Is OXY's Venture into CCS Really Worth Net Zero?

November 11, 2023

OXY Low Carbon Ventures . . .

Net Zero . . .

Net Zero . . .

OXY keeps saying it . . . Net Zero.

Heck their trademark is “Zero In,” so what else would you expect investors to focus on?

In OXY’s own words, OXY’s Low Carbon Ventures (“OLCV”) seeks to leverage Occidental’s legacy of carbon management expertise to develop CCUS projects, including the commercialization of DAC technology, and invests in other low-carbon technologies intended to reduce GHG emissions from its operations and strategically partner with other industries to help reduce their emissions.

In plain speak? Build giant air vacuums that suck carbon dioxide out of the air, and then pump/store it underground.

Giant Dysons. Who would’ve thought. Still they called it Net Zero. Rightly so since the carbon that’s captured and sequestered offsets the carbon dioxide emitted from burning the oil OXY produces.

Suck it Up

Carbon capture and sequestration they call it (“CCS”). If you keep the CO2 in the ground, then the government will pay you $180/mt via a tax credit. Use the CO2 to increase the pressure in your oil fields (to extract even more oil), then it’s worth $130/mt. These tax credits are made possible by Biden’s Inflation Reduction Act that recently passed. The flip side to all this free money are two things. First, it costs alot to build and operate these plants. They cost over a billion each, and even if you build it, operationally they're expensive and require lots of energy. Second, we’re not sure the market’s ready for such technological solutions.

These doubts swirl around for the investing public, and when they do, the market steps back and says “nah,” all that effort? It’s not worth much. Before you “show me the money” all that work to achieve net zero? It’s worth . . . Net Zero.

Why wouldn’t it. You’re building a direct air capture plant (“DAC”) (i.e., giant vacuum) in the middle of nowhere. If there was a face palm emoji allowed on the analyst reports, they’d use it. The endeavor sounds great in theory, but historically, they haven’t proven successful for one reason or the other (we’re looking at you Gorgon in Australia, or even OXY’s own Century plant). Never mind that those plants used decade old technology, and never mind that the Century plant was a point capture system that failed largely because the plant went underutilized. You’d also think that after a decade, you’d know much better the pitfalls to avoid for this new venture (i.e., that the learnings from Gorgon/Century have been better learned). Certainly, there’s been substantial progress made to de-risk this business.

Just look at what OXY’s done . . .

The advancements in partnerships, market development, and construction have been surprising. What was a vague notion on some corporate slides a few quarters ago has morphed into real world momentum.

The first DAC plant, STRATOS, a $1.3B facility in West Texas, is about 30% complete. STRATOS is designed to capture up to 500,000 tonnes of CO2 per year (0.5 mtpa).

As part of its third quarter announcements, OXY also disclosed that BlackRock, through its Diversified Infrastructure business, has signed a definitive agreement to invest $550M and form a joint venture with OXY to own STRATOS. BlackRock will contribute approximately $100M in 2023 and the remainder over the next few years as DAC 1 completes construction and comes online in mid-2025.

OXY has also begun front-end-engineering-design planning for DAC 2. DAC 2 is located on 106,000 acres in Kleberg County, Texas and is designed to capture up to 1 million tonnes of CO2 per year (1 mtpa), but will cost about 1.7x of STRATOS, so give or take ~$2B. Fortunately, the site was selected to receive a portion of a $1.2B US Department of Energy grant (the exact amount to be determined and funded in 2024), which should offset some of the capital commitments. In total, OXY expects to invest $600M/year in it’s OLCV business through 2026.

As for future capital commitments, OXY will undoubtedly look for additional partners. Here was Vicki Hollub’s comments on the matter.

Customer Interest

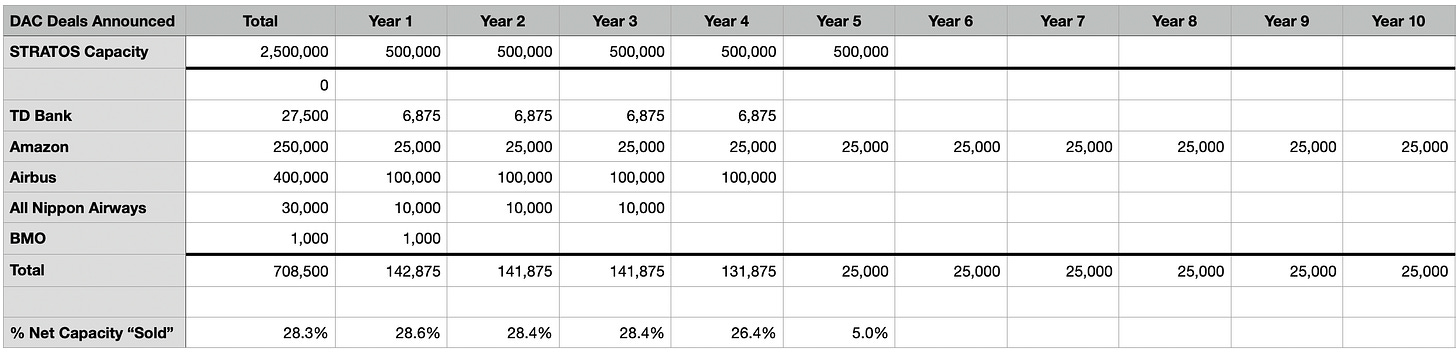

As a new endeavor, even the commercial uptake has been surprising to us. STRATOS, set to be operational in mid-2025, is already 65% “sold out” until 2030. Deals with Airbus, Amazon, ANA, TD Bank, Next Generation, the Houston Astros and the Houston Texans have been announced as the market for technology-based solutions (vs. nature-based solutions) for carbon dioxide removal (“CDR”) credit matures.

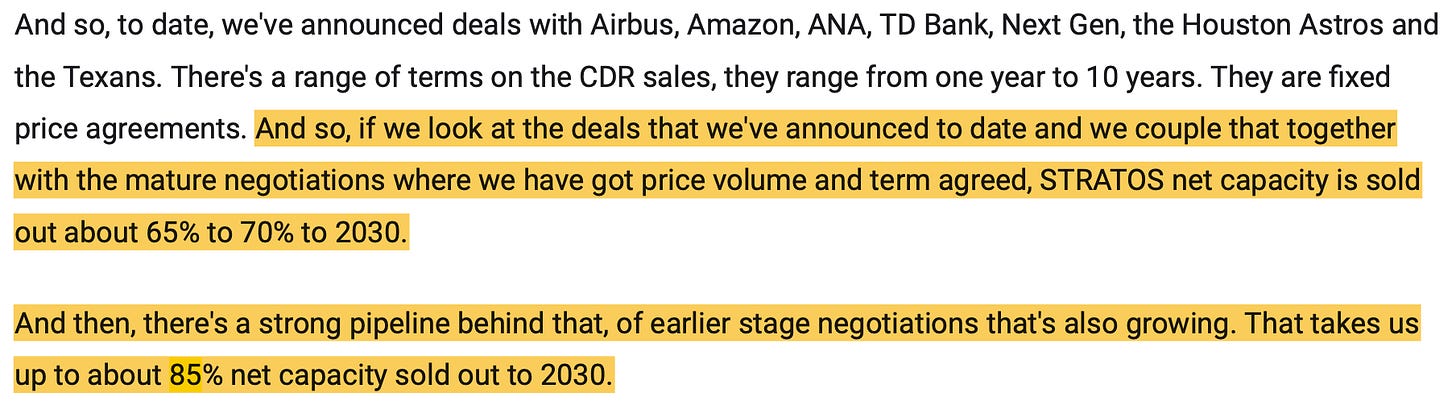

Only about ~30% of the capacity sold have been publicly announced, but OXY has stated that if we include mature negotiations and promising earlier stage negotiations, that figure rises substantially. Here’s Mike Avery, President and General Manger of 1PointFive, OXY’s main subsidiary quarterbacking the DACs . . .

So 60-70%, with a visible pathway to 85%. No wonder OXY is hitting the accelerator. OXY will attempt to target the hard to abate aviation and maritime industries with CDRs. Depending on the cost to operate the DAC, OXY has provided a guide as to the size of the market.

If the company is successful in lowering DAC operational costs, DAC could represent 6-8% of the corporate carbon credit portfolio (+/- 50 mtpa), requiring a buildout of nearly 50 plants.

Lowering operational costs will be crucial to determining how successful this business line will be. It’s partly why OXY just acquired the remaining shares of Carbon Engineering for $1B. By bringing the expertise in-house, the company can better control and ripple through cost control measures.

What’s it Worth?

What’s fascinating is that despite all of the above, the market has assigned little to no value for these endeavors. OXY’s share prices is still being exclusively driven by its oil and gas business, and despite some arguable “real world” value in LCV, the market’s largely zero’d it out.

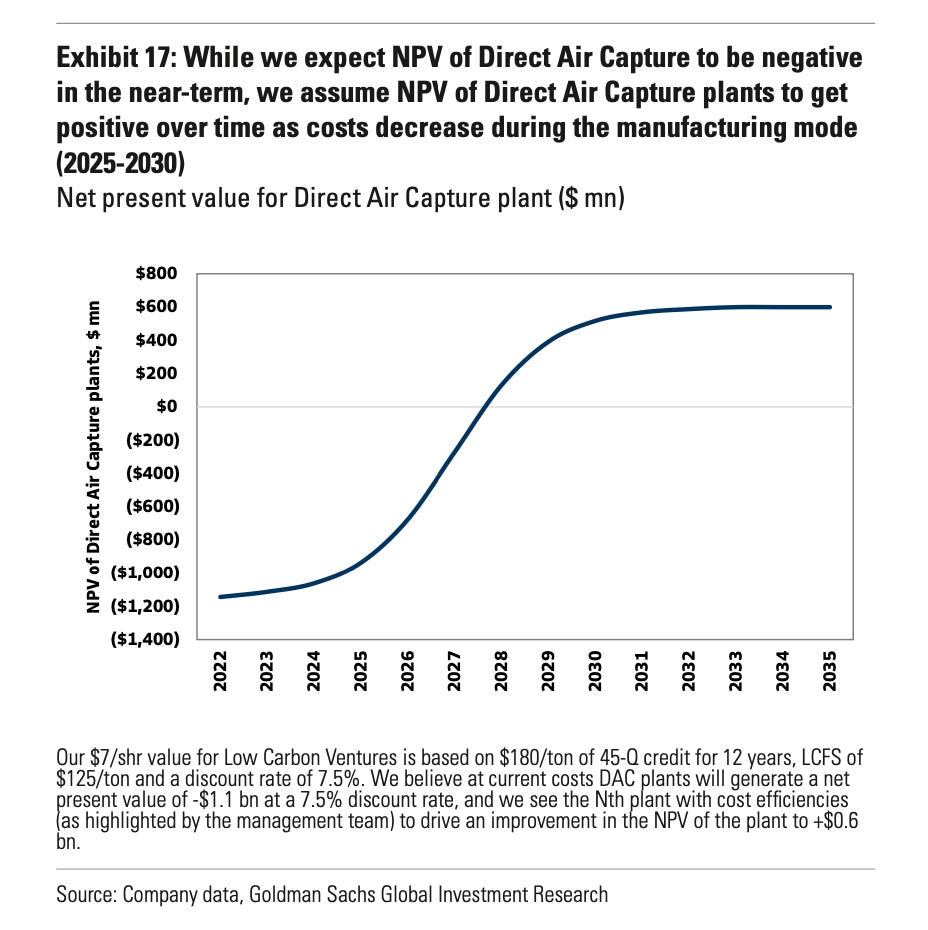

It’s a difficult valuation exercise. Much of the value will depend on whether OXY can successfully lower the cost to operate the DAC, enough to turn a profit. Eventually, the company anticipates the business could be as large as OXYChem, which for 2023 is a $1.5B pre-tax income business segment. Apply a conservative 6x multiple on that and you’re talking nearly $10/share of value just on the value of that business alone. Nevermind that a successful business would allow OXY to develop sustainable aviation fuel and “net zero” fossil fuels, which would certainly command a premium on the market. Still, we understand that even that $10/share “base value” is before you risk adjust LCV. Discount that for the time it takes to ramp the business, then it’s why the market’s assigning little value to it at all.

Ask Goldman Sachs, and they’d tell you around $7/share today.

Based on the credits, and the evolving market, it’s certainly worth something.

At the very least, one has to think . . . it’s not worth NET ZERO.

Let’s come at it from another direction. Even if you zero’d out all the OLCV DAC-ey stuff above, as part of OXY’s LCV business, the company’s invested in NetPower (“NPWR”), a clean energy company with technology that captures 97% of the CO2 emissions in natural gas (“NG”) plants. OXY will incorporate NetPower’s technology to capture and sequester the CO2 emissions from the NG power plants that supply power to its DACs. Yet, NPWR’s technology can be used to replace existing natural gas and coal power plants, so the total addressable market is substantially bigger.

OXY owns nearly 90M shares of this $2.8B publicly traded company (i.e., ~42% via a mix of Common A & B shares, of which there are about 215M shares outstanding), yet none of that value is reflected in OXY’s share price. NPWR's trading at ~$13.30 as we write this article, and one would think 42% of that $2.8B, or $1.2B is imbedded into OXY’s equity value. So call it $1.25/share. So even though OXY is trading at $60.90, isn’t it really $59.65 + $1.25?

. . . $59.65/share . . . that sure seems cheap for a company that’s going to generate nearly $6.5B in free cash flow for 2023 (if oil prices average around $75/barrel).

We get it though, there’s substantial operational risks as OXY continues to execute these plans. There’s neither enough information nor certainty to really build a model (YET) that allows us to pin down what the exact value of this venture is at this time. Without any cash flows, and only foreseeable spend, one could arguably say it’s a net negative, but we think that’s being too pessimistic. At this stage, the technology appears to work, and corporate sponsors and institutional investors are beginning to line-up. Is there hype? Sure, but for an oil company with extensive experience in enhanced oil recovery operations, CCS isn’t a far reach. They just need to get the vacuum cleaners right, and something tells me that their rush into DAC 1 and now DAC 2 in Kleberg County, Texas means this thing’s likely going to work. Vicki Hollub staked her reputation on the Anadarko acquisition, but that eventually (is currently) proving to be prescient. OLCV?

We’ll take that bet.

So $1.25, $7, or $10? Who knows . . . we just don’t think it’s Net Zero.

Please hit the “like” button above if you enjoyed reading the article, thank you.

Not enough land and that’s even if you don’t factor the carbon sink issue (ie trees suck in CO2 when they grown but release it when they die/forest fire/etc).

I would say the market assigns zero value to it because its coming to reality that climate change is MOSTLY a huge scam and just as the EV transition is failing and will fail, the market is foreshadowing that sucking co2 out of the air is probably not a relevant thing going into the future. You know what they say, slowly, then at all once.

Look how popular sentiment in regards to EV and for example Nuclear has shifted in only a few years.

Give it 2-3 more years of high inflation and ppl will ask even more question about "climate change being the most pressing issue of our time, even above nuclear war" (paraphrasing Biden i believe)

thanks for sharing though.