Me Look at Oil. Me Like What Me See.

September 2, 2022

They eye roll now.

Sometimes when I start talking, I can see their little eyeballs start to roll towards the back of their little heads.

Pay attention kids, Daddy’s talking. Write this down.

Nope. Not a finger lifted, nor a pencil shifted. Opportunity lost for whatever gem I’m about to deliver.

They call it “lecturing” . . . as if my younglings have ever attended one.

Fine. Me talk simple. Me talk like Grimlock.

You like Grimlock. He simple.

Me use pictures. Happy?

Big pictures.

You look.

Small words.

You nod.

Same for article this week.

Okay.

Me start.

Oil fall ~$10, 4 days. Bad.

Why? Iran? Yes.

Uh . . . Iran? Maybe no.

Me not know.

China? Maybe.

Chengdu lock down? Cheng-don’t lock down, not long me think. Birthday soon.

Lockdown long = sad people = no happy Party party.

OPEC+?

No . . . too . . . hmm what is big word? Esoteric.

Market bad = oil bad? Maybe.

Market bad = no money = recession = no good. No, ~$10 down too much, too soon.

Fun-da-ment-al? Too much oil stuff, oil stuffs go up?

Hmm, some, not much.

Oil on land (most oil), still go down. Same like before. Good.

No, fun-da-ment-al good, me like.

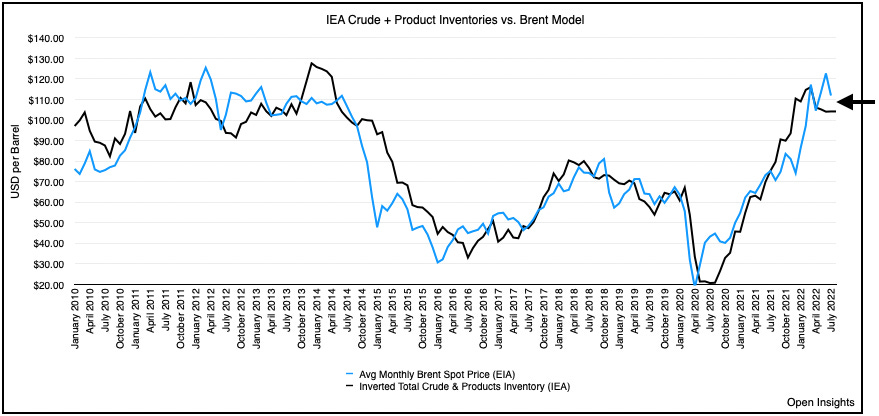

Oil should be +$100/barrel.

Oil not +$100/barrel.

Me think big reason like him.

Why he cry?

No one looking. Pretend. You sell house, only 2 people buy now not 200. You get bad price. No one in market? Price can go up/down, crazy, if people need/must sell now.

See? No one like oil.

No one at oil supermarket. Crickets.

Look at trades. Low. Low. Low.

Open Square say “the dramatic increase in volatility since the Russian/Ukraine invasion has forced banks/brokerages to increase margin requirements, thereby reducing the liquidity and number of market participants in the space. The reduced liquidity coupled with increasing price volatility means investors take an even further step back from the oil market. Fewer market participants coupled with less liquidity means less trading and less price discovery. In turn, volatility increases even further over time, reinforcing a vicious cycle.”

He gibber jabber too much.

Me eye roll.

He say Big circle, BAD circle.

Wait.

Circle is wheel, wheel go back and forth. Down prices can keep go down, but up prices can keep go up. Fun-da-men-tals keep push up price.

Crude stock not go up when should = demand good. EIA revise up June demand even though June highest oil price month. Inventories fine, supplies no fine. Reasons oil go up . . . eliding.

Good word, you scribble down.

So, keep big picture in big brain.

More violent down = more violent up.

You NO eye roll!

Me Done.

You like we write? You hit “like” button now.

Me like. Keep simple. Fun-da-men-tals. You like oil. I like oil. Thanks.

thank