Inhale . . . Exhale . . . Panic . . . Namaste in Oil

March 24, 2023

Clear your mind in times of stress.

Let the emotions flow through you as you inhale the uncertainty.

Acknowledge the anxiety and the fear.

Accept it.

Exhale that which you cannot control.

Empty your thoughts.

Inhale, exhale . . . just breathe.

Namaste.

Yeah, that’s not gonna work . . . too many thoughts swirling like shards of glass.

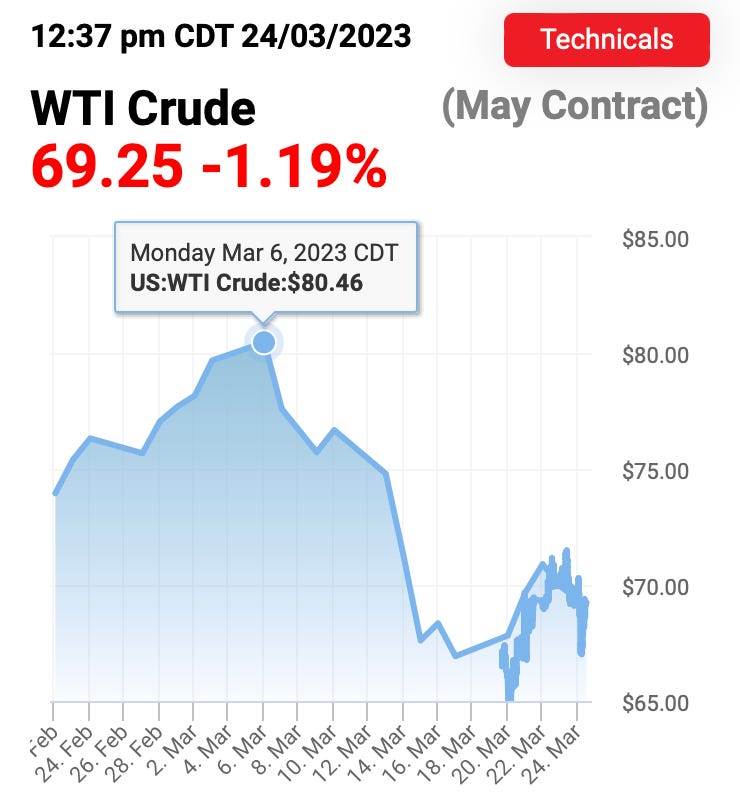

Oil prices . . . $68/bbl WTI and $74/bbl for Brent.

Bigly down in the past 2 weeks from $80/bbl WTI and $85/bbl for Brent.

SVB, Credit Suisse . . . BIG financial uncertainty. Financial contagion. Run on regional banks, held-to-maturity issues, mark-to-market losses. Risks lurking in shadows, shadow banking. Who knew shadows needed banks.

Welcome to the Great Financial Crisis (“GFC”) 2.0.

Oh wait, maybe it’s not because banks are well capitalized.

Oh, but again . . . shadow banking issues (i.e., deals struck by hedge funds, insurance companies, pensions, and other less regulated financial player who migrated the Wall Street casino games to the back street post-GFC regulations). Back-alley-ways where the table stakes are even higher and the leverage even more uncertain. We said it before . . . people are swimming naked, and the tides’ going out.

So the global economy will crash, or at least slow materially as credit tightens. That makes some sense as bank’s pull back from extending credit amidst the uncertainty. Since regional banks are experiencing the most stress with depositors fleeing, they’ll tighten lending standards, become risk adverse, and keep as much liquidity as possible. Regional banks make about 30% of all loans in the US, but given their familiarity with “the neighborhood” they make 70% of commercial real estate lending.

So even if just this group of lenders dial-down the risk, economic growth becomes much much slower. It won’t be, however, as even big banks tasked with bailing out their smaller brethren will pull-back given the backdrop. Thus, credit will contract, and so will the economy as the capital that fertilizes it declines.

That makes some sense.

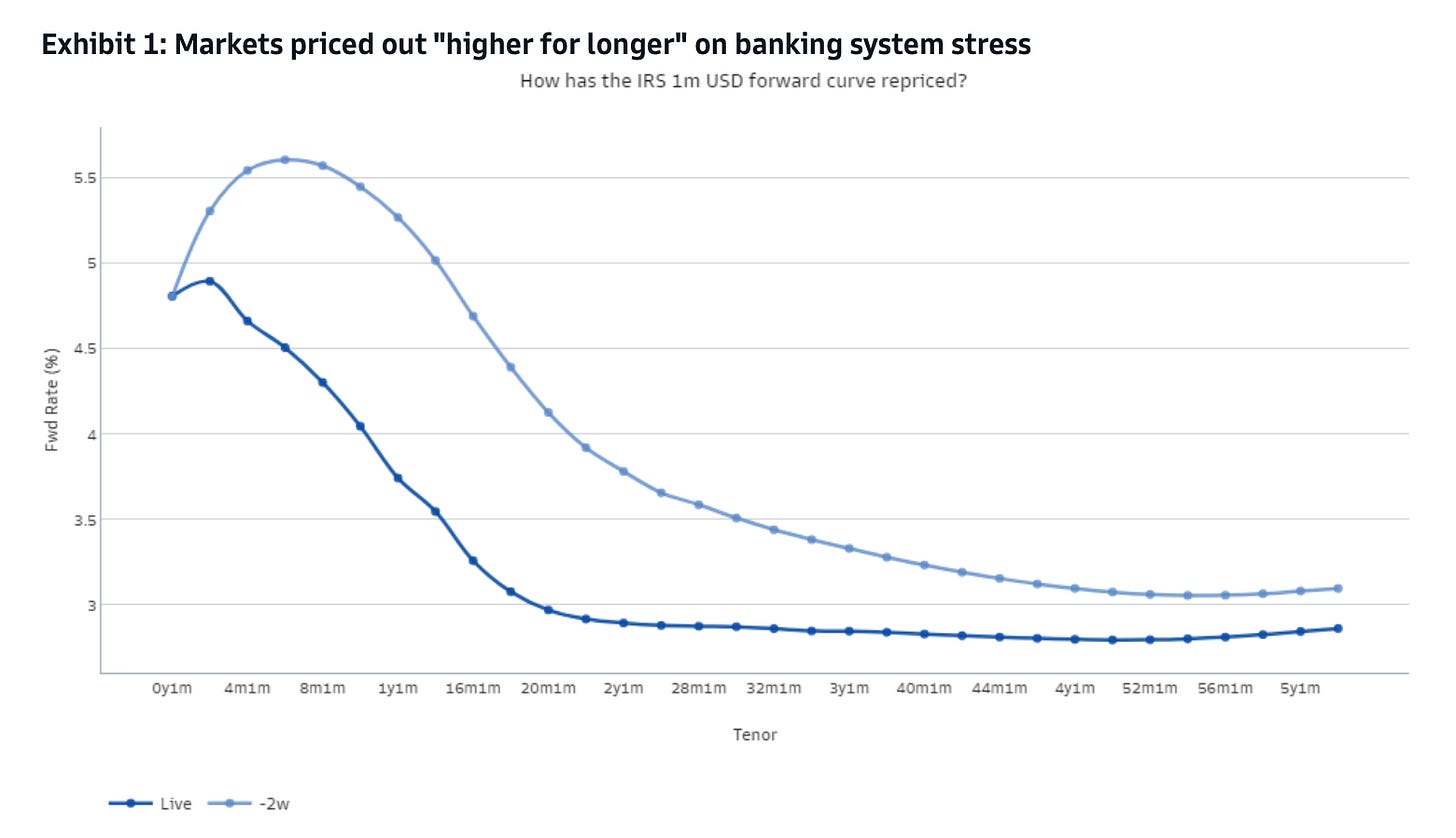

Maybe Apollo is even right. Right in that rates aren’t even at 5.5% today, we’re at nearly 6.5% if you factor in the indirect impacts of what the past 2 weeks have wrought (e.g., tighter lending standards, lower risk appetite, need to maintain higher liquidity) .

Besides the Fed just raised rates by another 25 basis points, 0.25%, so interest rates are still going higher. Yet, are they? The market is already betting that rates will have to start coming down before the economy does.

If SVB and Signature’s failures weren’t enough, Credit Suisse’s engineered takeover by UBS before its total collapse should call into question the sagacity of further rate increases. So for the time being, like the Swiss, the market is calling UBS, and with an emphasis on the last two letters.

How’s that possible if the Fed’s OG mandate is price stability? Wrestle inflation back below 2%! Yeah but is it really feasible if there’s contagion risk? Moreover, do they have to do it so publicly with interest rates when they know QT is much quieter, and the indirect affects of the current uncertainty coupled with tighter banking regulations going forward will allow them to hold (or cut rates), and rates would still be significantly higher than even 2 weeks ago.

Remember . . . 6.5%

So yes, the market is stressed. It’s stressed, because we need to price in these things. There’s so much uncertainty, which is why there’s so much volatility. While I ponder all of the above though, I come back to the notion that the economy, as uncertain as it is in the future, is still relatively robust and healthy today.

Furthermore, I do wonder . . . should it be this distressed? I mean . . . THIS DISTRESSED?

Yes, the economy is slowing, and has the potential to slow even more in the coming quarters, but is this really 2020 COVID slowing? 2008 GFC slowing? That seems to be the perception.

Perhaps. As a CFO I used to work for was found of saying “perception is reality.” To be honest, I always found that phrase to be nonsensical though, but I had neither the courage, nor conviction, to challenge it. Maybe it’s true today though? Still it’s amazing to me that the market’s perception of what’s going on is GFC level pessimistic, and it’s MORE THAN COVID 2020 pessimistic.

Early days of global pandemic? Be as pessimistic as you want. I support you. Today? Seems at least a bit better wouldn’t you say?

Yet, that’s where the market’s at. It’s seeing risks everywhere, and I mean LITERALLY EVERYWHERE.

Which to me seems . . . a bit overdone, a tad overwrought? Yet, that’s the market, and that uncertainty has trickled in and detonated the oil market . . . at the beginning of last week . . .

And at the beginning of this . . .

Arguably all of this is as we’re seeing fundamentals appear to be improving.

We get it though. We get that you’re uncertain, and the market’s scared. We get that all of the swirling narratives are creating incredible volatility, and casting doubt on everything you knew, or held to be true.

Could some of it be right? Absolutely. Will much of it be wrong? Almost certainly. Still when positioning becomes this dislocated, this hysterical, it helps to take a step back and take a deep breath.

Relax, clear your mind, and breathe.

Namaste.

Sell everything when it’s already so oversold?

Nah. Imma Stay.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Thanks for doing the work to put this info out for us!

I'm super pessimistic on everything, so I loaded the boat with calls on NVDA and puts on everything oil related!