Is the Ice Age Thawing for Oil Companies?

April 29, 2022

My kids love the La Brea Tar Pits. If you’ve never been, it’s literally a tar pit(s) situated in the the heart of Los Angeles. An active paleontological research site, the group of asphalt lakes are created form tar seeping up from the ground, rain water sits on top and voila, a giant sticky “lake.” Throughout time the tar pits have unwittingly trapped millions of creatures, anything from large animals to plants, fauna, and insects. Small animals become trapped in the tar and can’t escape, larger animals seeing easy prey fall victims themselves, then come the foragers who jump into the mess. It’s all one big gooey mess, but for kids who love animals . . . fossils galore. Remains of long-extinct Ice Age animals (i.e., giant sloths, dire wolves, and mammoths) excavated from the pits are sprinkled throughout the museum. Actual dig sites are open for visitors to explore. The La Brea tar pits are being redeveloped, and eventually should look like this once complete.

For now, it’s a smaller, more intimate museum perfect for a Spring day with the kids.

Why do we bring this up? Because while my kids marvel at the exhibits and breathe in the academia and wondrous science, I find myself marveling at the tar . . . and pondering . . . imagine the street value of all this oil . . . mmm sulphur.

As I get lightheaded from the toxic fumes while running rough calcs, I can hear the children saying . . . Daddy’s lost again, which reminds me to look up and do as my wife says . . . “be present.” As any fund manager with kids understands, it means “do the parent thing” while “doing the parent thing.” You live and breathe your investments, and in this case literally and figuratively. Still . . . be present. Oil can wait for another day (or a few hours at least).

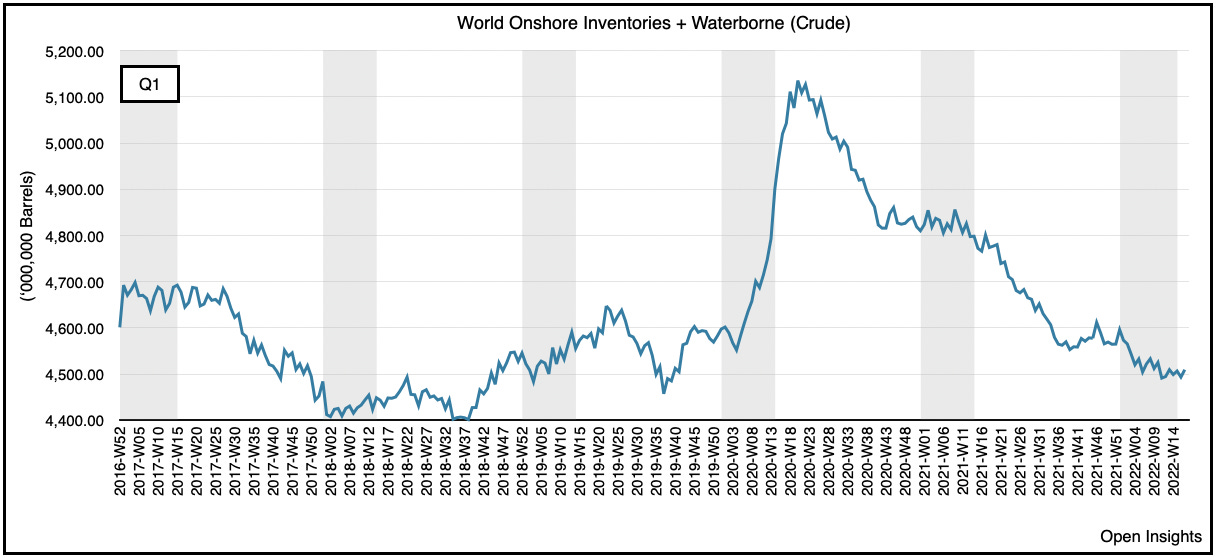

Fortunately, that time is now since we’re sitting in front of our desk again. As we trudge through the sticky thesis ourselves, we’re also reminded to be present. While we forecast the future, what exactly is going on in the here and now? Well here’s a satellite pic.

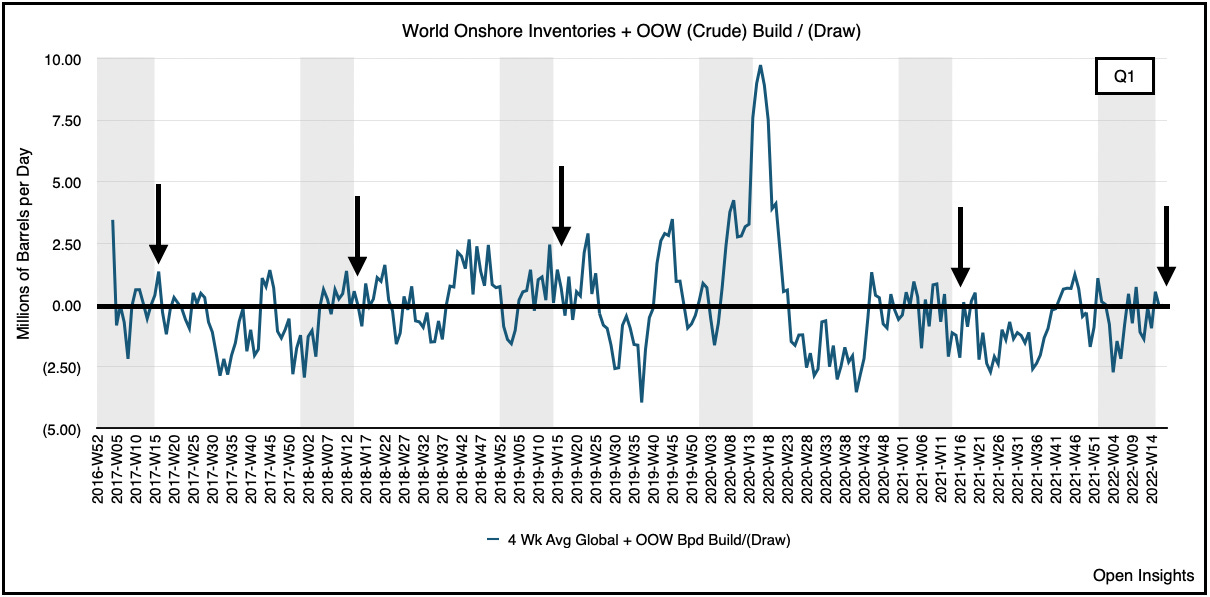

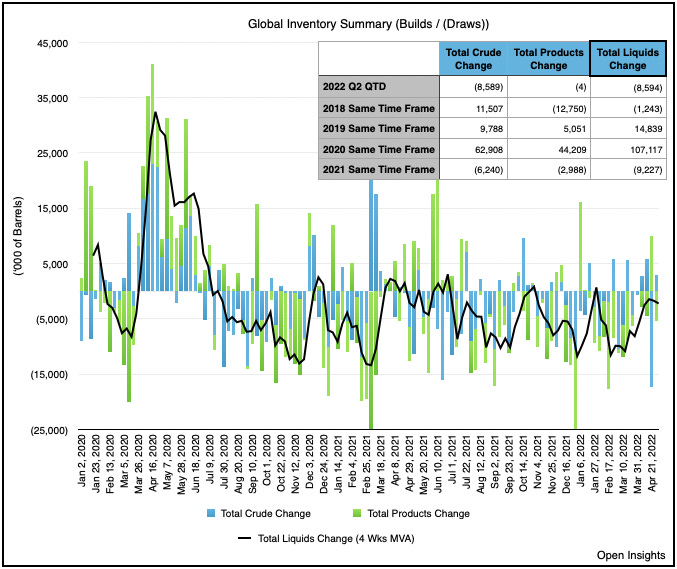

After falling ~1.1M bpd on average over Q1 2022, inventory draws have stalled. Not terribly hard mind you, but it’s been flat. Taking a look at our other tracker, one which aggregates about 1/2 of OECD reported inventories we can see the same thing. For the 2nd QTD (basically he first 3 weeks of April), we’re fairly flat, having drawn about 9M barrels in total over 21 days.

Again this is half of OECD, so perhaps it’s slightly more if we double it, but given the satellite picture, a conservative interpretation would be just a small draw. Again, none of it is terribly surprising because . . . China.

Much of this slowdown coincides with China’s COVID lockdown, and it’s something we addressed in our previous write-up. As that continues and threatens to expand to Beijing, with recent reports of increased testing, we’d anticipate the suppressed demand to persist for a few more weeks/months. This is what we wrote previously . . .

Still, we can easily see the quarantines and restrictions linger for another month. Thereafter, China’s economy will regain traction. Cascade a few monetary/fiscal stimulus programs, and we should see the country reaccelerate economically by the summer, and in turn, so should their fuel demand.

A few days later? This was reported on Bloomberg.

Stimulus? It’s coming. Then again it has to because locking-down is the only strategy, given how ineffective the Sinovac vaccines were. Mind you, they worked for the COVID Alpha variant and even to a small extent Delta, but Omicron? Forget it. We’re talking 1.3B people at risk given their zero-COVID policy, a 1% death rate = 13M people = half the population of Shanghai (or for the US-centric folks, the ENTIRE population of New York City, Chicago and Dallas, combined). The wave would simply overwhelm China’s hospital systems, and result in political tumult for the CCP. On the eve of its 20th Anniversary and Xi’s “ascendancy” to a third term, the political leaders undoubtedly settled for people being mad at them for being grounded vs. being mad at them for being dead. Like a Russian grocery store these days . . . those are slim pickings.

Money always helps though, so here it comes. This partly explains why the Chinese RMB is weakening here (USD to RMB) as 1) the flight to US safety (given massive inflation in the emerging markets) coupled with 2) the US Fed tightening monetary policy while China begins to stimulate. It’s all combining to weaken the RMB.

Not many choices though because again . . . ~13M and the political turmoil that will result if they let it happen. Fortunately, they’ll have time to ponder the next steps as Beijing locks down.

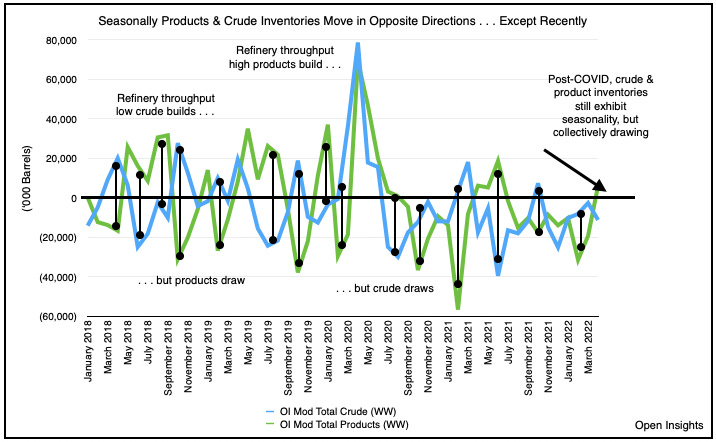

So for us, for now . . . it’s flat, which is to say that’s actually not bad because we typically build barrels (products/crude) during this time of year. If you’ve never seen what that seasonality looks like, it’s like this. Products draw during certain times of year, and when factories go down for maintenance, crude draws.

Flip, flop, flip, flop.

When you add both together (i.e., crude draws and product builds (or the reverse) = total liquids) that tells you directionally where inventories have gone, and as you can see, even as we continue to flip, flop, we seem to be flipping and flopping lower, which explains why the total inventory picture kept trending down (and why the flip and flopping is occurring below the -0- line above). We just don’t have enough liquids, whether crude or products, to meet demand . . . we’re short.

Well, not for now. We’ll get back to those draws though in the near future, hopefully when Omicron passes, or when China gets better control over the situation. That’s in the future though . . . for now, let’s just be present, and for now it’s flat.

The Melting of the Ice Age?

One more amusing thing occurred this week. A JP Morgan report authored by Dubravko Lakos-Bujas made the rounds on Thursday, and in the report he reiterated the firm’s call to overweight energy stocks given the rapid earnings growth and multiple re-rating. Energy equities, as he saw it, both exhibited “growth” momentum (given their increasing earnings) and a “value” tilt (given their depressed valuations). So active managers and quants who check boxes should love those two factors. What’s even more amusing in the report? A blurb about ESG funds. You know the ones that score investments based on how environmentally friendly the companies are. According to Lakos-Bujas, their recent severe underperformance plus energy’s outperformance may make ESG fund managers “adjust” their ratings on energy companies, and allow their funds to buy energy companies that are “improving” their green metrics. Shocked I say . . . shocked! For brevity, we’ll append Bloomberg’s summary of the note.

Oh the ironies in life. Then again, maybe this is exactly like the La Brea tar pits. What if big giant sticky, stinky, unloved lakes of tar really do harbor a wealth of scientific and academic knowledge. What if unappreciated and unloved oil companies really do provide a benefit to the world, one that’s short on energy supplies. Maybe the Ice Age for our energy companies is thawing after all. Good . . do it for the children. ESG funds potentially investing in energy companies . . . will wonders ever cease.

See you in the pits.

Please hit the “like” button below if you enjoyed reading the article, thank you.

Great work. I like your writing style

Enjoyable, data rich and entertaining. Nice work xxx