Oil, The Market's Chew Toy

May 4, 2023

Invest in the energy markets long enough and you soon get used to this.

It’s the steady state, the normal state. In case you didn’t know, oil investors are the toy. “They say” the physical market disciplines the financial, but like a kindergarten teacher outnumbered 30 to 1, the paper market can sure be an unruly bunch. 30 barrels of paper side bets vs. one real barrel physically traded. So when the paper market senses a hint of macro uncertainty? Oil becomes its chew toy.

Sure I can pull-up a few charts about the physical market.

How crude inventories are flat.

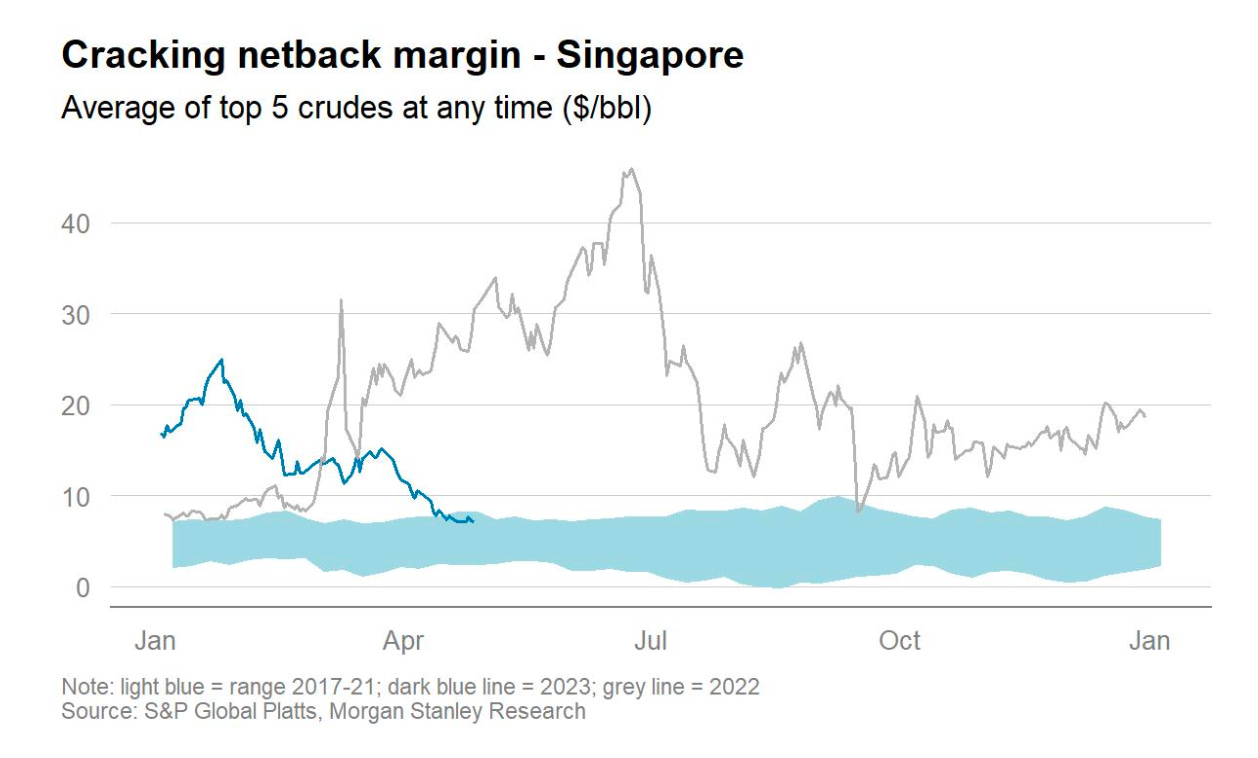

How implied product demand is fine, or how refiner’s margins are above 5-year averages.

Yet, no one cares. No one cares because 30 barrels, 30 kids, are running around untamed, and it’s been 32 years since Arnold Schwarzenegger was the Kindergarten Cop.

30 for 30. Nice symmetry to it. What’s not nice? This . . .

The precipitous drops. It’s not easy to stomach for investors in the space. That untethered decline can make you question everything. Your thesis, your data points, your views, your forecast, your net worth, your self-worth.

Maybe China isn’t reopening. Maybe the global economy is doomed. Maybe that banking crisis is really just another prelude to a Great Financial Crisis.

Maybe . . .

Yet . . . China reopening seems to be keeping pace. Sure manufacturing PMI in April of 49.5 is dissappointing, but to us . . . manufacturing weakness is really about us. We overstocked during/post-COVID and now need to bleed down inventories, but once they normalize, we’ll order things again (assuming we or the world doesn’t collapse into a global economic black hole).

So diesel demand is off. Trucking is off. Sure, we can see that. It makes sense. It’s the Bullwhip Effect for supply chains, and you’re seeing the whip crack.

Unlike us, however, the Chinese consumer was never over-stimulated with free money. So instead of spending their savings on stuff, they’re having tea with each other. Each other means services.

Food, dining, travel, etc. It’s why you’re seeing the divergence in PMIs. Services PMIs are exceeding expectations, which is why you’re seeing a discrepancy.

Services though accounts for over 1/2 of the Chinese economy, and it is robust. The Chinese are visiting each other and going on some trips . . . for reals.

This is why, even with the manufacturing malaise, oil demand in China continues to climb as the year progresses.

Crazy right?

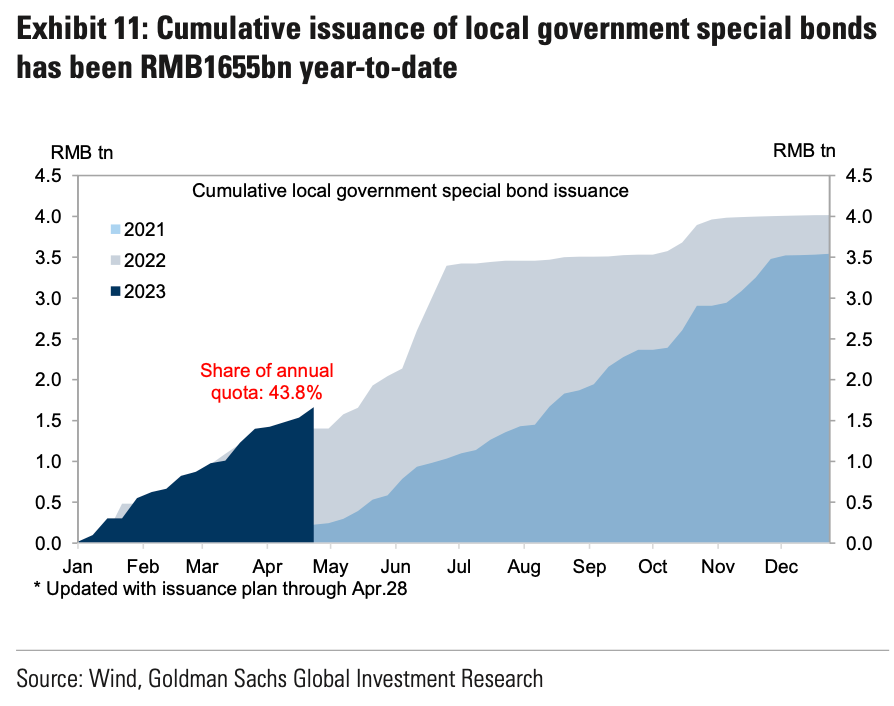

Now is this the bang-on reopening many were banking on? No. As manufacturing languishes, so too will nearly a third of the Chinese economy. Yet, that’s not to say that oil demand won’t continue to climb. Manufacturing activities will pick-up when our inventories normalize. It will also pick up if the property market stabilizes . . .

. . . and it will if government stimulus pushes higher.

Thus far, both appear to be climbing. As for that other component likely to drive demand higher (i.e., international flights)? On the whole international flights are up as is demand.

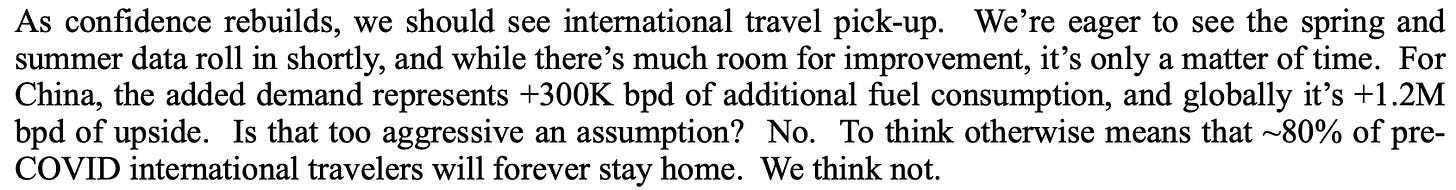

Most of the flights today though are “regional” international flights (i.e., inter-Europe, inter-Asia) and the trans-Pacific flights), whereas trans-Pacific (i.e., the fuel guzzling ones), have yet to pick up significantly. As amazing as it sounds, there are still restrictions.

Take China and the US for instance. Pre-pandemic, there were 150 daily flights between the two countries. Today? 8 are allowed. In the coming week that number will be increased to a whopping 12! Yes. 12. So no it’s not a lack of demand right now for international trips, it’s the restrictions. They’re so tight that currently a round-trip coach ticket from LAX to Shanghai costs ~$3,000, and that’s paying for the luxury of having 1 stop in (take your pick) Manila, Seoul, Taipei, or Tokyo.

$3,000.

Inevitably, these restrictions will ease and international travel will resume in full. Will they really? Yes, we think so. Once you get used to the short trips, the long ones are inevitable. Go ahead though, take the other side of that bet. Again as we said in our quarterly letter . . .

It Is What It Is

We do think there are legitimate reasons to be concerned. While things appear to be fundamentally “okay” (perhaps even “meh”), there are uncertainties. How well will China’s property market recover? Will China’s recovery continue apace? Will higher rates lead to systemic failures globally? How will US consumers fare as student loans restart and excess savings decline? Those things, and more, are still TBD, and the outcomes varied. Having said that . . . those things aren’t predetermined, and certainly weren’t determined in the past few days to warrant the sell off.

So really, the kids are running wild, and the puppies’ are gnawing on everything. This is about banking, this is about global macro uncertainty, this is about rates, and this is about worries. This is about correlation, and side bets and hedging. It’s about concerns about the broader economy being reflecting in the paper market.

Not that it matters.

What it isn’t though is physical. At least not yet. Later? Perhaps, but not now.

So let the kids run free and the dogs roam. It’s the Lord of the Flies with puppies in tow. If the recovery continues, slow or otherwise, then eventually the timeless adage for commodities will apply once more.

The physical side will discipline the financial.

So get your spritzer bottle ready.

Bad doggy, bad kiddies! NO!

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.