Oil Investors Get Bitten This Week

October 6, 2023

Dum dum . . .

Dum dum . . .

Dum dum dum dum dum dum . . .

Just when you thought it was safe to go back into the water.

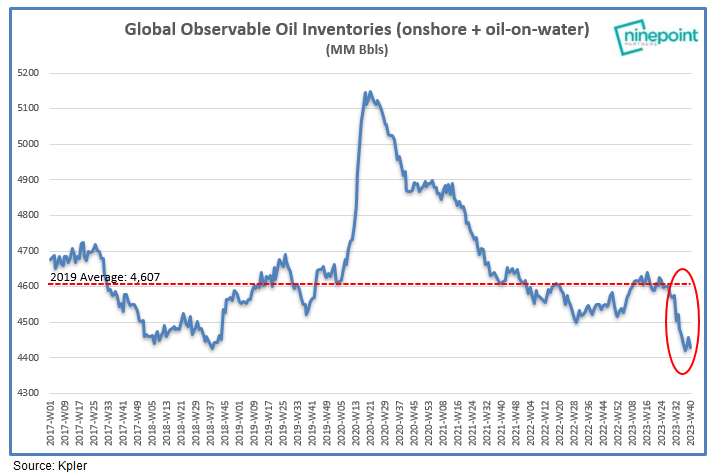

Just when you thought inventories were collapsing and all is going swimmingly.

Just when you thought oil prices will climb past the $90s and vault into triple digits.

This. This happens . . .

What’s that? That my friends is quid pro quo.

Quid pro quo taking a bite out of the hopes and dreams of energy investors.

Dreams that turned into nightmares this week, when unexplained selling hit the market for no good reason. Some of the reasons proffered? Technical issues, EIA report on weak gasoline demand, macro-uncertainty. Nah. We knew. We somehow thought . . . the market knows something.

Frankly, quid pro quo was fully expected by us.

It’s too tempting. It’s just too tempting to trade away a bit of price for huge political gain.

Now what’s interesting about the Wall Street Journal article, and what’s still left unwritten are aplenty:

a) will Congress even approve/ratify such a defense treaty (do they need to?),

b) what will inventories look like by next year, if the Saudis do release additional barrels?

c) won’t prices still be higher given the low inventory levels?

d) aren’t the Saudi motivations the same for oil prices even if such a treaty were in place given the needs of Vision 2030?

e) what are the real details of what’s being negotiated?

All of these issues are still uncertain and unresolved. It’s early days, and we needn’t jump to any conclusions quite yet. For the market though, the selling pressure this week was tantamount to concluding that this was already a done deal. $10/barrel in a week is definitely assuming a deal is done, and those barrels are back on the market.

It is not, and those barrels are not.

What is certain, however, are inventory levels, and so long as global demand stays firm and Q4 seasonality stays consistent, oil prices “should” solidify around the mid-$80s, and potentially recoup $90s. This is especially true if those barrels don’t come until early next year. By then inventories should be even lower than today. In the end, you can scare investors out of the water, but today’s time spreads and the physical tightness don’t lie.

Eventually, the backwardation will lure investors back to the water.

Still, $100/barrel? That might not be in the picture for a bit as we add geopolitical quid pro quo to the macro-uncertainty.

Fortunately, you weren’t full bull already were you? Were you? As the title to our last article said . . . No one should ever go full bull in the oil markets.

Even the shark says so.

Don’t be . . .

Dumb dumb.

Dumb dumb.

Dumb dumb, dumb dumb, dumb dumb, dumb dumb.

Please hit the “like” button above if you enjoyed reading the article, thank you.

one question: can you actually trust ANYTHING that comes out of the WSJ regarding oil and Saudi Arabia? Last I checked, Saudi despises the WSJ for the 10+ bullshit articles over the past few years