Inflation Will Get Mufasa Scary . . . Easy as 1, 2, 3

December 10, 2022

We’re looking the wrong way. We’re looking the wrong way because even though some of us don’t believe inflation is “transitory” the market sure is acting like it is as inflation expectations have only crept up the past few weeks despite the blistering CPI and PPI prints of late.

No doubt today’s 6.8% print will shock many, though any visit to the grocery store, gas station, or open house would’ve given you a heads up. Like in the Lion King, things are going to get scary . . . Mufasa scary . . .

and things are about to get more expensive.

Now many commentators have articulated that inflation is indeed transitory because pandemic constrained supply chains coupled with a surge in consumer demand have grossly exacerbated the shortages (perceived or real). Hence the prices of durable goods (i.e., cars, appliances, etc.) have soared in the past year. The prevailing argument though is that once supply chains clear up, prices of durable goods (i.e., those exorbitant car prices, etc.) will calm down and become deflationary as inflation is measured year-over-year. Fair point, but . . . and here’s the big BUT . . . what about the other 88% of the things we spend our money on? Inflation’s going higher . . . it’s as easy as 1, 2, 3.

What about Shelter?

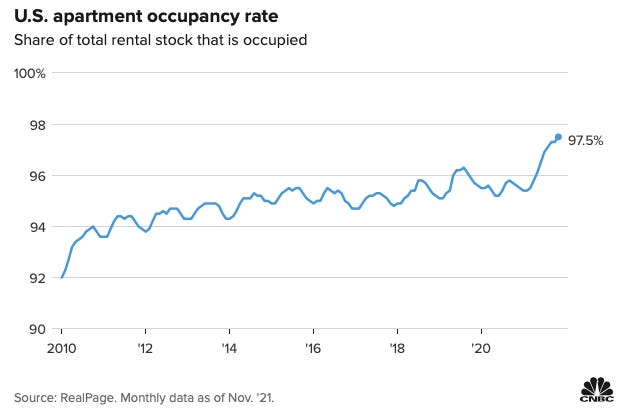

~30% is spent on shelter (rent or an “owner’s equivalent” of rent that’s a proxy for homeownership), and shelter is a rolling 6 month average for six subsamples (prior version of this article noted 12 months, but this has been corrected). The price of shelter lately? According to RealPage, a real estate technology firm, “[t]he annual increase in asking rents for new move-in leases hit 13.9% in November.”

Rising rents are a byproduct of high housing prices, the pandemic’s aftershocks, and rising wages. The rising costs of homeownership also traps renters who otherwise would’ve moved on from apartments and purchased homes. Moreover, some renters are still hesitant to move as companies continue “working from home,” existing rental agreements executed with lower rent prices during the pandemic are still in effect, and rent control stymies movement. Consequently, US apartment occupancy rates have roofed.

Even a cursory search of “rising rent” yields a bevy of articles documenting rising rental prices from California, Texas, Florida and New York, and as we’ve documented, the higher prices aren’t confined only to the large cities as even Tampa, FL, Riverside, CA and other medium/small cities are experiencing the same trends.

Now remember, shelter is again a rolling 6 month average, but with 6 samples, we’re still capturing some of the pandemic 2020/early-2021 costs. Wait until those earlier months roll-off.

What about Services?

~30% is spent on service. The largest cost component of services? Labor. The price of labor lately? 🚀🚀🚀🚀

. . . and it’s going higher because guess what? Despite the wage increases, they aren’t keeping pace with 6.9% inflation (real wages register -2.1% . . . negative 2.1%).

Employers will almost certainly pay more shortly because it’s an incredibly tight labor market, much tighter than pre-COVID. Today, we have 3M more jobs available than the number of unemployed people (i.e., 3x more jobs vs. unemployed today than pre-COVID). There simply isn’t enough qualified people to fill jobs today.

Consequently, it’s why you’re seeing headlines like this . . .

It’s only the beginning, because guess what? You, as a consumer, haven’t even begun to shift spending from stuff to services. If we get back to our consuming ways for services (i.e., travel, leisure, dining, etc.), which are much more labor intensive industries, we’re definitely going to see 4 rocket emojis for wages. 🚀🚀🚀🚀

What about Non-Durables?

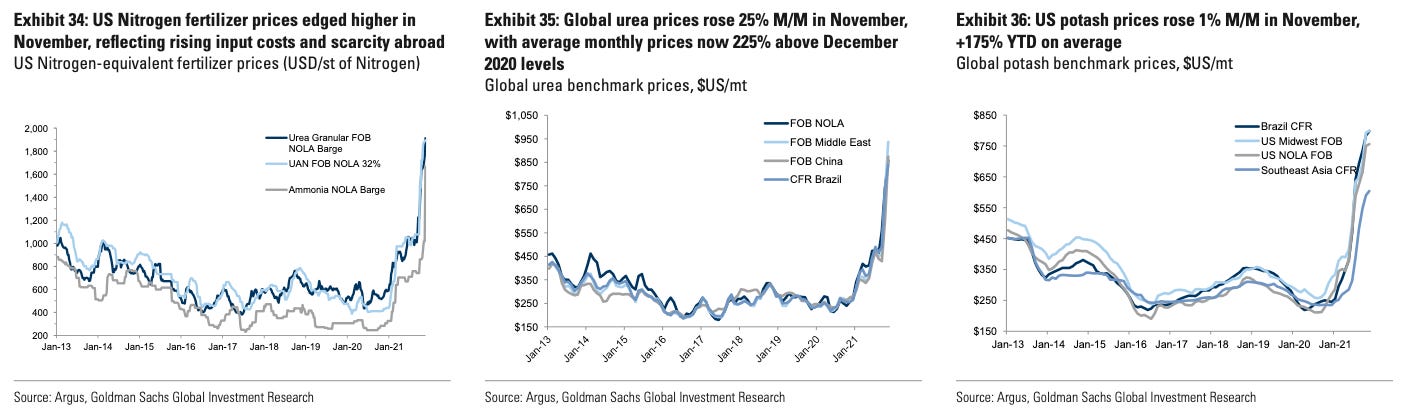

~30% is spent on non-durable goods (i.e., clothing, food, gasoline, etc.). The price of food in the future? Watch-out. Natural gas is a key component of fertilizer, accounting for 80-90% of its cost. In turn, fertilizer is a material cost for farmers. In the case of corn producers, fertilizers account for a third to 44% of the operating costs. As natural gas prices have risen, something we’ve discussed here, fertilizer prices have vaulted. Here’s the cost of DAP, a common phosphate fertilizers.

Here’s the cost of urea, another popular nitrogen-based fertilizer.

Wait a season, and see what happens to food prices in 2022 when the costs start rippling through. Farmers will likely cut fertilizer use, which reduces crop yields. In turn, reduced crop yields will impact not only crop products, but also the livestock, packaged-food, and beverage industries. For instance, rising soy bean prices will affect dairy and meat producers, and rising corn prices will impact high-fructose corn syrup prices for drink makers. As Elena Sakhnova, a VTB Capital analyst stated “[f]ertilizer cost is one of the biggest drivers behind global food inflation now as prices for all three groups of nutrients, potash, phosphate and nitrogen, are at levels not seen for about a decade.” The situation in the US is somewhat better, but that’s because we have an ample supply of natural gas. Nonetheless, natural gas is getting more expensive worldwide, and both agriculture and NG markets are global, so eventually rising prices will reverberate.

What’s occurring in the natural gas market is also a corrollary to what will happen for the oil market. Years of underinvestment and depleting inventories are setting us up for higher crude prices. In turn, gasoline, diesel, jet fuel and condensates/NGLs used to move and manufacture consumer goods are also headed higher. As we’ve detailed before, this is a structural shortage, one which we’ve yet to feel the consequences, so we anticipate not just the energy component of non-durables to rise, but the cost of goods that rely upon energy to rise. Could the next few months see slightly lower energy prices because of the recent decline in oil/gas? Sure, but that’ll be transitory in the face of the structural issues. The trend is clear, and it will likely be higher. So inflation for food, energy, etc.? Yeah, more to come.

In the end, while we believe the cost of durable goods will decline (and be deflationary) as supply chains fix themselves, the 80/20 Pareto principal will kick into gear. Much of what we spend our money on will continue to become increasingly expensive as we head into 2022 and our consumption patterns revert to the norm. This is what our COVID recovery looks like and higher prices are certainly in our future. It’s as easy as 1, 2, 3.

So in the end . . . Mufasa!

Please hit the “like” button below if you enjoyed reading the article, thank you.

What is transitory is the recent pullback in oil!