Marvel at the Market's Fall

May 13, 2022

I am Groot.

Like the fictional Marvel character that’s about the extent of my market commentary these days if you really pin me down. Groot if you don’t know (and how could you NOT know??!) is from a race of tree-like beings whose language is impossible to understand. So what comes out of their mouths sounds like “I am Groot” . . . for everything.

So that’s where I’m at these days. Screaming at squirrels and responding “I am Groot” to all manners of questions because that’s all there is to say when you’re looking at charts like this.

Charts that look eerily similar to ones like these ones posted by Shrubbery Capital @agnostoxxx.

Just take a look at the bottom left chart, the early 70s. Eerily we appear to be in similar macroeconomic situations with the backdrop of geopolitical uncertainty, higher commodity prices and an inflation figure that continues to scorch our standard of living. Much of this is set to persist too.

April’s CPI figure? 8.3%. It’s good right? We’re down from 8.5% from the prior month. That’s great right? RIGHT?

I am Groot.

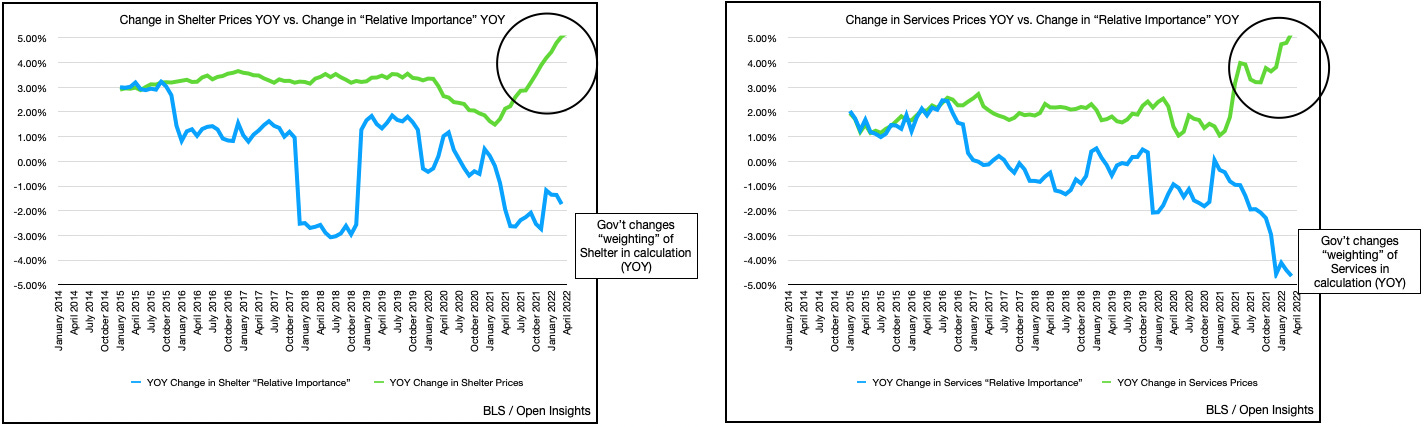

I am Groot because of 87%, basically everything but durable goods (i.e., shelter (32%), services (28%) and non-durable goods (27%), seems to be headed in the wrong direction.

Weird right? It reminds me of an intern I used to have. She’d nod for awhile as I explained some esoteric tax concept, and then pause, furrow her brow and say . . . “wait . . . what??” Yeah how does that make sense? How does CPI fall, but the underlying prices creep higher? Well weighting. Though the prices rose, the government adjusted their “relative importance” in the index (i.e., the portion of every dollar you spent on those things fell).

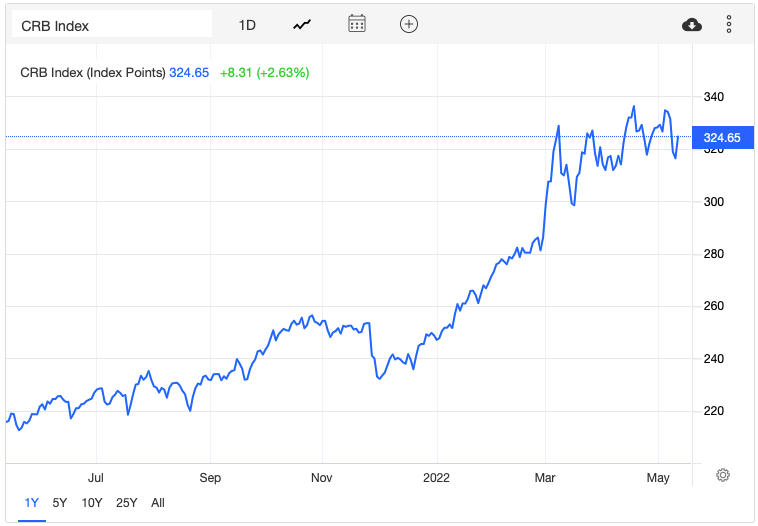

Good thing shelter and services have become less important #amiright? Beyond that though, aren’t we bound to head higher/stay higher? Food, energy, housing all appear to be increasing as the ramifications of the China COVID lock-down, Russia/Ukrainian War, and commodity shortages are just beginning to assert themselves. Stuff has been shipped, crops haven’t been planted, energy supplies haven’t been weaponized, and things haven’t been drilled or mined in sufficient quantity for years. Probably helps explain why commodity price have only leveled off, but not sold off, despite the deep dives in the stock and bond markets.

You know all that though right? You do because if you’ve read our article, we’ve been pounding the table about it. No we’re not pounding our chest that we’re right. This isn’t that article. Doing so means disregarding the suffering (both financial and physical) that is occurring or about to. This article is simply saying . . . you are here.

You are here, and we’ve been here before, and we’ve really just started.

You are here because this isn’t about fundamentals, even though we arguably could make a case about why it makes sense this is happening. 5% earnings yield for the SP500 right now? That’s reasonable? Is it when interest rates are doing this and rising.

You are here because inflation is forcing central bankers to act. Remember the Fed has two mandates, jobs and price stability. With the unemployment rate clocking in at 3.6%, it’s pivoting all-in on price stability and that means nailing inflation to the floor. Unfortunately, what we need is a scalpel, but the Fed only has a hammer, and with a hammer, it’s time to bang on. Raising rates and withdrawing liquidity. Quantitative Tightening. Yet with a balancing sheet having ballooned by nearly $5T (TRILLION) since the onset of COVID, how can the Fed extract enough sugar from the system without a crash.

How do you normalize a nearly diabetic market from this constant and continuous dose of sugar?

Look at that, the Fed has barely just begun to slow the purchase of bonds, and the wheels are coming off. We press on though. We all have to press on though because we need to.

Rising commodity prices means we’ve focused too much on building businesses to replace our mothers (food delivery, ride share, outsourcing errands) and not enough on what we need to survive in an big boy world (energy security, raw materials, rare earth minerals). Adulting is hard.

You are here because reality is reasserting itself. Greeds twin is fear, and untold greed in the decade of free money means the level of fear has to rise to match. MMT has consequences, and we will feel it all. The market is pricing it in now, and whereas greed dominated before, fear will increasingly play in the coming months.

Sure this will stop. It will stop when the hedge funds unwind, when the pod shops shut down and liquidate their crowded and mutually reinforcing positions. Slowly each fund and each investor will say enough. That’s when capitulation occurs and apathy sets in. We’re not there yet. We’re still a bit aways. This unwind won’t be rational. It may start with rational reasons, but it will end with emotional ones.

The last $100 at the casino is the easiest to lose. These last few hands at the blackjack table isn’t about money, it’s about crossing the rubicon from fear to capitulation. “I can’t believe the market is falling so much” becomes “I might as well bet the last $100, I’ve already lost so much.” We’re almost there, but we need just a bit more fear.

How this happens is uncertain. Straight-line down? Panic selling? We don’t know, or at least I don’t. Nor do we know the bottom. Force us to come up with a figure and we’ll say the SPY at 3,600, Nasdaq at 10,000 and Bitcoin below $20,000. Pressure us a bit and we admit, those are very conservative numbers because we’re dealing with emotions now, and emotional swings can be scary, whereas the figures above aren’t scary enough.

Pin us down though, and we’ll likely just say . . . I am Groot.

We’re all Groots now, so please please be careful.

Please hit the “like” button below if you enjoyed reading the article, thank you.

I am Groot

I am Groot ! I found the inflation measure adjustment charts enlightening. I own various small businesses providing beauty related services - we just raised prices 10-15% - services as a whole are definitely rising more than 5%.