Inflation is . . . Transitory

May 14, 2021

Is it just us, or are all central bankers seemingly like . . .

Then again, what else would they say?

Really, what else could they say?

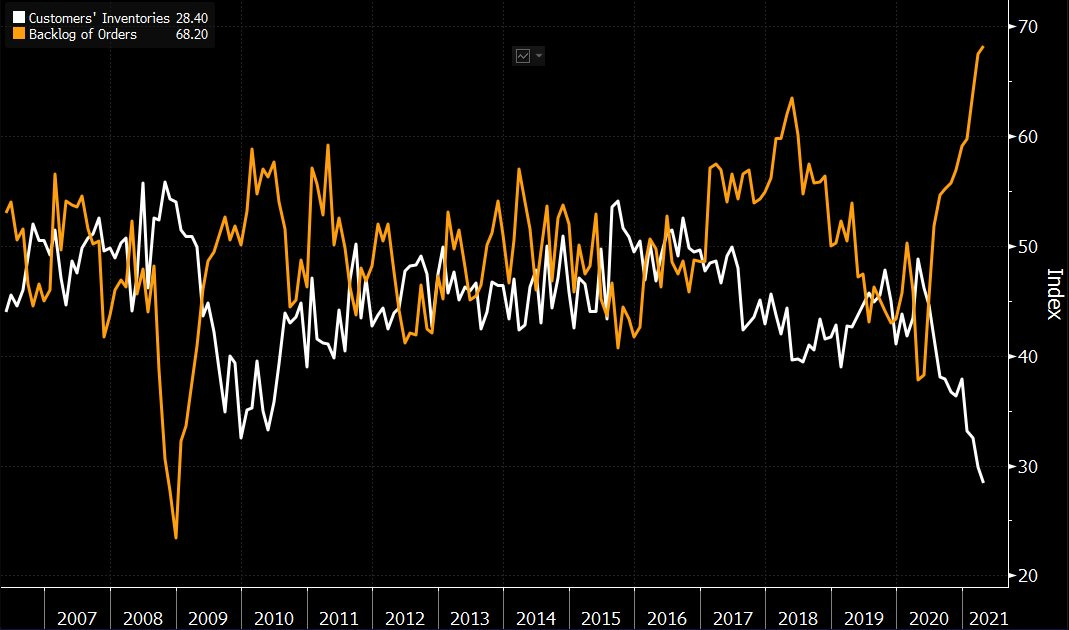

Of course they have to say it’s transitory. We know that, you know that, and most importantly, they know that. Heck, we showed it last week. You can’t have this and not call it transitory . . .

. . . and you certainly can’t do this and not call it transitory.

What’s interesting is that the above doesn’t even take into account what we’ve done for 2021 (and are about to do). Tack on another $4.5T between Biden’s American Jobs Plan ($1.8T for infrastructure) and American Families Plan ($2.7T for social net), we’ll easily duplicate our 2020 largesse.

So yes . . . don’t believe what the market is telling you.

This bout of inflation? Transitory.

Surely this can’t be right though, can it? I mean we all know Jedi mind tricks only work on the weak minded, and our years of slaving in an oil trade has tempered our little brains. We’re supply-siders, we know that if you underinvest in producing commodities (be it metals, minerals, or energy) eventually, logically, we’ll have less of it, right? So even if demand returns, there’s already a mismatch between low supplies and “normal” demand. We haven’t even factored in “elevated demand”.

Our detractors though say that isn’t the right lens to view the issue. First, inflation is a transitory issue because of base year effects. As we measure inflation on a year-over-year basis, today’s prices will naturally be higher because we’re comparing them to the depths of 2020 when overall demand and prices collapsed. Second, inflation is elevated now because we’re all still stuck at home buying goods, but once we reopen and shift our spend to services, the demand for commodity intensive “things” will abate.

Really? Because is sure doesn’t seem like that. We’re already seeing a supply issue, but if we were to address the demand side, then it sure appears that our appetite for “stuff” is being born from a trifecta of stimulus induced spending, massive material investments into decarbonization/electrification, and the need to restock global inventories.

If so, at least 2 of those 3 things aren’t transitory and will take time to recover. Nah. It couldn’t be that. Okay if not, what else?

Oh here’s one . . . jobs. BCA Research says it’s jobs, that’s why it’ll be transitory. Because as they contend, you can’t have secular inflation if you don’t have jobs. BCA is channeling a bit of a BlackPink k-pop song here, singing . . . “Oh wait til’ I do, what I do, hit you with the DDU-DDu-DU.” Here it goes . . .

Low employment = low wage pressures = little rent increases = housing is a large part of inflation calculations = no long-term inflation. Whoa. Let’s run that tape back.

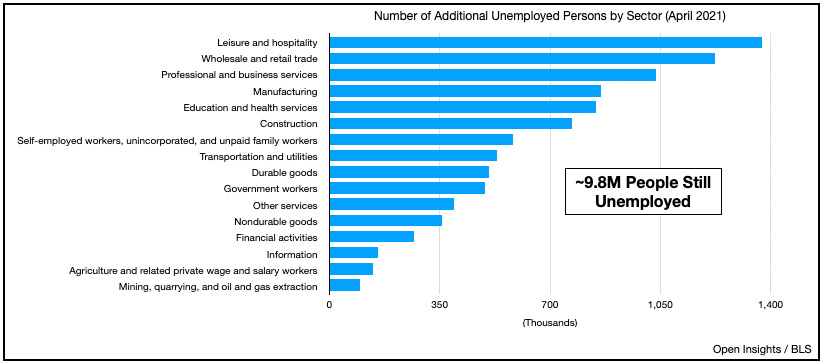

Okay, you can’t have inflation if there’s high unemployment. Eventually stimulus spending will fade, and demand will evaporate because nobody has jobs, or if they do there aren’t any wage pressures (too many candidates for too few jobs). We can kind of see that. So many still out of work . . .

. . . and not just out of work, but there’s a pool of people who’ve left the labor force.

Interesting. Essentially BlackPink . . . err BCA . . . is saying that our 6% unemployment rate isn’t the full picture because not only are people unemployed (our 6% unemployment rate = ~9.8M workers unemployed), but many have left the labor force (i.e., ~3.5M more workers). With no jobs, people can’t pay more for housing, and since housing comprises a large portion of the inflation index, no secular inflation.

Intriguing, but somehow we can’t even get to the rent/inflation conclusion because we’re not entirely sure that the jobs won’t be there. Let’s step-back a bit. Are ~9.8M people really unemployed? The figure is correct, but aren’t there always people unemployed?

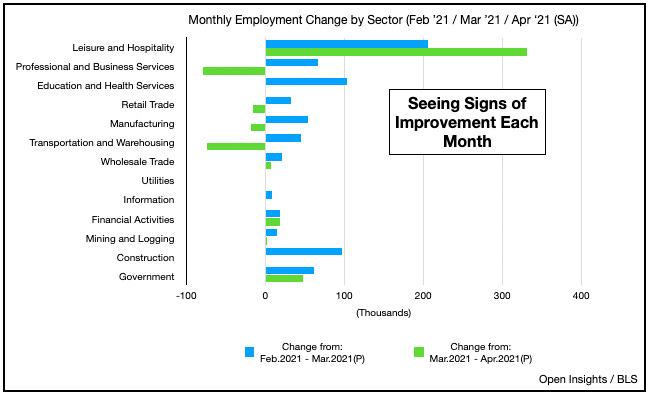

So it’s really ~4M more people unemployed. Even pre-COVID, we had a 3.6% unemployment rate (i.e., 5.8M people out of work). Moreover, for those 4M workers unemployed, furloughed workers are already being rehired . . .

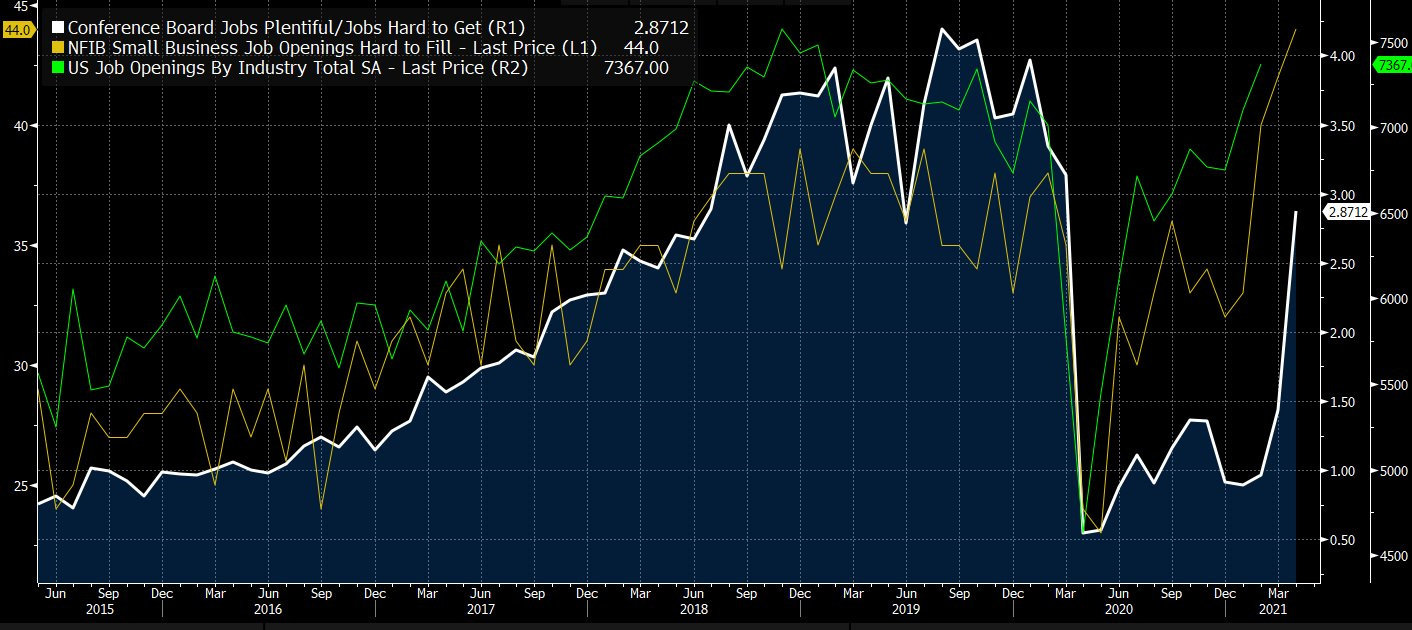

. . . and more importantly, jobs are plentiful on almost any measure (private surveys to public government JOLTS data).

We’re also seeing signs of improvement in the hardest hit industries (leisure and hospitality and retail),

and as the weeks have progressed, our initial claims for unemployment benefits have been declining.

Lastly, we’d contend that the “permanent” job losses noted above won’t be permanent. Many of those jobs will eventually come back as we revive our economy. The number of bankrupt restaurants, retail outlets, etc. will eventually be replaced and locations revived. Given the liquidity, low interest rates, and government assistance, the revival will almost certainly be quicker than in prior periods where on average it took 4-6 years for “permanent” job losses to return. Again the COVID pandemic was a liquidity crisis and not a solvency crisis, hence businesses overall faired better than during the Great Financial Crisis.

What’s interesting is that we’re in a bit of a transition period, a time when the economy is starting to regain altitude and health restrictions/capacity limitation are lifting. It will take a few more months for normalcy to return, but we doubt it will take years. What’s permanently lost won’t remain so, and as we’ve written before, eleven months of lockdown aren’t sufficient to change our habits. Eventually, inevitably, we’ll return quickly to what we were doing previously, which means we’ll need the labor force to provide the services. Enhanced unemployment benefits from the federal government are also set to expire in September, and as that clock ticks to zero, expect recruiting to begin in earnest.

Lastly, as we noted above, we’ve yet to pass and spend Biden’s $4.5T of additional stimulus on infrastructure and social services. Those are real dollars, and even with the tax offsets (which we’re convinced will inevitably come up short when tallied on a CBO “forecasted basis” and in actuality when tax receipts come-in), it will materially buttress the economic recovery. So will slack in the labor market mean inflation really is transitory? We doubt it. We disagree that inflation will be transitory, but can at least agree that it will be . . . until it isn’t.