Oil's Impending Parabolic Recovery

August 10, 2020

Here’s a riddle. What’s 10 - 1 - 100? The answer? Oil.

As a baseline, we have a global addiction of 100M barrels per day (bpd) of oil demand. Thanks to COVID that demand is currently lower by ~10%, or ~10M bpd. That’s our 10.

Our 1? That’s the 1M bpd increase per month Goldman Sachs anticipates demand will recover from now until the year-end. So by December, demand will likely be ~95M bpd. Global inventories today are drawing by ~1-2M bpd, which means there’s already a supply deficit. Where’s the extra 5M bpd coming from as we head into year-end? Ostensibly from those trustworthy oil caretakers of the world, OPEC+. Recall OPEC+ recently agreed to adjust production in response to the COVID demand hit. The agreement is divided into three phases and we’re in the midst of the second phase, whereby supplies are curtailed by 5.4M bpd (vs. their Q1 2020 actual production). The curtailments will ease again in January, coinciding with recovering global demand, but the truth is as OPEC+ increases production, it erodes its spare capacity. Eventually, inevitably, we’ll need OPEC+ to produce at its highest levels. Why? Non-OPEC production, or lack thereof, will be the reason. Non-OPEC production is largely dependent on capital, something nonexistent as oil prices hover in the mid-$40s. A four handle means there’s little cash flow and even less credit, which is probably fine for now as there’s also little demand, but as we recover, as we emerge from our COVID shelters, the landscape will shift because of that pesky number . . . 100.

Again that’s our global thirst for oil . . . 100M bpd. It was in January 2020 and it will be again. Sure OPEC+ has you covered from 90 to 95M bpd, but thereafter? You’re on your own, which means you’re on your own to incentivize the marginal producer to get off the couch. You know, the one that’s burned all energy investors for the past 5 years. The one who can no longer grow production ad infinitum using a dubious flywheel of increasing debt, production, and reserves? The one whose owners have the audacity to expect and see a return on their investment. Yeah that one. The most expensive supplier on the block. It’s going to take a whole lot to move that producer, weighed down and hamstrung by debt, off the couch, so bring the money. We will though because prices be dammed. We’re addicted. We’ll want our 100 as we want our lives back. So bring your hundred and make it rain. In fact, bring more. Why? Because prices are going parabolic.

Linear Extrapolations Have Never Worked For Oil Markets And It Won't This Time

The consensus is thinking in a vacuum once again. Back in March/April, a seeming eternity since it is 2020, analysts and pundits had predicted that global inventories would runneth over after Saudi Arabia embarked on its oil price war. If demand fell by ~30M bpd and the Saudi’s refused to cut production, how could we not reach tank tops by May? We doubted that because we understand how producers react once prices reach a certain level. Sure enough fast forward to today and storage never came close to exceeding storage capacity. The market disciplined itself. We’re currently ~400M bbls above the norm, an elevated, but manageable inventory level.

So why is the consensus thinking in a vacuum again? This time, it has to do with their oil price forecast. Sell side analysts, Goldman, Morgan, HSBC, etc. have oil price targets of $50-60/bbl for 2021. Naturally, these forecasts incrementally increase oil prices by $5-10/bbl per year to reflect some sort of linear progression as demand recovers. History tells us that oil prices seldom recover linearly. It’s more akin to riding a rocket on the way up, in contrast to a barrel over a waterfall on the way down. Instead, we ask readers to ponder this key question:

What are the drivers of global oil prices in the years ahead?

For us, the number 1 driver of global oil prices will be how US shale responds to higher oil prices. We say this because the market is relying on the US to fill the impending supply gap. While OPEC+ has spare capacity today, it’s limited and will only provide a temporary safety net.

Once used, the market must move higher to incentivize US shale to fulfill demand. US production, however, will lag this time. Our discussions with E&P board members and operators throughout this crisis reveals that financial discipline has finally taking hold. As access to debt and equity markets close, E&Ps are forced to shun growth models and embrace profitability. Stakeholders now demand a return and the boards recognize it. Thus, US production is responding exactly in-line with this shift.

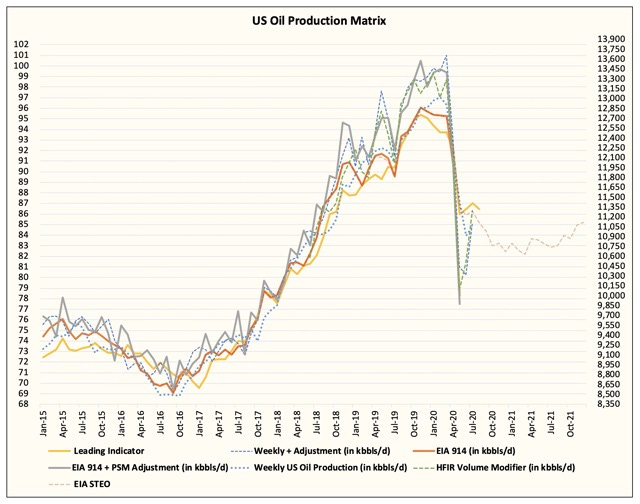

After the collapse in May, US production has recovered slightly as shut-in wells return. The initial recovery, however, appears to have stalled. Despite producers returning nearly all shut-in production, associated gas production continues to trend lower. This indicates that the underlying decline rates are substantially higher than what the consensus already expects.

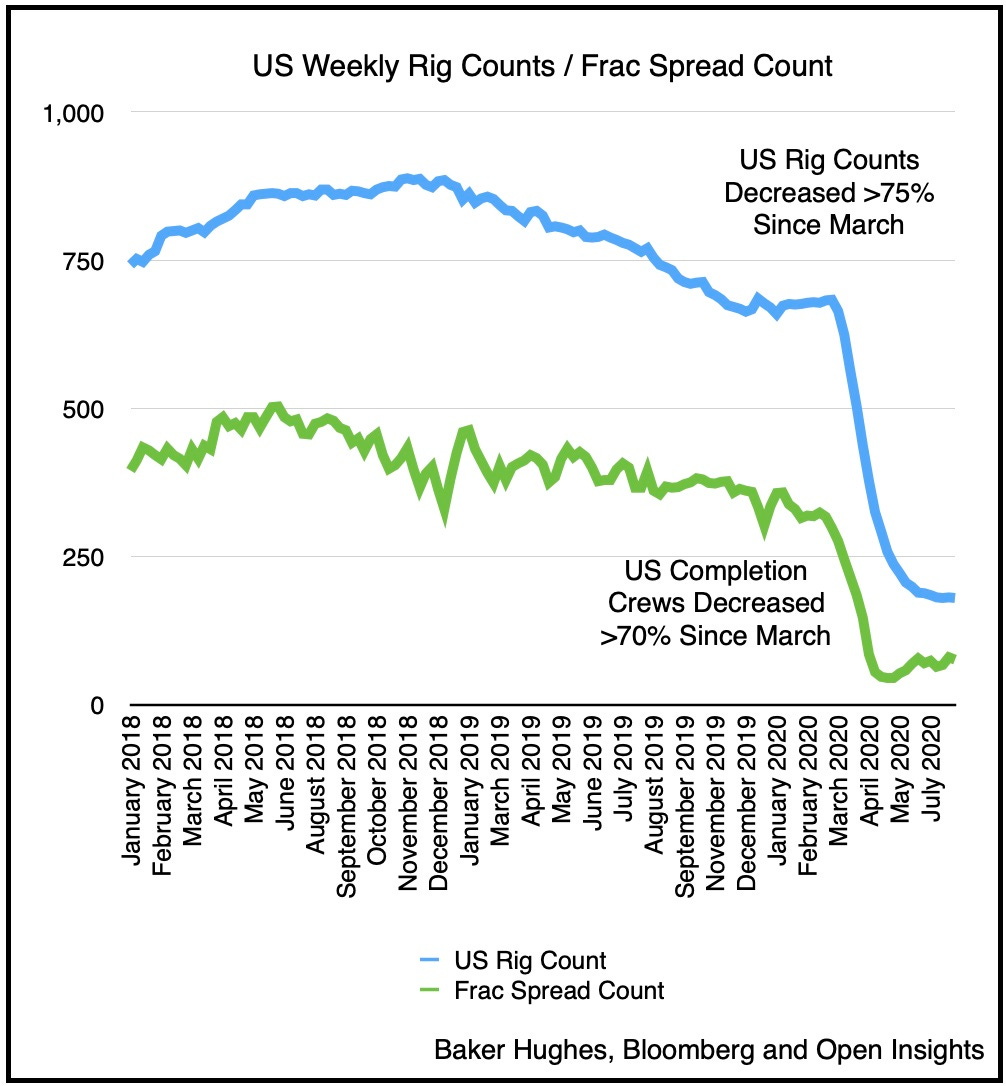

In fact, based on recent discussions with producers, August figures will mark a turning point as production slides into year-end. Our initial forecast that US shale production would decline by ~250k bpd per month has proven correct. US production has already fallen by ~1.25M bpd in the past 5 months and currently sits at 11.1M bpd. If shale producers fail to increase activities from today’s moribund levels, the rate of declines will continue. The key indicator we’ll use to monitor this? Frac spread counts and it’s not looking pretty.

With the frac spreads at 70, the declines will surely continue. We would need to see a “V” shaped recovery in frac spread counts back to 275 in order to avoid the coming declines. By our calculations, US oil production will fall to 10.7M bpd by year-end vs. our prior estimate of 11.1M bpd.

While this revision may not seem like much, an oil market with a 400k bpd deficit equates to 146M bbls less oil produced in a year. As analysts gain confidence in the longevity of the decline, the market will begin pushing oil prices higher to incentivize a US shale response. Based on our estimates of producer cash flows and discussions with management teams, we likely won’t see any activity response until +$60/bbl WTI. The initial response will also be muted as producers first apply free cash flows to repair damaged balance sheets and increase cash reserves.

In the current environment, many producers are learning that bankers are no longer as supportive as before. Cash is king and the idea that credit facilities can serve as a robust liquidity reserve or working capital facility has been abandoned as banks withdraw from the sector and pull/place restraints on existing credit lines.

Accordingly, E&Ps must reduce debt levels and increase cash. For leadership teams, all of these issues reinforce the notion that their companies must operate with significantly less leverage going forward. Balance sheet prudence is now the mantra as many pivot away from relying so heavily on reserve based lending facilities (“RBL”).

Consider that almost all mid-cap and smaller E&P producers have RBLs, and you quickly realize why production continues to wallow even as oil prices have risen. As we roll through Q2 earnings calls, it’s clear, E&Ps collectively have little desire to increase production. Whether it’s voluntary or involuntary, the results are the same. Capital constraints will suppress supplies.

Consequently, the muted supply reaction will surprise a market fully expecting the taps to be turned back on. If the market begins to see the looming deficit, oil prices won’t simply rise to reflect the near-term deficit, it will leap to induce a production response to solve the widening longer-term shortage. The market will bid oil prices higher to induce not only more production, but more production sooner. Will it be $70? Will it be $80 by year-end? We believe it will be closer to $70/barrel by year-end and on their way higher in 2021.

Sure globally we’ve been sick. Globally we’ve been weary of traveling far and wide, but we’ll recover (and likely faster than many believe as we’ve spelled out in our first newsletter), and when we do our appetite and addiction will return. Old habits die-hard, and since they do, we’ll eventually pay a steep price. One that’s about to go parabolic.

Join the Distribution List

So that concludes this letter. We’ll endeavor to send these out weekly, so if you would like to be added to our distribution list click on the subscribe button above. This is our start and it’s our invitation to you to join us and share your thoughts. Welcome to Open Insights and let the conversation begin.