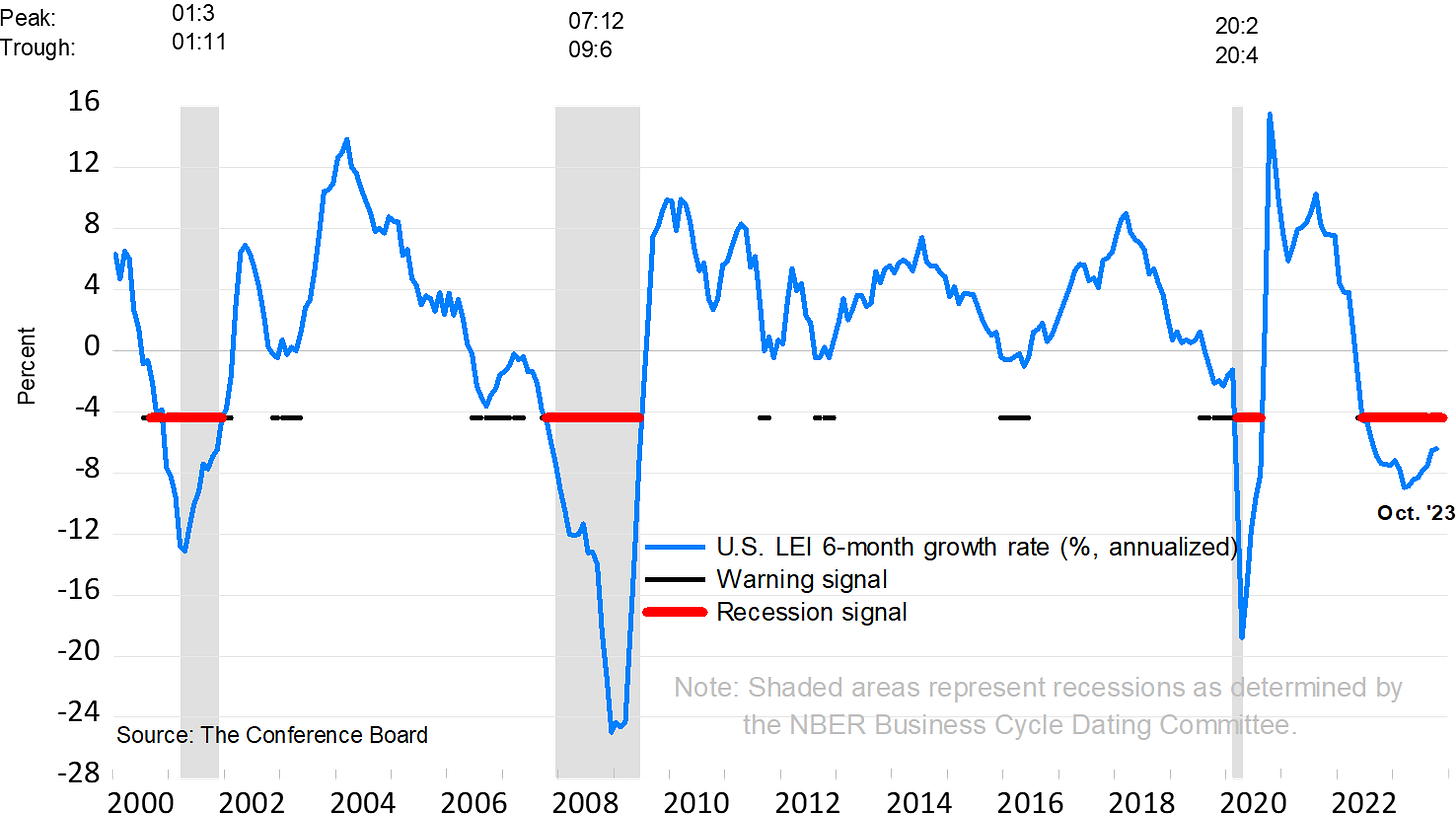

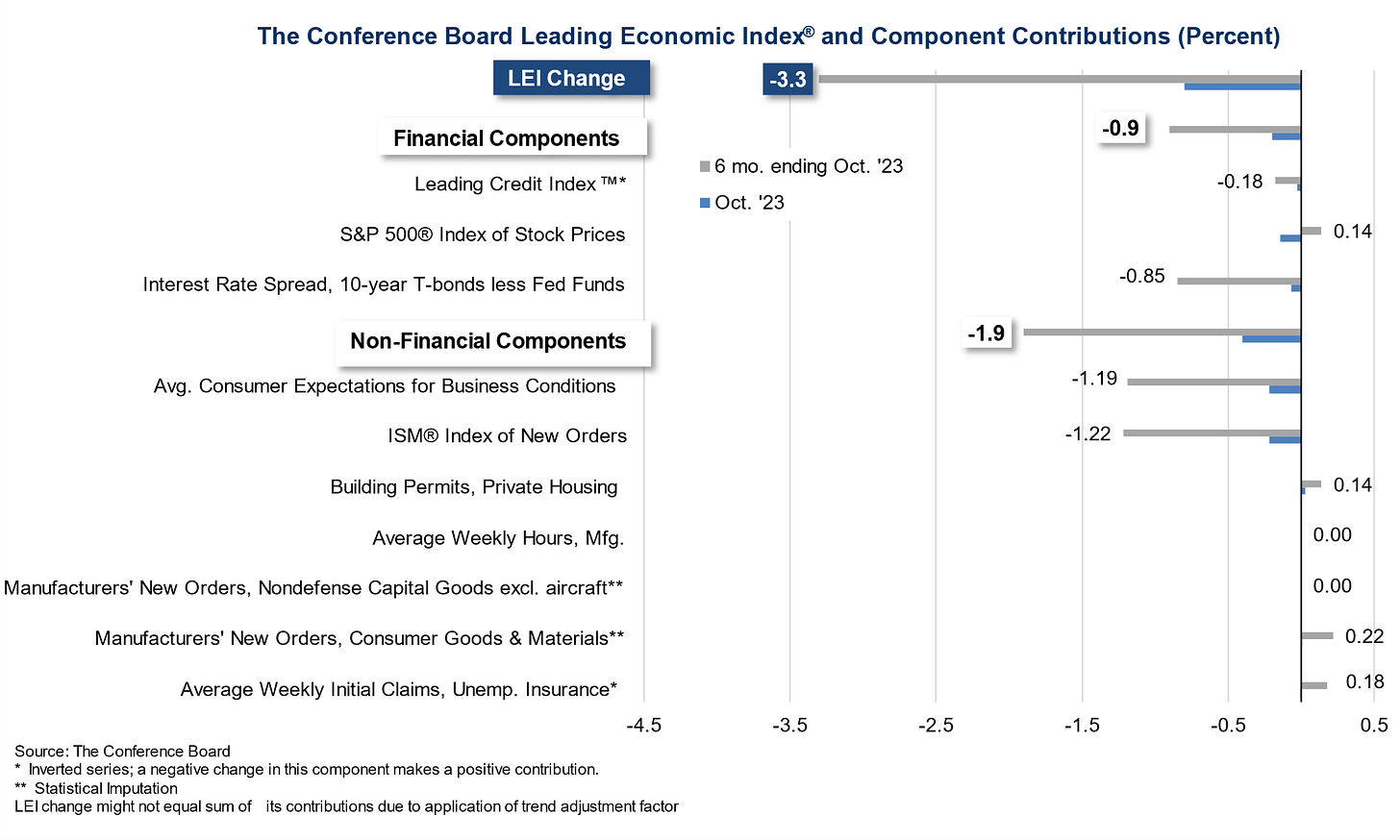

It kind of makes sense because the Fed’s constraining the cost of capital, starving the economy of liquidity. The Conference Board’s Leading Economic Index Indicator, a mish-mash of financial and non-financial components are already in recessionary ranges.

The tension though is between what we’re seeing on the financial side vs. the non-financial side. Interest rates and tighter financial conditions impact asset prices, liquidity flow, and the funding for large purchases/items almost immediately. The financial markets move in a flash, quickly incorporating the collective wisdom (if you want to call it that) of the crowd and the new expectations of a more expensive environment.

Tightening financial conditions, however, leg into the economy at a slower pace. The impact though eventually happens (6 to 18 months depending on which analyst you follow, we’re close to month 12). It’s why you can see the “negative” component contributions in the LEI waterfall. Capital tightens, liquidity recedes, big and small orders fall. As corporate sales and profitability decline, businesses begin cutting expenses to right size their businesses. We’ll delay consulting services, cut/defer capital expenditures, and separate out “nice to haves” vs. “need to have” things. Eventually, and usually only as a last resort, when the low-hanging fruits have been harvested . . . we begin layoffs.

Contrary to what many think, corporate managers are loath to announce layoffs since people hate cutting teammates, re-hiring is time intensive, and new hiring is often uncertain (quality and availability of candidates). Moreover, if you guess wrong on the direction of the business or economy, and things rebound, you’ll be castigated for insufficient planning. What’s worse than failing to land the “quarterly earnings” plane on the downside? Failing to land it on the upside when your competitors race ahead and you lag behind because you cut too deeply.

Still, we are on a path of unprecedented tightening. We’ve ratcheted capital down, and if you tighten the top, you’ll see it all drop.

Yet, there’s the competing notion that although we’re having a “financial” reset, the real economy is still growing. Many have pointed to the Atlanta Fed’s GDPNow indicator having fallen to 1.2% in Q4 as evidence that we’re falling into a large recession. While things have started decelerating . . . 1.2%? Last time we checked, it’s still a positive number.

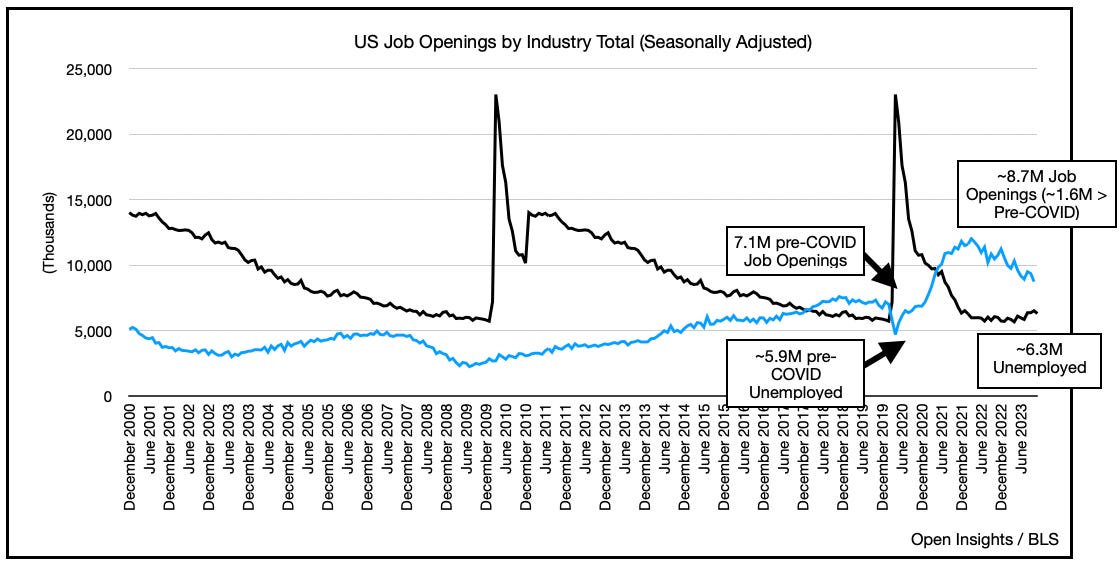

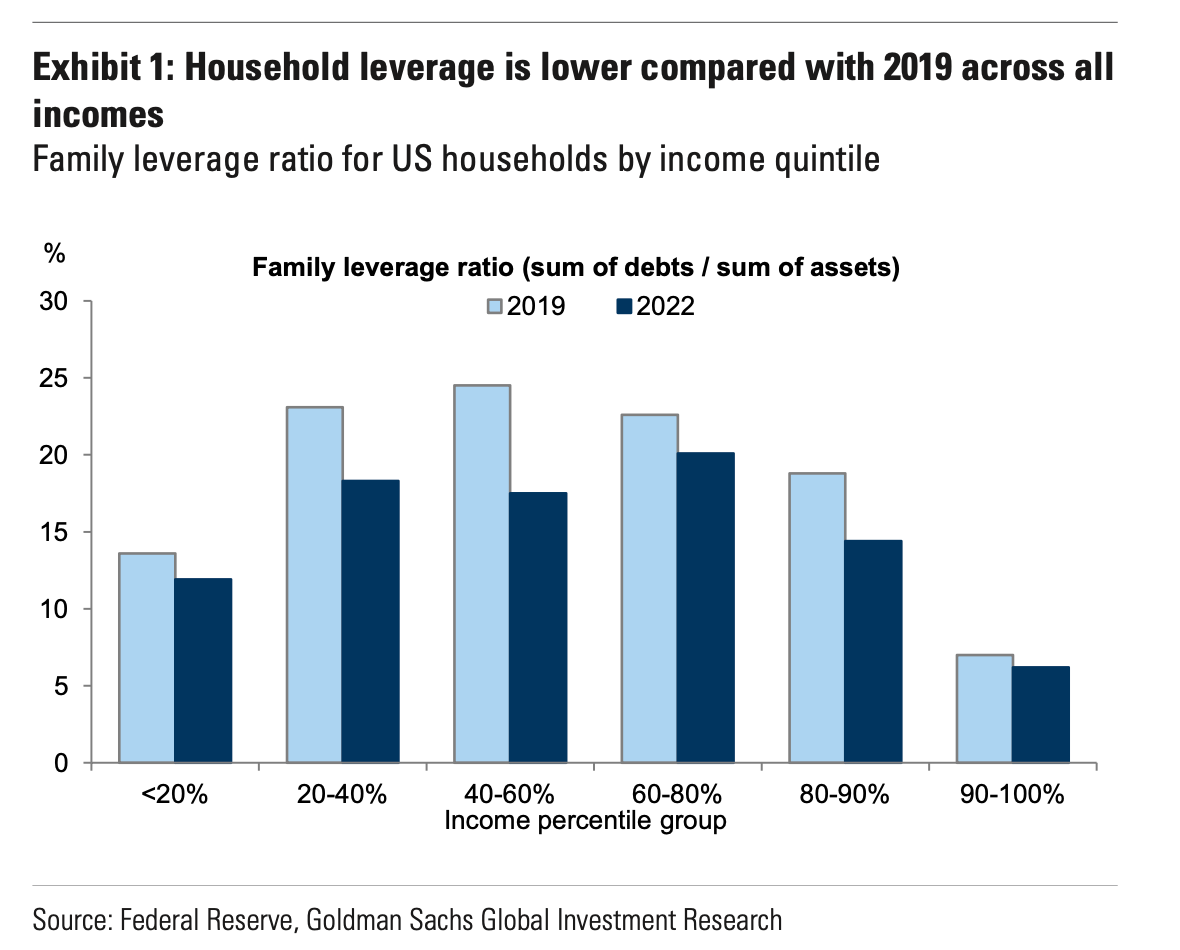

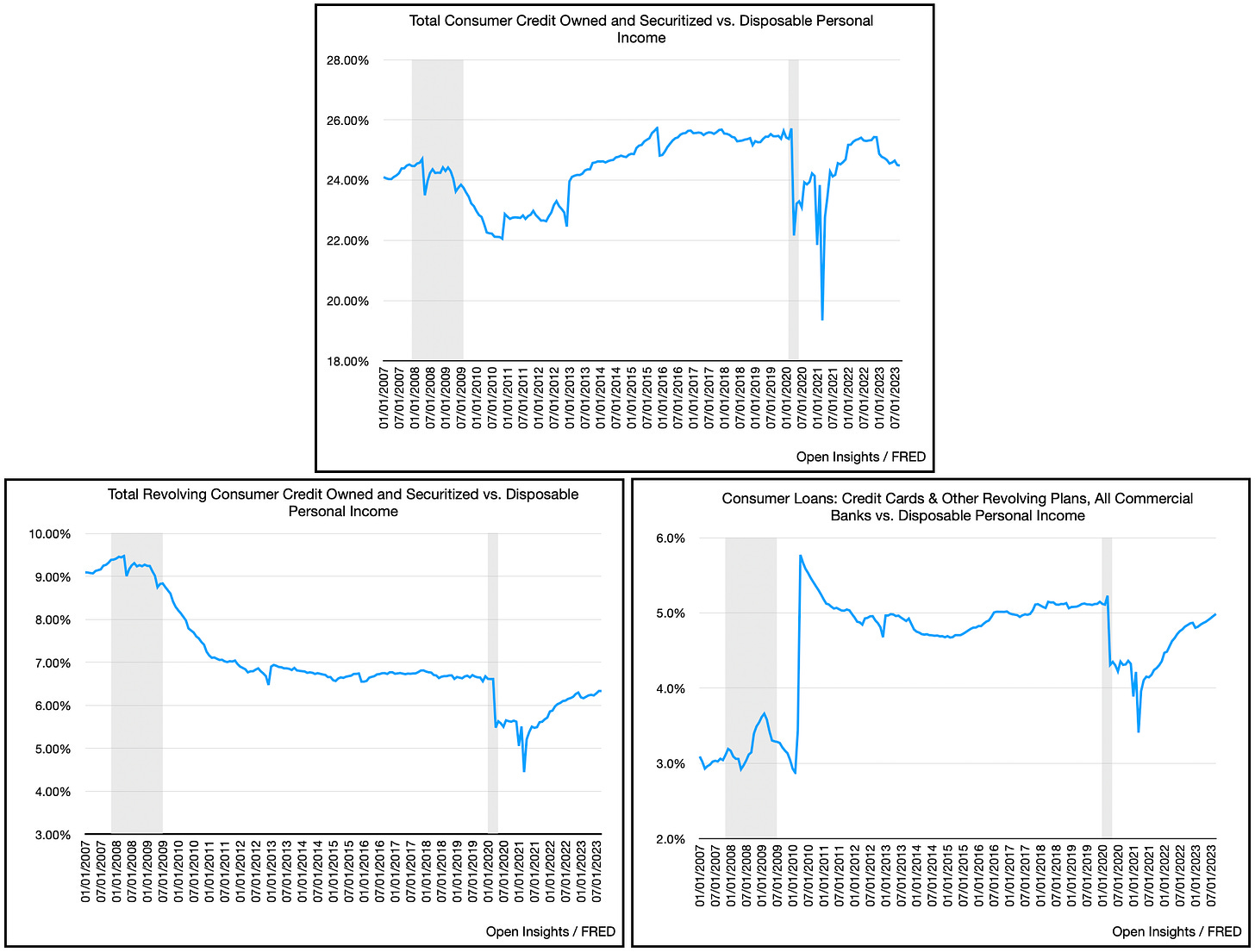

So we come back to the fact that 70% of this economy is driven by consumer spend, and again jobs are plentiful, unemployment is still low overall, and the consumer isn’t overlevered.

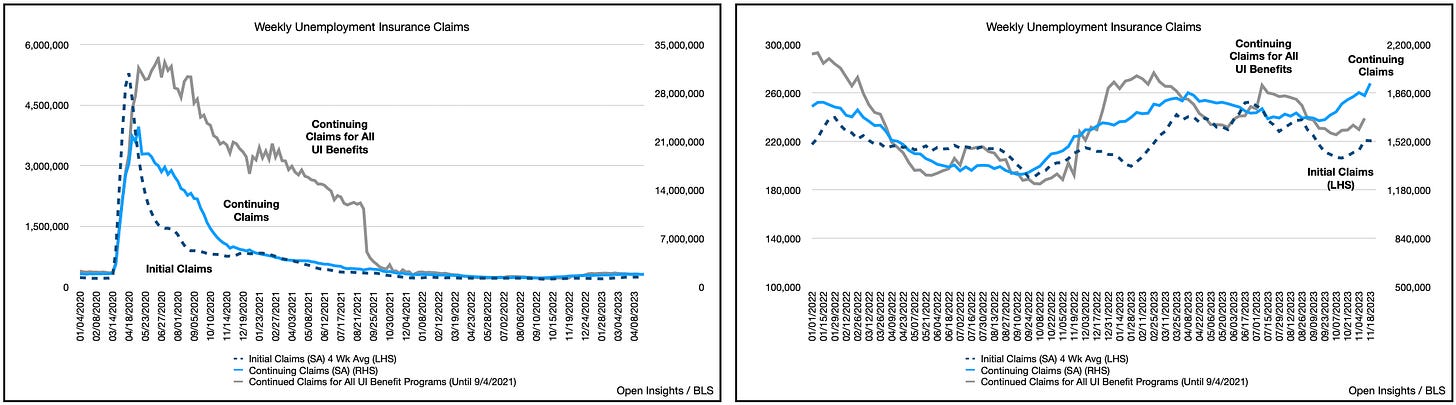

While unemployment claims have ticked up, they’re still relatively muted.

So we still have jobs . . . and despite the worry that we’re all undertaking more debt, people do forget . . . we also make much more now (across all income strata).

That can’t be right, right? Oh it’s 2022, 2023 must be materially different now that we have nearly an extra year of consuming.

Hmmm maybe not.

Still, let’s play this out. The Fed will meet in 2024 along this schedule.

January 31

March 20

May 1

June 12

July 13

September 18

November 7

December 18

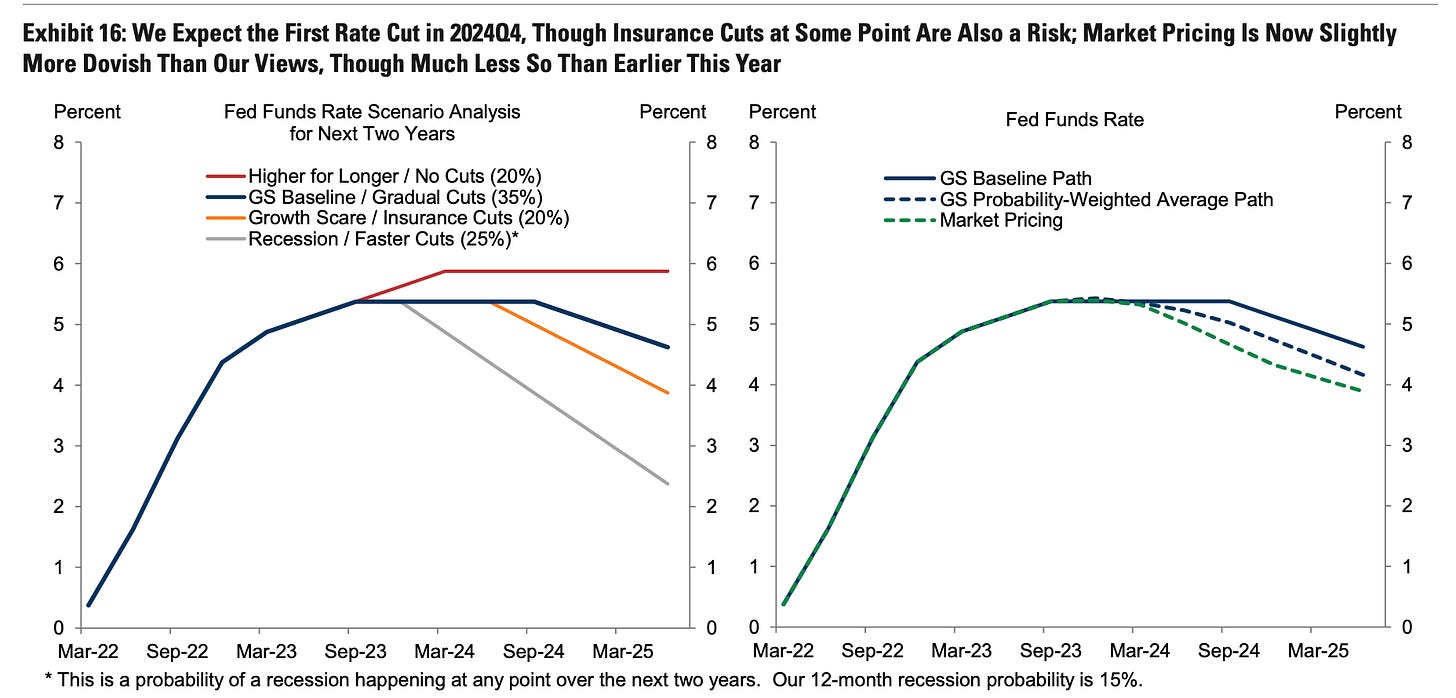

The market anticipates this is the rate path (right chart).

It’s expecting an almost 1% reduction in interest rates in 2024. In contrast, Goldman expects a more muted 0.25% reduction to interest rates. How it all plays out will depend largely on inflation and the pace by which it falls.

Do we think it will? Yes, housing a large component of inflation will continue to decline as rent increases abate as new housing supplies come online. The Fed’s preferred gauge, the core PCE index, is tipping in the right direction, but will it take another quarter or two to hit sub-3%?

Likely, in which case we think the Fed holds its hiking bias. If, however, soft growth dips into contraction, then the Fed can start shifting its language (before actually cutting), and talk the market into front-running the possibility that rate cuts are incoming. Financial conditions have already eased noticeably in the past few weeks as cooling growth data and inflation figures allowed the market to front-run the Fed’s policy, but whether that was premature, too extended, and/or too much remains to be seen. We’ll need to see what inflation figures print in the coming months.

As for the Fed watch, just pay attention to the language used in the upcoming December meeting. If they remove the hiking bias and replace it with some cooing words, there’s a likelihood that actual cuts are happening earlier in the year than later, in which case, the market is likely correct. We’re of the opinion that the Fed will be conservative here. They’ll need to thread the needle, remove the hiking bias (call it “neutral stance”) and avoid over tightening. The possibility of a soft landing for the economy requires a subtle and deft touch. If they leave it on autopilot, and stay restrictive, they could ultimately over tighten, and drive the economy harder onto the runway.

For now, the economy is slowing, globally and domestically, but consumers are still hanging in there as most have jobs, debt loads are manageable, and job prospects while softer, are still plentiful. Wage inflation is easing as well, which is helping inflation figures come in lower. Whether all of the above remains so or not, depends on how the Fed reacts here.

Still, keep in mind . . . when the Fed starts cutting, recessions start coming, and stocks start shivering. How hard or soft they shiver? Well, that’ll depend on hard our pilots land that plane . . .

Ladies and gentlemen, the captain has turned on the seat belt sign. Buckle-up, we’re coming in for a landing.

Please hit the “like” button above if you enjoyed reading the article, thank you.

It strikes me that the likelihood of 125bps, as currently priced, of cuts is the least likely outcome. either GS is right, and there is a token 25bp-50bp cut late in the year as the economy maintains its growth trajectory, or we see 350bps-400bps as a recession comes to fruition. But, given the economy has withstood 5.50% rates pretty well so far, cutting for the sake of it seems the least likely outcome. at least to me

You guys suffer from several problems:

1. Memory limited to the time since the inception of Twitter.

2. Forgetting that we are coming out of nearly two decades of unprecedently low interest rates that may or may not repeat themselves in the future.

3. Wrongly assuming that Fed Funds Rate of 5.5% would damage the economy and cause a severe recession while the rate of inflation, 3.2% today and 3.6% on the average over the last 50 years, was 13% in 1981 when FED Chairman Volker tamed it by creating a recession by jacking the Fed Funds Rate to 22.36% effective rate.

4. As a result of all the above, engaging in endless discussions of "soft landing for the US economy," which is as fictitious as the term itself with the attendant nonsense of "people are suffering everywhere," "bankruptcies are increasing," "people are being ravaged by high inflation" and the communist mantra "rich are getting richer and poor are getting poorer" - all of which we have also heard from the REPUBLICAN presidential candidates during the presidential candidates' debates. At the same time, Americans have been living in the richest, most democratic and the freest country of the world with the highest standard of living on the Earth ever when, only for instance, meat is being sold at prices that are 40% to 90% lower than in 1975 adjusted for inflation.

5. The fact that Secretary Yellen is using the term "soft landing" notwithstanding. She is also worried about the inescapable fact of "income inequality" - the sine qua non of the well functioning capitalist economy as it provides a measure of effectiveness of individuals' actions and a measure of self-improvement - see the Nobel Laureates in economics on this subject. The communists provided a perfect solution to "income inequality" by (1) taking money away from the "rich" and "giving" it to the "more deserving" and (2) by assuring that a tractor driver on a farm was making the same salary as a surgeon. The result? It made all of us living in a communist country at the time poor, with the exception of the communist party brass who were "more equal" than the rest of us.