Oil's Summer Doldrums

June 28, 2024

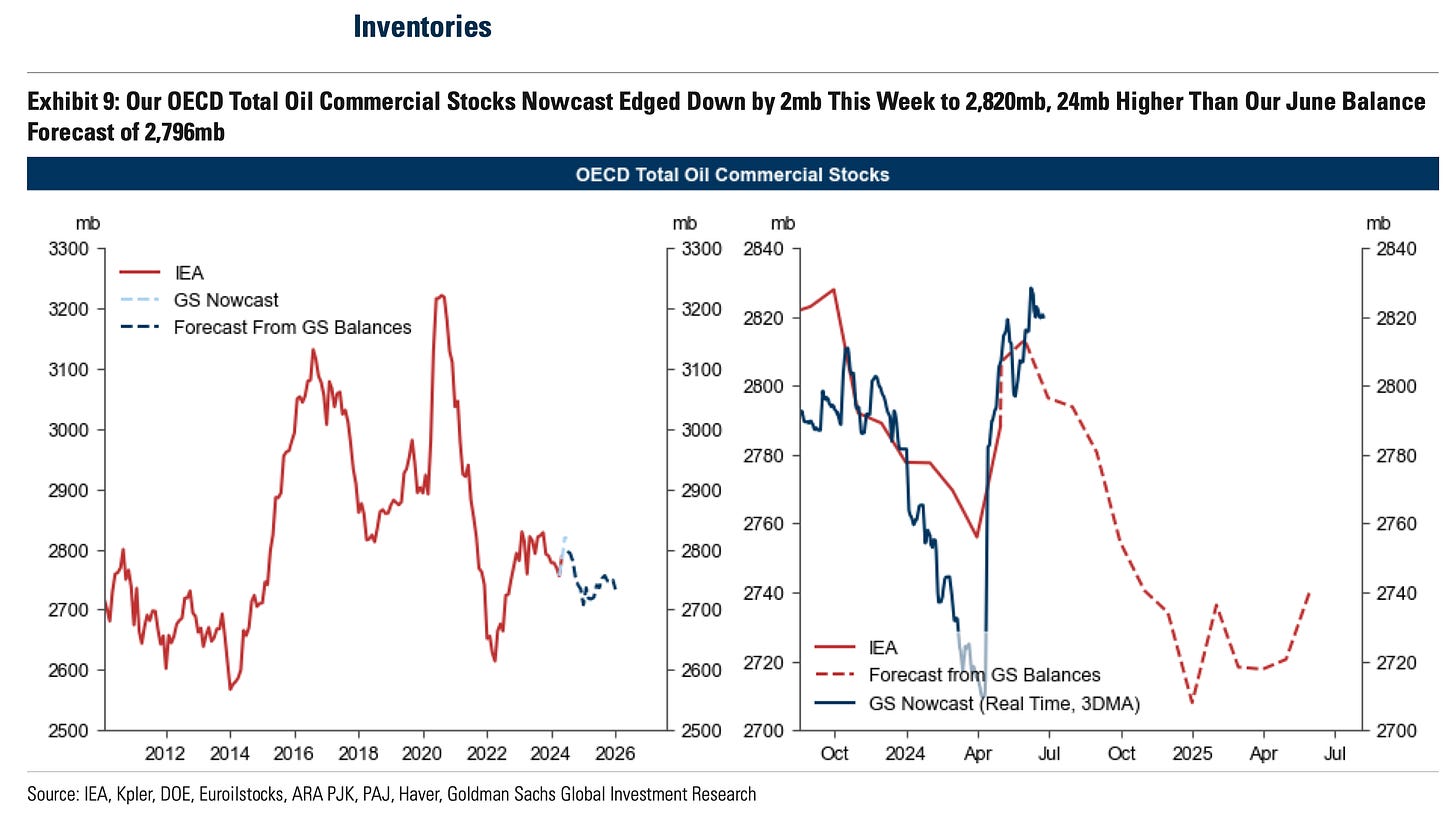

There’s this malaise in the oil market that we can’t seem to shake. One that’s kept us range-bound for most of the year. $70 - $90/barrel. We’re bouncing between those guideposts like a ping pong ball, and without clear direction. In the most visible areas (i.e., the OECD countries) we’re starting to see the forecasted summer draws.

It’s early days, but we’ll need that right side of the chart to tip over if we want oil prices to stay within the range (more on why later). Though oil inventories outperformed in Q1 (i.e., drew heavier than anticipated), they’ve given it all back in Q2 and then some. Hence for the year, we have some excess barrels.

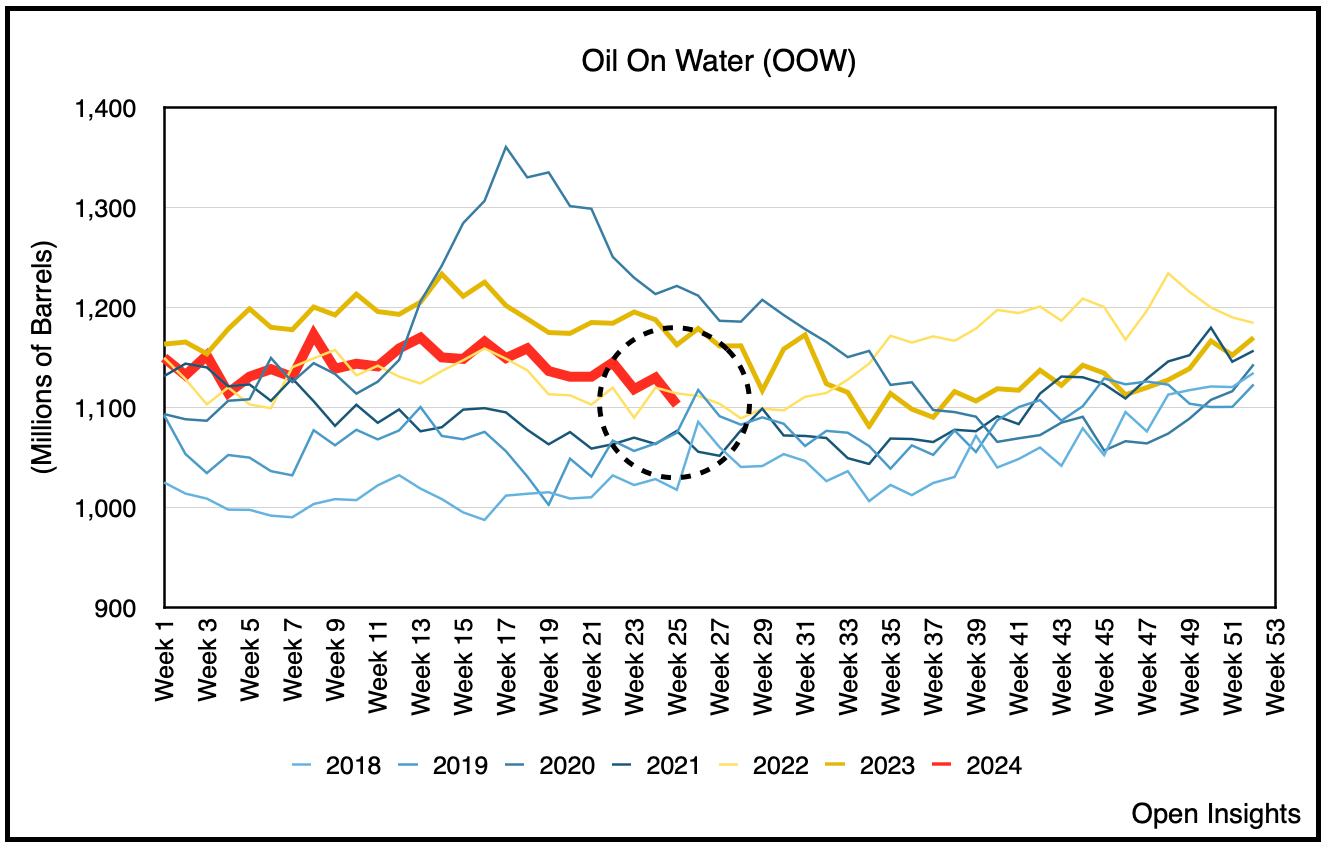

What’s heartening to see though is OPEC+ (namely the Saudis and Russia) beginning to pull back on exports. Consequently, oil on water (“OOW”) has begun to decline, slightly more than what seasonality would suggest.

Summer heat in the Middle East means domestic demand spikes a bit too, which reduces exports, but the recent decline in OOW suggests some compensation (i.e., for Russia’s own overproduction) is occurring. Moreover, the Saudis themselves have throttled back exports which further suggests they’re cognizant of oversupplying an arguably tepid market.

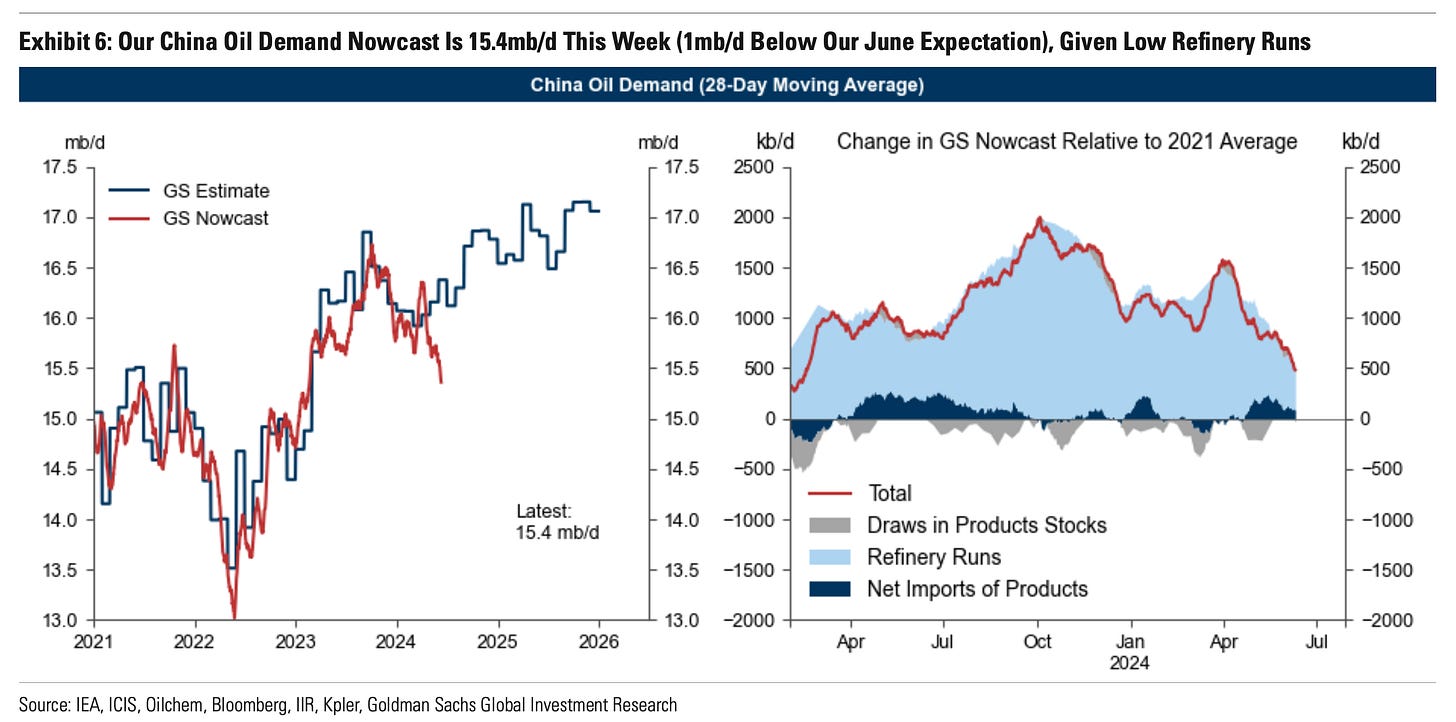

Where’s the overall weakness coming from? You guessed it, China.

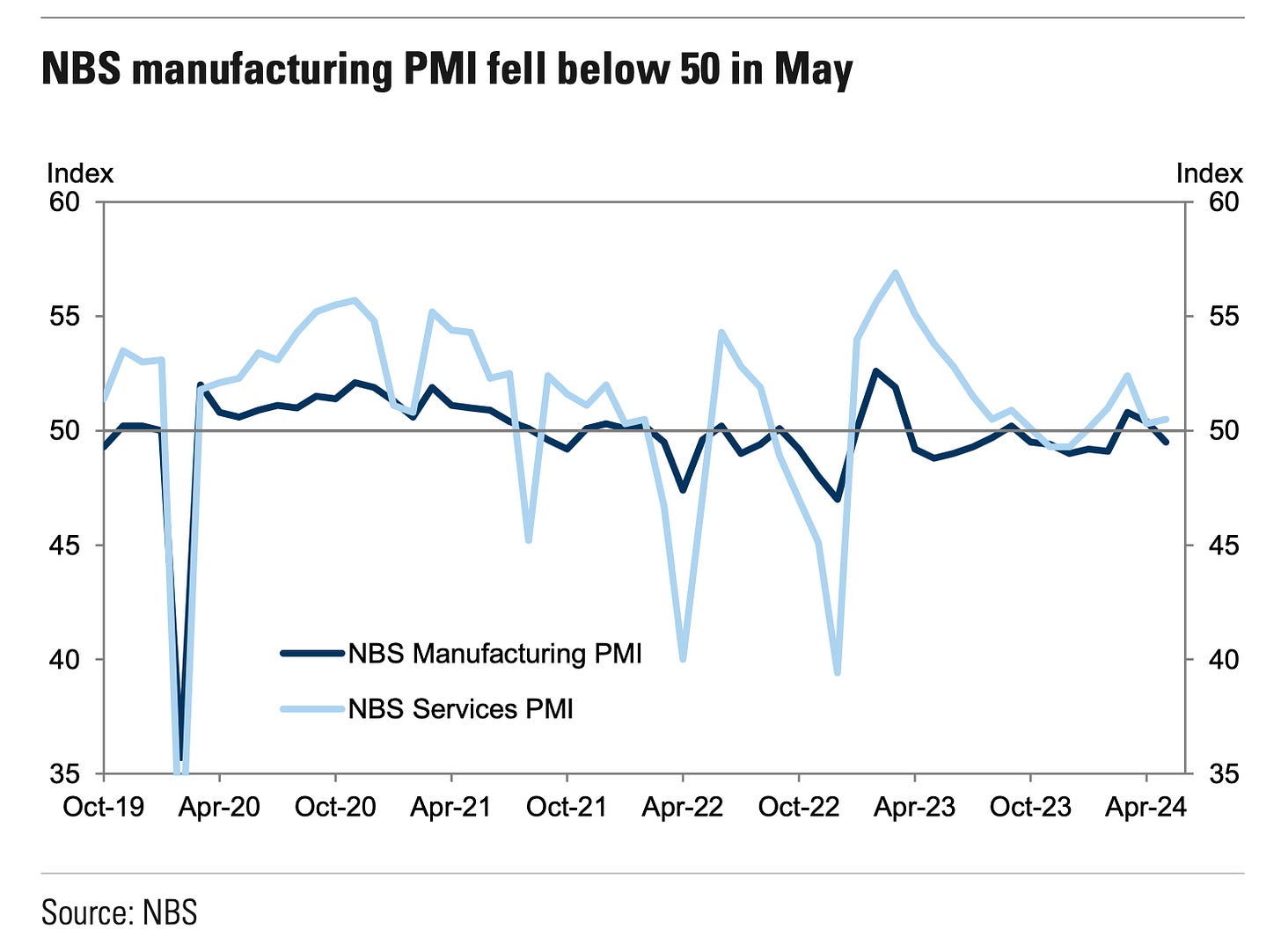

Refinery demand in China is simply weak, and why wouldn’t it be when manufacturing is weak.

The expectation was for PMI to increase to about 50.6 . . . it clocked in again within contraction territory of 49.5. Mind you these are official statistics, you can imagine what it’s really like on the ground.

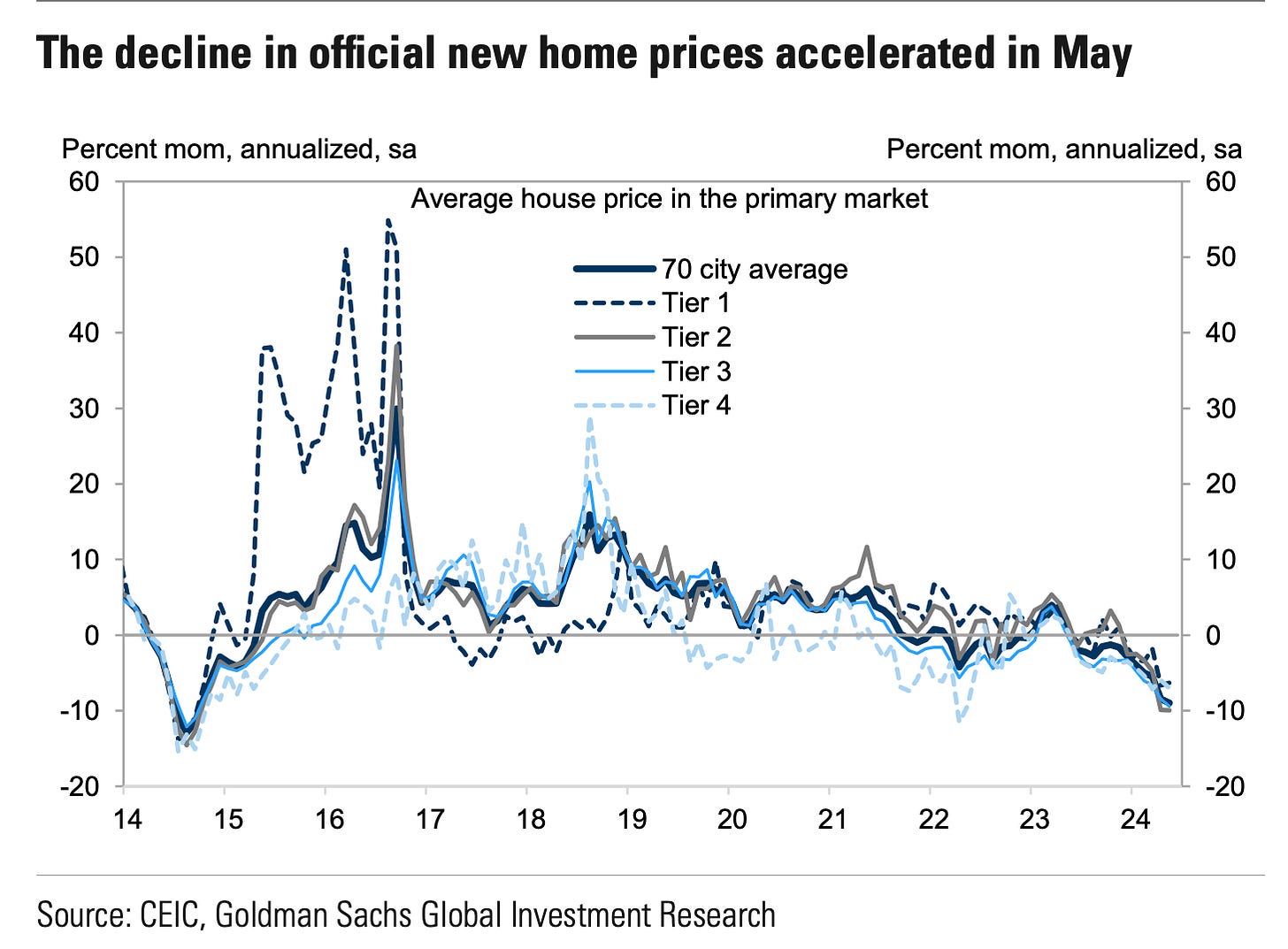

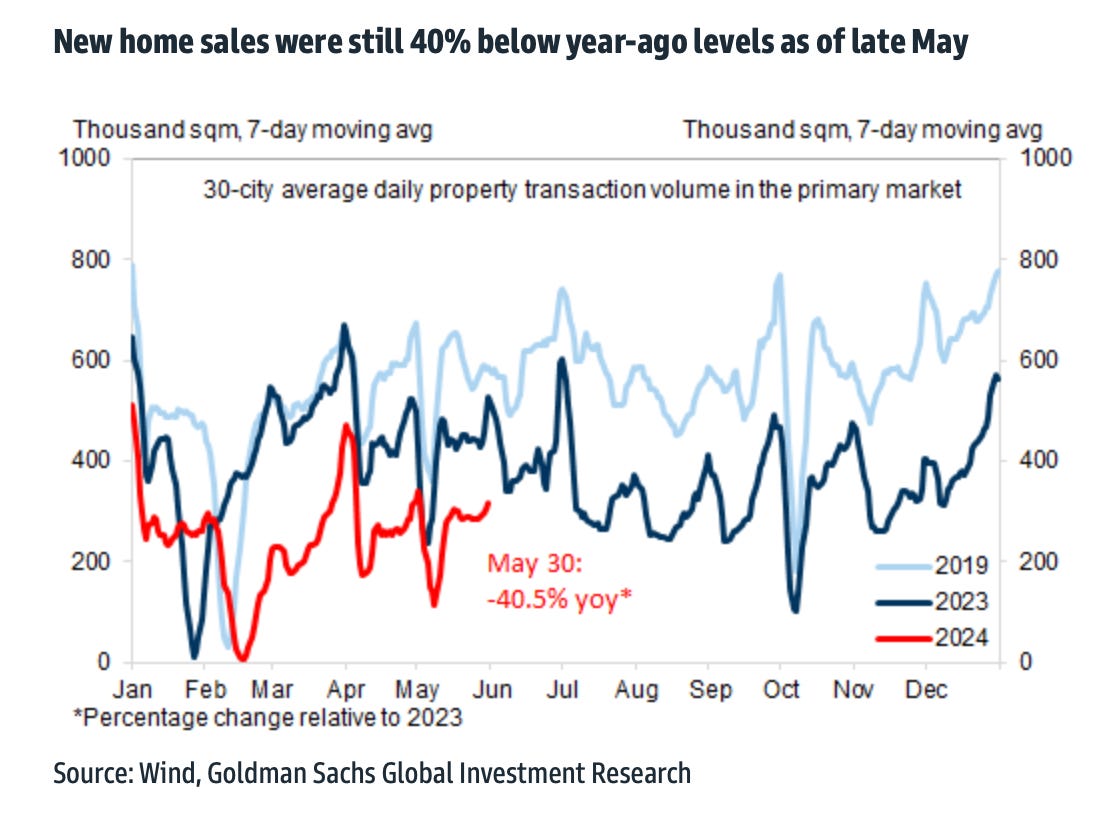

Property that is, as that portion of the market continues to sink and new home prices keep declining. Since the below is month-over-month, and seasonally adjusted, the momentum is clearly to the downside.

Overall it’s ugly, and year-over-year figures don’t inspire much confidence either.

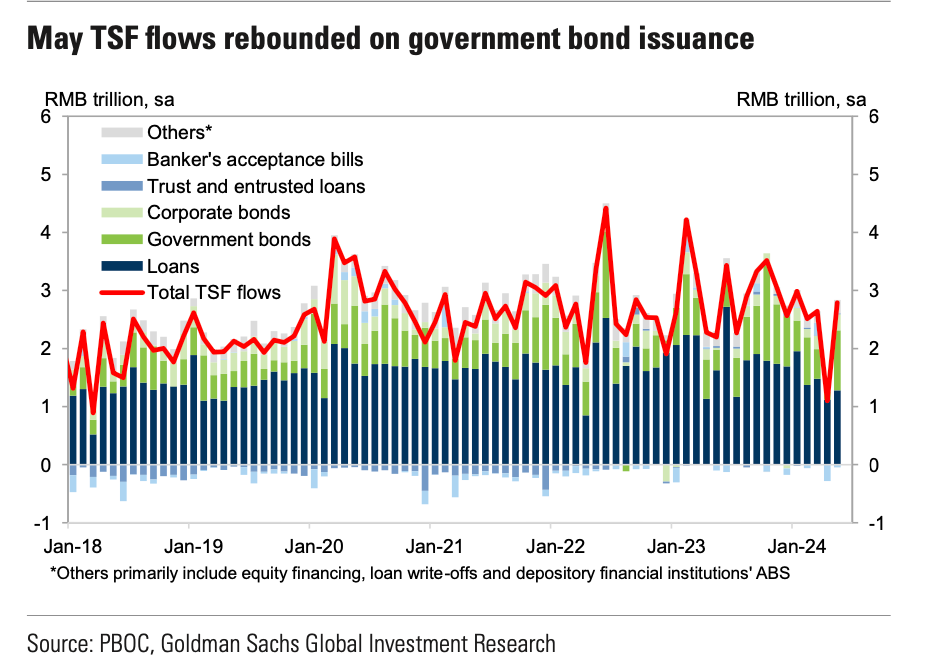

What about all that Chinese stimulus? It’s there, well it’s getting there. After a slow start government bond issuances have increased, but demand to borrow money is tepid.

Total social financing (i.e., loans to the private sector provided by the financial system), have increased, but if you take a look at the last bar, loan demand (dark blue) hasn’t been that high, and much of the higher “V-shaped” uptick has come from government bonds. Logically the government issuances will mean increased fiscal stimulus to local governments, but that’ll take time. For now, the Chinese aren’t spending and not borrowing to spend for that matter. So if we’re just relying on the average household it’ll be tough to change sentiments. They’re clutching very tightly to those purse-strings, and the grip strength of a Chinese mom on a spare penny is legendary.

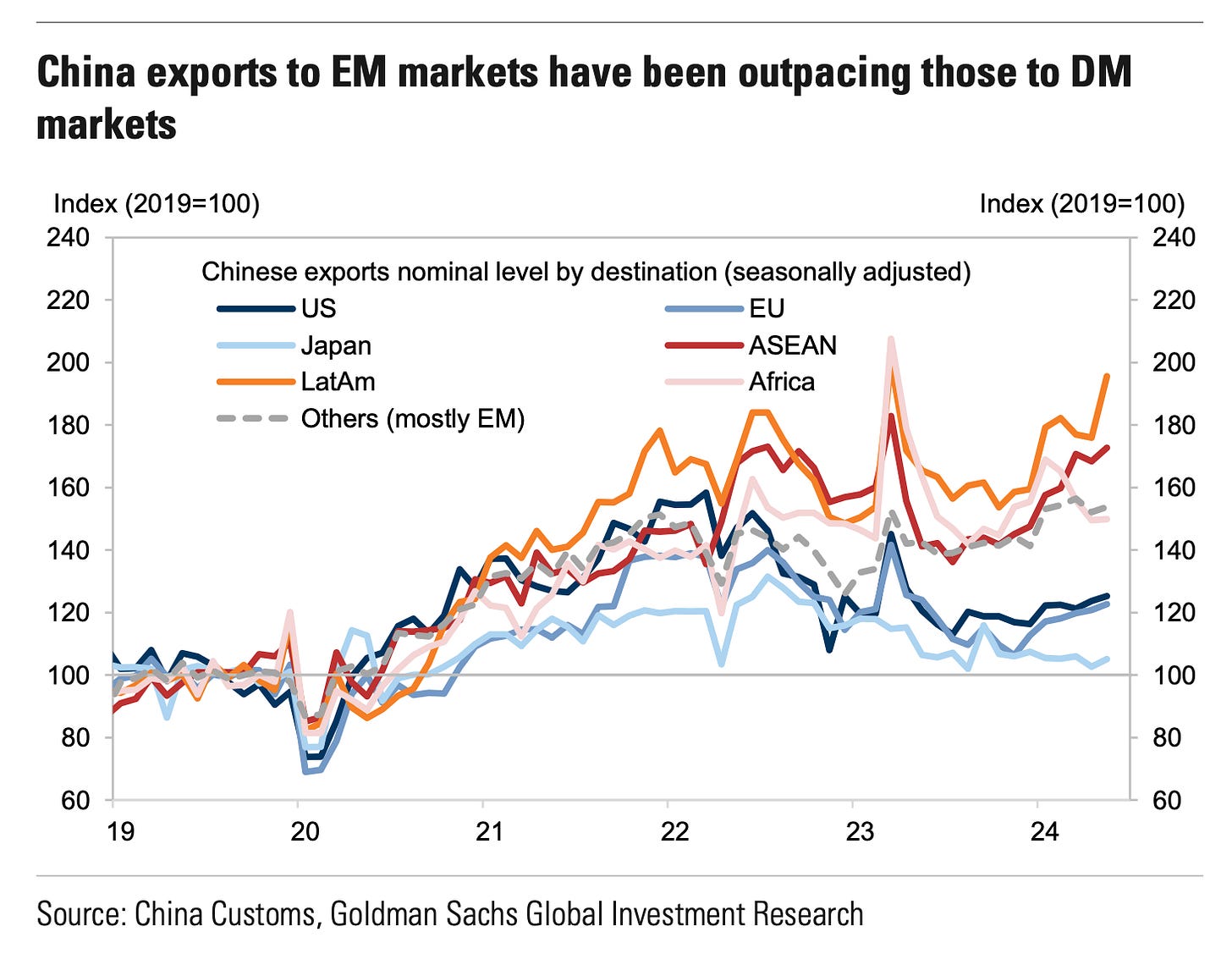

It’s not all tears and fears though. Exports have started to pick-up.

Not to the US, Europe, or Japan, but most everywhere else. We’re important though because . . . well, we’re rich. Emerging markets are nice, but developed markets have bigger wallets.

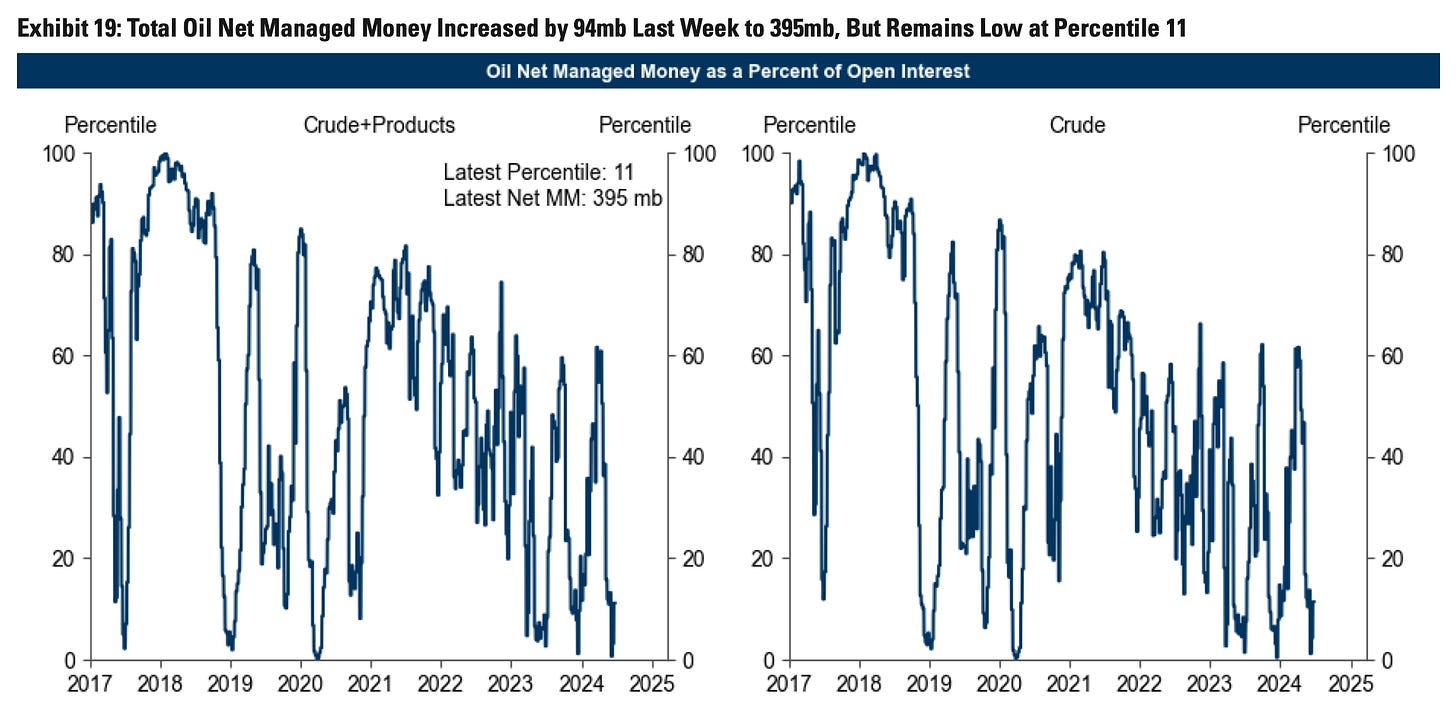

About the only thing that’s positive right now in the energy market is probably positioning. We’ve been hovering near $80/barrel for WTI, and financial positioning is already at the floor. So are inventories (even though they’ve risen a bit), which is why the physical market is having a greater impact on buttressing that floor here. Could the paper market (which trades +30 barrels for every single real barrel traded) further slam oil markets? Certainly, but that would already be plunging positions to even greater depths.

In fact, look at that lower right hand corner of the first chart. Total oil net managed money has already fallen to near zero. It’s since rebounded to the “11th percentile,” but there’s basically a rampaging bear in the paper markets rights now. So if we finally get some summer draws AND China’s economy finds its footing, and just stops bottoming, then we could set-up to spring back up to the $90s as financial players move back in.

Still that’s a lot of “ifs,” which is why positioning is reflecting the lack of confidence.

The best we can say though is that the floor seems to be holding. Absent an immediate recession, demand also appears to be stable in OECD countries. It’s not over-the-moon, but it’s not under-the-ocean.

So if OPEC+ maintains its discipline in the summer (the low exports we currently see don’t spring back up), demand stays firm, and China flattens out, our price floor should move higher in the coming months.

Something to ponder as we head into our July 4th celebrations. Feel free to travel far and wide for that . . . someone needs to keep up our demand. ‘Murica!

Please hit the “like” button below if you enjoyed reading the article, thank you.