Oil Fundamentals in January. View from Above.

February 1, 2024

$77.85 and $82.41/barrel

Those were the average prices for oil in 2023 (WTI and Brent, respectively).

Today, we’re looking at the screen and it’s blinking $75.77 and $81.70, just a hairbreadth away from the average. Does that make sense?

Let’s take a look since we’re already one month into 2024 shall we?

How time flies.

So anyways, again, does that make sense?

Perhaps.

Well, actually no, not really. No because if we were to step back and look at global inventories, Brent prices should be nearer $90/barrel.

That’s $90/barrel without any geopolitical premium/risk built in. Yet, we’re nearly $10/barrel lower. It’s likely because there’s a perception that there’re oodles (yes, that’s a technical term in the oil market) of spare capacity. There’s also the perception that the economy will soon slow down, the labor market will deteriorate, and the global demand to move things and people will start declining. I guess. Sure, but the economic indicators seem to indicate that things are . . . fine.

Still that perception exists, and hence there’s little reason for fundamentalists or computers (i.e., CTAs) to go long despite where inventories are at. As you can see . . . sidelines they’re sitting (Giovanni Staunovo).

Our fundamental side, however, is telling us that physical barrels do count, and what happens to barrels does matter. So what are inventories doing? Well just look again at the chart above (satellite data). Oil inventories are inverted (i.e., the higher they are the, “fewer/lower” the amount of barrels we have). Specifically, the chart above depicts onshore inventories, and since the start of the year, they’ve declined ~28M barrels, nearly 1M bpd.

Yet, oil prices hasn’t moved. It hasn’t moved despite inventories drawing during a quarter when they normally should be build. Perhaps it’s building on the water. Perhaps inventories are declining on land because disruptions in the Red Sea and the Persian gulf have redirected tankers all around. The disrupted supply chain means stocks should decline onshore, but build offshore as tankers take longer to sail around Africa, and in turn, there are more “boats with barrels on the water.” So what does oil on water look like?

Hmm . . . down by 1M barrels since the start of the year.

Well, now hold on a second. The oil on water data combines two things, floating storage (tankers parked near your shore waiting to unload) and oil actually in tankers sailing around. Hear me out, perhaps floating storage is declining (again because if your onshore storage is declining, maybe you’re also dipping into what’s floating around your shores), but oil on water (the moving stuff) is actually building like you’d think (since tankers are being rerouted on longer journeys). A HA!

So what does floating storage look like?

Flat.

Literally zero build/zero draws.

What the?!

Okay, let’s strip out floating storage. What’s on water? Surely it’s gone up since the beginning of the year as tankers sail around.

Down 4M barrels.

Fascinating.

Bring it all back again and you’re basically seeing oil on water levels pretty flat, and onshore inventories draw in January. We wouldn’t have expected that given the tension in the Middle East and the “questionable” demand we entered into 2024 with. Such is the oil market today.

The takeaway? Oil inventories are drawing when they seasonally build, there’s still low positioning in the market, and there’s still apathy about the geopolitical risks. Fascinating.

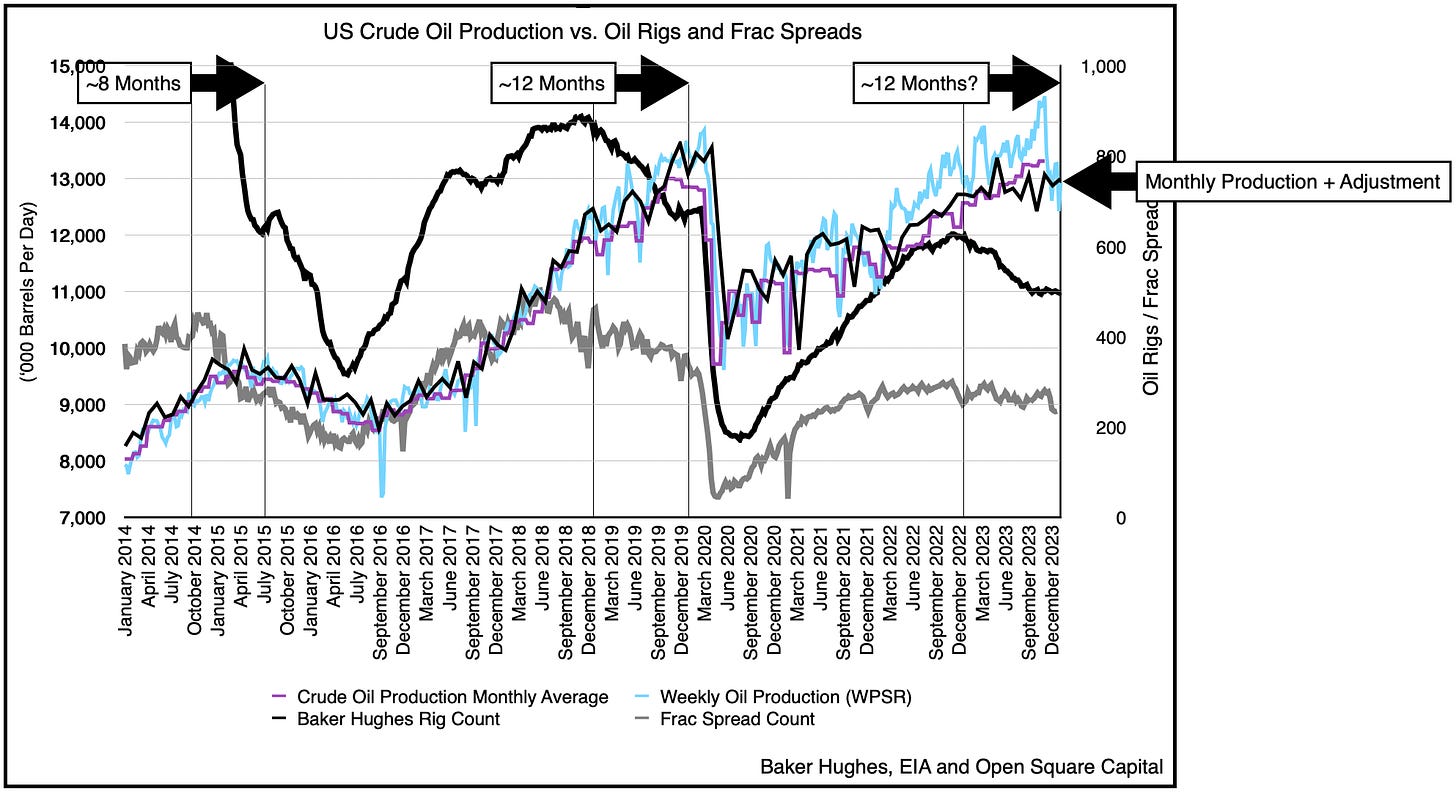

If US production growth really starts to slide here like we think it will (November production figures were finalized, and US production has flatlined in the past three months), then we may actually be onto something. All of the handwringing about global supplies shooting higher in 2023 may have just been more smoke than fire.

Fascinating.

Onto February and March we go, but for 2024?

Fundamentally . . . so far . . . so good.

If you haven’t read our year end review for 2023 and look ahead letter, we encourage you to do so.

Please hit the “like” button above if you enjoyed reading the article, thank you.

Perhaps that means that crude price is only sporadically and unpredictably rational.

And you know what they means....

They minor movement are no longer predictable... until they once again are...

and perhaps the relevant variable are hidden.