IAC: A Bento Box for Half Off

September 2, 2025

OSC: Alright, alright, alright. Last article for our intern Matt Nakagawa!

Matt’s back to school as a rising sophomore at the University of California, San Diego in the coming weeks, and he’s set his sights on a Big 4 accounting career (Lord help him). Nonetheless, always open for internship opportunities, so if any reader would like a helping hand, feel free to reach out and we’d be happy to pass along his resume.

Matt finishes his internship in sartorial style as we tailor this last company to what he’s been learning all summer. It’s a somewhat more difficult one, but interesting nonetheless . . . IAC.

So take it away Matt.

Matt: IAC is an American holding company founded by media executive Barry Diller, the creator of Fox Broadcasting Company and a member of the Television Hall of Fame.

OSC: Yeah for those who don’t know, Barry’s one of those icon’s in television and movies. A REAL real Hollywood mogul. Ran Paramount Pictures for a decade in the 70s/80s (think Indiana Jones, Beverly Hills Cop, etc.), Fox (Simpsons, Married with Children), QVC/Home Shopping Network, and the USA Network. Since the 2000s, he’s been running IAC, which has spun out Match.com, Vimeo, etc.

Just an extraordinarily successful career and mentor for a whole generation of media executives (Don Simpson, Michael Eisner, Jeffrey Katzenberg, etc.). He’s 83 now, and still running IAC.

Matt: That’s right, so today, IAC operates a diverse portfolio of media and internet businesses spanning over 100 countries. The company structures its holdings into four primary segments:

People Inc. (Dotdash Meredith)

Care.com

Search

Emerging & Other (includes brands like Vivian Health, Mosaic Group, and IAC Films).

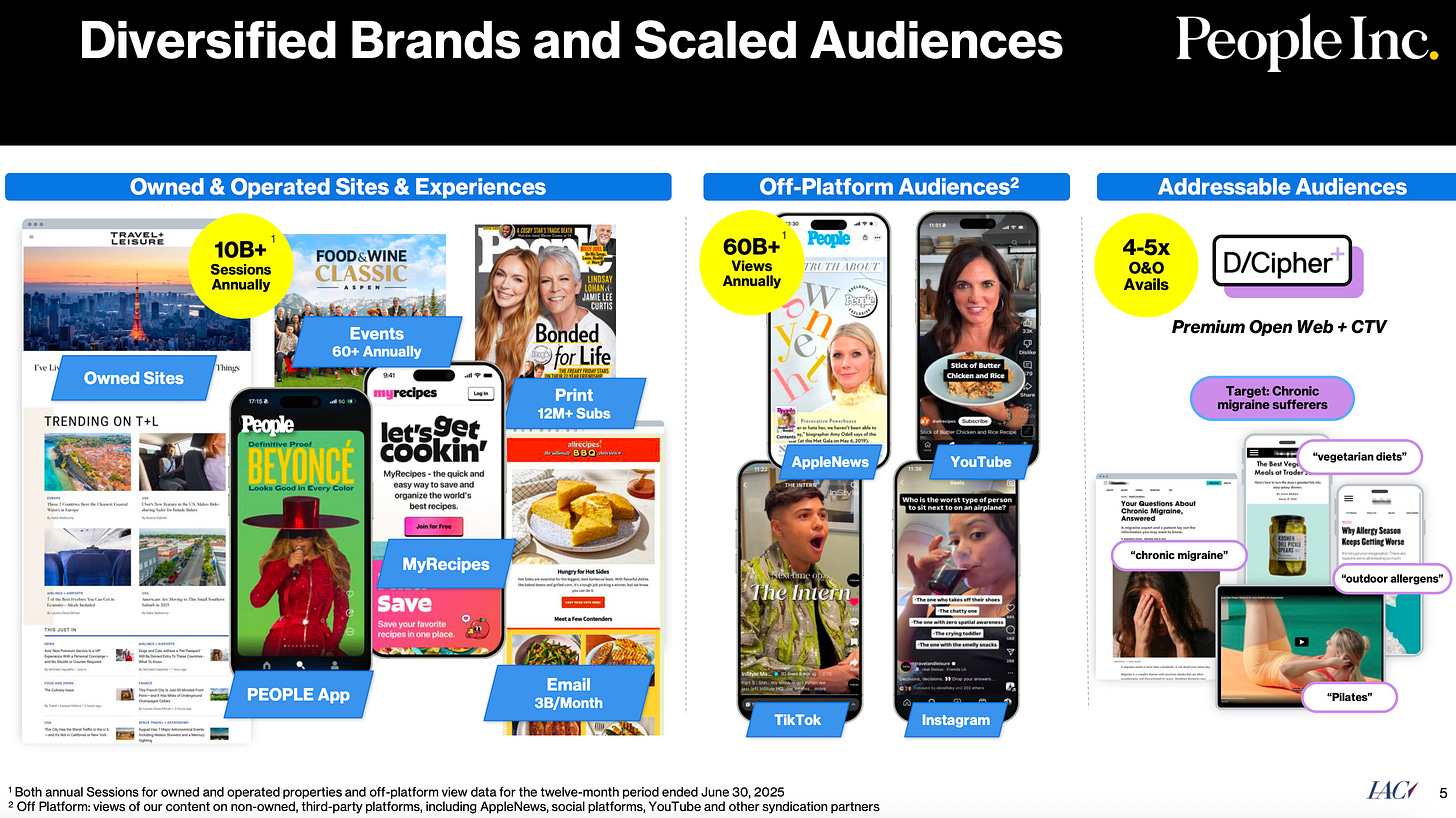

Each of the segments encompass a variety of individual brands, but Dotdash Meredith is the company’s largest segment and serves as the cornerstone of its media strategy.

Beyond its core segments, IAC maintains significant equity stakes in other prominent companies. It owns 23% of MGM Resorts International (“MGM”) and a 31% stake in Turo, a peer-to-peer car-sharing marketplace.

OSC: I think you’re missing Angi right?

Matt: Well, IAC used to own Angi (formerly Angi’s List), but that was recently spun-off to shareholders in April 2025. In this article though, we’ll focus on the value that lies within IAC’s core holdings and how beneficial spin-offs of these holdings can be for IAC shareholders.

OSC: Awesome. What does the market cap of this company look like?

Matt: Currently, IAC sits at a market cap of $2.9B. The company has ~79M shares outstanding with a price of $36.55/share. Looking at their debt, as of the latest quarter, IAC’s net debt totals out to $0.5B (i.e., $1B of cash + $1.5B of long-term debt, which matures in 2030/2032).

With a total enterprise value of ~$3.3B, this company is very lightly levered.

OSC: With all of these holdings, how does this company generate its revenue?

Matt: Great question.

OSC: Thank you.

Matt: . . . .

IAC revenue stems primarily from its four major business segments: Dotdash Meredith, Care.com, Search, and Emerging & Other.

While IAC holds significant equity stakes in companies like MGM and Turo, the investments are considered passive.

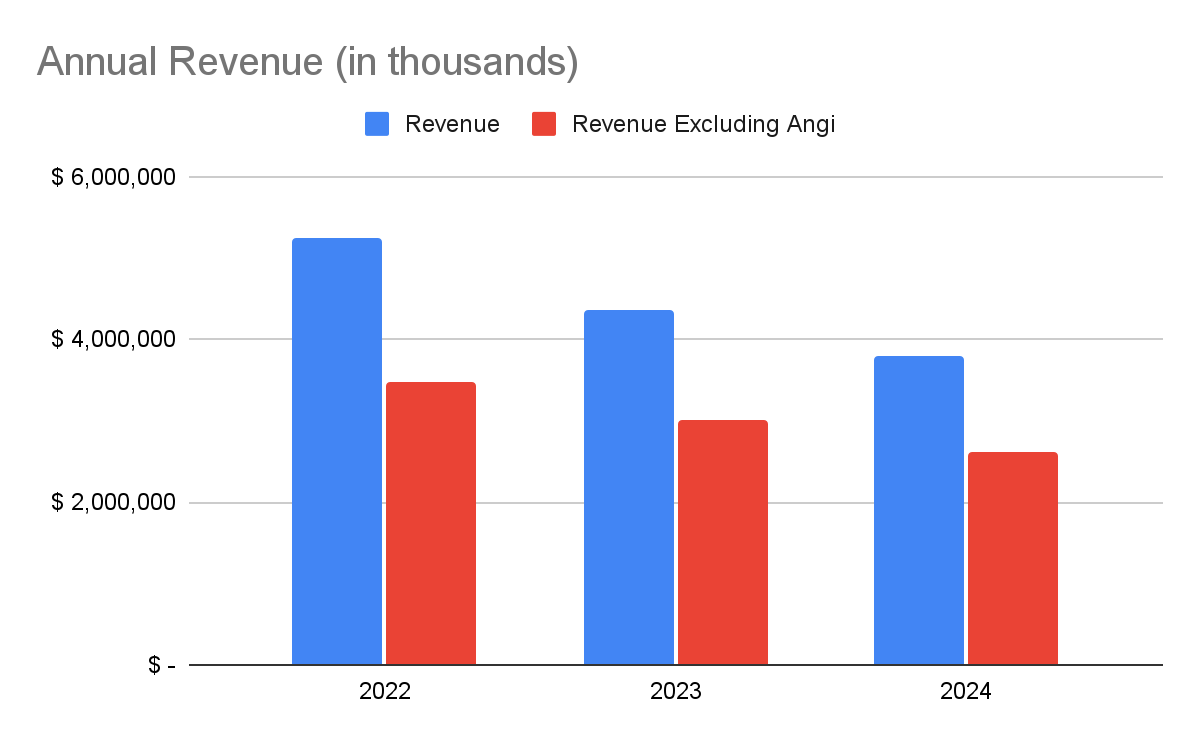

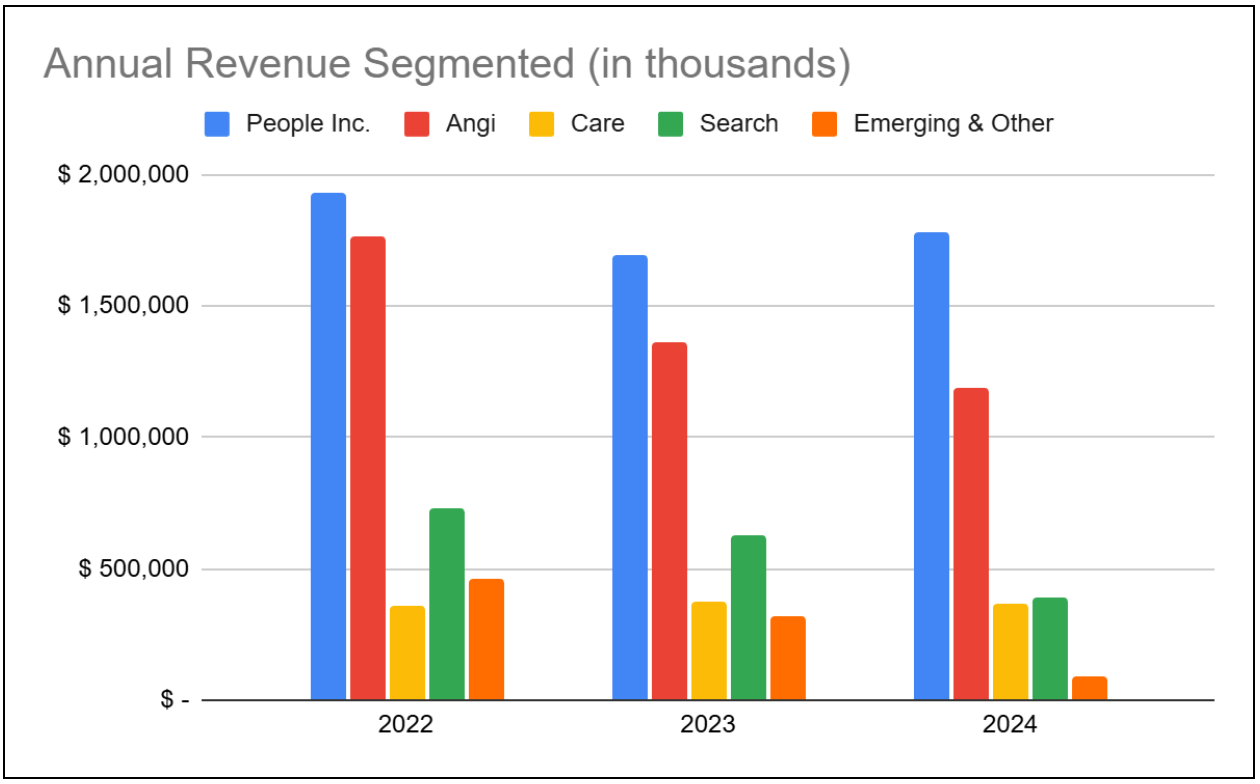

In total, IAC’s annual revenue for the past few years reveal a clear downward trend. Since Angi was only recently spun-off, the prior year figures reveal that revenue with Angi fell by 17% from ‘22 to ‘23 and 13% from ‘23 to ‘24. If we exclude Angi, then the decline was lower (i.e., 13% and 13%, respectively). (All slide information from IAC corporate filings.)

To pinpoint the drivers behind the revenue decline, we need to analyze performance at the segment level, looking at how revenue from IAC’s key holdings has changed year-over-year.

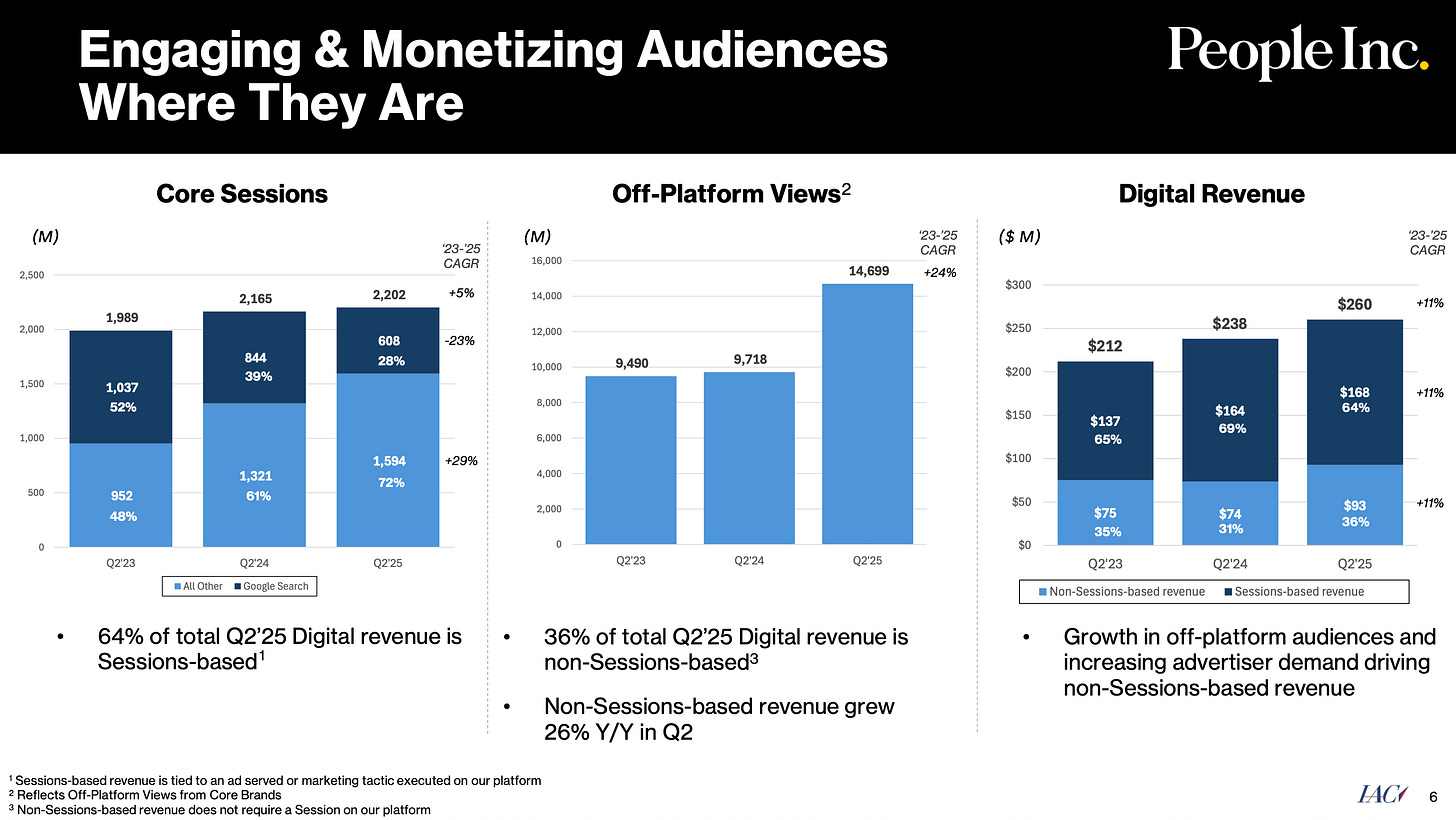

As we can see, Dotdash Meredith is by far the largest driver of revenues. It’s largely fluctuated from ‘22 to ‘24, with a 12% decline from ‘22 to ‘23, followed by a 5% rebound from ‘23 to ‘24. Recent trends (i.e., Q2 year-over-year) shows a reacceleration, so 2025 looks to be rebounding as well as advertising comes back.

This relatively stable performance suggests that Dotdash Meredith is not the primary driver behind IAC’s broader top-line decline. Similarly Care.com has remained relatively stable over the past two years.

In contrast, Search—IAC’s search-related business— and Emerging & Others has seen a sharp drop in performance. Revenue from the two segments fell precipitously from ‘22 to ‘24 by a combined 60%. In ‘22, the two segments accounted for 20% of the company’s total revenue so despite the small size, the large decline contributed to nearly 50% of IAC’s revenue declines in the past few years.

OSC: So to summarize, the largest business (Dotdash Meredith) is relatively stable and may be improving, the second largest business (Angi) was just spun-out, and of the remaining three segments, one is flat (Care) and two are in critical condition (Search and Emerging & Others)?

Matt: Yes.

OSC: Okay, if revenues are declining for certain segments, what metric do they like to be judged on?

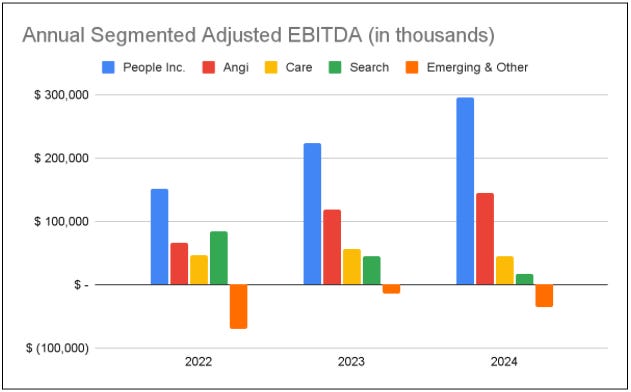

Matt: Adjusted EBITDA.

OSC: Typical. Adjusted EBITDA. It’s like earnings, except not since we get to add-back all the bad stuff we don’t like. Like taxes, don’t like taxes. Interest? Nope hate that, which is ironic since if you don’t pay it, the creditors come knocking. Depreciation and amortization, yeah really dislike when things like cars wear out. Stock option expense . . . we like our employees, but loathe having to pay them so much, so let’s pretend we don’t.

Matt: Ranting again . . .

OSC: Ah yes, continue.

Matt: Adjusted EBITDA . . .

OSC: Oh that’s a much prettier chart, no wonder they like to be judged on that. Strip out the undesirable expenses and everything’s up and to the right.

Matt: Yeah, particularly the largest segment Dotdash Meredith.

OSC: Okay, let’s walk through it then, the company generates very little FCF (2-3%), but it likes to tout the growth of its Adjusted EBITDA. So we can’t value it based on all of the cash it’ll supposedly rain down upon shareholders (share buybacks/dividends). I guess the only thing it can do is spin off these assets (or sell them), and extract value by forcing the market to realize their value based on this “pretend metric.” In fact on that basis, it actually looks attractive.

Matt: That’s right.

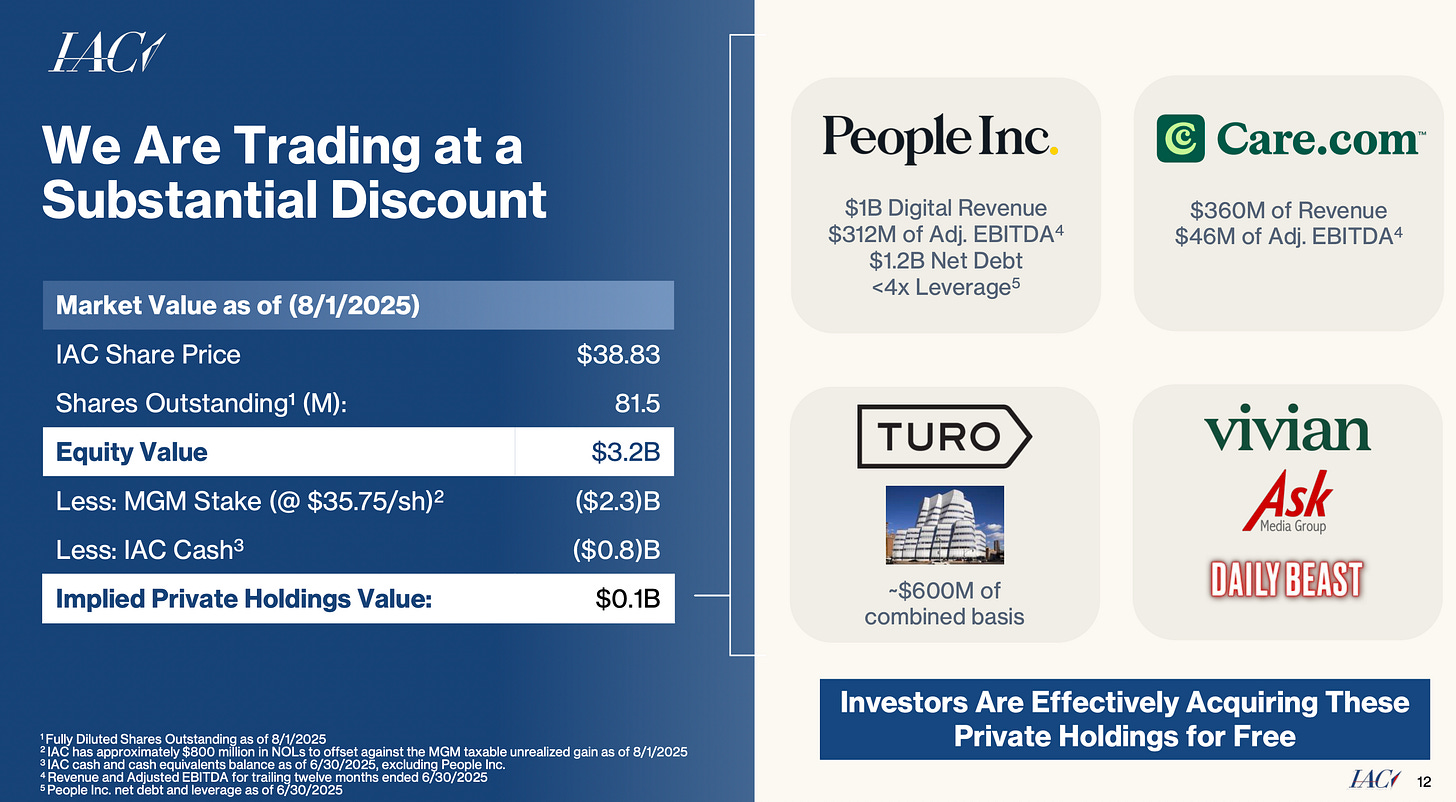

OSC: So how much is this collection worth if we start spinning things off?

Matt: It’s worth about 70-80% more.

OSC: Nearly double?

Matt: Nearly double. It has a current market cap of $2.9B, however, if you spin everything off, the company/companies may be worth ~$5B in total.

OSC: Do tell . . .

Matt: Again, this is a $2.9B market cap company, $3.3B if you include debt.

Let’s start with the easiest piece, IAC’s holding of MGM. MGM is a publicly traded company and IAC currently owns 23% of the stock, and at today’s market price of ~$40/share, the stake is worth $2.4B, nearly the entire IAC market cap.

Tack on another $0.9B for IAC’s 32% ownership of Turo. Turo was recently valued at $2.7B in 2024 before its IPO was pulled.

OSC: Since the IPO was pulled perhaps, isn’t that $0.9B for Turo . . . as my son says . . . suss?

Matt: If you used Lyft and Uber (1 to 4x 2024 sales), you’d still be anywhere from $0.3B to $1.2B. So it’s in the ballpark.

Thus, with MGM and Turo alone, you’re essentially getting IAC’s core businesses for free. IAC knows that though, here’s their investor presentation slide . . .

OSC: Yeah, it’s no real secret, but just disliked given the cornucopia of assets. What about the rest? How does Dotdash Meredith and the others pencil out?

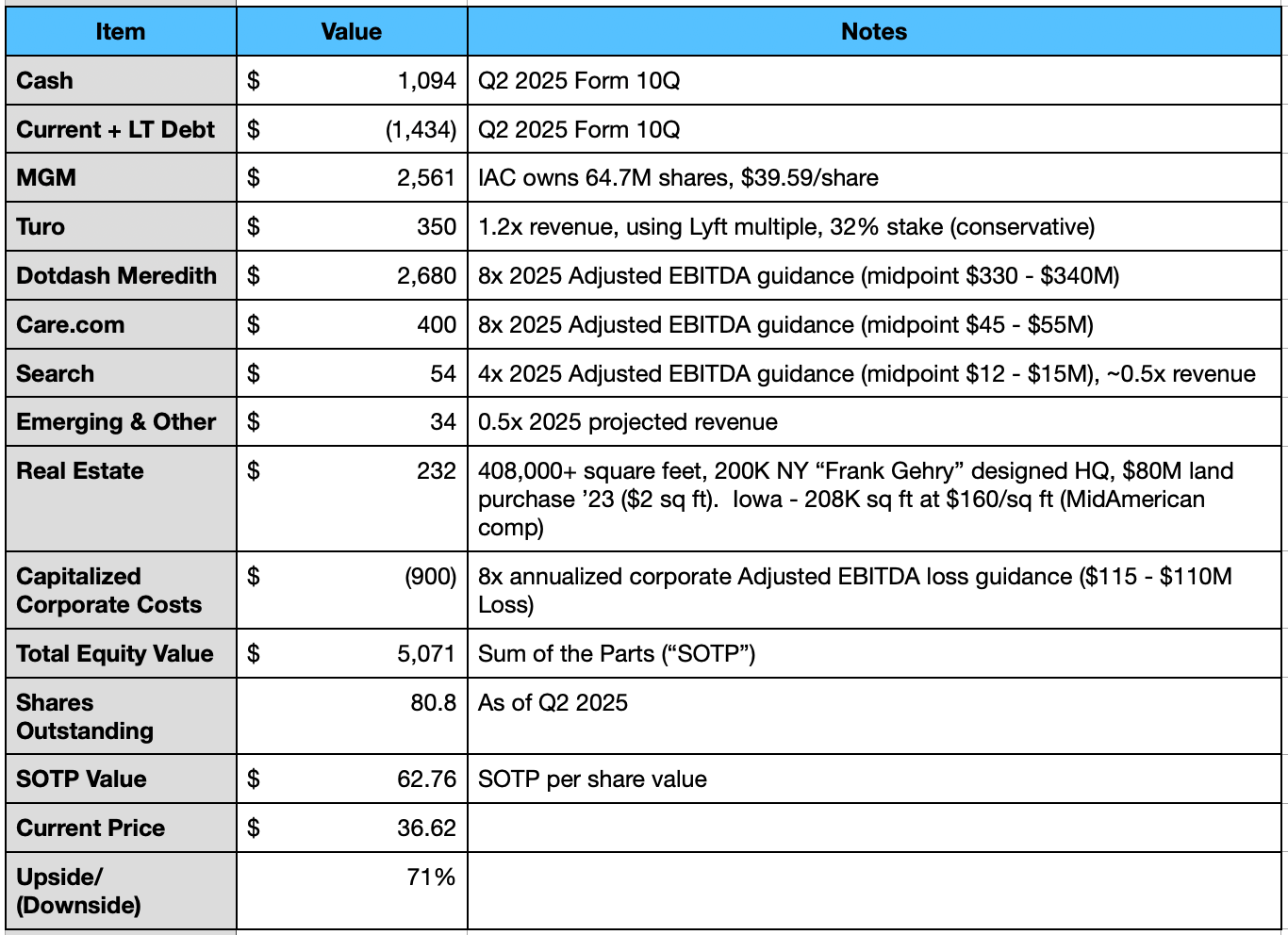

Matt: Here’s the breakdown:

OSC: Those are some pretty conservative assumptions there. You could easily up the Turo valuation and Dotdash Meredith. Then again, you may need to “stress test” the real estate given the tough marketing comps for commercial buildings in NYC.

Having said that, you don’t seem to be giving much value to “Search” and “Emerging & Other,” so those may be too conservative. Overall, it seems balanced.

Is this a buy then?

Matt: Yes and no. There’s undeniable value within IAC, but that value is concentrated in just a few key holdings, and it’s only likely to be unlocked if those assets are spun off. Think of IAC like a bento box: you usually eat the best parts first and leave the least appealing for last. The same logic applies here. When considering which assets to spin off, it makes the most sense to focus on the most valuable pieces, not the weaker ones. In IAC’s case, those crown jewels are Dotdash Meredith and its stake in MGM.

While spinning off Dotdash Meredith, or selling IAC’s stake in MGM could unlock significant shareholder value and drive a substantial increase in the stock price, these are one-time events. Once executed, they can’t be repeated, meaning they offer a short-term boost, not a long-term growth engine. Once the core assets are spun off, IAC is left with the “less compelling pieces”, smaller businesses that contribute little value individually and are unlikely to generate meaningful returns if spun off on their own.

OSC: Yeah, I’d agree. It’s not simple, but there is intriguing value here. That’s the issue with IAC all along, the core business is basically an incubator, and as it spins-off assets, investors can then keep or sell the spin-off shares depending on their view of the standalone businesses. Since 2020, IAC has spun-off Match Group, which is now worth $9B, Vimeo (which at the time of spin was worth $7B (now a 1/10th of that), and the recent Angi spin (worth $700M today). IAC stock though will tend to wallow, under appreciated until closer to the catalyst. Even so, investors will need to view the spin-offs as part of their “total return” as the value returned comes from not just IAC’s stock appreciation, but also things they give you.

What becomes of the remaining IAC after it sells its MGM shares or spins-off Dotdash Meredith? Arguably those items are the cornerstones of IAC today, as the other online assets are in decline and valued closer to liquidation. As for the real estate, since the company just bought the land underneath its corporate HQ for $80M a few years ago, it’s unlikely they’ll do a sale-leaseback on the property, which means that asset is locked-in.

Ultimately, though there is value here. Conglomerates, internet, or otherwise, tend to have a discount. Investors just don’t like fussy enterprises, and prefer “clean stories.” It’s why mispricings like this exist. The price this investment will extract is your patience. You’ll have to have patience as it spins-off and sells companies to you in the coming years (like it’s done for decades). As you hold it, it’s important to understand and value the assets they’ll throw off to you, keep this one, discard that one. A dating website may work better than a video sharing one, and an online travel website better than a shoe-selling one. Buying an incubator means you become an incubator yourself, and for most investors that’s not a skill-set many have. Still for those willing, this is a dollar bill selling for 60 cents. The market for whatever reason just doesn’t like cheap bento boxes.

Matt thanks for all your hard work this summer, it’s been an absolute pleasure and I’m sure our readers have benefited from your hard work. Best of luck at school.

Matt: Thank you!

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.