Jesus Take the Wheel . . . for Oil

February 1, 2021

There’s this Carrie Underwood song that we heard once. One that made us chuckle. It was about a lady who was driving home on a snowy night to see her family. As this is country music, the sympathy dial was set on max, and the songwriters included a baby in the back seat and set the date as Christmas Eve. Suddenly our protagonist hits a sheet of black ice and her car begins spinning. Now traffic accidents aren’t something we laugh at, but the song is called Jesus, Take the Wheel, because as she spun, her decided course of action was . . .

“Jesus, take the wheel

Take it from my hands

'Cause I can't do this on my own

I'm letting go . . .”

Now admittedly there’s probably a metaphor lost on us here as we thought the refrain was instructional. Two things, first, if you do hit black ice, it’s a good idea to keep the steering wheel straight and lift your foot off the accelerator. Second, then pray. Both probably helps, but what you don’t want to do is only the latter. So why are we writing about this? Well it occurred to us last week that hmmm . . . who knew Ms. Underwood was really singing about oil investors.

10 and 2 on the Wheel

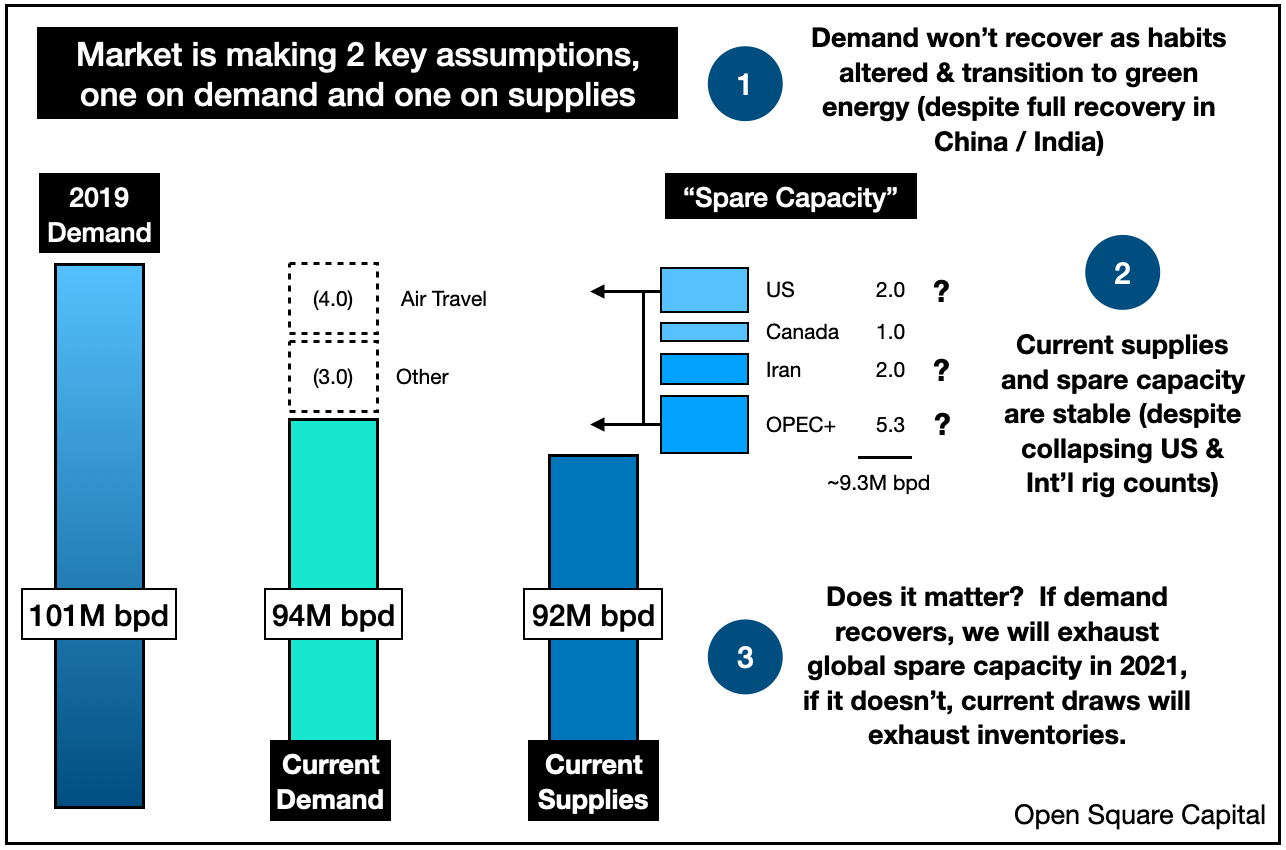

We’re basically at that stage in our oil thesis where “where we go from here” really comes down to demand recovery. Will global GDP recover from our economic tailspin after hitting COVID black ice? Will people travel again, will politicians lift stay-at-home orders, will the economy recover, do vaccines work, will it EVER BE NORMAL again??? We’ve been on record of saying yes, yes, and yes to all, and it will all happen faster than you think, but we understand that there’s a huge chasm between thinking it and seeing it. For long-oil investors, that uncertainty and doubt is bridged by an understanding of human nature, but also partly by faith. So for many, we’re at the stage where we’ve said Jesus, Take the Wheel.

Yet, before he does that, before we relinquish full control of our fates, let’s at least assess the situation shall we? Let’s at least peek through the window to see what we can see and let’s at least take the basic steps to help ourselves.

Peeking Through Our Fingers

So what are we seeing? Interestingly, things aren’t that bad. We know this because we see the real-time oil demand. We’re seeing how NGPs that feed into petrochemicals/plastics, etc. used in manufacturing and industrial activities are drawing heavily and about 2x the average. This real-time data is then being confirmed as economic data is released. Other indicators, increased railcar loadings, higher manufacturing activity and higher shipments of capital goods all generally point towards an accelerating economic recovery. Manufacturing sentiment is also climbing, so from an industrial perspective, companies are producing more and getting back on track. Furthermore, they are reporting increasing confidence that this will continue. Much of this is because inventories were deliberately drawn down in 2020 as companies raced to shore up balance sheets and reduce stocks, but a restocking cycle coupled with a reopening economy means we’re playing catch-up now for “real stuff.” We need to both restock and meet higher demand, so this tailwind is strengthening. Thus, a strong rebound in Asia and US manufacturing activity is currently holding up oil demand.

That’s on the industrial side. Now fast forward a bit and take a peek into February/March and into Q2. What we see looming is a services recovery. The service sector is the next piece of the economic pie to finish baking. Services (i.e., travel, leisure, entertainment, etc.) are what’s currently holding us back as COVID mobility restrictions are still in place, but as the pace of our COVID recovery trends upwards, so should the trajectory of oil demand and oil prices. So how’s THAT looking? The simple truth? . . . Getting better.

COVID Recovery

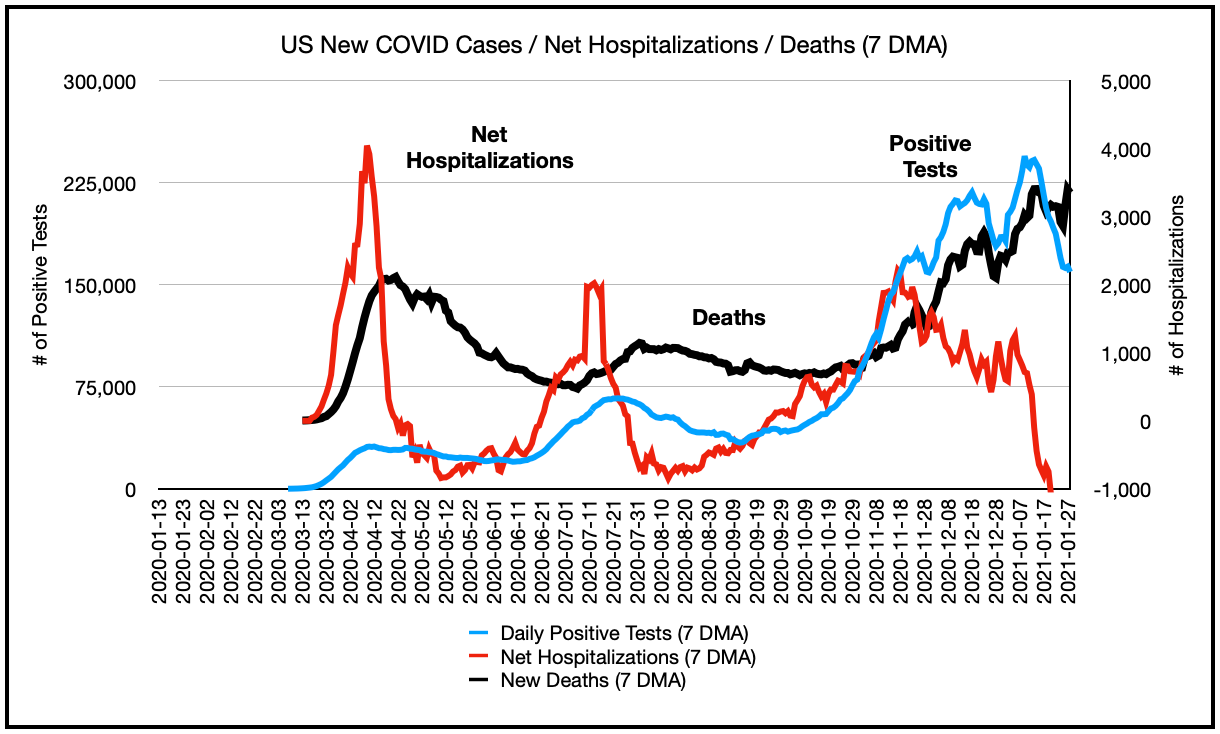

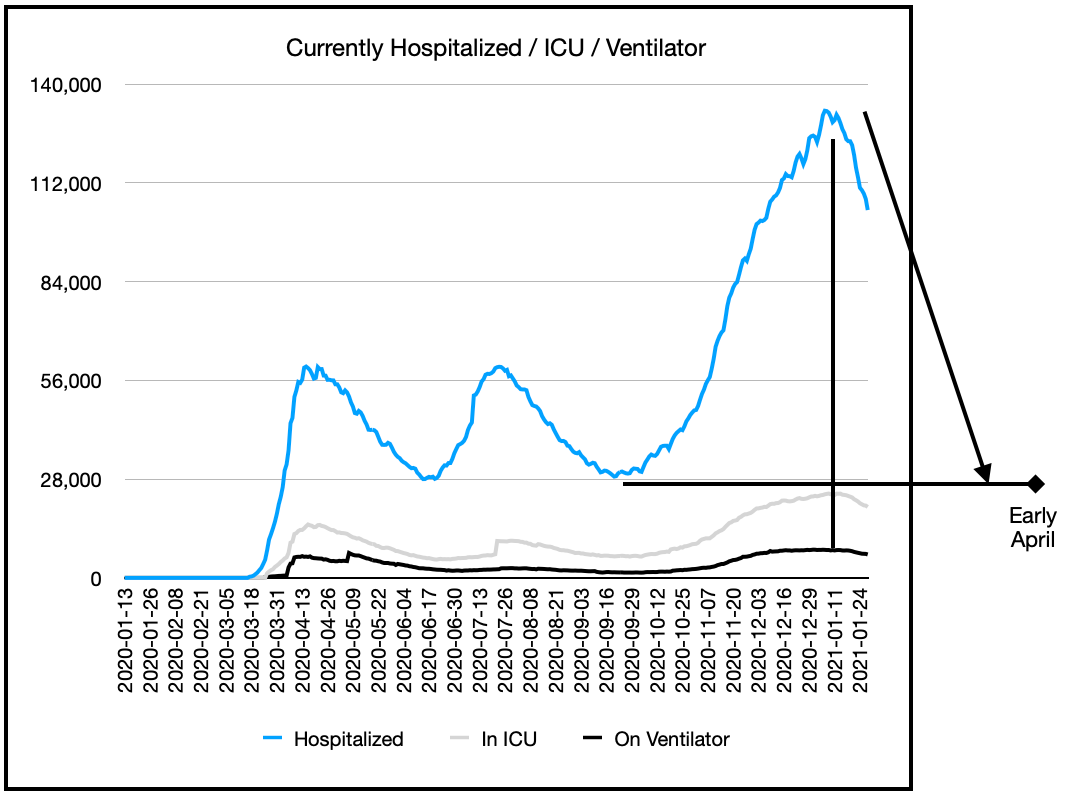

Here in the US, we’re seeing positive cases, hospitalizations and deaths decline in intensity now as the third wave abates.

As we fully shift into the first quarter, COVID cases in the US are already falling in all regions. These numbers should continue their downward slide as vaccination programs intensify. Although dosing is proceeding slower than we initially anticipated, they are still occurring and should increase after the Biden administration takes full control. The Biden administration is planning for 100M doses within 100 days, which puts us around 1/3rd vaccinated before Spring Break. The fact that we are first vaccinating the elderly, high-risk patients, and those living in Long-term Care Facilities (“LTCF”) means that almost 80% of the hospitalizations and deaths will be eliminated by March, which would greatly reduce the scale of this pandemic.

Globally, the Europeans are a few weeks behind the US in its roll-out. As COVID cases increase across the pond, fears of variant COVID strains surfaced and EU sought shelter. Hence we’ve seen countries increase restrictions into the year-end. The UK has plunged itself back into the highest tiers of lockdown, scared that a morphing virus would overload hospital systems. Other countries then restricted travel to the UK and tightened domestic restrictions to further isolate the risks and their own growing contagion. Rising cases in Germany also saw that country impose a lockdown to mid-February. Japan and Korea were no different as local cases increased and even China’s northern cities experienced an uptick, forcing authorities to impose a lockdown in that region (though the country remains largely open elsewhere). Despite all of these restrictions, there is light at the end of the tunnel. Vaccinations are beginning and will increase as we move forward into February and March.

Given how we’re allocating vaccinations (i.e., to the highest risk patients first), we can envision a scenario where variant COVID strains, increased testing and relaxed social distancing practices lead to higher case counts, but the figures that measure the severity of the pandemic (i.e., hospitalizations and deaths) fall dramatically. This is important because ultimately that’s what we want, an overall reduction of the strain on our hospital systems. We are in the early stages of vaccination and even more vaccines are scheduled for approval. UK/EU recently approved the AstraZeneca vaccine (which is easier to store/distribute) and Johnson and Johnson reported that its vaccine was >70% effective (requires only one shot) and could be approved by March.

There certainly are risks. What if COVID variants (UK and South African) lead to a major uptick in cases? Maybe, but it’s in a race vs. increasing vaccinations. Vaccine developers have said that the current vaccines do work against the newer strains of the virus. Moreover, we’re already testing positive in the US for these COVID strains, which means they are already proliferating. They’re in low numbers, but given the inconsistent testing, it’s safe to assume that these highly contagious variants are already in our community. Here’s a blurb from CNN on the UK variant’s prevalence in the US.

While they certainly didn’t drive the third wave of COVID cases we saw in the US, we think they likely contributed to it. Despite their discovery here, again we’re seeing cases, hospitalizations, and deaths continue to fall in the US, and more importantly in the very states mentioned above, which tells us that the firestorm is burning its way through, all the while the firefighters and the vaccines are regaining ground now.

Ultimately, we’re confident that every country will work out their logistical challenges for distributing the vaccine because a politician’s livelihood depends on it. Once resolved, the world will begin to heal quickly.

Recovery: Fiscal Stimulus + Healthy Consumers

It’s why we’ve long anticipated the summer to be “BANG ON,” but in the US we’re beginning to think that spring break will be a key mile marker because by then, the main cohorts that are hospitalized and pass from COVID (i.e., those over 65) will have already received their vaccines (even the first dose of the Pfizer/BioNTech & Moderna vaccines provides decent efficacy). Given the travel patterns we saw during Thanksgiving and Christmas, we’re of the opinion that the pent-up demand will take another step higher as the pandemic eases in the spring, and then significantly more so by summer.

Just look to China as a barometer of recovery. Nine months after wrestling control of the coronavirus there, leisure travel during the Mid-Autumn festival in October had recovered to ~70% of prior year levels. Note that all of this was before vaccinations occurred. Thus, we’re eagerly waiting to see what travel looks like in early-February (i.e., Chinese New Year (February 12)), especially as China has already approved a locally developed vaccine. Even with lockdowns in the North, we anticipate travel to be robust elsewhere. What happens in China won’t stay in China as Western recovery should mirror China post-vaccination.

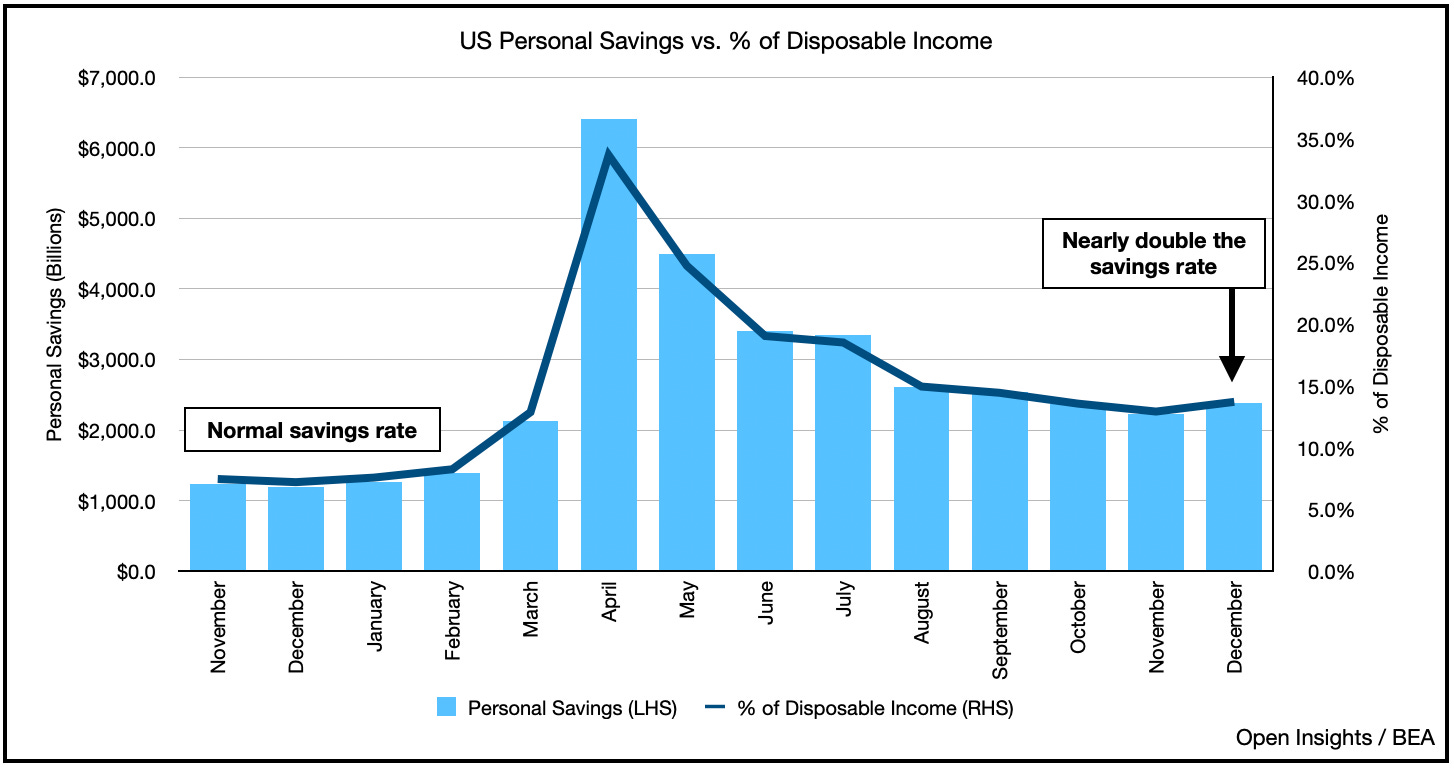

Have Money, Will Spend

Once given the opportunity, we believe consumers will then unleash a tsunami of spending on service providers. Airlines, hotels, restaurants, resorts, entertainment destinations, etc., they are all poised to lift-off as hordes of consumers eager for fresh experiences emerge from their shelters and descend upon these venues. Consumer spending accounts for over 70% of this country’s GDP, and consumers are arguably healthier than they’ve been in awhile. Most of us have done little this year but bake bread, and the activity diet means we have plenty of dough. Savings rates are currently double what they’ve been historically, and the below chart doesn’t even account for the recent $600 stimulus or the incoming $1,400 stimulus checks.

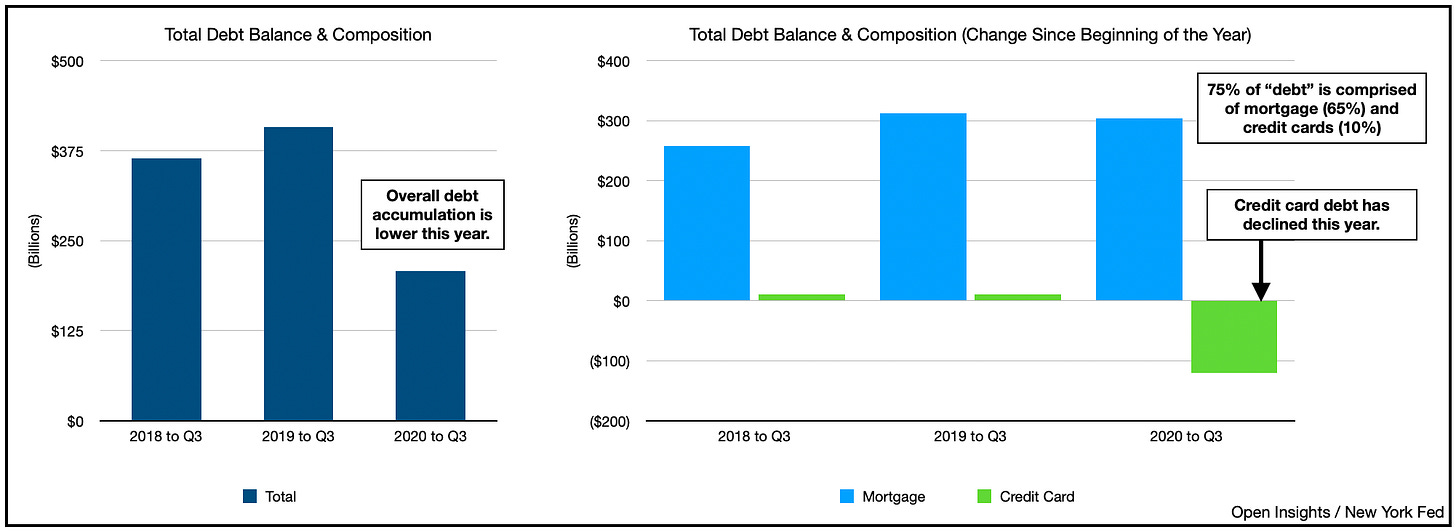

In addition, some consumers have even paid down their credit cards, the most expensive debt.

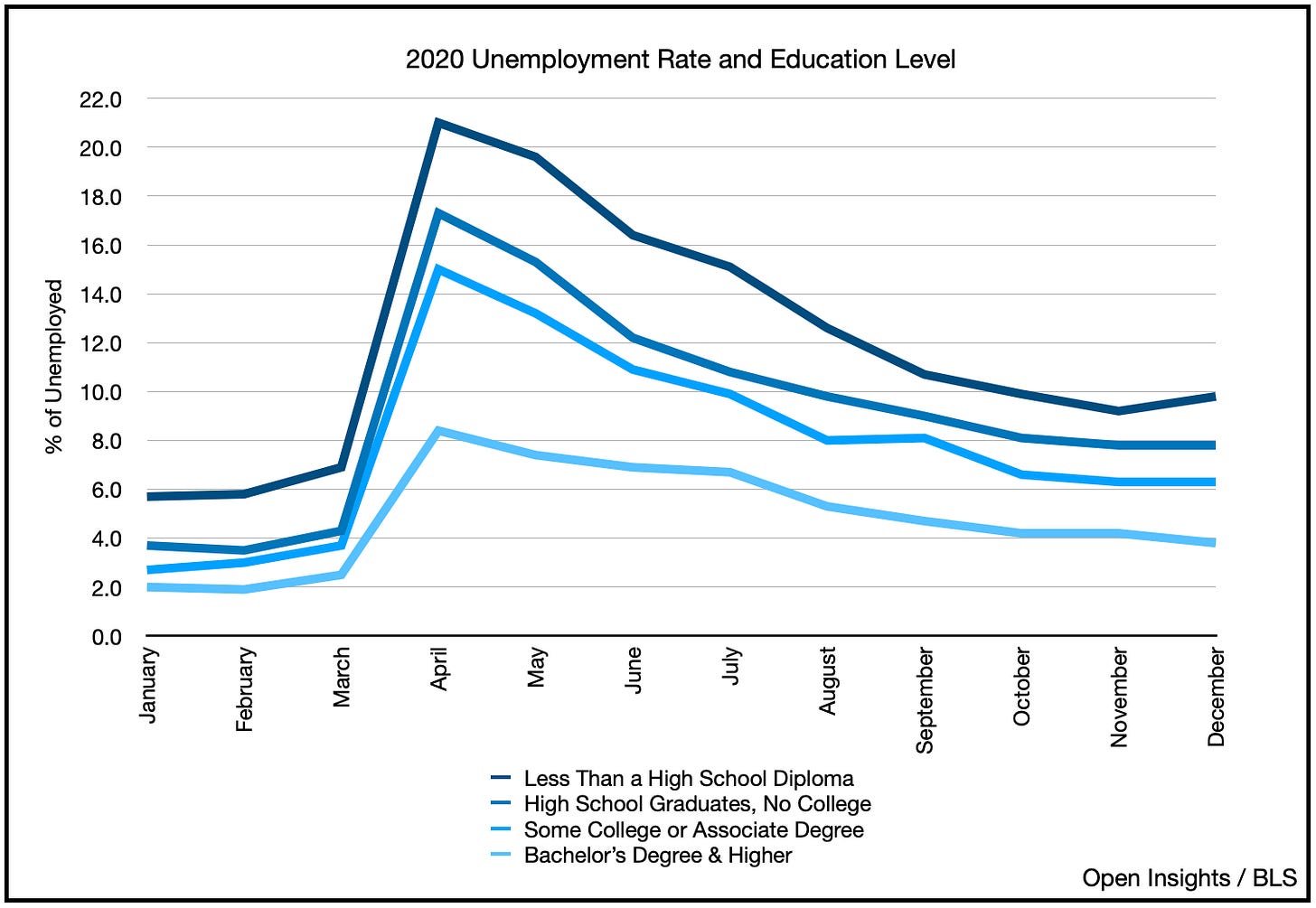

It’s counterintuitive right? We have one of the highest historical unemployment rates, but yet consumers are infused with more cash and less debt? Well as you likely surmised, the unemployment rate is an average, and on average, white collar workers, those with more education and higher paychecks have done well. Unemployment rates in those demographics have been trending lower, and overall have fared much better than those with less education.

Consequently, it’s a “K” shaped recovery, where those who are wealthier have benefited much more from lower borrowing rates and stimulus checks. Despite the exacerbation of income inequality and their attendant issues, the flip side is that we head into a summer where consumers are both willing AND able to spend.

Increased Mobility = Recovering Demand

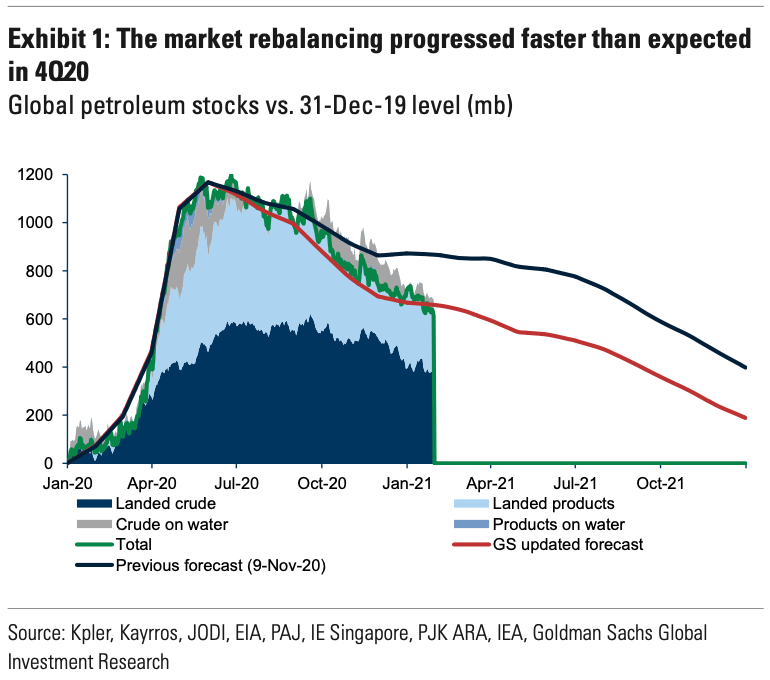

As mobility restrictions ease and pend-up demand gets unleashed, energy demand will steadily increase in Q2 and Q3. We project oil prices (Brent) to be approximately $65-70/barrel by the late-summer as inventories fall. Our forecasts assume that current draws moderate slightly because of seasonal demand weakness, but increase as we hit the summer season. Higher draws over what we anticipate will garner a faster price response, but on average if the pace hews closely to what we’ve seen, then oil prices should climb steadily. As of now, we’re seeing inventories continue it’s slide downwards.

The above chart from Goldman Sachs illustrates the continuing pull on inventories, mirroring what we’ve seen in our own tracking. Though the graph is only until year-end, January data thus far points to the same trend.

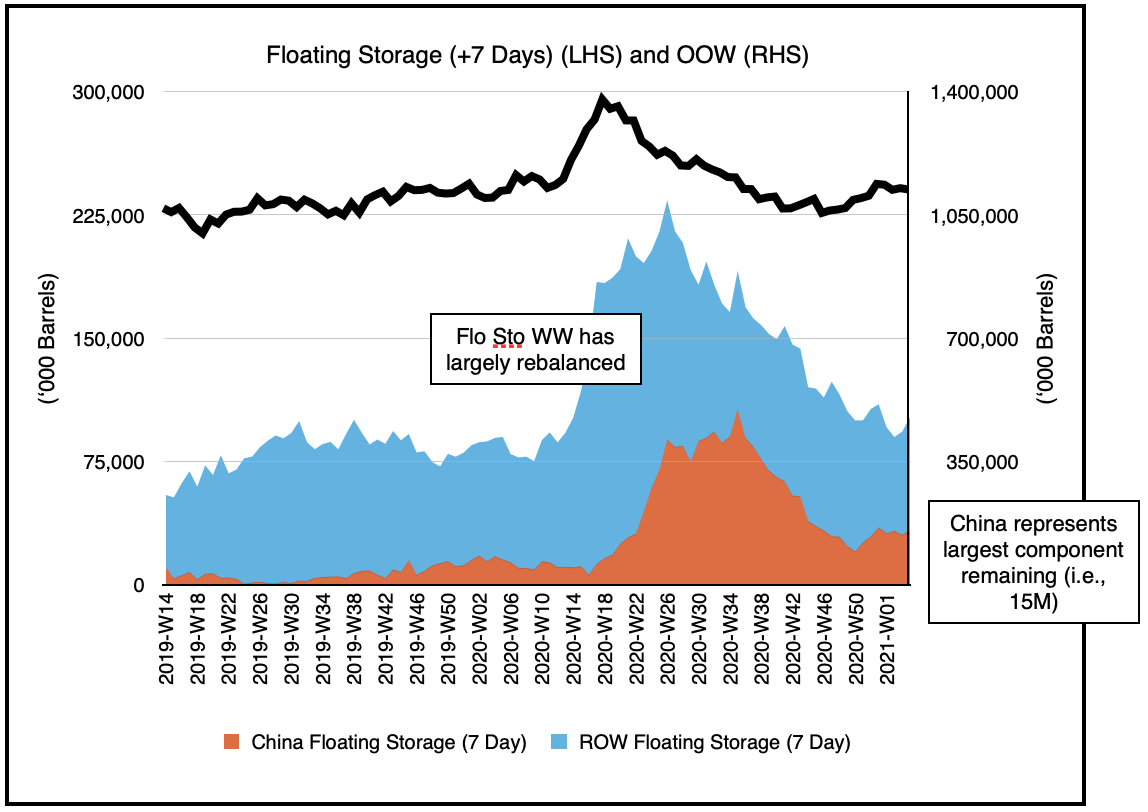

As we anticipated, floating storage (i.e., oil stored in offshore tankers which are typically the most expensive in storage costs) have emptied, so going forward, draws that were previously impacting offshore storage will now be felt onshore.

Satellites that track onshore storage will begin to see the additional drain as will storage data. No longer will we need to drain A+B, after B runs dry . . . A will bear the brunt, and A is what most oil market watchers track.

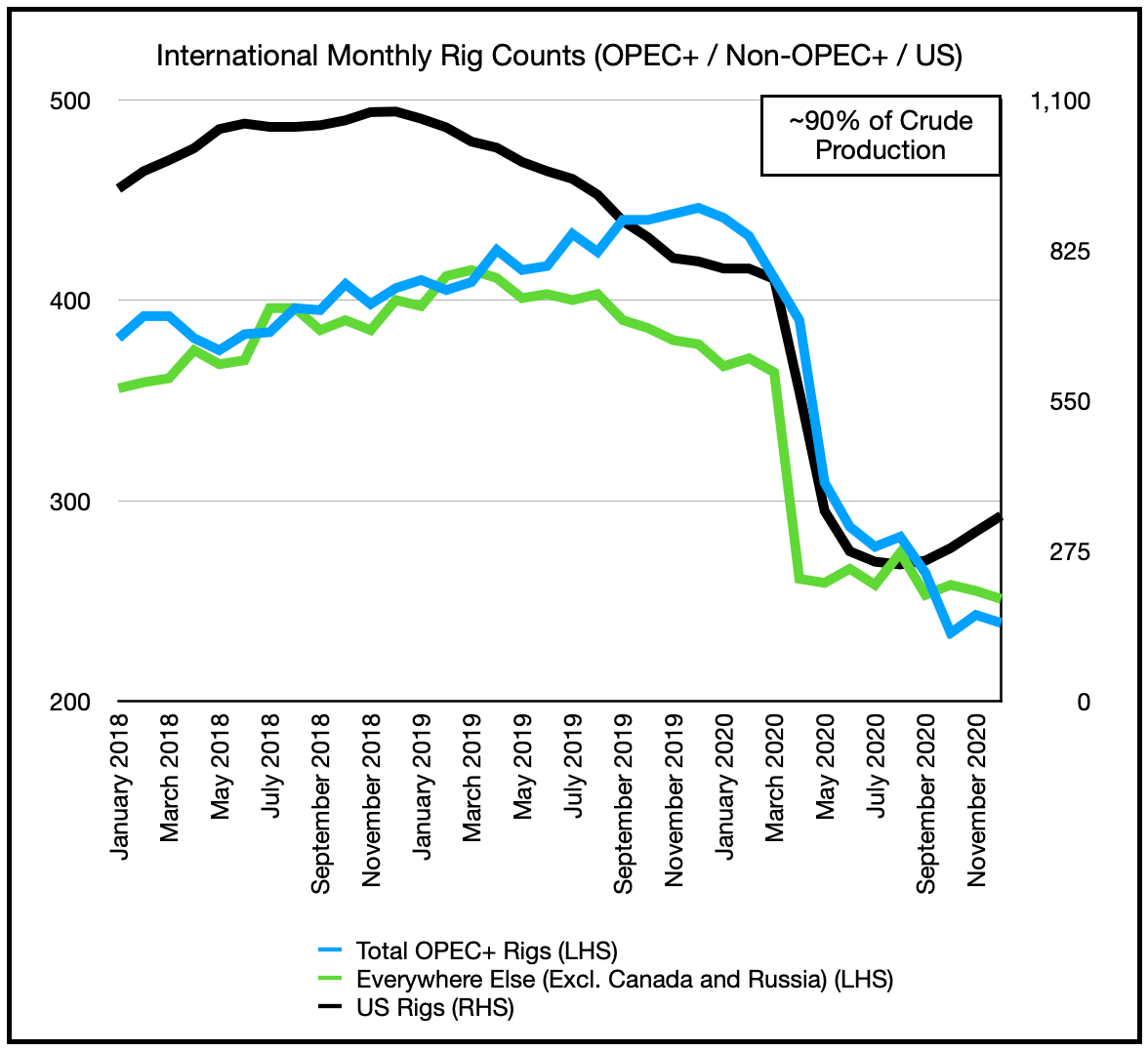

Make no mistake though, we are still woefully underinvesting in energy. For much of 2021, we’ll continue drawing simply because demand recovery will outpace supplies. Internationally, rig counts as of December are still sliding lower, down >35% from the beginning of 2020. US rig counts are on the rise, but from a low base, and still down near 60% from a year ago.

We estimate we’re globally drawing ~2.5M bpd today even with subdued international jet travel. As vaccinations increase and mobility restrictions loosen, demand will tick higher, but supplies will be hard pressed to satisfy both the recovering demand and current deficit.

Persistent inventory declines will force oil prices to move firmly higher, and production this year will undoubtedly wallow. From US shale companies to OPEC+, the largest producers are collectively restraining production and waiting for inventories to draw (i.e., prices to rebound) before committing additional capital. US production alone is down 2M bpd from +13M bpd just a year ago and will likely decline in 2021 as capital discipline takes hold across the sector. Producers have set forth reinvestment rates of 70-80% and committed the remaining cashflows to shareholder returns. Note that these are the same companies that previously reinvested at 100-140% rates, outspending cashflows to grow production. Those days are over. US producers have already guided that they’ll sit this year out. As for everyone else, the rig counts say it all. Production and drilling will only return if prices do.

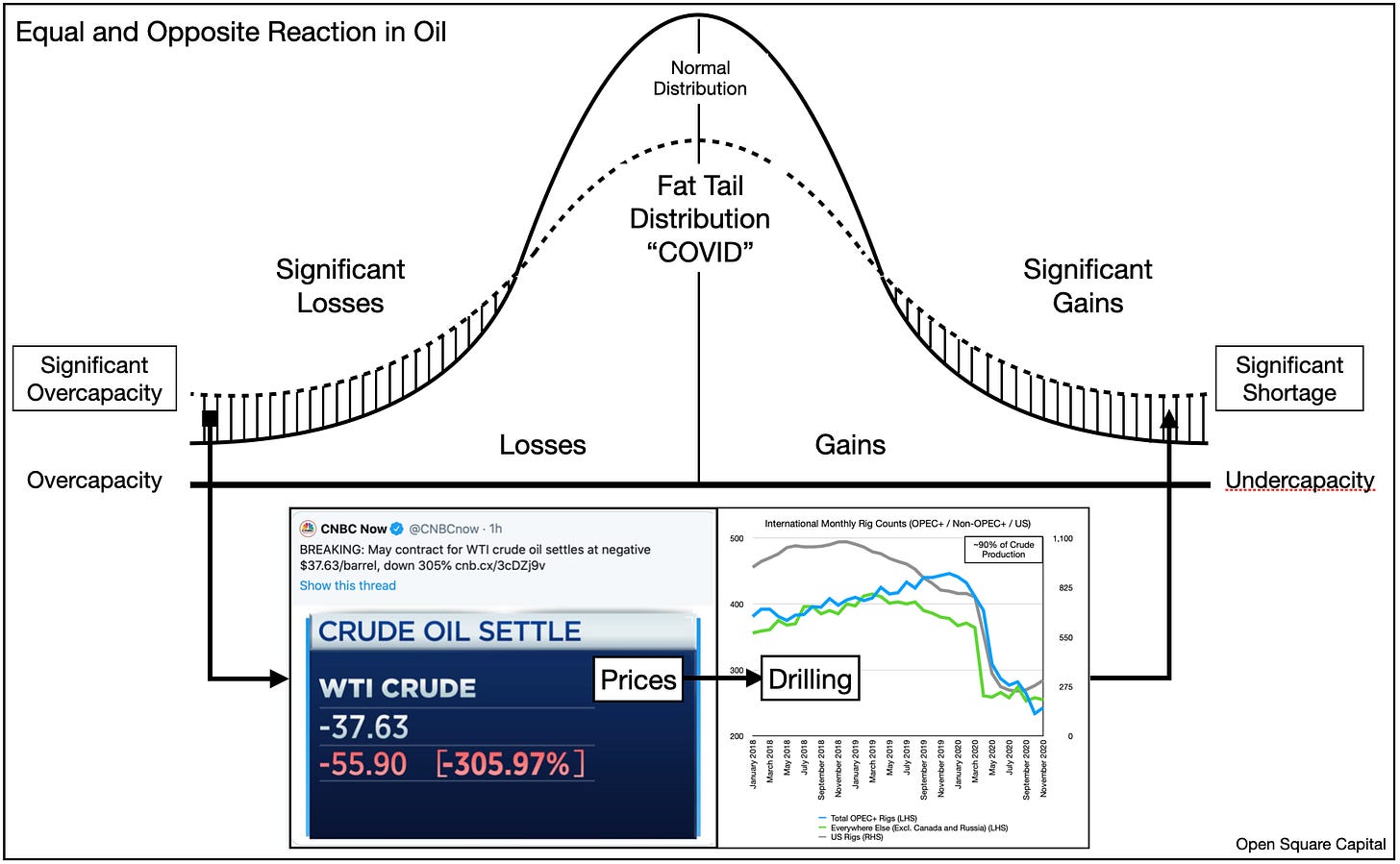

We’ve been saying this for awhile, but it’s becoming increasingly obvious as the months of recovery stretches to a year. Our noble desire to shift our energy sources to greener pastures has far exceeded our ability to do so, and this short-sightedness coupled with decisions made during a pandemic will accelerate a reckoning. The pendulum now swings the other way because that is how the world works. It’s Newton’s third law, for every action, there is an opposite and equal reaction.

One tail-risk event will be followed by another as the forced reset in the energy sector will require us to also reset oil prices. Whatever they end-up being, we can assuredly say they’ll be much higher when the economy recovers.

So that pretty much sums it up. For oil investors, keep the steering wheel straight, keep your foot off the pedal, keep your wits about you, and most importantly, keep your faith. Now Jesus, Pleeeease Take the Wheel.