Oil Thoughts on the Break

April 4, 2024

Daddy why are you taking a picture of that boring building?

This my youngling . . . is the Chicago Federal Reserve, it and its brethren have the largest printing preszzzZZZZZZZ . . . in the world . . . too late, I’ve lost her. She’s asleep, but I’m enthralled. Ain’t this GREAT?!

Not to them. Not to them.

NOW THIS MY CHILDREN! THIS IS the CME! The Chicago Mercantile Exchange, a place where derivatives are traded!

“Noooo Daddy!!! Make the boring STOP!!!” they scream in fright.

We’re on Spring Break, well at least the kids are. The wife’s leading the way as she often does, blending education with fun. Husband in tow, I’m simply following along, trying to lend a help on the education side . . . largely ignored. Eye rolls abound, but I present these bounties of pics to you my dear reader. Like a cat dragging home unwanted things.

Pictures of finance! Forget the Field (the museum with Sue the T-Rex), the Shedd (a big aquarium), Millennium Park with the Bean, or Wrigley Field . . . the CME, oh yeah.

Woohoo I scream as I scream in delight.

Good times. While I’m away from the desk though, my thoughts aren’t too far from the market. Yes, still reviewing in the morning, yes, still checking throughout the day, and yes, still monitoring post-close. Though my kids are having fun . . . it doesn’t seem like many of you are.

I’m seeing two things of late on that emotional train wreck I like to call Twitter . . . okay “X”. X used to be a site where people could freely exchange ideas and professionals can gain some insight into what certain sectors of the market are thinking/doing. Today, however, unless you have extensive filters on, the algorithms push you quickly down rabbit holes quicker than a rabbit itself. Confirmation bias, anchoring bias, all the biases, they’re filtered to trigger you. The algos ares simply designed to hang you up on the topic you’re reading, or more accurately unhinge you. Either way, twitter these days can make unflappable investors . . . flap.

We suppose that’s intentional as rage or faux-rage, leads to further engagement. Spend more time on the app, and Mr. Musk can monetize that “engagement.” For investors, the utility of that engagement though is limited and could be negative. Nonetheless, it’s still a thermometer I use, and though vastly worse than before, still useful on occasion.

One of which is today, where we’re seeing the bear/bull debate play out in real time about commodities, and whether they will/will not recede from their recent rally. For context, commodities have recently done this . . .

while the oil market has done this . . . and that’s before today’s Iranian news.

Both are “up and to the right” as a mix of tighter inventories and higher demand have led to higher prices. In turn, it’s leading to consternation that the oil rally is overextended and we’re due for a pullback. “That rise?” detractors say, it’s not higher demand, or tighter supplies, that’s all geopolitical risk as the Middle East continues to be a powder keg.

Perhaps some, but look at that again chart. The recent rise since the beginning of the year isn’t just geopolitical risk, it has to be more since geopolitical risk should be faded right? Well since YE 2023, we’ve been on the same general heading and that heading has been up. If it was geopolitical risk, we should’ve seen some of this fade in February, but instead prices climbed.

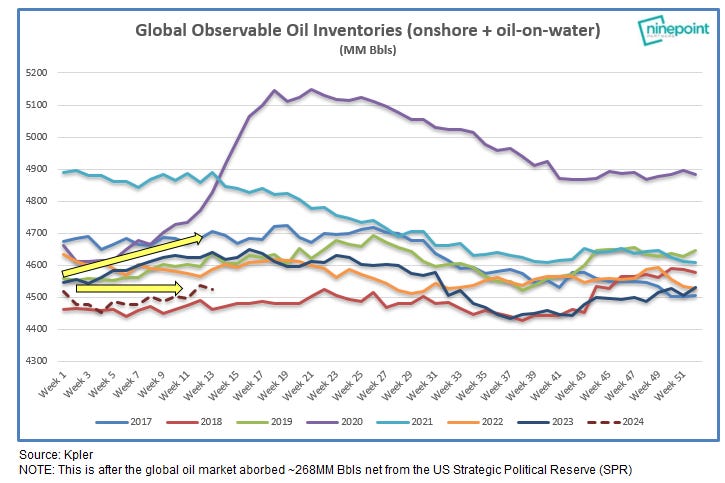

More likely, this is inventory related, or at least mainly so. We’ve just finished the first quarter with nary a build, a season where we’d typically see onshore oil inventories increase as lower demand coupled with higher refinery maintenance depresses petroleum demand. That is not today as crude inventories stay low . . .

while demand keeps getting revised higher . . . by nearly everyone.

What happens now is whether refinery margins collapse, which indicates that end consumer demand is weaker than we expected, forcing refineries to shut-in. If crude prices continue to push higher, and product demand weakens, then we’ll likely see refineries begin to shut-in as refinery margins fall. Again that does not appear to be happening as the US economy continues to show strength. US 3/2/1 crack spreads look fairly decent, as does Asia.

Globally, we still have a recovering China and an improving Europe. If those come to fruition, then oil prices have further upside. Eventually capped? Yes, as we think OPEC+ would step in, and/or the Biden Administration would release SPR to cap prices in an election year. Still those efforts will prove temporary because if we begin to exhaust spare capacity and/or SPR, then crude prices on the other side of those efforts will prove even scarier.

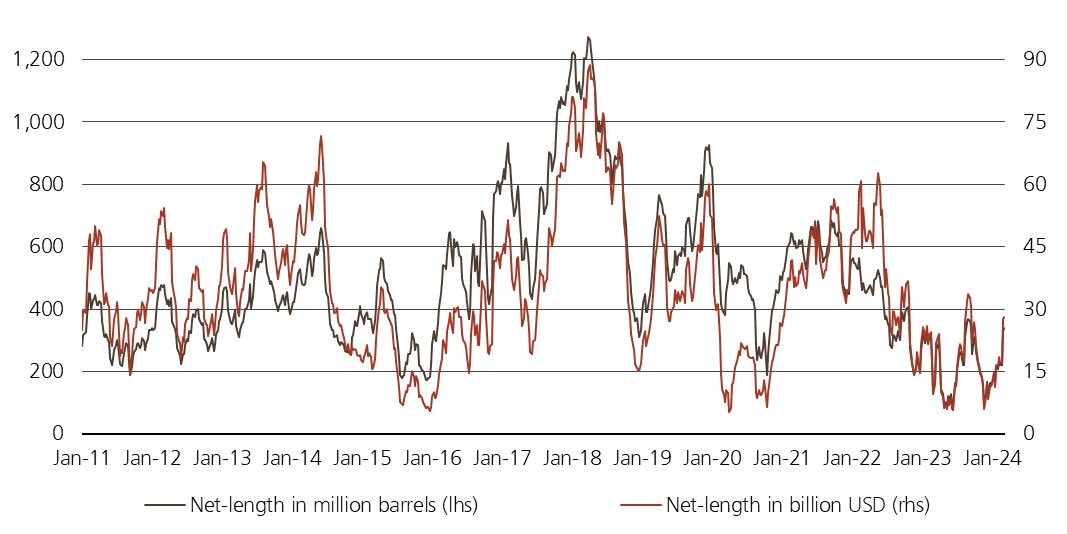

For now, is the hand wringing warranted, or are we simply experiencing PTSD from all the years of on/off rallies we’ve experienced? Our take? It’s the latter. Sentiment is hard won, and it’s still very skittish. Despite low inventory levels, the excess spare capacity (Saudis), potential SPR releases (US), and threat of recessions, means that we’ll likely see bear arguments dominate, and positioning remain low.

Geopolitical risk will also keep investors on the sidelines as traders wouldn’t want to go short, but are also cognizant that the upside doesn’t tend to have longevity. Hence, why positioning is nowhere near stretched. It’s simply off the mat.

Which isn’t too much of a surprise. Geopolitical risks should be faded, but it definitely shouldn’t be shorted. Until there’s true supply disruption, it’s a lot of scary noise. In the end, fundamentals matter.

Whether Iran hits Israel for its targeted attack in Damascus will be the next shoe to drop. More importantly, what does Israel do in retaliation? We surmise it’ll depend on the damage, if such an attack were to happen. Once again too many mental threads to pull before any outcome can be certain, and we could spend a thousand words just running through some of the immediate impacts. For now, as with all geopolitical events, it’s best to wait.

While we do, it’s at least safe to say . . . fundamentals justify today’s prices, and where inventories are at and where they’re headed in the short-run (i.e., the approaching summer), we can be fairly certain. If the economy holds, we’re priced correctly. If so, then so too are the oil stocks. Extremely cheap? No longer. But also overextended? Not even close. If anything they’re fairly valued.

As they say, the risks are skewed to the upside.

Happy Spring Break.

Please hit the “like” button above if you enjoyed reading the article, thank you.