Iran / Israel War - In for a Penny, In for a Pound

June 13, 2025

Scrap it . . . what we originally wrote for the week has been upended by geopolitical issues. Namely the Israel / Iran attacks in the past 18 hours. No doubt you’ve read about them, and as we head into the weekend oil prices have rocketed upwards. Not just today, but over the last few days.

We’ve had two bounces in the last week. One a few days ago when the war drums began pounding . . . and today’s premium coming on the heels of Israel’s initial attack.

We keep this in mind because it’s helpful to think about the “unaffected” price. Before all the chaos, oil prices hovered in the low $60/barrel range as bearish sentiments abounded:

OPEC+ releasing additional supplies of 411k/bpd every month since May;

Guyana and Brazil bringing online production from long lead projects that are finally getting started;

Possibility of recession in H2 2025 because of the slowdown in global trade (impacting global demand);

Low/no geopolitical premium as Russia/Ukraine impasse and Israel/Iran tensions haven’t impacted oil supplies.

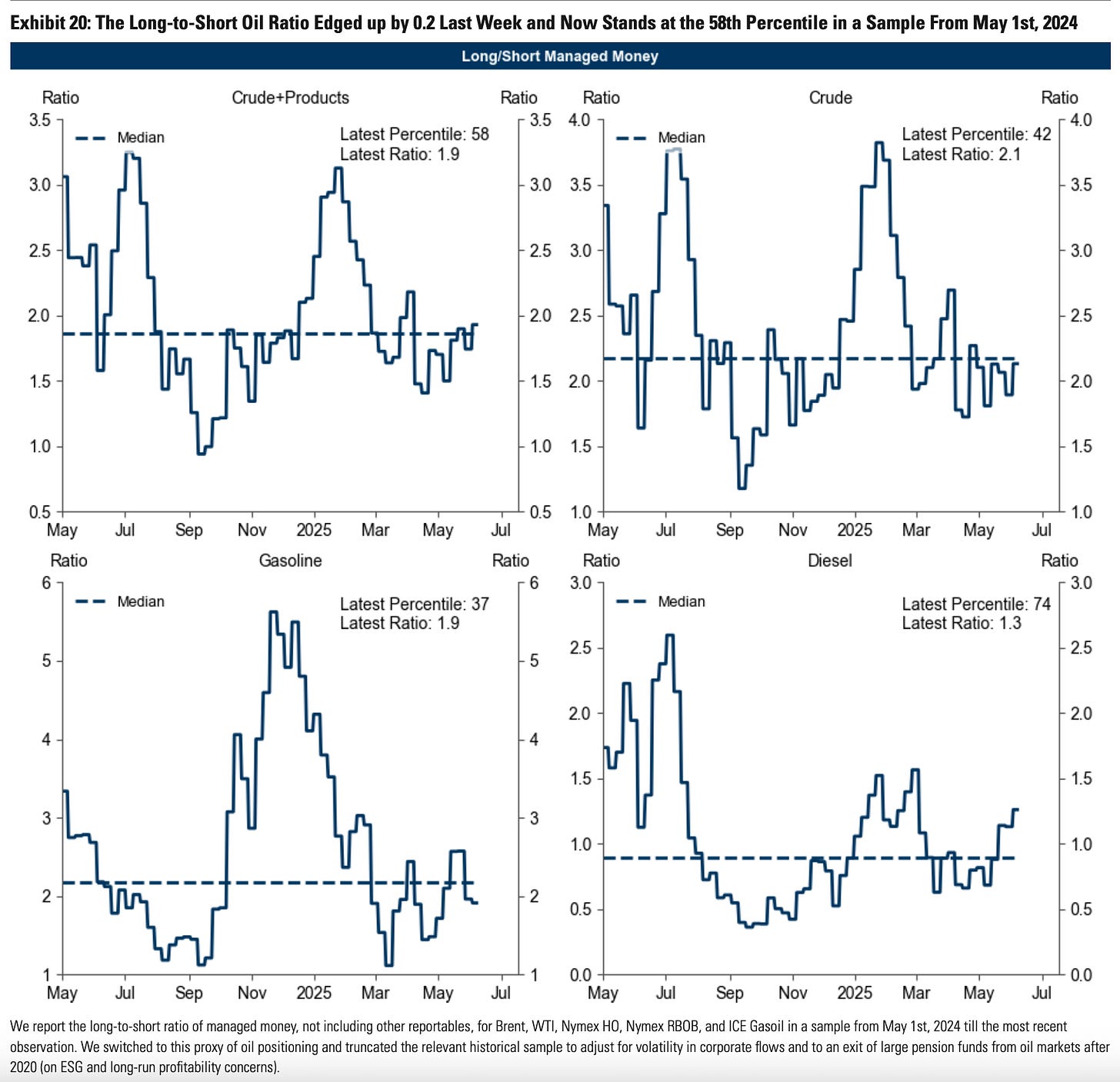

Mix it all together and we had a bearish cocktail of assumptions that suppressed oil prices. Although inventories would portend a $70/barrel price, given growing inventories in Q2, and potentially increasing inventories in Q3/Q4, few are long oil, and in fact many were short.

So the attack now comes as a surprise. Not for everyone, as surely some people were tipped off to “preposition.” For the broader market though, yes, it was caught flat footed. Now CTAs and momentum funds will play catch-up as they push-up prices. Higher begets higher if missiles keep flying and bombs keep falling.

Still, most of this will fade if oil infrastructure remains unaffected. If Israel, guided by Trump’s aversion to high oil prices (as high prices lead to higher inflation and higher interest rates), refrains from attacking oil facilities. Whether it’s Iran’s Kharg Island, which is one of the countries main distribution hubs, or another facility, if these assets are left untouched, Iranian oil, which is largely flowing to China can continue. In turn, if it continues, then oil prices will decline. In the past, that’s what happened. Attack, but in a limited scope (see October 2024). Attack, but with advance forewarning. Attack . . . but largely for show.

This time though. This time (dare we say it), seems . . . different?

There we said it.

This time, it’s personal.

Because really, what makes things more personal than existential threats? Your opponent questioning your very right to exist. If Iran was willing to sanction and fund a horrific October 7th massacre that killed ~1,200 people, it’s almost assuredly a regime that would eventually provide a small yield nuclear device to its proxies (no we don’t think they’d actually ever really launch one themselves). Israel is slightly bigger than the size of New Jersey. Imagine what even a small nuclear detonation would do to that country. Unlikely you say? Maybe, but Iran has already pledged to extinguish Israel’s very existence, which means we’re not talking about end goals, only about acquiring the means to achieve them.

As for Iran . . . this too is personal now. Forget theocracy, religion, and all that. Israel just assassinated the Ayatollah’s entourage. Go after Taylor Swift’s Squad, and you’ll quickly find yourself on her hit list.

If you think the elimination of Iran's Quds Force General Qasem Soleimani in 2020 (which led to retaliatory strikes against US Middle East bases) was personal, what happens when you conduct targeted elimination strikes against these folks?

Decapitation strikes . . . sure feels existential. So after these initial attacks, and Iran’s counter attack, we wonder if this can stop quickly.

Disarming Iran’s nuclear capability isn’t the only goal, the secondary goal is to prevent them from reacquiring it, which means eventually targeting the very economic engine that fuels their ambitions . . .oil (i.e., energy infrastructure).

What has previously prevented US administrations from endorsing that plan has been the fear of spiking oil prices. Fortunately, whether intentional or by happenstance, oil prices started this conflict significantly lower thanks to Liberation Day and the uncertain economy. At near $60/barrel before the fighters and missiles flew, even the recent 20% climb puts us slightly below where oil prices were at near the beginning of the year. Said another way, even if it moved higher, we’d still be well below the +$100/barrel reached in the beginning days of the Russia / Ukraine war in 2022.

Today, the cash generated from sanctioned Iranian oil dwarfs any other industry, and it’s the lifeblood for what keeps the Iranian regime in power. Take that away, and you’ll throw the entire country into poverty, and poverty inevitably brings political instability, which historically sparks the outcry for regime change. Is Israel above pushing Iran into such a political quagmire? Likely not because after October 7th, and Iran’s direct attack in 2024, the gloves are off.

You know this time might be different simply by looking at the intensity of Israel’s attack in the opening stages. This isn’t a tit-for-tat slap, this is a closed fist, fully cocked upper cut, delivered with a dose of political deception (i.e., the US’ negotiation attempts). The punch has caught the Iranians off guard, but Iran will respond in the coming days. If so, doesn’t Israel really broaden out the full Iranian target list? We think so. If you’ve staggered your opponent, your home crowd will start chanting for the finishing punch.

Arguably, if regime change actually occurs, that may also be a geopolitical win for the Trump administration in the Middle East, and economic recovery in Iran could spur additional oil production as sanctions are lifted. So long-term gain could outweigh short-term pain. Nevertheless, that’s a longer term pathway.

Right now though, it’s time to dance. The gloves are off for the two fighters. In for a penny, in for a pound, and we’re definitely heading to pound town.

Please hit the “like” button and subscribe if you enjoyed reading the article, thank you.

wow, what if there was an actual invasion ?

"...cash generated from sanctioned RUSSIAN oil dwarfs any other industry, and it’s the lifeblood for what keeps the PUTIN regime in power..."

so we have MAGA's friend russia, that is fully backing Iran, that is battling Israel, that is fully backed by MAGA, who wanted a strike on Iran as long as there was plausible deniability.