Shooow Me the Inflatiooooon . . . 14 pics.

February 23, 2021

We can’t possibly have inflation can we? Supply constraint and heightened demand are just byproducts of an unusual black swan right? We can make the argument that our current stay-at-home lifestyle distorts demand for all manner of things. Surely cooking individual servings at home leads to increased food waste vs. restaurants that are more economically conscious of the costs. Our work-from-home lifestyles also means we simply “buy more stuff,” which artificially increases the demand for goods. Couple this with low inventory as retailers destocked throughout COVID 2020, prices could and should increase. Yet, this is all transitory right? A blip on our decade long deflationary road.

Inevitably, doesn’t all of this abate as the economy unlocks, as we resume outdoor activities? We’ll eat at restaurants again, places that are designed to efficiently serve food to larger groups of people. We’ll “buy less stuff” as we redirect our dollars to services and wean ourselves from goods that distract us from our four white walls. Stores will restock and shelves will refill. Supplies will increase.

Then there’s housing and medical care. Will home prices keep increasing if people begin to list more homes for sale once COVID fades (i.e., who really wants to have an open house with COVID . . . ick)? For rentals, will landlords be able to raise rents this year, or next as we recover? Doubtful as major cities have emptied the past year. For healthcare, will Biden’s plan to widen healthcare access temper rising healthcare costs in the coming years as Obamacare did?

Wouldn’t the totality of all the things above be deflationary? You’d think . . . but then we think. Maybe it’s all just words. Words and thoughts we’re throwing out there to think inflation couldn’t creep up on us. Words that seem to fail when we’re looking at pictures of late. Just 14 pictures, a tiny more than a baker’s dozen.

Pictures of . . .

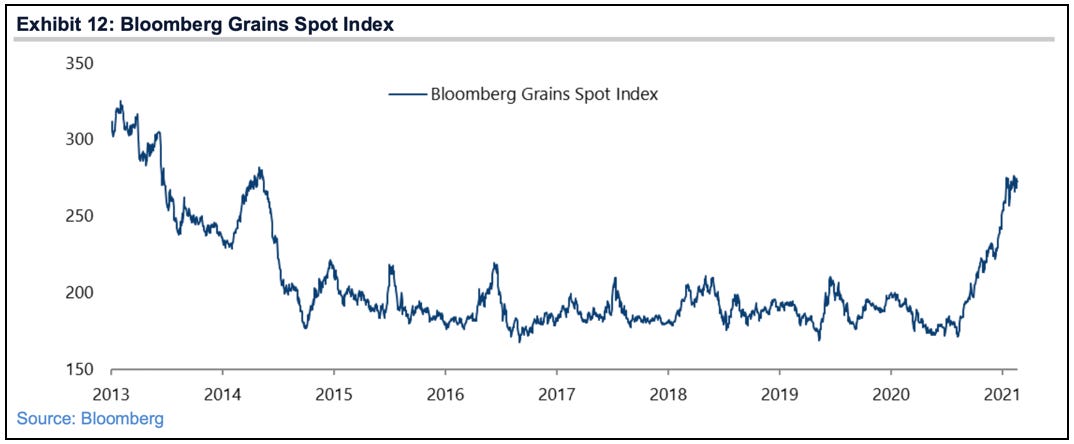

Things we eat . . .

Things we, piggies, chickens and cows eat . . .

Things we build with . . .

Things that go into the stuff we make . . .

Things that move things . . .

Things that matter (overall commodity indices) . . .

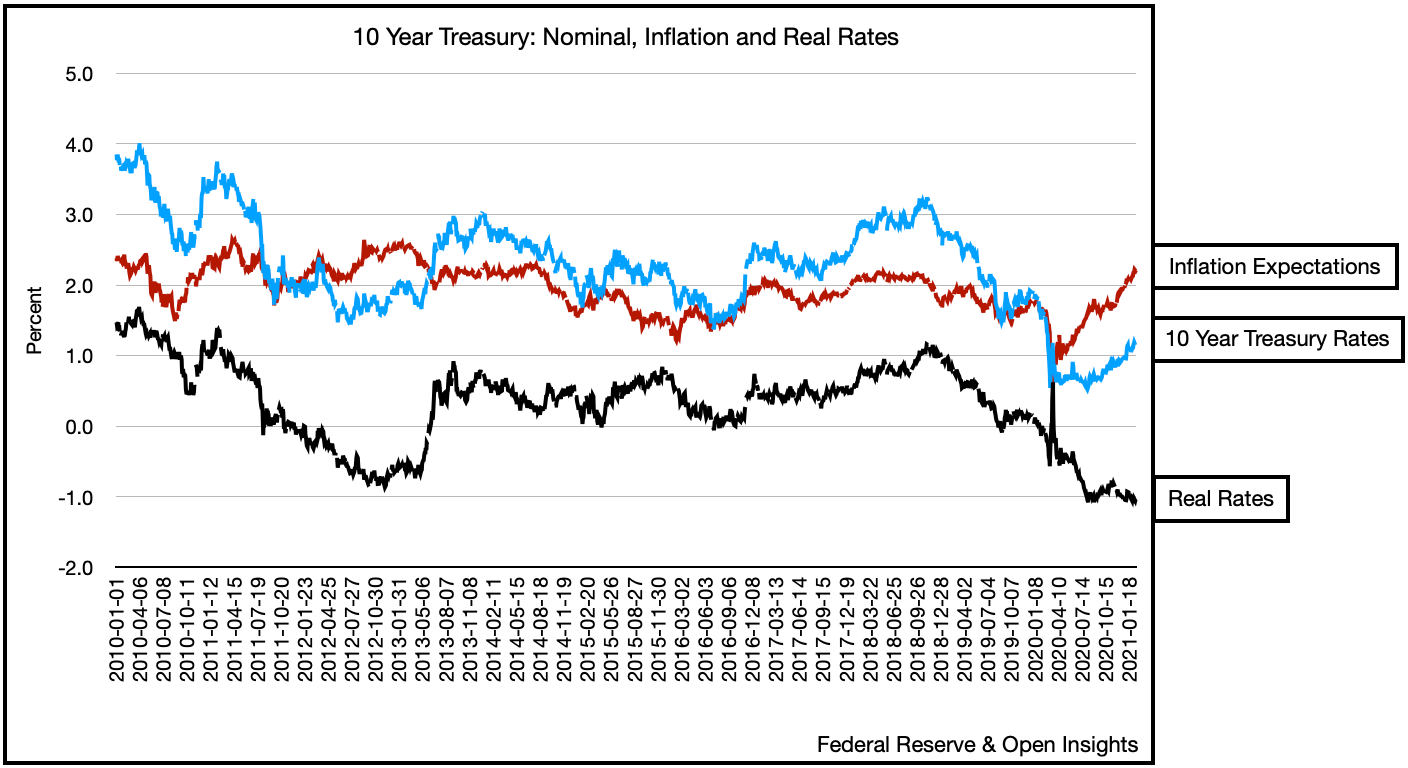

. . . and ultimately things that count (money), more specifically, the cost of money.

Maybe in the end, what we said earlier was all just empty words because the pictures are sure trending up and to the right. It’s tough to argue with this because as they say, a picture is worth a thousand words, and the treatise above may just be telling us that inflation could be about to run . . . no matter what we say.

(We’ve explored inflation in prior articles and why this time could be different than say immediately after the Great Financial crisis. It’s something we’ve been focused on will as it will have direct impact on our oil thesis. We’ll continue to update our readers going forward, but be sure to check-out our prior articles for additional background on our thinking.)

(Links below):

Issue 1: Our First Newsletter

Issue 2: Get to the Choppa! Helicopter Money

Issue 3: Oil’s Impending Parabolic Recovery

Issue 4: Global Debt & the Pandemic

Issue 5: Inflation? Buckle-up . . .

Issue 7: This Isn’t a Bubble . . . That’s Coming (Part I / Part II)