Looper: Bruce Willis' Cautionary Tale of the Markets

February 10, 2022

There’s this movie I recently re-watched that I can’t seem to get out of my mind. It’s called Looper, starring Joseph Gordon Levitt as a hitman in the past. Crime fighting in the future has become so sophisticated that killing someone is exceedingly difficult without detection. As the protagonist explains it

“Time travel has not yet been invented but 30 years from now, it will have been. I am one of many specialized assassins in our present called loopers. So when criminal organizations in the future need gone, they zap them back to me and I eliminate the target from the future. Loopers are well paid. We live the good life and the only rule is never let your target escape, even if your target is you."

Shenanigans ensue when Levitt’s future self (played by Bruce Willis) comes back in time and Levitt has to “loop” his future self. The movie is the typical redemption story, bad isn’t that bad, and bad (spoiler alert) eventually redeems itself. Yet after watching it and then seeing the shenanigans in the stock market, I’m beginning to wonder if life is imitating art.

Because looping seems to be abundant. Despite the frenzied run-up of the market, we’re beginning to loop back to what we really were. The world got sick, massive monetary and fiscal interventions ensued, and valuations lifted off. As the pandemic faded though, you still are who you are. You’re business is what it is, and despite the euphoria of the overall market, you still peddle the same wares in the marketplace.

Which is why we’re looping. The generals of the market are looping and getting hit . . .

The soldiers of the market are looping . . .

Those that entertained us are looping . . .

and those who took care of us during the pandemic are looping . . .

Much of this is simply due to rates. We’ve noted before that interest rates are gravity, the ever present fixture in all valuation models, and as inflation continues to surge ahead, rates are beginning to climb. Hence gravity/interest rates are rising as the weight of inflation distorts everything around us.

The entire curve is now looping . . .

On a larger timescale we’re also looping. Looping back to what matters. Shifting from growth to value (don’t read too much into those two words though because we’re not talking about “competitive moats,” etc). Ostensibly all investors are value investors since they buy things with the notion that they’re undervalued (well of course excluding short-sellers). What we really mean is mean reversion.

When the cost of capital falls (interest rates / cheap equity), everything’s game for funding. Moonshot ideas, companies with better business plans than actual businesses, and existing companies with “exciting & embedded options” are all entertained, funded and celebrated. The lights dims though when capital becomes more expensive and credit stingier. The music fades as investors expect more and demand more in the face of inflationary pressures. Potential future returns can’t overcome real inflation. Them costs be real son.

So on the high-end we’re looping. Growth is mean reverting. Value? Things that have been forsaken for years (hence “value”)? Yeah, that’s looping too and rather quickly. The input costs of almost everything that fundamentally fuels our global economy is looping.

Because we’re looping here (oil) . . .

We’re looping there (labor & job openings) . . .

We’re looping everywhere (commodities: oil, agriculture, metals, etc.) . . .

Looper was a movie released almost a decade ago. Just enough time where today’s 20 and 30 year old investors have never seen it. Many investors have also never seen core inputs rise this much during their careers.

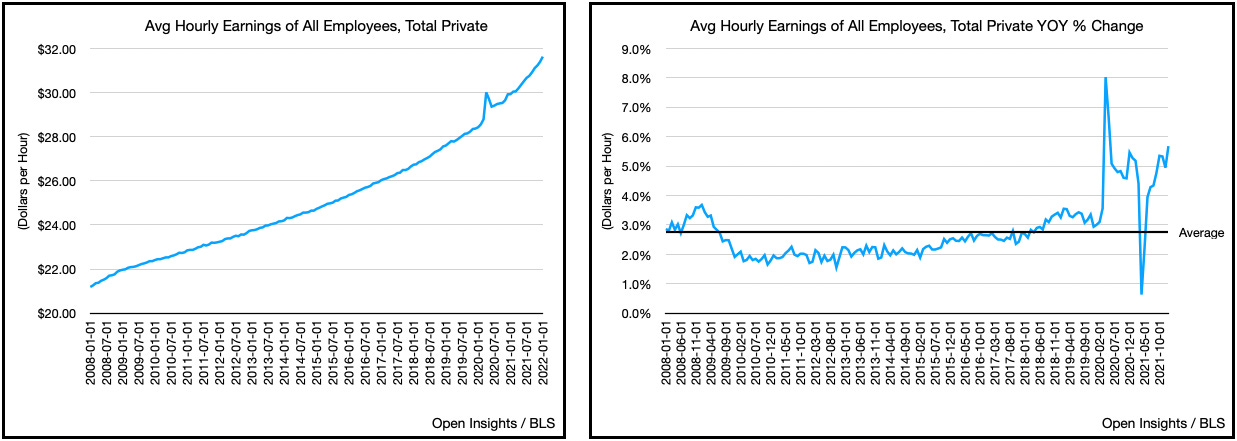

Well . . . you ain’t seen nothing yet. Because how do prices go back to where they were when everything pushes up? Especially wages. When minimum wages now clock in at $15/hr (ie., $31K a year) and YOY changes in average hourly wages are near 6%? When average hourly wages are doing this . . .

. . . and it’s not even keeping up.

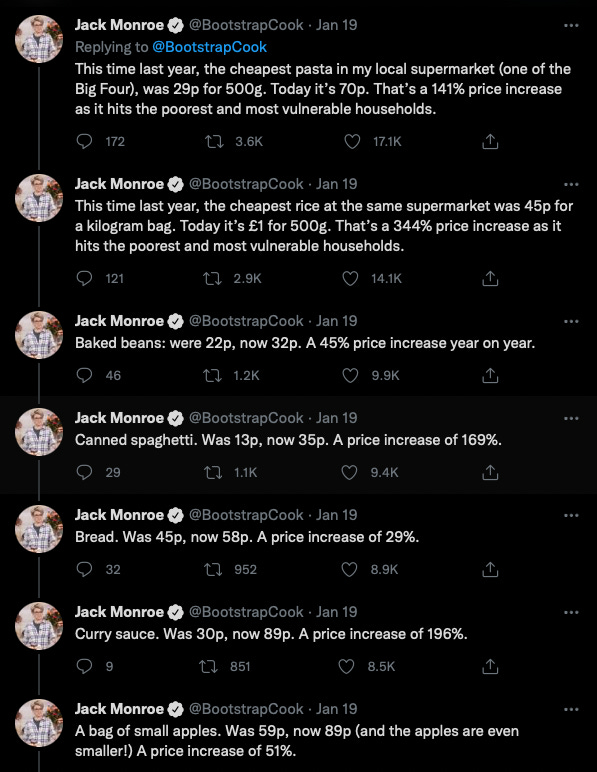

Sure prices of used autos, refrigerators, etc. (i.e., durable goods) may decline as supply chains right themselves, but try lowering someone’s wages. So the price of services will go up and stay up. It’s something we discussed previously. What about food and energy? Well food is already experiencing the same inflationary issues, and it’s hitting the poorest first. Here’s just a snippet from a UK food blogger to hammer home the point.

Pasta doubling?! Expect more. We anticipate it’ll worsen as the increased costs of fertilizers means farmers use less, thereby reducing crop yields. We’ll know soon enough as planting season starts in the coming months and harvest season 6 months thereafter. Reduced corn and soy bean yields will inevitably increase plant and livestock prices.

As for energy, we’ve long written about the imbalance in supply and demand.

Don't Look Back . . . It's a Shortage . . . Just Run

Our Q4 2021 Letter & Look Ahead

Which explains why oil prices continue to surge higher. Iranian barrels returning to the market (actually returning to the market “more freely” as they are already being smuggled) may help relieve the situation, but only temporarily.

The fact remains that the coming days of higher prices were sown by the years of underinvestment and the COVID pandemic exacerbated the entire situation. Prices now need to rise to incentivize more production and tamp down demand. There just isn’t enough. So as many hope/pray that energy prices return to normal, we’re asking the opposite question. What if normal is simply higher? Should $3/gallon gas be $3 anymore if there isn’t quite enough AND everyone makes more and can consume more. Similarly for crude this . . .

What if the old $100/barrel isn’t the new $100/barrel anymore?

So again, energy is looping, metals are looping, agricultural commodities are looping, labor is looping, and the cost of money is looping. Thankfully we’ve seen this movie, so we know what to expect. As for the other loopers?

Joe: This job doesn't tend to attract the most forward-thinking.

Please hit the “like” button below if you enjoyed reading the article, thank you.