Let it Burn? Not Yet. There's Money to be Made

February 11, 2023

Let it burn.

It’s an article we wrote in 2021 when climate activism and admittedly our frustration with it was at a high. It was written before energy prices vaulted higher in 2022, and Russia’s invasion of Ukraine proved to the world how precarious our collective energy security can be. It was written before . . . well before many things.

Fast forward 1.5 year later and the situation has decidedly changed. As ESG investments have proven economically/commercially challenging while energy supplies have become stretched, the tone is shifting. What was this . . .

Has become this . . .

There are plenty of justifiable reasons for this turn, terrible returns for renewable projects as inflationary pressures increase, sub-optimal capex investment policies, an inability to maintain and grow dividends without significant free cash flow generation, and most importantly a handicapped stock price. So if your American friends pivot, it’s time to follow their lead.

As the economic reality of renewables clash with the blind fanaticism of climate activism, the pendulum is swinging back in the market. It is after all a weighing machine, and as ESG investments sour while energy costs and investments soar, capital allocators pay attention. Moreover, as families deal with higher energy costs this year, it’s really driving home the need for cheap and secure energy despite the wishful thinking of green enthusiast. What cuts through the rhetoric is the heavy hand of reality, and the invisible hand of the free market, and those two are undoubtedly slapping the world upside our heads.

Renewables will save the world, it will pave the way for a green energy transition. Hogwash. It wasn’t true then and it’s still not true today. Energy density and transient availability doom solar and wind energy as truly viable alternatives. Nuclear? Now you’re talking, but the irrational fears are too much to overcome. So you’re left with fossil fuels and left with this, the full brunt of underinvestments in fossil fuel development for nearly a decade.

Sure this doesn’t include short-cycle projects, who’s blistering growth papered-over the economic neglect for many years, but those days are ending as the Permian and US shale reckon with slower growth and resource exhaustion.

And we knew it was going to turn. It’s not a miraculous discovery or altogether insightful to know that people are people, and what they say they want, and what they can actually stomach are two entirely different things. Furthermore, it’s decidedly different when you’re wealthy and dictating the terms to those less economically blessed. So pivot to renewables? No thank you. Shun and sanction Russian barrels? We’ll pass.

A Compromise

Lest you think this is a rant piece, it’s not. It’s a recognition that though our emotions can take us from one extreme to another, from drill-baby-drill to climate fanaticism, reality dictates real solutions. Incentivize people enough and they’ll come up with one or many ways forward, and we think they have.

If abandoning fossil fuels isn’t an option, and tackling climate change is a necessity, then the medium-term solution has to be something in between. What will come to pass is ultimately a blended business for many oil companies. Companies that have a “license to produce” if you will. A business where fossil fuel development couples with a “net zero” strategy that allows an E&P to keep producing the much needed/desired fuels, but in a way that’s less harmful for the environment in totality.

The technology?

Carbon capture, utilization and sequestration (“CCUS”).

Conceptually, CCUS isn’t difficult to grasp, just difficult and expensive to execute. There’s two ways to do it. Point-Source Capture and Direct Air Capture (“DAC”).

Both versions capture CO2 and store it or repurpose it to reduce overall emissions. Point-Source Capture traps the CO2 at the source, be it a power plant, cement factory, steel mill, etc. and sequesters the CO2 in deep geologic formations underground. This is a clean solution that’s site specific, and can reduce emissions for various industrial operators.

DAC, however, is a much grander endeavor. Imagine a giant vacuum cleaner, sucking in air, trapping/separating CO2 from it, and then storing the CO2 underground (or repurposing the CO2 for enhanced oil recovery (“EOR”)).

It’s a hugely expensive project, and typically requires a consortium of large companies to design, finance, construct and operate. One of the leaders in this space, Occidental Petroleum (“OXY”), recently broke ground on its first Direct Air Capture plant (“DAC”) in Texas, and the ~$1.1B plant should be operational by 2024. OXY isn’t alone in these forays as Exxon is also working on its own CCS strategy.

For us, what’s interesting about DAC is the pace of development. Prior to the passage of the Inflation Reduction Act (“IRA”), OXY had originally planned to construct 70 DAC facilities by 2035. Since the IRA’s passage? 100. Why? Taxpayer subsidies.

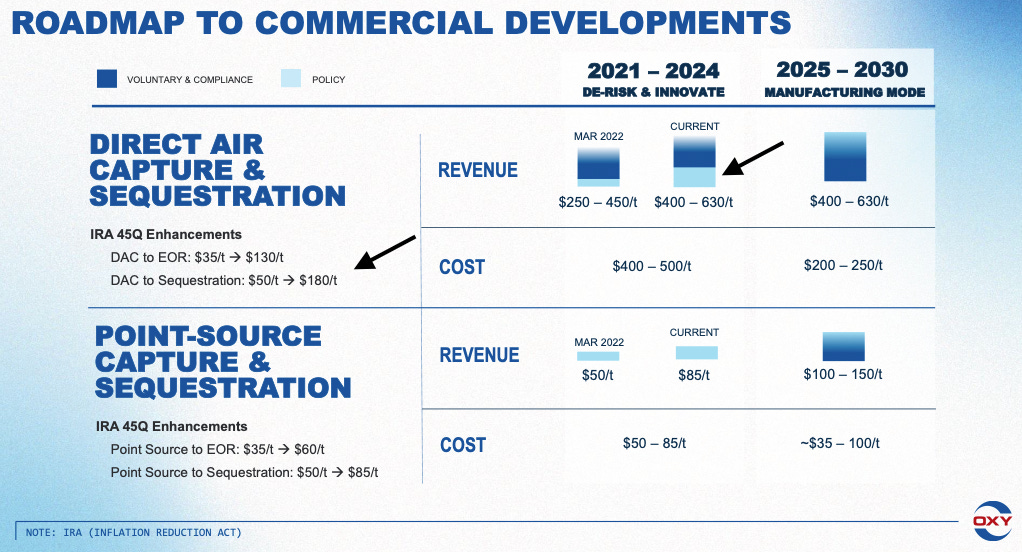

Enhanced tax credits (i.e., 45Q) provide a tremendous boost to the revenue line. Sequestering CO2 from a source begets a $85/tonne credit ($60/tonne if you use the CO2 for EOR). Grabbing CO2 from the air? $180/tonne credit for sequestration ($130/tonne for EOR/utilization). That type of heavy taxpayer lifting really helps establish a pathway to profitability.

Each DAC will capture and store ~1M tonnes per annum, and create net carbon removal credits of ~900K tonne per annum. In many ways we can see OXY (or other E&Ps) develop a lucrative midstream business with potentially large upsides, something akin to the LNG business built by Cheniere. Participants can sign long-term contracts and pay OXY a tolling fee to produce carbon credits to offset their emissions. In turn, OXY can use these agreements to obtain financing to further build out their DAC fleet, preserving a portion of the credits to sell/trade in the broader market.

Other DAC facilities can also be retained by OXY to develop “net zero products.” Here’s a sampling . . .

If E&Ps like OXY can reduce the operating expenses of these plants and as the carbon credit market matures, there’s a distinct possibility this business can be tremendously successful and highly sought after. The world emits nearly 40B tons per annum of CO2, and even with 100 DACs capturing 1Mtpa, there will still be a vast unaddressed market. The scale of these projects also naturally restrict the pool of players to large integrated E&P companies, industrial conglomerates, or nationalized oil companies. While OXY’s investment will hardly make a dent in addressing the global issues of climate change, it’s a significant start, particularly if the company successfully proves out the business model for other actors.

Still, there are the skeptics. Here’s Akshat Rathi, a Bloomberg reporter who recently asked Vicki Hollub, CEO of OXY, in an interview (October 27, 2022) . . .

“What do you say to someone who has heard our conversation today and has heard an oil company CEO saying we are going to make net-zero oil, and then they think this is greenwashing. And it's a way to extend the social license, and extend the life of oil, which is, without controlling for emissions, the cause for climate change. How do you respond to that?”

Ms. Hollub’s response was incisive as she rejected the very premise of the question . . .

“What is different, and what's most important for people to get is the net-zero-carbon part of it. Because too many people are focusing on killing energy sources, rather than killing emissions. The common enemy that we all have are the emissions and that's what we need to control.”

. . . which brings us all the way back to the original comments by Exxon’s CEO.

“It’s an “and” equation: meeting the world’s needs and reducing emissions.”

There’s no escaping the global thirst for energy, and there’s no escaping our continuing dependence on fossil fuels. They are simply too embedded in our modern lives, and the easiest and cheapest source of energy for developing nations to use. Even if we were to simultaneously witness technological breakthroughs in energy generation, battery storage and energy transmission, it would still take decades to commercially deploy them. Fossil fuels are here to stay for decades to come.

CCUS represents a viable, albeit expensive way to mitigate the deleterious effects of our ravenous appetites. Is it perfect? Certainly not. Does it provide energy companies with a social license to continue their oil and gas extraction activities? Absolutely. Is it also a potential segment for growth (i.e., net zero oil, carbon neutral products, selling carbon credits)? It sure looks like it.

What’s interesting for energy investors is that as our global energy crisis unfolds, the E&Ps in our portfolios should appreciate handsomely because of the significant free cash flows generated from higher oil prices. Energy companies participating in this new CCUS space, however, may experience a secondary lift as the first DACs come online and the market wakes up to the opportunity.

2024 is just around the corner, and there are many companies hungry for the social imprimatur of being “carbon neutral.” The question is how much will they be willing to pay for it? A lot we think, especially after your competitor achieves that target first and trumpets their success.

So let it burn?

Not quite yet.

There’s money to be made.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Outstanding. This needs to be widely distributed.

Wow

You wrote a long article after saying “if climate change is a necessity, then…”

What if it’s not?

If you have accepted that it is, would you please share the evidence with us?