Nike: Our Intern Takes the Shoe Dog for a Walk

July 16, 2025

OSC: Whassup Matt,

Matt: Hi.

OSC: Welcome back again.

Matt: It's good to be back. What do we have in store for this week?

OSC: So since last week you made lemonade out of lululemon, we figured this week you could run with the gods. What company did you look at?

Matt: Nike. (Full disclosure, Matt owns shares of Nike in a personal brokerage account).

OSC: Awesome, the company founded by Phil Knight, whose autobiography, Shoe Dog was a great book by the way. So tell the readers all about today’s Nike.

Matt: To me, Nike has been a staple athletic brand throughout my entire life. As a basketball player, the Nike logo is practically on almost every basketball player’s shoe. However, Nike is much more than just a basketball shoe brand. The company, originally named Blue Ribbon Sports, was actually founded as a running shoe brand for track and field athletes. This all changed when a guy named Michael Jordan came along.

Today, Nike has taken the sports and fashion world by storm with their variety of athletic and leisure apparel. From their Air Jordan shoes to their streetwear (e.g., Nike Dunks), these are just a few of the many products that have taken the world by storm in the past few decades. You can say that Nike is the God of shoe companies.

OSC: Ooooh . . . nice commercial there.

Matt: After seeing their stock plummet during COVID (falling from $102/share to $68/share), Nike recovered and reached a new high of $178/share in 2021. Since then, it has trended downwards, trading at ~$72/share that we see today.

OSC: There’s probably alot of stimulus money getting spent in 2020/2021. People were at home snatching up shoes. Looking at the chart, there’s been a dramatic dip since 2021, what’s causing that?

Matt: Post-COVID, Nike’s former CEO, John Danhoe, pivoted the company into focusing on lifestyle footwear. With the popularity of Nike Dunks, the company concentrated its marking efforts on these types of leisure products.

After seeing major success in 2021 and 2022, the company began experiencing slower growth in revenue due to changing fashion trends and over saturation. Historically athletes have been at the core of Nike’s business, however, Donahoe decided to challenge this image by selling more lifestyle shoes. Instead of innovating new products to align with more recent trends, Donahoe kept with his original strategy for too long.

By 2024, revenue growth had flatlined, and Donahoe shifted to cost cutting, implementing a three-year, $2B cost cutting plan that reduced headcount by 2%. Despite the focus on reducing expenses, revenues continued their decline, which led to the eventual departure of Donahoe.

OSC: That’s tough. If you can’t grow sales, you can try and juice your profits by cutting expenses, but eventually you can only cut so much.

Matt: Exactly. The focus on lifestyle brands was also accompanied by a shift in how Nike distributed its products. The emphasis of promotional activities in Nike’s own direct channel cannibalized sales from, and alienated, their wholesale and distribution partners like Macy’s and Foot Locker. This ultimately hurt sales overall, and gave an opening to rivals such as Hoka and New Balance.

OSC: It’s never a good thing to compete against your distributors. Okay . . . that makes sense, basically they overplayed their hand in churning out “fashionable” products and stuffing it through their own channel at the expense of their distribution partners. That usually leads to discounts and promotions as you’re grabbing at volume them and competing on market share against your own allies. Not great.

Matt: Yes, essentially, the plummet in Nike's stock was the result of the above factors. So in comes the new CEO, Elliott Hill.

OSC: He have any good ideas?

Matt: Hill’s strategy consists of two key components: shifting the brand focus from lifestyle to athletic apparel and rebuilding relationships with wholesale partners.

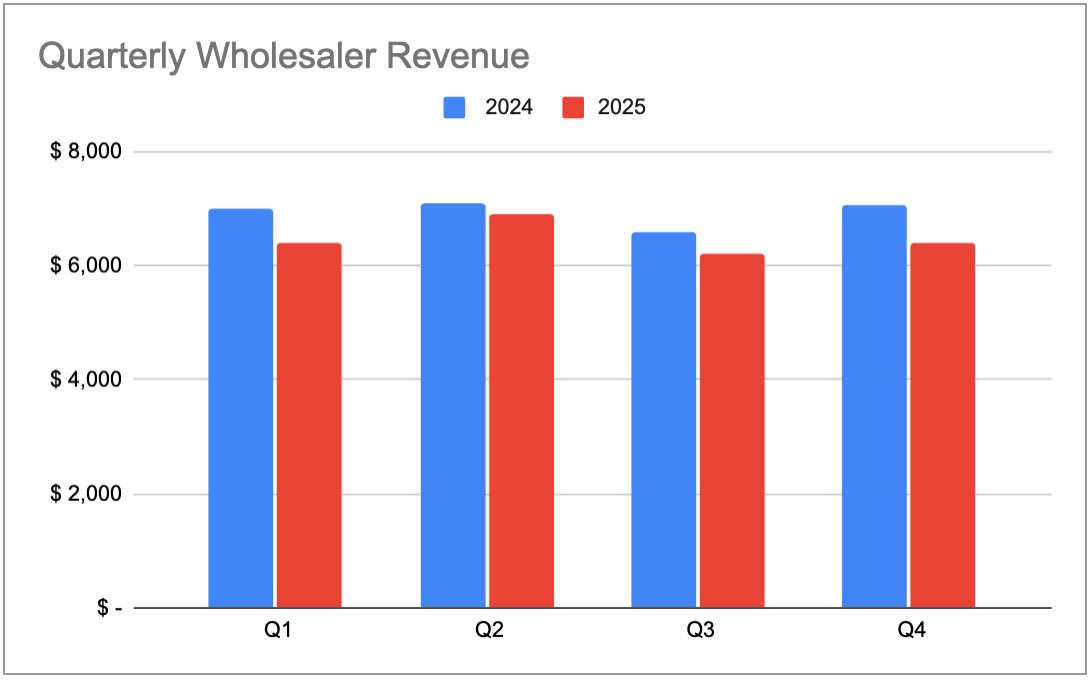

OSC: Smart, because the first part isn’t working anymore, and the second part (i.e., repairing the wholesaler relationships) is necessary since Nike sells slightly more than half of its goods through that channel. So righting the wrongs of the past?

Matt: Yes.

OSC: Okay so Donahoe was the man, CEO during this boom and bust period, sold too many “cool” shoes, which became uncool, and in walks Hill in . . .

Matt: October of 2024 (slightly in the middle of FY2025 Q2).

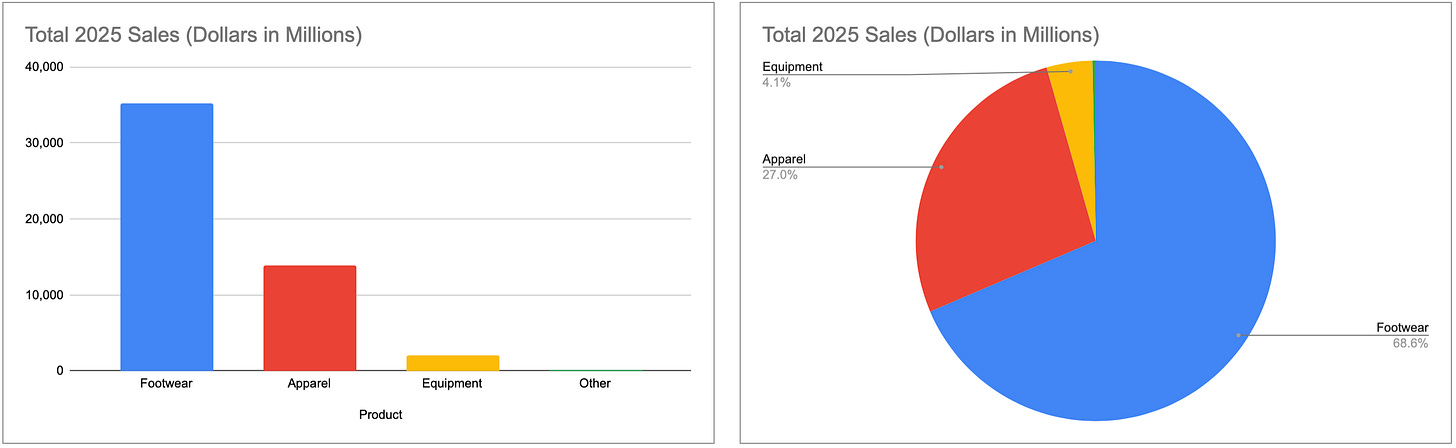

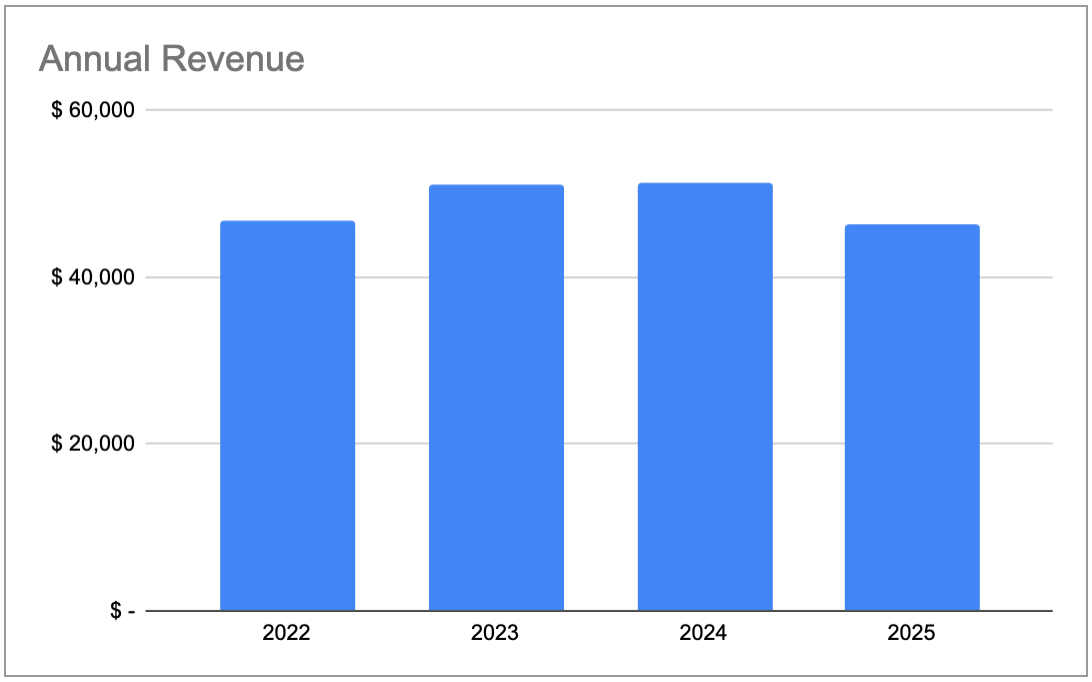

OSC: Ah, so he’s only had two full quarters under his belt. Okay, so Hill comes in and says “we’re going back to basics,” focusing on athletes again, telling stories, etc. I mean heck, this thing is still really a shoe company. (Note all charts are in millions)

Is it working? Looks like they just finished up their 2025 fiscal year (it ends in May 31). Is his strategy paying off, can we see it in the numbers?

Matt: To evaluate the effectiveness of this strategy, we can examine Nike’s overall revenue, with particular attention to sales from wholesale channels.

OSC: Good place to start . . . topline sales, then work your way down.

Matt: Between 2022 and 2025, there has been a steady decline in year-over-year revenue growth. Revenue rose by 9.65% from 2022 to 2023, flattened in 2023 to 2024, but then dropped 9.84% from 2024 to 2025.

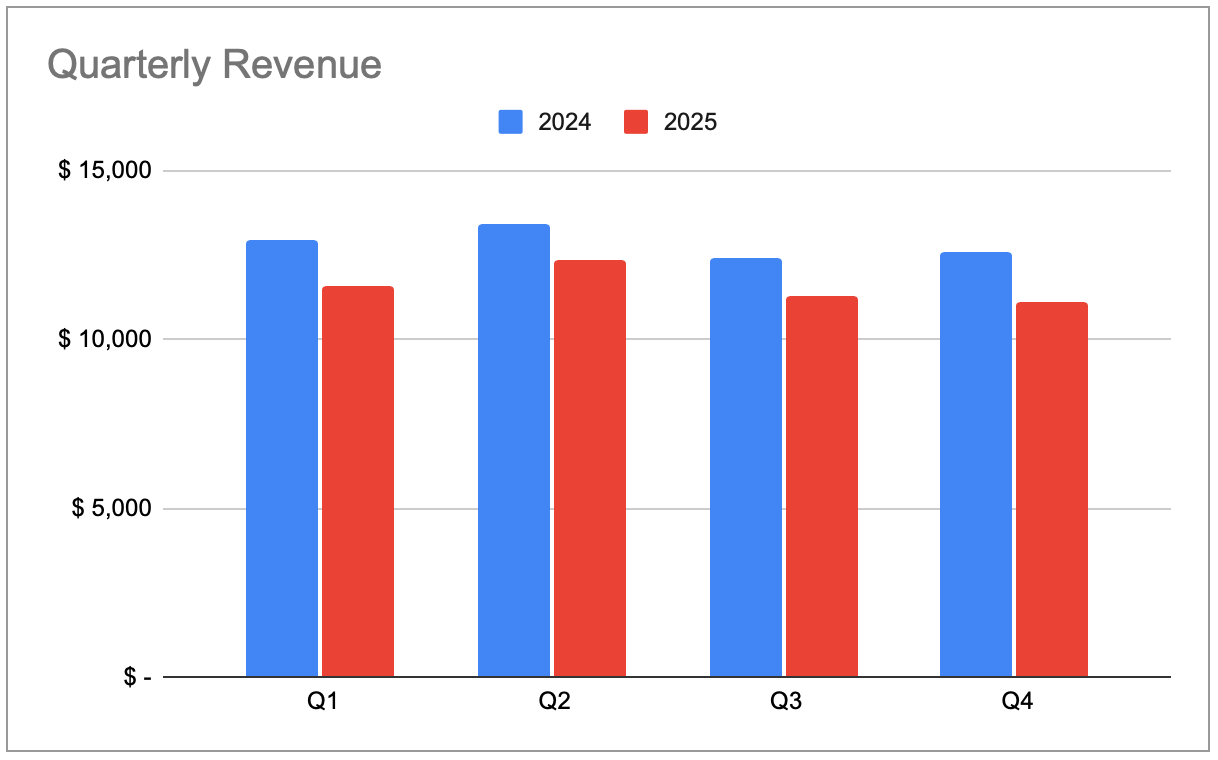

Because Hill took over during Q3 of fiscal 25, it’s probably better to look at the company on a quarterly basis.

OSC: . . . and how’s that going for them so far?

Matt: If we look at revenue from a quarter-over-quarter standpoint, we can create a better picture of Hill’s current performance. Over Donahoe’s last two quarters, revenue declined in Q1 by 10.43% (2024 vs. 2025) and in Q2 by 7.72% (2024 vs. 2025).

Although Hill assumed leadership at the end of Q2 2025 with expectations of improvement over Donahoe’s performance, revenue still declined in the final two quarters of FY25. In Q3, we saw a 9.33% decline (2024 vs. 2025), along with a 11.97% fall in Q4 (2024 vs. 2025).

OSC: What about the wholesalers, the second part of his turnaround strategy, are they selling more?

Matt: Q3 and Q4, year-over-year, were down 2% and 9%, respectively. Not great.

OSC: Okay, so looks like, in the past 2 quarters that Hill’s been in charge, we’re still drifting lower. What about the cost of the products, I’m sure they’re impacted by the tariffs and inflation?

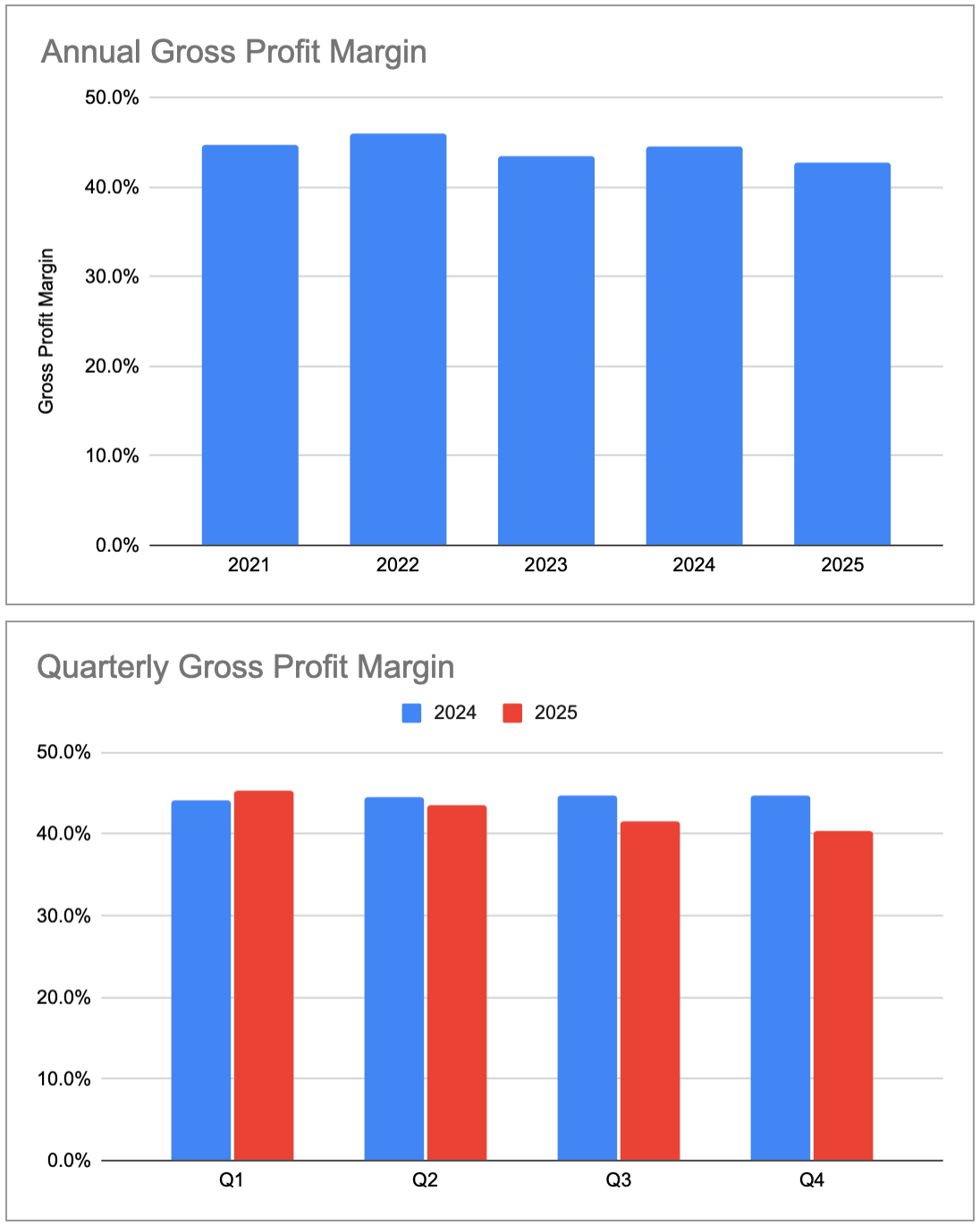

Matt: Even before the trade war, gross margins were already coming under pressure.

During Donahoe’s final two quarters, gross profit margin declined in Q2 from 44.6% to 43.6% (2024 vs. 2025). Following Hill’s appointment at the end of Q2, there were high expectations for a turnaround in profitability. However, those expectations have not been met. Gross profit margin fell further in Q3 from 44.8% to 41.5% (2024 vs. 2025), and the decline continued in Q4, from 44.7% to 40.3% (2024 vs. 2025). While it might be easy to attribute this decline solely to Hill’s leadership, it’s important to consider external factors, particularly the impact of Liberation Day.

With tariffs imposed by President Trump taking effect on April 2, 2025, Nike’s performance in Q4 likely suffered as a result. These tariffs have increased the company’s cost of goods sold (COGS), while revenue has been declining since Hill took the helm. Per Nike’s, Q4 FY25, earnings call transcript,

“Gross margins declined 440 basis points to 40.3% on a reported basis due to higher wholesale discounts, higher discounts in our NIKE Factory Stores, supply chain cost deleverage and channel mix headwinds”.

This combination, rising costs and falling revenue, poses a significant threat to Nike’s future profitability.

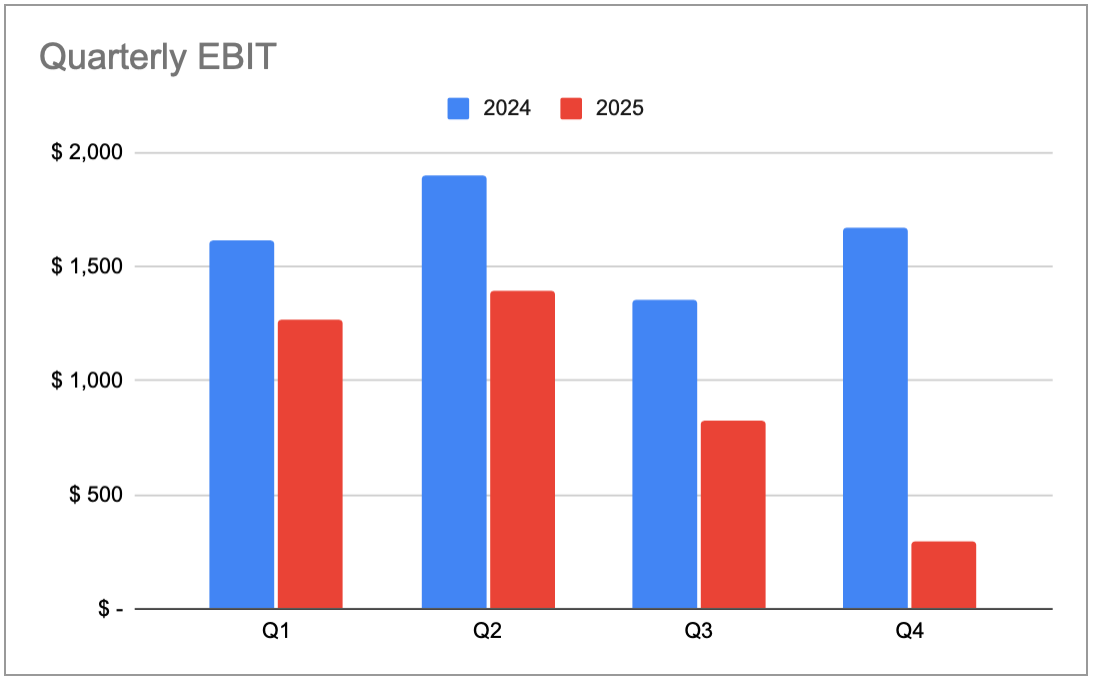

OSC: Yeah, though it’s only a say 4.3% decline on gross margin basis (for example in Q4), if your entire net profit is 15% (so out of every dollar you sell, you keep 15 cents), a reduction of 4.3% gross margin (because the shoes are just more expensive to source), your profits just declined by 25% (i.e., 15% net profit falls to 10.7% profit all else being equal). Given that they’re having difficulty controlling product costs, are they having any success corralling corporate costs? Opex?

Matt: Well . . .

OSC: Ooof. So declining revenues, higher COGS, lower gross profit, and falling EBIT because they aren’t cutting opex fast enough. Brutal combination. Then we take a walk through their balance sheet (latest cash flow statement isn’t out yet), but we can see cash and cash equivalents fell from $9.8B to $7.4B, so a reduction of $2.4B in cash.

Matt: They’re burning cash.

OSC: Yeah, and that’s interesting because Nike for the past 4 years generated about $5-7B of cash from operations a year, less ~$800M of capex, it pocketed $4-6B of free cash flow a year. Now it’s all cascading lower and cash flows have evaporated.

Okay, let’s wrap-it-up, is this a buy? Is there a chance Hill will pull this off? How does it compare to lululemon since both are arguably in the same space?

Matt: With both wholesale and overall revenue trending downward, Nike’s outlook for the next few years appears increasingly uncertain. In its recent earnings call, the company acknowledged continued pressure, stating:

“We expect these headwinds to continue through the first half of fiscal '26.”

As revenue continues to decline, the company’s valuation is likely to face mounting pressure. This contraction in revenue is also contributing to a drop in gross profit. The decline can be attributed not only to lower top-line performance but also to a rising cost of goods sold (COGS). As tariffs begin to take effect, Nike’s COGS is expected to increase further, compounding the pressure on margins. A simultaneous increase in COGS and consistent revenue decline will inevitably erode profitability.

When comparing Nike and lululemon, we see two companies operating in the same industry but performing at very different levels. Nike is significantly larger, with approximately three times the valuation, five times the sales, and four times the market capitalization of lululemon. Despite this size advantage, lululemon is currently on a stronger growth trajectory and is expected to double its revenue by 2026.

Nike, by contrast, is focused on stabilizing its top-line performance amid ongoing declines. lululemon is still emerging as a company, generating strong cash flow and delivering high returns to shareholders. Nike, meanwhile, is facing increasing pressure to reverse its downward trends. Although both companies are subject to the same broader macro challenges in the athletic apparel market, Nike is currently experiencing more internal headwinds than lululemon.

OSC: I think I’d echo that, for Nike you’re buying a $105B market cap company, cash and debt are about the same, so basically a $105B total enterprise value kicking off negative cash flow for the time being. Hill is pivoting strategies, but it’s just an issue of size when you’re already selling $45-50B of shoes and athletic gear every year. If you retrench to focus on the “athlete,” that’s basically the strategy since . . . forever, and it’s hard to see where material growth can come from. Now they’ll likely slash costs, take a bunch of impairments on old inventory, and blow-out the fashionable shoes at a discount, so this could all be an accounting issue where the new CEO throws the kitchen sink to start anew, but the reduction of cash is real . . . that means they’re burning cash as this turnaround strategy finds traction, and even if it works, can that strategy grow this giant company again? There was a reason they pivoted to more trendy shoes to begin with, maybe it was a gold vein they found and they just over-mined it, but that’s just a broader untapped market. So retreat, retrench, and soothe your wholesalers. Fine . . . but where will the growth come from? On balance, I think you’re right, we should . . . Nike Dunk this one. hehe. So why do you still own it?

Matt: That’s a whole other article . . .

Please hit the “like” button and subscribe if you enjoyed reading the article, thank you.