Now Comes the Hard Part for Energy Investors

January 31, 2022

Now comes the hard part. That is, to hold. Holding. Hold energy investments while investors HODL tech. Holding as you see oil prices print $80, 82, 84, 86, 88, 90. Holding with the understanding that despite oil’s seemingly parabolic rise, it’s simply a byproduct of storage grinding lower everyday.

In the fourth quarter we experienced a downdraft, whereby oil prices climbed from $75 to $85/barrel, and then back down to end at $77, round-tripping the entirety. Those of us in the oil market knew, however, that much of the selloff was related to Omicron and derisking by traders after a year of handsome gains. Why risk your performance bonus at year-end when the majority of gains had been achieved?

So as the calendar refreshed, we anticipated oil prices to continue their climb (if, and a BIG if, inventories failed to build materially). That my friends is occurring now. Consequently . . .

Yes, some of that price response is due to the Russian “aggression” towards Ukraine, but not much. Not much because 1) whether Russia invades is still so uncertain, 2) the West won’t sanction Russian energy exports directly, 3) if direct sanctions are minimal, then we’re factoring only indirect costs (i.e., the friction from other sanctions), which will increase the cost of Russian oil transactions, and 4) emergency IEA SPR releases will dampen the initial shocks. Whether Putin weaponizes energy is something else entirely. For now, we don’t believe that scenario is fully accounted for in today’s oil prices (i.e., oil would likely vault into triple digits were that to happen). Besides, the key point is will he invade? That’s still up for debate (though we’re on the side of yes). So what accounts for most of the rise? Fundamentals, actually inventory balances to be precise, which already indicate that $80-90/barrels are well within reason.

It’s not only crude prices, but product prices. We know because refinery margins are also roofing at this point. So there’s a real pull on products, and in turn, a real pull on crude.

So now comes the hard part. No, not the hardest part, which was buying energy stocks when oil prices free-fell in 2020. If you weren’t shell-shocked, then you’re lying. For all the bravado and bellicose tweets we see these days, for all the mispelled “LEDGEND” and self-congratulatory messages, it was scary and it was undeniably difficult and fraught with risk.

Yet, as we can see from the performance figures of many funds with a current energy theme/exposure (Ninepoint, HFI Research, ours), it was well rewarded and frankly well deserved.

Still, now comes the hard part. The hard part is holding.

No, not the HODLING done by the crypto or tech bros, which are premised on narratives as shallow as their ability to spell check, but holding. HOLDING real and tangibly profitable companies. Holding while you see oil prices print seemingly unbelievable figures on one screen, and then contrasted with what we’re used to seeing for energy equities (i.e., low prices). Oil stocks have certainly moved up, but not nearly enough. Still, with our time under tension now measured in years, our ability to stay patient is nearly Herculean. We simply need to remember that by any sensible calculation, if oil prices were to stay anywhere near today’s levels, the companies will drown in an embarrassment of riches.

For us, it’s the Goldilocks tale of three bears, one small and nearly debt free (Gear Energy), one medium and reducing debt rapidly (MEG Energy), and one large gearing-up to announce a new shareholder return policy (Occidental). All of our oil positions are generating nearly ~30% free cash flow to market cap at $80/barrel oil price. Cash flows matter, especially in a world of 10/20/30x revenue metrics. We’re talking 3x FCF multiples here people. We’ll write about these companies more in later articles and as they report quarterly earnings.

Burning

We hear it and see it everywhere. Comments like “oh but oil prices won’t last, this is the heyday and they’ll surely fall as the economy weakens, EV rises, China deteriorate, etc.” No. They won’t. At least not for awhile. Yes, there’s going to be volatility, it’ll move up and down, it always does. Nothing goes in a straight line, but despite all the hand wringing and consternations, despite all the debate about oil and its evils in the past few years, we simply kept using it and we hesitated drilling for more.

It is all reversing now. All the sayings and cliches apply. The chickens are coming home to roost, the piper is getting paid, and we’re reaping what we sow. As for the ESG crowd? Well what we wrote in September 2021 still rings true today as it did then. In an article called “Let It Burn,” we said this about the ESG movement:

The pace of our energy crisis is quickening and prices will become increasingly volatile as the shortages reverberate globally. Whatever the price our misguided climate policies would have cost are ratcheting ever higher.

It’s too hard though right? Because a real dialogue about energy consumption, who should sacrifice, who should pay more, where we can find more energy, what we can do, and who should bear the burden in costs, funding, resources, land, etc. would mean tradeoffs (i.e., real sacrifice), and for those in the developed markets, that very word, sacrifice is anathema. YOUR sacrifice though, that’s okay. In fact that’s sacrosanct because that’s how we’ll do this. So thank YOU for your service in this collective effort. You’ll pay and suffer more, but we’ll laud you for it. Words are cheap, but energy won’t be. So let it burn.

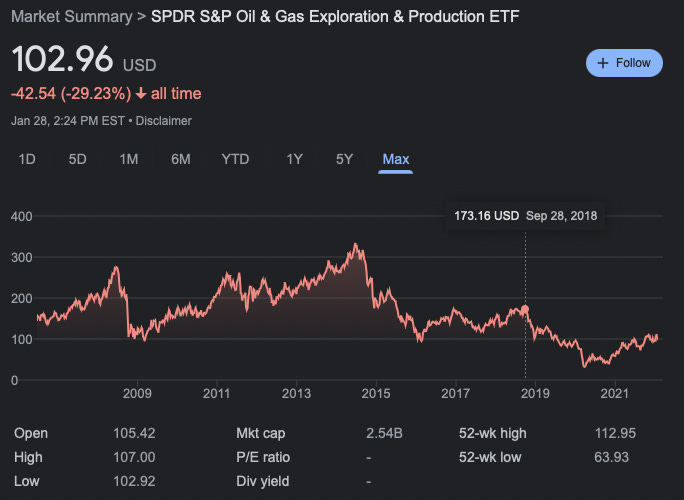

Hold because if you think this is it, there’s more to come. Hold because 3x FCF shouldn’t exist in a 1.8% 10 Year Treasury world. Hold because energy equities are woefully undervalued. The last time oil prices were near today’s levels (in fact they were below), XOP (i.e., the ETF basket of oil producers was 1/3rd higher). Even more surprising is that today’s underperformance is occurring amidst a backdrop in which inventory levels are lower, spare capacity is falling and global risk is rising. Said another way, XOP would need to rise 50% to even match 2018 levels.

We’ve little doubt that it will. As this secular bull market continues, caused largely by our collective indifference to energy security and our contradictory actions in our daily lives, we’ve little doubt that these stocks will rerate, regain, and reignite.

So for now? Hold . . . like these ladies.

For a summary of our 2021 and a look ahead to 2022, our Q4 letter can be found here. Please hit the “like” button below if you enjoyed reading the article, thank you.

All i can say is LETS GO.