OPEC+ is Dead, Long Live the King

May 4, 2025

So as we headed into this weekend we ended the week on a high note. Actually 9 days of high notes from the market ripping for 9 days straight. Apparently the trade war we declared has come and gone and all is well in the world. Maybe not, but for now, Q1 earnings weren’t too terrible, and the guidance given by the MAG 7, which are a large piece of this market, were not that bad frankly.

Meta’s declaration that it will actually INCREASE capex on AI spending has buoyed all manner of stocks, especially those in tech, and that has soothed the wringing hands. Add in some soft purring sounds from China about trade negotiations, and we’re off to the races.

SPY is up nearly 1% a day for the past nine days. Strip out the MAG 7 and we’re up around 6.4%, so a third less. Interestingly, small businesses, as represented by the Russell 2000 are up nearly as much, even though we’d argue they’re still being disproportionately impacted by the trade uncertainties. For the time being, all’s calm in an up market.

The bond market also seems to have settled down a bit as the 10 year treasury hasn’t budged much in the past week.

Thank goodness for that since that’s the disciplinarian if the class starts to get too wacky. In our minds, we’re going to chop here for a bit. Until trade agreements and negotiations start to play out. We’re one month post-Liberation Day, and the economy’s holding together, but prices are about to nudge higher as the goods that should’ve arrived at the beginning of this month don’t.

We’ve chatted with a number of people who are in the export/import business (i.e., making real consumer goods and bringing them to the US), everything’s on hold, and what isn’t on hold is being held in China either to “batch the cargoes” so you can at least ship a full boat, or just waiting and hoping that resolution comes before inventories run out. Given the lag, it likely will. Heck even in this writer’s excursions to Target stores we can see it. The electronics section sure has some more empty sections than it normally does. You are right though, that’s all anecdotal and free to interpretation, but wait a few weeks and then it’ll be pervasive. Retailers have messaged that in 6-8 weeks we’ll start to see the impact, and we’ll need some real clarity, otherwise it’ll get ugly. After this week, 5-7 weeks now, and the clock keeps ticking.

The market is forward looking though right? It’s why it’s navigated that crater of a tariff pothole in the roadway with nary a scratch. S&P 500 earnings have only been brought down by 3% and Palantir (PLTR) is at a 52 week high. Now don’t get us wrong, we’re not saying there isn’t a pathway where all of this works out. You can spitball a scenario where we come to a trade agreement with India, Vietnam, South Korea, and Japan relatively quickly, lower trade barriers to those countries, and then start rubber stamping these formulaic agreements all around with smaller countries, eventually leaving China as the outlier. Oh what about Chinese goods? Isn’t that like 1/3 of the stuff we receive (i.e., 20% direct, and 15% indirect)?

Well, like the oil trade, if it’s stuff we really need, fear not . . . we’ll just turn a blind eye to the “reimport/reexport” from other countries. Just how sanctioned Iranian oil is shipped to China via Malaysia (and considered “Malaysian” oil as to not offend sensibilities), we’ll do the same for our goods.

We can imagine a time when we’ll say . . . interesting, Vietnam’s trade to the US is significantly higher, when they haven’t expanded manufacturing facilities yet. Do you really think an administration that’s rolled out such an ill-conceived tariff policy wouldn’t turn a blind eye to rebadging goods if push came to shove, and the economy or voter discontent became an issue? What is “manufacturing” anyways . . . maybe it really is a matter of slapping on a sticker. It’s all in a name right? Optics Trumping Reality, and maybe that’s the real theme these days.

Another thing to think about is that the US is a services based economy. Yes, we loooove stuff, but we can shift our spending dramatically if need be, and our services sector could hum along for a bit.

Just look at what happened pre-post COVID where the two flip-flopped, and then flip-flopped back when we locked down and then unlocked. Said another way, we can hang on for a tad if need be.

The question becomes can the Chinese? If manufacturing is 25% of their economy (and really that’s understated as almost everything else is hinged on it), won’t the pressure increase much faster? For the US, manufacturing is 10% of our GDP, so the relative pain, while painful, is still less. South Korea, Japan, and Taiwan (i.e., 25%, 20%, and 33%) are already negotiating, given the outsized GDP impact, would it be surprising if China does begin to soften its stance and send out signals that it’s willing to thaw the frozen relationship?

People forget the wave of COVID lockdown protests in the fourth quarter of 2022. If you don’t remember, there’s even a Wikipedia entry.

What we’re saying is . . . this isn’t clear cut. It’s not clear cut that the administration’s uncertainty and chaotic posturing won’t force capitulation. If not capitulation, at least a reset of the status quo. The US tariff barriers, or frankly, embargoes, are so extreme that it does reset what’s possible in the range of outcomes. Many countries are willing to drop tariffs on US imports to zero now . . . where was that in March? What are tail events suddenly become real tangible possibilities. What if by chance, intentionality, or unintended consequences, some of this stuff works? What if outlandish demands are followed by some change for the better? Yes, that’s optimistic, but let’s play along?

What if . . .

Heck, what seems crazy then doesn’t seem so these days. We’ve all jumped out of Overton’s window, and we’re all boiling frogs these days. The real difference this time is we’ve invited the entire world to bathe with us in the cauldron. Let’s all FAFO shall we?

Again, perhaps it is all optics. It’s all show. Perhaps, Mr. Maher Goes to Washington is the most accurate depiction of what this is all about (highly recommend watching this). (Whatever your political leanings, a willingness between two extremely different individuals to have dinner and engage is still something to be appreciated).

So we’re all watching theatre, and everyone’s playing their part: China (act tough), the US (be tough and PR this thing if it gets rough), and the market (we’ll gladly eat the positive PR if you spoon feed it). Yet, what if . . . what if when the lights come on, some of this works and trade tensions fall? Lower trade barriers for some, reset relationships for others?

Large scale restocking, large need to rebuild inventories, cost intensive re-shoring/on-shoring, manufacturing plant expansions, etc. For those left out, or for those with reset relationships (i.e., China) . . . massive stimulus as they have to find and support new customers (i.e., their own people). Maybe??? Remember if the current status quo is boiling water, hot water will seem exceedingly cool to the froggies.

5-7 weeks left. Tick tick. For the time being . . . enjoy the show. Ribbit.

OPEC+ Accelerates Oil

Speaking of which, on the oil front, OPEC+ decided this morning to reintroduce new barrels to the market by reducing its voluntary output cuts that it implemented with 8 of its members in 2022. For clarity here’s a chart from Amena Bakr that illustrates the various “cuts” that are currently in place from OPEC and the larger OPEC+

Most analysts would tally those cuts up and say that OPEC+ has nearly 6M barrels of spare capacity, ready to be brought online on a whim, but the reality is it’s much less. Most of these cuts are based on a fictitious “reference level” (some arbitrary number they used during the depths of COVID) to show that they are cutting production. Given the incentives, if they picked a high number, then the cut would appear larger . . . so they did just that. Long and short is, OPEC+ elected to use a 40.5M bpd figure, and so producing 37.5M bpd = 3M bpd cut! Reality was they were already producing at 38.5M bpd in Q1 2020 before COVID, so that’s likely the real level.

As the years have gone on, depleting oil fields in (Nigeria, Angola, etc.), coupled with sanctions (Russia), means production has fallen. When Russian invaded Ukraine and everyone produced “flat out” to compensate for the production hit, OPEC+ production increased back to 37.5M bpd (for those part of the quota system).

Today after a series of cuts, it stands around 34.0M bpd.

1.4M bpd of declines from Russia alone. Largely because sanctions plus aging oil fields have hammered their production. The gulf states (i.e., UAE, Kuwait and Saudis) account for the other 1.5M bpd of decline since they’re adhering to the quotas, all three of them in that pyramid of cuts above.

No more though as they’ve announced that since Kazakhstan and Iraq (i.e., 2 of the 8 OPEC+ countries agreeing to that cut) are not following the voluntary cut (i.e., the top of the pyramid). Since Saudi’s are really the only ones cutting here, they’ll be the ones reintroducing the barrels.

How much? Well set aside the “voluntary” cuts and the nonsense production quotas, it’s easier if you simply look at how much they produced before the silliness started. 9.9M bpd. They can flex it up to 10.5M bpd, and that’s likely where a comfortable level would be, so give or take 1-1.5M bpd. Tack on another 400-500K bpd from the other Gulf states like Kuwait and UAE, and we think that’s the “spare capacity.”

If they bring it all back though, won't the Saudis flood the market as they reintroduce barrels? Yes, and arguably they would because they’re now engaged in a price war, market share grab, strategery to bankrupt shale, geopolitical gambit to curry Trump’s favor. Are they though?

Of course . . . it’s all inextricably intertwined.

Yeah we’re not sure about that.

The reality is if you’re the only one cutting, then a few things are true: 1. the barrels from everyone else is already on the market, 2. you’re not getting “credit for these cuts” as the oil market is in the doldrums, and 3. you’re the patsy, but you’re also in control as the only barrels “to be added” are yours.

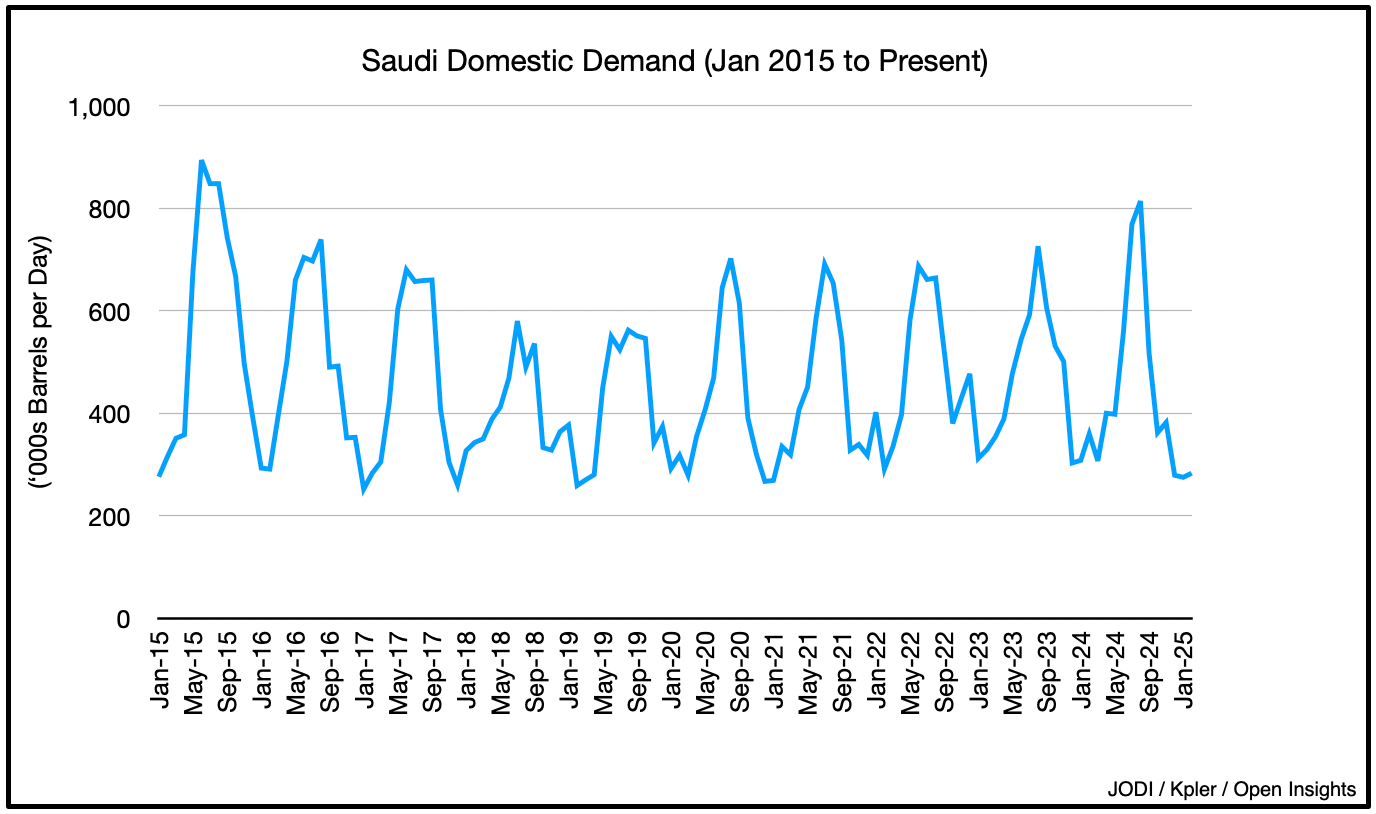

We think they’ll add to production, heck summer demand alone begins to spike in May and June so if you add 500K bpd of production then, it may not even wind up on the water for exports as your burn it all up yourself.

Thereafter, US shale will have started declining. It’s already stopped growing and decline rates will certainly steepen as producers pull back on capex spending. At $50/bbl, we’ll likely fall from 13.1M bpd today to 12.1-12.3M bpd by the end of the year. No one’s making money at $50/bbl, and producers with healthier balance sheets will pull back from drilling their good wells into a $50 oil environment. So that 800K-1M bpd decline? The Saudi’s will waltz right into that hole.

Will they flood the market to hammer cheaters? Doubtful. Why do that and then force yourself into longer periods of having to bleed down that inventory later. You control the pace. It also doesn’t seem like they’re preparing to hurry up that production. The OPEC 8 was supposed to increase production by 411K bpd in May, and here’s rig counts for the largest producer among them (Saudis) as of April:

Heck just look at overall OPEC+ rig count too. It’s not like anyone’s really ramping since 2024. We’ve been sliding since then, and again the figures are as of April 2025.

So if people are cheating already, and you drop the involuntary cuts, will you actually get more “real barrels” onto the market, or does your current production profile fit the revised quotas? Well, we realistically think Saudis will produce more, but you might not see it in the market. So ultimately, what they produce could be used for domestic consumption. Then as US shale production declines, you’ll start to see them push more into the market pending what happens with the global economy. From our perspective, it’s a market grab, but one in name only. Actual material barrels? We’ll see, but it could be more optics than anything.

This doesn’t mean prices won’t still take a hit. The Saudi’s have removed the “put” on oil prices, and traders can freely short oil until fundamentals constrain them (though that’s in flux because of the macroeconomic issues). Definitely expect a lower period of oil prices until things baseline, and shale production declines enough to balance out the tariff demand hit and Saudi supply increase. Eventually though, if and when the world recovers and starts growing again, removing the “put” also means removing the “ceiling.”

Try growing global production with no US shale. OPEC+, and more accurately, the Saudis, will be in full control. Maybe that’s the real plan all along.

The King is dead, long live the King.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.