Inflation, Energy & Our Giant Hamster Wheel

September 17, 2021

The good ‘ole consumer price index (“CPI”). How we love thee. Our love for things, like inflation, just increases year-over-year.

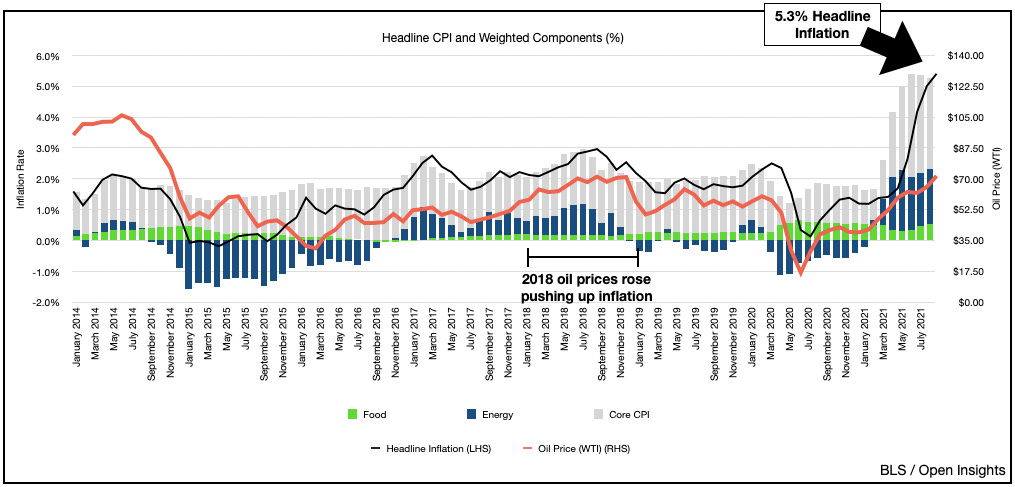

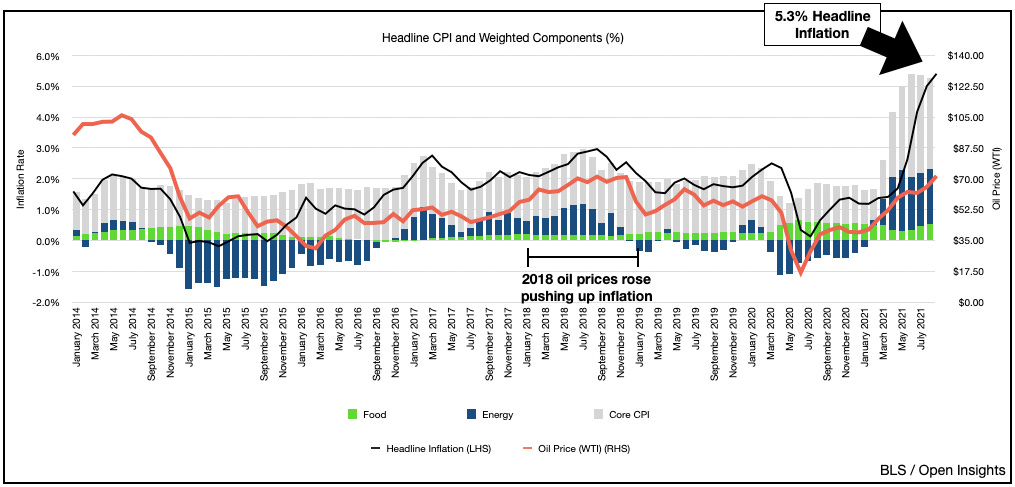

The consumer price index printed 5.3% for August, a small dip from the prior month’s YoY 5.4% increase. If you like that, you’ll like Core CPI even better. Core CPI (which excludes food and energy prices (i.e., the very things that sustains and moves us)) declined from 3.2% to 2.9% (July and August), so hurrah!

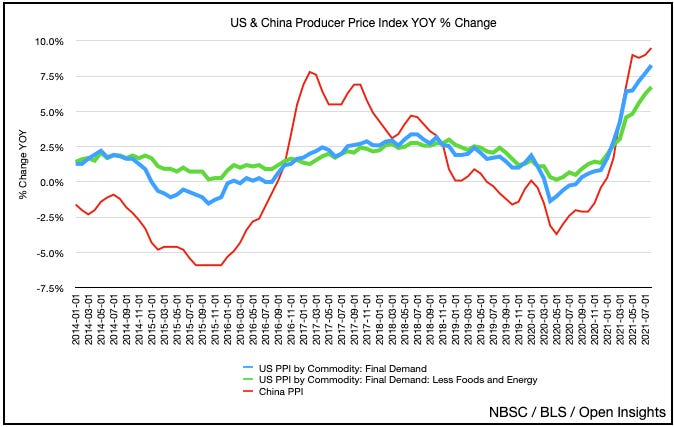

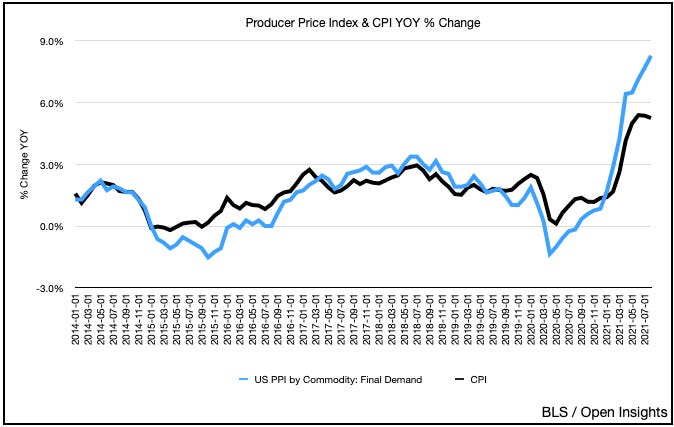

The figures led many analysts to say that it’s further evidence that the bouts of inflation we’ve faced these past few months are receding, but are they? Are they when the Producer Price Index, a broader measure of the input costs for US producers also printed a high of 8.3% for August? In China, where we “buy all the things” from, we’re looking at 9.5%?

Are they if these input costs then ripple through to us later?

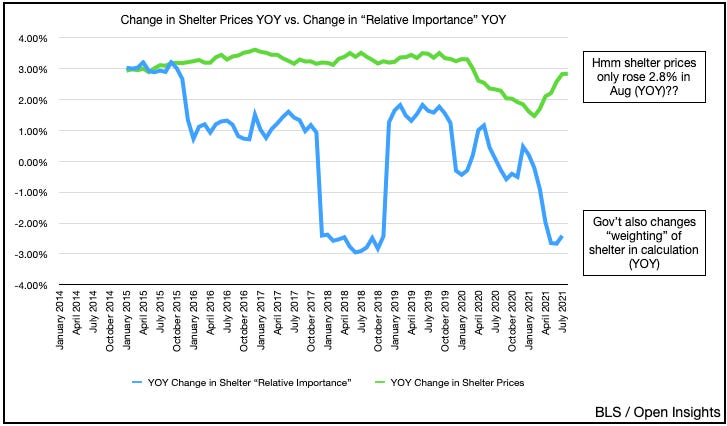

Now we know, don't worry about CPI they say. Almost 40% of CPI is housing (a composite of homeownership expense and rent), and housing is fine. Just look, housing costs (i.e., “shelter”) have only increased 2.8% YOY in August.

Does that make sense though? Because the real world sure isn’t showing 2.8%. Not only have home prices rocketed, but so too have rents.

Note the locations above where we’re seeing explosive rent growth. It’s not just New York, Boston, San Francisco, or San Jose, but secondary cities. We’re not usually cynical, but on the whole, 2.8% seems awfully low. What’s interesting is not only is the CPI indicating that housing costs have barely budged, but the weighting of what we spend for housing has also gone down. Again, doubtful. We know, however, that housing typically lags based on how the data is collected (i.e., ~12 months), which only pushes the problem on the CPI further into the future. Said another way, as inflation falls for certain transitory items (COVID related), the largest component will begin rising as those increased housing expenses ripple through. Still for now, even with the lag we would’ve expected some of the rising prices to creep through. Are wages to blame?

The Hamster Wheel

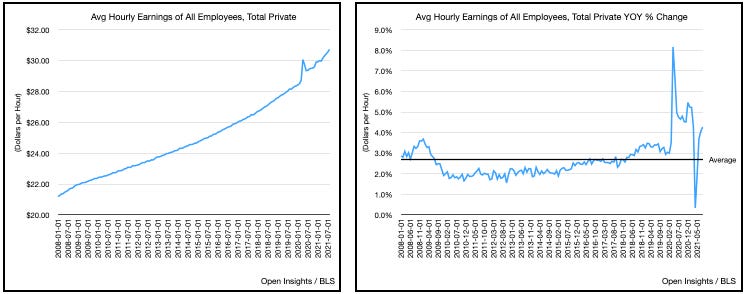

Well housing costs are driven by wages. So maybe wages are taking a dip, or have leveled off. Hmm . . . nope.

Actually what’s even a bit scarier is that despite seeing all these headlines . . .

. . . “real wages” (i.e., wage growth adjusted for inflation) have actually declined.

So even with the wage increases, if you get the feeling you’re on a giant hamster wheel lately and getting nowhere quick, that’s not true . . . you’re actually going backwards a bit.

What’s even scarier is that the wheel may just speed up because of rising energy costs. What’s happening to natural gas prices in Europe is a bit of a precursor to what we think will happen to energy costs worldwide. Remember, increasing energy costs plays a large factor in driving inflation since it’s a key input cost into everything, transportation, plastics, petrochemicals used in manufacturing, etc. We can see energy’s impact this year as rising prices have contributed an outsize influence on bumping inflation higher (dark blue bars).

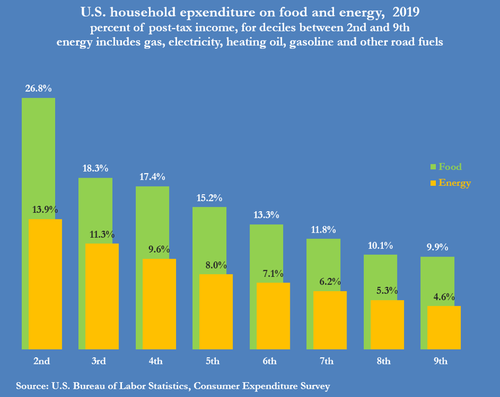

Unfortunately, the impact of higher energy costs will fall disproportionately on the lower income groups.

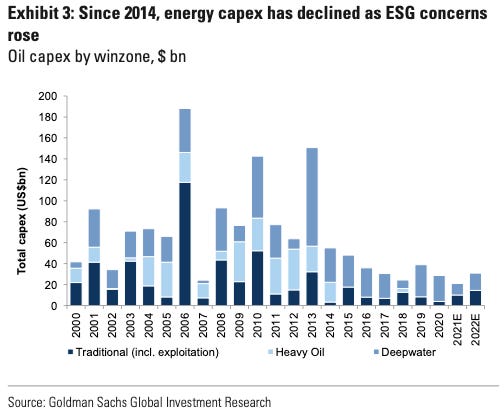

As we’ve noted earlier, the same supply/demand dynamics that are spiking NG prices in Europe are a harbinger of things to come for the global crude market (here, here and here). The dearth of investments are already biting, and as demand continues higher, but inventories lower, we’re starting to now eat into the winter stores.

Don’t think the producers will bail us out because anyone within OPEC+ is following the script and continuing to add only gingerly more barrels to the market. Those outside of OPEC are parroting Mike Wirth’s, CEO of Chevron, comments “[w]e could afford to invest more. The equity market is not sending a signal that says they think we ought to be doing that.” So it all leads to a constrained world, and a constrained world thirsty for oil means higher oil and petroleum product prices.

Don’t think the politicians haven’t noticed. They have, but in trying to get ahead of the political fallout, the attention is misdirected.

Pandemic profiteers, if there is such a thing, isn't causing increased energy prices, it’s the dearth of investments caused by ESG, inadequate investor returns, environmental regulations, and a general disregard for anything “old economy.”

So what does this all mean? Things are about to get expensive. The very thing that moves things and are the raw material for things is about to get pricey. That expense will be borne largely on the backs of the lower income groups as they fork over a higher percentage of their income to compensate.

Won’t that create a backlash though? Sure, which is why politicians are already addressing it. If our social and political impulse (i.e., the “rise of populism”) is to shrink the widening income inequality, guess what direction wages will have to go to compensate if spiking energy prices lead to further spikes in inflation? If wages go, housing goes, and if housing goes, inflation goes. As Rihanna’s sang . . .

Round and around and around and around we go

Oh, now tell me now, tell me now, tell me now you know

We sure are on a giant hamster wheel, and if we’re right about energy, get ready to run faster.