I Can Do Anything, Better Than You

November 28, 2020

It’s as if the world’s vaccine developers are all singing the same Irving Berlin show tune. “Anything you can do, I can do better . . . I can do anything, better than you.”

Since we last wrote a few weeks ago, this is what we’ve seen:

November 9 - Pfizer/BioNTech’s vaccine . . . +90% effective;

November 16 - Moderna’s vaccine . . . 95% effective;

November 17 - China’s Sinovac vaccine . . . 90% effective;

November 18 - Pfizer/BioNTech . . . oh wait, upon further review, we’re 95% effective;

November 23 - AstraZeneca/Oxford . . . 70% effective.

Like the good students they are, our scientists are now showing their work, and boy are the proofs wonderful. Even the most cynical of us would have to admit, something is happening here. We’re witnessing a breakthrough. You can discount one or two studies, and perhaps even those from Russia, but collectively, the results are beginning to speak for themselves. Double-blind studies complete with rigorous safety protocols, administered and overseen by competent and apolitical professionals. That’s what we deserve and that’s what we’re getting. Have these studies been accelerated? Certainly, the circumstances warrant the regulatory flexibility, but more importantly have the results been compromised? Highly unlikely, particularly given the unprecedented level of media and scientific scrutiny.

Pfizer/BioNTech’s news of an efficacious vaccine on November 9th, combined with Moderna’s news a week later, and AstraZeneca’s news on Monday have bolstered the market despite increasing COVID cases, hospitalizations and deaths. Although the data for all three vaccines were initial snapshots from their larger Phase 3 clinical trials, it’s all extremely encouraging.

Between Pfizer/BioNTech and Moderna, Moderna’s results were slightly more positive because the company’s vaccine does not require ultra-cold refrigeration and is stable at refrigerator temperatures for 30 days (or longer if kept in freezers). The easier logistical requirements, however, are counterbalanced by Moderna’s scale. It’s a much smaller company that does not have Pfizer’s logistical infrastructure or experience, so for developed countries (and the US in particular), the Pfizer vaccine will likely take the lead after it’s rolled out.

Outside of the US, AstraZeneca’s vaccine news was also welcome because that vaccine is priced around $2-3 a dose, about 10x cheaper than the Pfizer/Moderna vaccine, which benefits developing countries and those participating in the WHO’s COVAX framework for vaccine distribution worldwide.

After the announcements, we’re now off to approval as Pfizer has filed for an Emergency Use Authorization (“EUA”) with the US Food and Drug Administration (“FDA”). The company is also conducting a rolling submission with regulatory agencies in the UK, EU and Canada. Moderna is slightly behind Pfizer, but only by a few weeks in the US. AstraZeneca is preparing to submit its results in the UK, EU and Canada. The company’s US trial will take longer to conclude (early 2021) as it was previously paused for an adverse event. Ultimately, we believe Pfizer’s vaccine will be the first approved in the US, and AstraZenecca’s to be approved in the UK / EU. Had the vaccines shown lower efficacy and/or more complications, then we could see the regulatory agencies approach EUA more cautiously, but given the current outbreak and unmet needs, the pressure mounts for a quick approval. The extremely high efficacy rates will push the issue over the line, and should overcome the concerns.

Recall that we previously wrote

“Here's where we differ from the consensus. We believe the pandemic will end more quickly than the consensus believes. If the vaccine roll- out proceeds as we anticipate, the pandemic should effectively be over by March 2021. The reason is because once the vaccines are approved, the solution to our global pandemic shifts from a scientific issue to a logistics challenge (manufacturing speed and distribution), which is easier to solve. It’s akin to a series of rivers being gated by dams. As each approval is granted, a barrier is removed and the water/vaccines can flow to the populace. Whether it takes the agencies one or two months to approve the vaccine matters less than how quickly drug manufacturers have been (or will be) producing the vaccines because eventually that's what will dictate how fast developed and emerging markets will recover.”

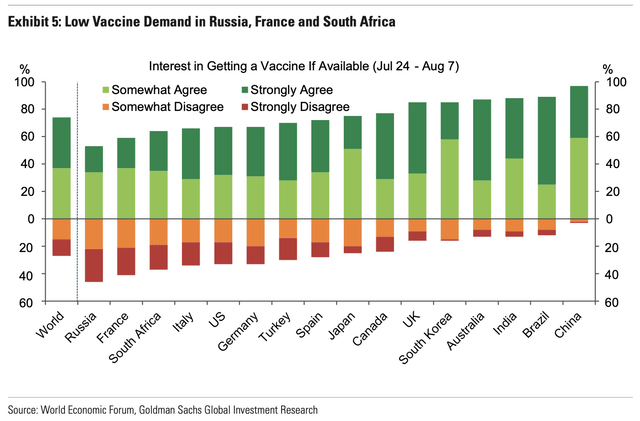

In the West, the largest issue surrounding vaccination isn’t scientific or logistical, it’s societal. Based on survey results, those in the West simply do not want to be vaccinated. In contrast, compliance rates in the East are much higher. We previously included this chart to illustrate the issue.

As the news of a +90% efficacious vaccine percolates, however, it gives us greater confidence that the number of vaccinations may ultimately be higher than what the original surveys indicate.

A vaccine that’s 50% efficacious for 50% of the population that will voluntarily take the injection means 25% of the population is vaccinated, but up that efficacy to 90% and 2/3rds of the population willingly vaccinates? This means almost 60% of the population is vaccinated, an almost 150% increase. Consequently, when the dust settles, our overall immunity should be higher, and could approach herd immunity.

As cases, hospitalizations and death rates dive, we’ll begin to ease our restrictions on daily life. Those figures should drop quickly as the initial batches of vaccines will be allocated to the highest risk groups. The elderly, healthcare workers and those with 2 or more comorbidities. As these groups account for almost 2/3rds of hospitalizations and 80% of deaths, vaccinating this initial group means the pandemic will effectively be over. An endemic continues, but again that’s imminently more manageable and acceptable than our current predicament.

Even more importantly, if a +90% effective vaccine is available, the onus shifts from the government needing to protect you to you needing to protect yourself. That shift to individual responsibility becomes critical for loosening the restrictions on our economy because . . . here’s the important point . . . you, and not politicians, are to blame if you get sick. Voters and history won’t blame politicians, and that’s what they want. Until then, they’ll continue to increase or maintain the restrictions even if we see COVID fading as they’re an asymmetrical bet for politicians. At worst they can appear to be conscientious leaders overreacting in order to save lives, and at best they can appear to be civic leaders if cases, hospitalizations and deaths fall. So when in doubt, restrict. Besides having already suffered the political fallout from increasing restrictions around the holidays means there’s little reason for politicians to relent as we close out the year and vaccine approval/distribution approaches. If they’ve already written-off Q4 and the holidays, then they’re asking us to do so as well.

EU and US COVID Update

Now this isn’t to say that COVID is worsening. There are indications that it’s already plateauing in the West. Europe is already on the decline as Spain, France and UK numbers are on a downward slope. France, one of the worst hit countries in the fall wave, is beginning to see declining numbers of positive cases and hospitalizations, and plans to ease restrictions shortly.

EU recovery though is uneven, as cases persist in some countries. Germany plans to extend restrictions to December 20 as cases continue to climb there, but the UK, like France, will ease back into a three tier system on December 2 as their second wave declines.

The US will likely follow this well trodden path in the coming weeks as we see hospitalizations now break lower, especially for the hard hit Midwest/Rustbelt, and the number of positive cases begin to level-off.

Again the trajectory of net hospitalizations precedes that of cases and deaths, so we expect the latter two to begin falling as well. It’s not lost on us that as some jurisdictions tighten restrictions (e.g., barring in-class learning (NY City) or imposing curfews (California)) that we’ll begin to see cases fall because that’s been the nature of the pandemic and our societal reaction to it. If there are two things we’ve done well during this pandemic it’s that we’ve simultaneously underestimated it, and yet completely overreacted to it.

Fiscal Stimulus?

So we’ll continue to restrict portions of our society and strangle the economy until the vaccines are distributed and/or cases dive significantly. Given that, one would think that politicians at the federal level would hurriedly pass some type of fiscal stimulus to bridge us over this Q4/early-Q1 period right? The poor and certain industries (airline, travel, hospitality) are bearing the economic brunt of this pandemic, so surely if state and local politicians clench and lock down on one hand, the other federal government would offer the other helping hand of assistance? Doubtful as Republicans are positioning themselves as the fiscally responsible party as we head into the Georgia special election in January to decide the fate of the Senate. An agreement at this stage requires the Democrats to pare their wish lists down to a skinny agreement, one shy of $1T (from $2.2T), and hand Republican’s a political victory. So dream on. Instead Democrats will hope to carry both Georgia elections, win control of the Senate, and pass a larger stimulus bill. We think that’s unlikely as Georgia is a historically “red state” and Republicans will likely win at least one of the two Senate seats, which means they’ll retain control of the Senate, setting-up for further roadblocks down the line.

Looking for Better Days Ahead

The market, however, will remain hopeful and try to ignore the weakening economic backdrop and lack of financial stimulus as we approach year-end. Holidays are nothing if not filled with good cheer and wishful thinking, an optimism for better days ahead. Hopeful that a vaccine approval in the coming weeks means that this pandemic will begin to abate, hopeful that a stimulus can bridge us over the current economic rough patch, and hopeful that the uncertain and unprecedented 2020 can begin to fade and “normalcy” can return. This “hope” translates to a higher multiple than we can honestly justify with our current fundamental backdrop, but one that makes more sense if we think 2021 normalizes quickly, something we believe will happen.

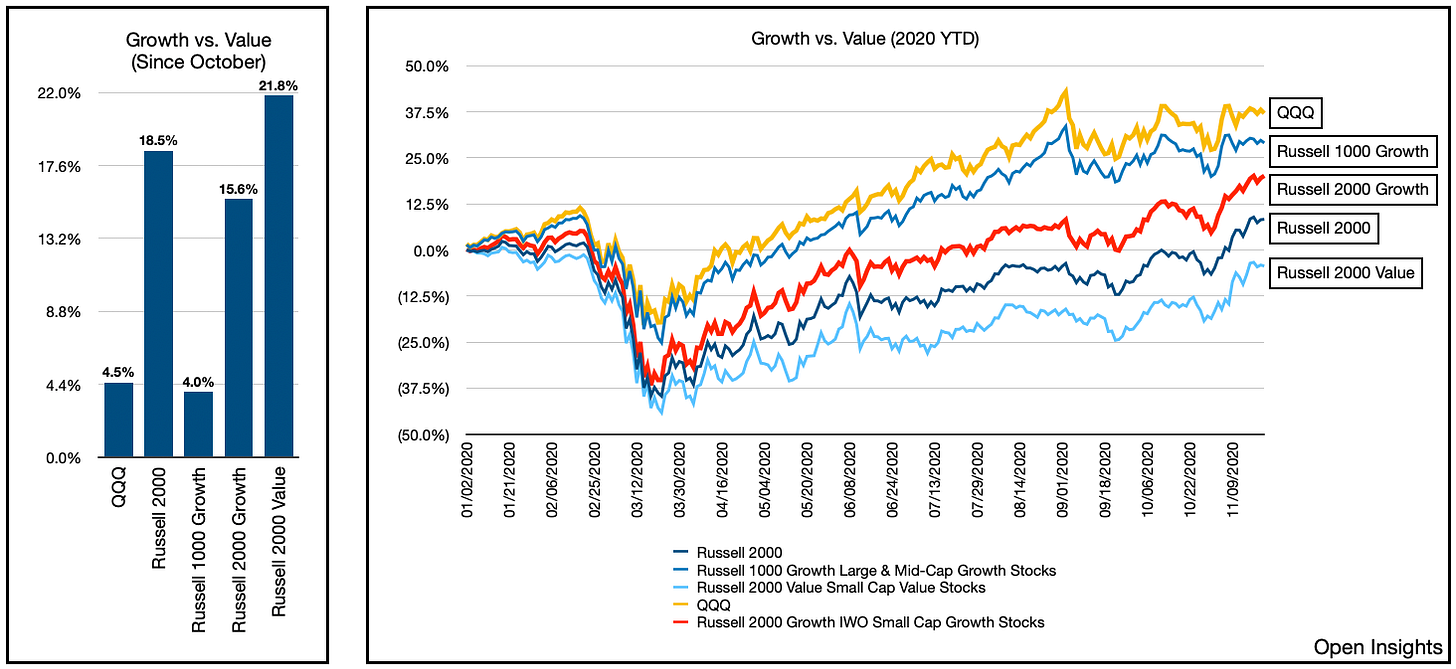

After prioritizing and vaccinating the high risk populations, Dr. Anthony Fauci, has pointed out that the healthy general population can expect first doses by April, which means this summer will be, as they say, “BANG ON.” If anything, the market is beginning to agree with that assessment as investors shift their asset allocations. Bank of America’s latest Fund Manager Survey shows the increasing preference of managers to overweight small cap stocks vs. large cap, and even bottom fishing in that worst performing sector year-to-date, energy.

Despite these moves, note that slight overweight in tech from the Fund Manager Survey. While investor’s may be dipping their toes into value stock, it’s not necessarily a wholesale shift in the portfolio. Old habits and momentum will die hard. Said another way, we don’t expect tech to crash per se as we recover. More likely, tech could simply stand pat as other sectors catch-up, particularly since it now represents such a large component of the market.

Perhaps the “belief” that things will normalize is increasing. Why else begin that shift now? We’re still waiting for the approval of the vaccines and how quickly we can roll them out, but small caps are already moving. At the very least we think there’s some short covering occurring. Long-tech and short “real economy” has been the strategy du jour for much of the year, so even a small shift will translate to large moves as short-covering begins in earnest off of a low base and momentum follows through.

Since October, we can see that value stocks have vastly outperformed growth, so something is afoot, and it’s something we think will continue as the steady drumbeat of good news grows louder in December.

Pulling Forward Prior Expectations

We believe we’ve just started as the market begins to reprice the possibility that the global economy can recover quickly in the coming months.

Before November, the market was anticipating Phase 3 data from vaccine developers to begin trickling out in December, and while some were optimistic that the vaccines would work, none really anticipated the extraordinary efficacy rates being reported. Many even doubted that the new RNA based vaccines would work, but it’s fair to say that there’s been something of a technological breakthrough. The torrent of good news now means everything gets accelerated. Effective immunity/actual herd immunity and economic recovery are all pulled forward by 3-9 months. Now the challenges become logistical/behavioral, but that is a much simpler issue to resolve than developing a nearly 100% prophylactic vaccine for a novel virus.

In the coming weeks, we’ll begin hearing that global regulatory agencies are approving the vaccines for emergency use, and then vaccinations will begin for front-line healthcare providers and high- risk populations. As the vaccines roll-out, the news will turn even more positive if cases also taper off. In January, we’ll also have JNJ and a few other vaccine makers report their results. Outside of the US, AstraZeneca’s vaccine will also be approved and vaccinations in the UK and EU should begin in December. Last, China will begin distributing its Sinovac vaccine, and that bodes well for recovery there, and Russia its Sputnik vaccine (though we’ve seen little data on that one). At the very least it will be hard to “short” the market with the upcoming news cycle and the political transition/inauguration in January.

So in the meantime, as we all share thanks and begin celebrating the holidays with our family and friends (socially distanced and in limited numbers of course), we wish you good health and better days to come. With a little luck, the market and our global economy will end with good cheer.

Join the Distribution List

So that concludes this letter. We’ll endeavor to send these out weekly, so if you would like to be added to our distribution list click on the subscribe button above. This is our start and it’s our invitation to you to join us and share your thoughts. Welcome to Open Insights and let the conversation begin.