OECD Inventories? Let it Drain . . . 'til Summer!

March 15, 2024

Odd how things work.

Just last week we wrote:

“It’s not much of a surprise to us though because if we snap back to our “holy grail” of charts (i.e., inventories to oil prices), we’re getting closer to where we should be.

One could quibble that we are actually slightly below where we should be, and we wouldn’t argue with that. To be fair we’re probably under by a few dollars, but much of that will depend on the direction of inventories in the coming months. So how’s that looking?”

This week?

There’s your few bucks. Just like Good Will Hunting . . .

Now certainly some of this is related to Ukraine’s continuing attacks on Russian infrastructure (i.e., refineries), but this is crude we’re talking about. If refineries go down, shouldn’t crude demand fall? One would think. Yet, what’s being quietly and slowly, but surely revealed is that 1) OPEC+’s plans may just be working, and 2) demand may just be slightly stronger than the market had anticipated.

OPEC+’s plans? Well let’s be honest here, all those voluntary and involuntary cuts? They’ve mattered little. They’ve mattered little because for the most part OPEC+ exports have been pretty stable.

Exports to date are pretty flat vs. 2023 though if we were to dive deeper, we can see Saudi exports have definitely clocked-in lower. Since Iranian exports are higher, net-net . . . flat. Flat is good though because what all of this is designed to do is hold supplies at the same level even as Iranian exports are absorbed into the market. The Saudis effectively stepped aside (temporarily) to accommodate Iran, and as increasing demand steps higher, they’re left as really the only country with material spare capacity.

Before they release that extra production though . . . all that OECD inventory?

Let it drain.

In our real-time tracker for OECD inventories we can see, we’re drawing higher than normal vs. 2018/19, but below the robust days of 2021/222 when supplies had yet to recover from COVID.

Notice 2023 vs. today though. For Q1, we’re well ahead of where we were last year. A nearly 50M barrel delta quarter-to-date.

So overall, OPEC+’s constraint (or restraint) has allowed demand to soak up the excess. Now that Chinese and Iranian floating storage have drawn to essentially been emptied . . .

. . . what’s drawing are OECD stocks.

That, however, is surprising the market because it had anticipated flat inventories at best, and more likely a build. This is low demand season after all.

So much so that IEA has just revised first quarter demand by +270K bpd to 1.7M bpd. Overall 2024 demand is forecasted to rise by 1.3M bpd (a +100K bpd add vs. last month).

Hmmm +1.7M bpd in Q1, but only +1.3M bpd holistically for 2024? For that to happen, Q2-Q4 would need to see falling demand year-over-year. Maybe, but doubtful.

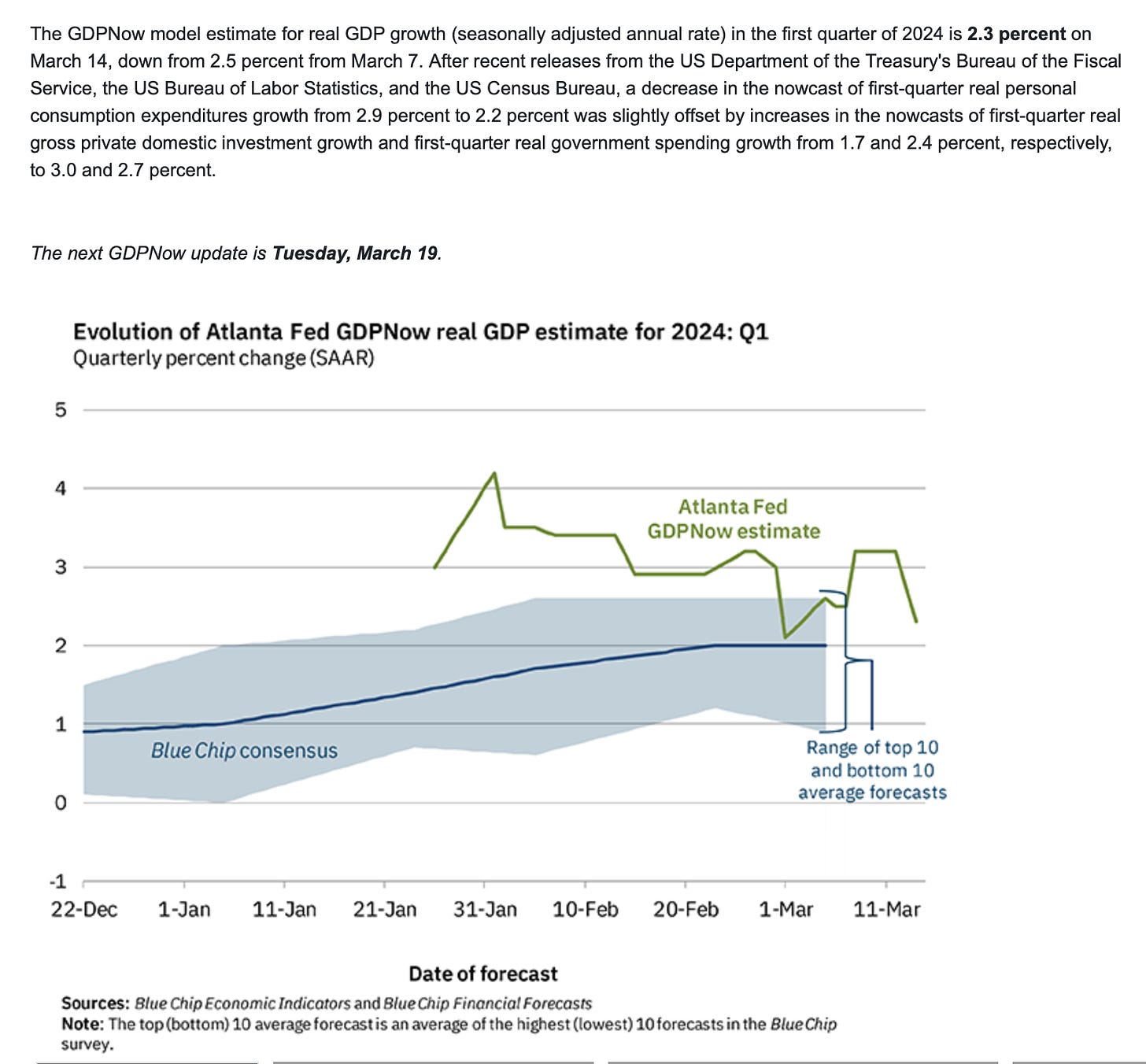

We’ll have to see there, but with US GDP still clocking in above 2% and copper (a leading indicator of the health of the global economy) turning up, this bodes well for oil demand.

So into refinery maintenance season we go. If inventories continue to dwindle in OECD land that sets-up for a very very interesting summer as demand spikes. In the meantime, the Saudis are certainly dancing and doing their own Elsa impression. Let it drain. Let it drain, can’t hold it back anymore.

So sing-a-long because afterwards? It’s . . . summmmmmer.

Please hit the “like” button above if you enjoyed reading the article, thank you.

Excellent